CA Sudhir Gupta

@CASudhir_Gupta

CA in Practice | Your Smart guide to Tax Planning |Teacher by passion | Tweets are personal | Retweet ≠ endorsement | Stock market enthusiast | Proud Indian🇮🇳

You might like

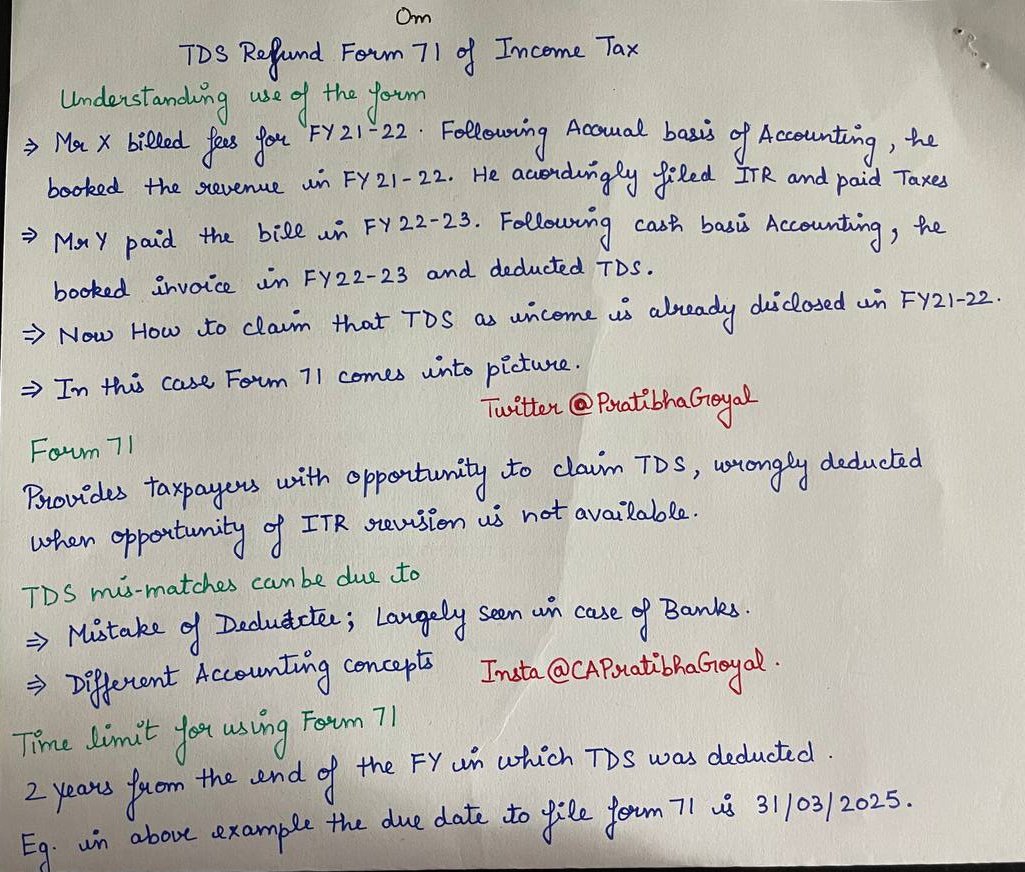

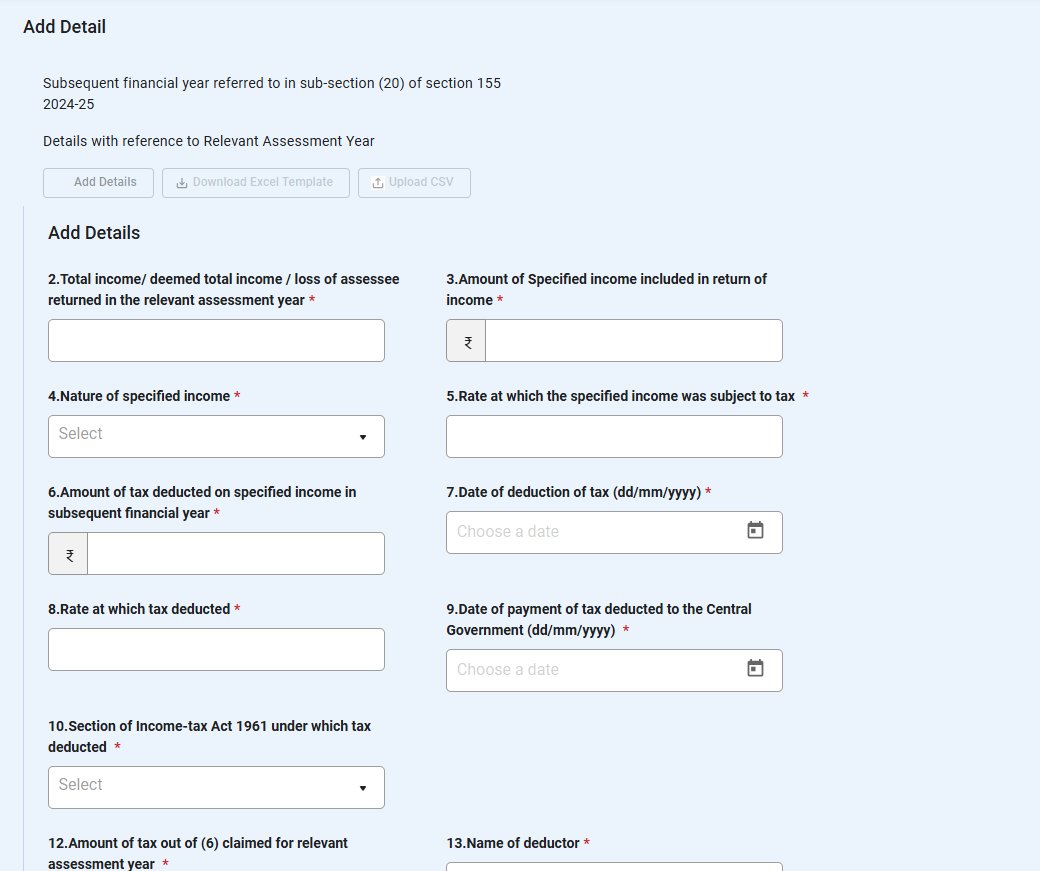

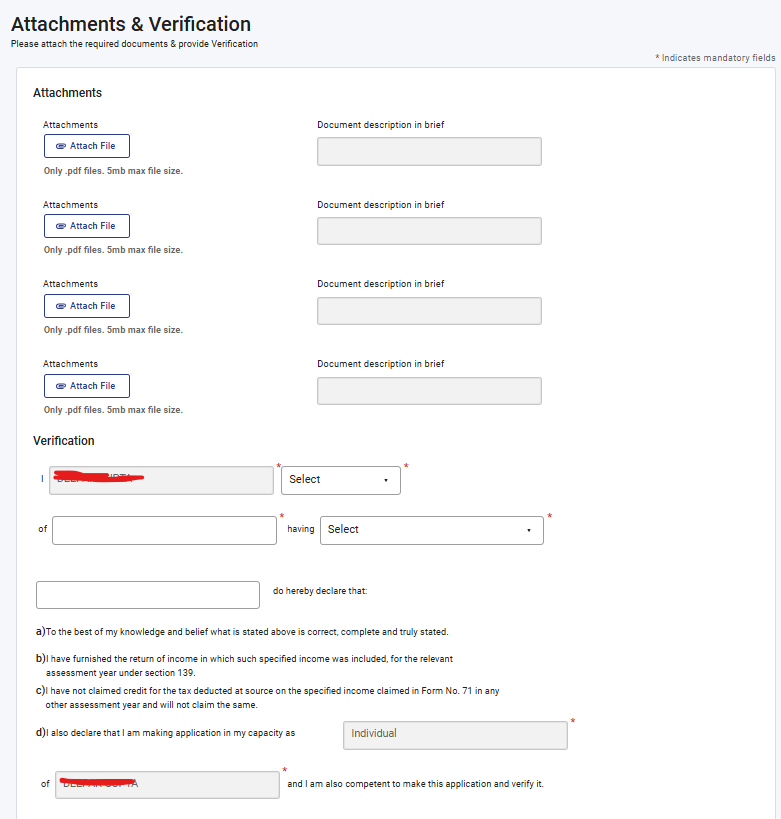

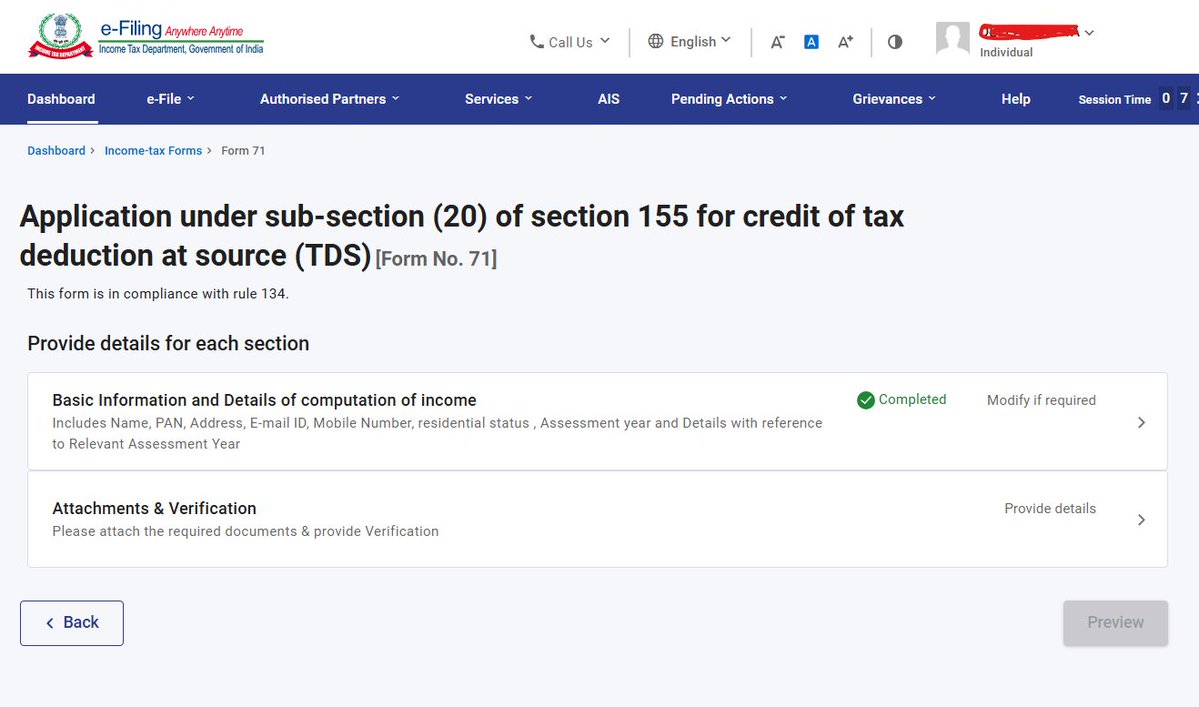

Want to claim unclaimed TDS? ITR filing time over? Form 71 might help you! Thanks to @PratibhaGoyal

Can LUT be filed post-Export? Research by Abhishek Raja Ram; 9810638155 Whether an exporter is eligible for GST export benefits (such as refund of unutilized Input Tax Credit) if Letter of Undertaking (LUT) is filed after the actual export but within the same financial year.

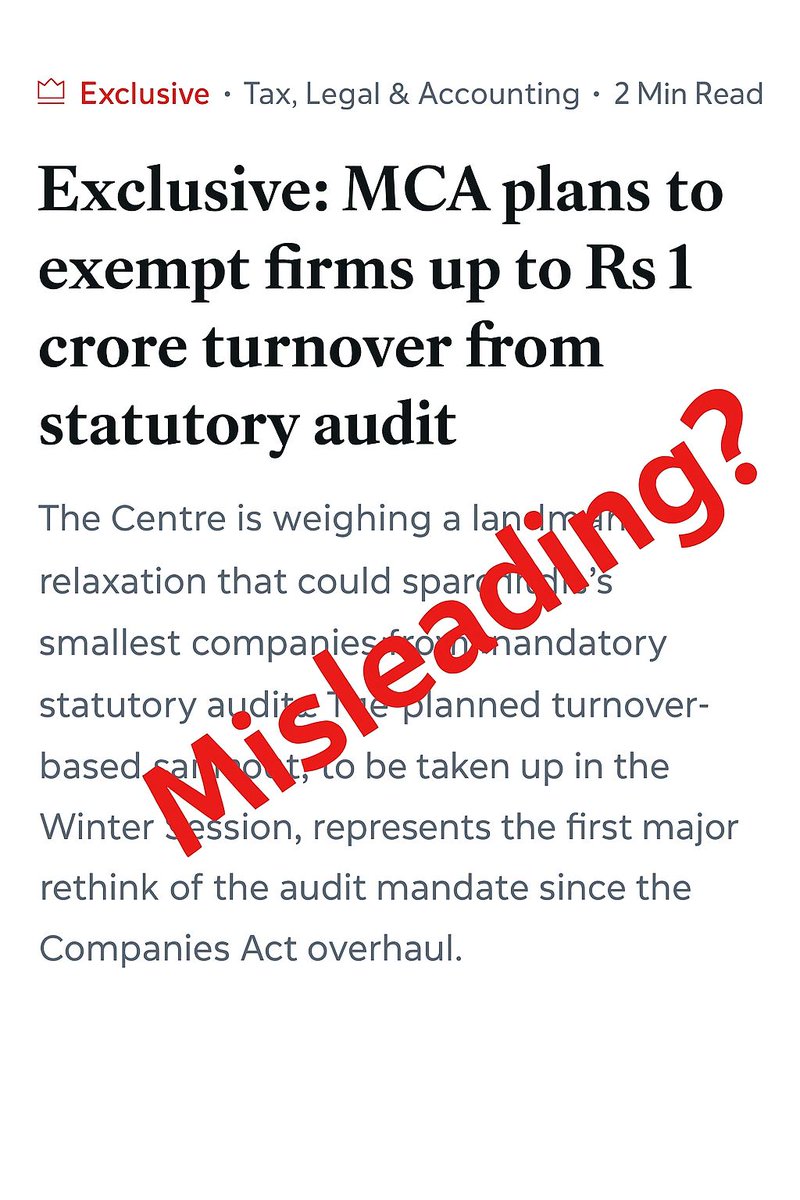

No - the Company Law Committee has NOT recommended scrapping statutory audit for companies with turnover up to ₹1 crore. A lot of CAs & professionals have circulated this since yesterday, so I dug deeper. Here’s the factual position 👇 🔹 “The Corporate Laws (Amendment) Bill,…

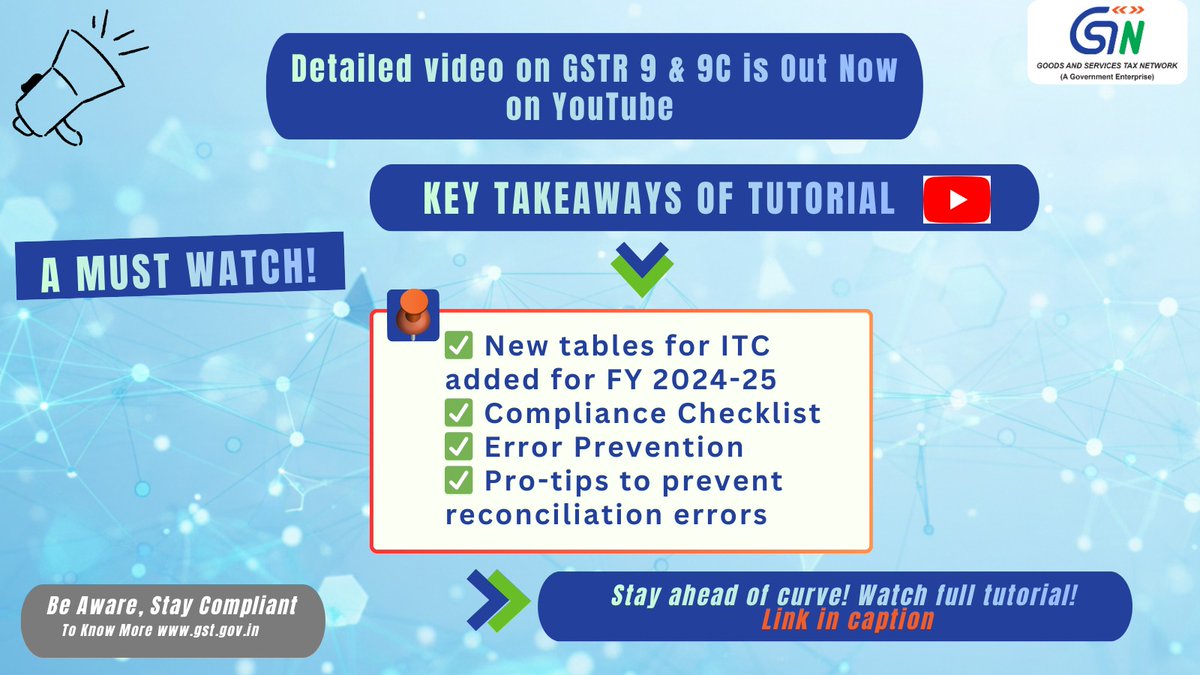

Dear Taxpayers, GSTN released detailed video tutorial covering the latest updates to GSTR-9 and GSTR-9C for FY 2024–25. Watch tutorial from official GSTN YouTube Handle click to link: youtu.be/_Fu4d64icTI #GSTR9 #GSTR9C #GSTN #EaseOfDoingBusiness #DigitalIndia…

Thank you Sir, you are so kind 🙌🏻🙌🏻 Here is the link of high resolution pdf: drive.google.com/drive/folders/… We have also recorded the video, link is below: youtube.com/live/BLkuKZAjS…

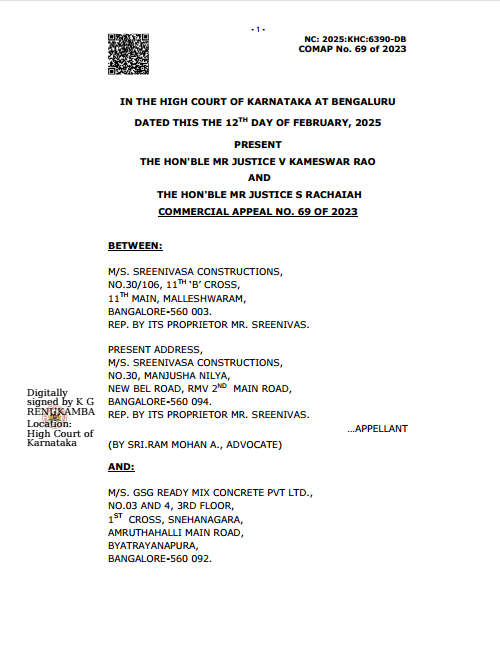

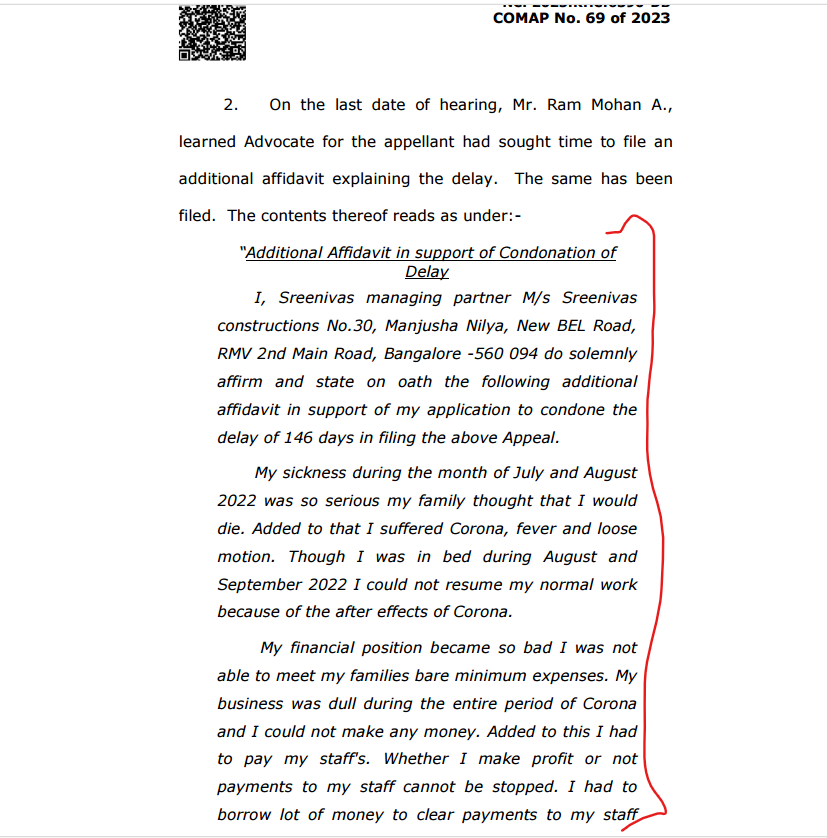

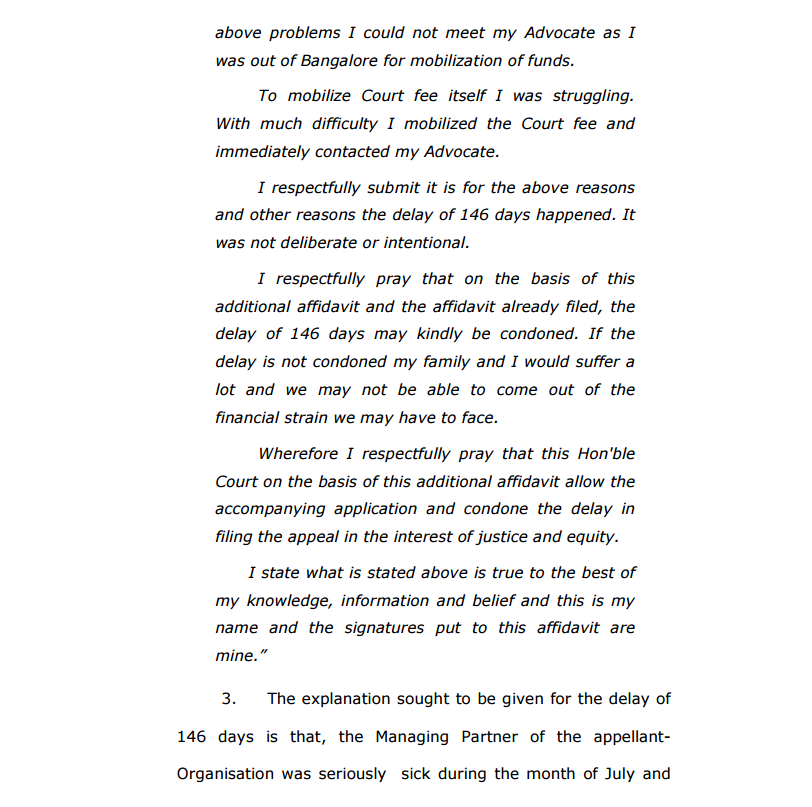

How to NOT draft your Application for Condonation of Delay, Exhibit 1 - The Appellant sought condonation of 146 days of delay in filing this Commercial Appeal Can you tell what's wrong with the Affidavit quoted in the image below?

United States Trends

- 1. Kalani 5,333 posts

- 2. REAL ID 6,794 posts

- 3. Milagro 29.2K posts

- 4. Cyber Monday 59.6K posts

- 5. Vanguard 11.8K posts

- 6. Penn State 8,636 posts

- 7. TOP CALL 11.8K posts

- 8. Admiral Bradley 10.4K posts

- 9. MRIs 4,498 posts

- 10. Hartline 3,784 posts

- 11. #GivingTuesday 4,018 posts

- 12. Merry Christmas 49K posts

- 13. #OTGala11 109K posts

- 14. Jason Lee 2,316 posts

- 15. Shakur 8,229 posts

- 16. Jay Hill N/A

- 17. MSTR 34.4K posts

- 18. Brent 9,973 posts

- 19. Token Signal 4,568 posts

- 20. Check Analyze 1,194 posts

You might like

-

Sudhakar Vemparala

Sudhakar Vemparala

@srianalytics -

Vipul Soni (NiSM Certified)

Vipul Soni (NiSM Certified)

@GalaxyFinancia1 -

Shweta Chinmay Virani

Shweta Chinmay Virani

@Shwetavshah7 -

Nandkishor Singh

Nandkishor Singh

@nandupurnea -

Durga Prasad Mahapatra

Durga Prasad Mahapatra

@DGprasadspeaks -

Avinash

Avinash

@avi_fintwit -

sridhar subramanian

sridhar subramanian

@sridhsatwi -

Market_Sniper_

Market_Sniper_

@Market_Sniper_ -

JohnyBoii💥

JohnyBoii💥

@joonnyboii -

Emmanuel uzoezie 🐝

Emmanuel uzoezie 🐝

@Emmauzoezie -

S Patel

S Patel

@AlgoPatel -

Akhand Bharat

Akhand Bharat

@MyCallOptions -

Astro Sumit

Astro Sumit

@Learner_Sumit -

SHITIZ ARORA

SHITIZ ARORA

@SHITIZ28 -

CA Govind Gupta 🇮🇳

CA Govind Gupta 🇮🇳

@Cagogo_03

Something went wrong.

Something went wrong.