CPA Solutions

@CPASolutionsID

A full service solution for busy small business owners. Allow me to save you and your small business some money!

คุณอาจชื่นชอบ

Medicare Advantage might significantly change in 2026. Here is your guide! weneedacpa.com/2025/10/medica… #retirement #finance #medicare #SocialSecurity

weneedacpa.com

Medicare Advantage Changes in 2026: What You Need to Know - CPA Solutions

Discover key Medicare Advantage changes for 2026, including insurer exits, CMS policy updates, and expanded drug coverage..

A new bill introduced in Congress could possibly eliminate taxes on social security benefits for retiree as soon as 2026. Here's what you need to know! weneedacpa.com/2025/10/elimin… #retirement #socialsecurity #taxes #incometax

weneedacpa.com

Will Congress Eliminate Taxes On Social Security in 2026? - CPA Solutions

Discover how the proposed "You Earn It, You Keep It Act" could eliminate federal taxes on Social Security benefits for retirees

Once again Medicare is change significantly in 2026. Here is what you need to know! weneedacpa.com/2025/10/medica… #medicare #retirement #socialsecurity #retirementage

weneedacpa.com

Major Medicare Changes Coming in 2026: What You Need to Know - CPA Solutions

Discover the key Medicare changes coming in 2026, including a $2,100 Part D cost cap, lower drug prices, and Medicare Advantage plan updates.

While not a popular choice, many do wait until 70 to claim Social Security Benefits. Learn the pros and cons here! weneedacpa.com/2025/10/claimi…

weneedacpa.com

Claiming Social Security at 70 in 2025: Pros and Cons - CPA Solutions

Maximize your retirement income by understanding the pros and cons of claiming Social Security at age 70 in 2025.

Retiring early? It's certainly possible, but know the pros and cons of claiming Social Security, early. weneedacpa.com/2025/10/claimi…

weneedacpa.com

Claiming Social Security at 62 in 2025: Pros and Cons - CPA Solutions

Thinking about claiming Social Security at 62 in 2025? Discover the key pros and cons, to help you retire smarter.

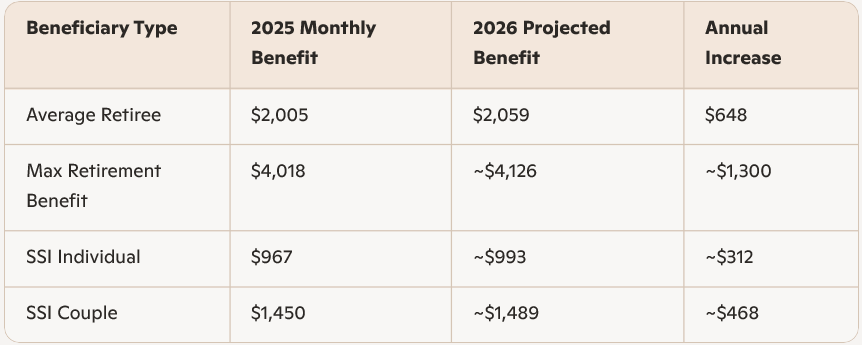

Attention retirees, YOU WILL get more in social security next year. Learn how much it may be in 2026! weneedacpa.com/2025/10/2026-c… #SocialSecurity #costofliving #retirement #finance

Believe it or not property taxes may change for you in 2025. weneedacpa.com/2025/10/proper… #finance #propertytaxes #taxes #retirement

weneedacpa.com

Understanding Property Taxes: What Homeowners Need to Know - CPA Solutions

Learn how property taxes are calculated, what they fund, and how to reduce your bill. A complete homeowner’s guide

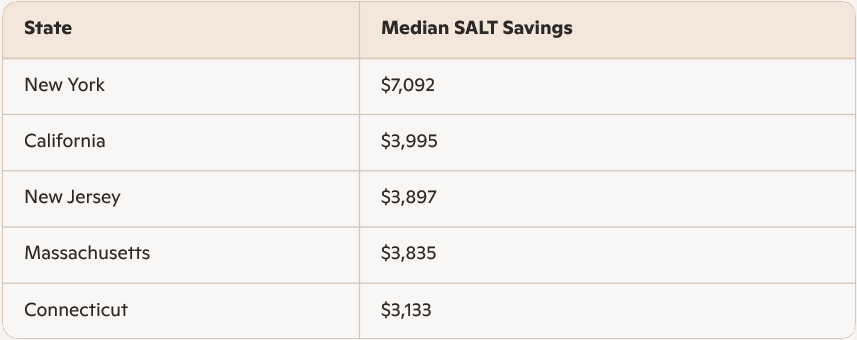

SALT (State and Local Income Tax) tax deduction is a hot topic. Here is your guide to the deductions for 2025 weneedacpa.com/2025/10/salt-d… #taxes #deductions #income #finance

Here is how the One Big Beautiful Bill may impact your taxes in 2025. weneedacpa.com/2025/10/one-bi… #incometaxreturn #taxes #finance #retirement

weneedacpa.com

How the One Big Beautiful Bill Affects Taxes - CPA Solutions

Signed on July 4th, the One Big Beautiful Bill is a landmark legislation that will change taxes significantly going forward.

With the signing of the One Big Beautiful Bill. Social Security benefits are set to change in 2025. weneedacpa.com/2025/09/social…

Living abroad? Yes, you may still owe taxes to the US Government but learn how to avoid double taxation with the Foreign Tax Credit. #finance #expat #traveling #incometax weneedacpa.com/2025/09/irs-fo…

weneedacpa.com

IRS Form 1116: How to Avoid Double Taxation - CPA Solutions

IRS Form 1116 is a form that people not interact with but it is important to understand this form if you have foreign income.

There are 9 states with no income tax. Can you name them? weneedacpa.com/2025/09/states… #states #incometax #taxes #finance

You can probably guess which state has the highest property taxes (it's New Jersey) but can you guess which state has the lowest? weneedacpa.com/2025/09/proper… #propertytaxes #investing #finance #FinancialEducation

weneedacpa.com

States with the Highest and Lowest Property Taxes - CPA Solutions

With 50 states the tax treatment for every state in the US can vary wildly especially for taxes like property taxes.

If you own a well, mine or even a farm. Here is how to reduce your taxable income through the Depletion Deduction. weneedacpa.com/2025/09/deplet…

weneedacpa.com

Depletion Deduction: How To Potentially Reduce Taxable Income - CPA Solutions

Natural resource extraction isn't common but it can lead to huge profits. However the depletion deduction can lower some of that income.

Are you royalty or did you just buy the rights to Just Bieber song? 😂Here how royalty income is taxed. weneedacpa.com/2025/09/how-ro… #royalty #income #taxes #finance

weneedacpa.com

How Royalties Are Taxed in 2025 - CPA Solutions

Royalties are a very underrated investment vehicle. However many people ask "How are royalties taxed", and we have a guide to help you out.

For many investors Net Investment Income Tax are a worry when planning their strategies. However there are ways to minimize the taxes owed. weneedacpa.com/2025/09/net-in… #investing #finance #taxes #incometaxreturn

weneedacpa.com

Net Investment Income Tax: What It Is and How to Minimize It - CPA Solutions

The Net Investment Income Tax is a 3.8% tax the IRS levies on higher-income individuals, trusts and estates that earn net investment income.

If you live abroad you still have to pay taxes. However here how to potentially lower your taxes through the Foreign Tax Credit. weneedacpa.com/2025/09/2025-f… #taxes #incomeTax #finance #money

weneedacpa.com

Maximizing the Foreign Tax Credit in 2025 - CPA Solutions

If you live abroad the foreign tax credit is a powerful tool that you can maximize in order to help you save on taxes.

A situation that no one wants to be in but if you have to here is a guide to IRS tax relief for disasters. weneedacpa.com/2025/09/irs-di…

weneedacpa.com

IRS Disaster Relief 2025 Extensions: Guide For Taxpayers - CPA Solutions

Disaster situations are something that no one wants to experience however you can get some relief from the IRS in the form of tax extensions

Worried about getting taxes done on time? Well did you know that you can file an extension in April and get an additional 6 months to file? weneedacpa.com/2025/09/2025-f…

weneedacpa.com

How to File a Tax Extension for 2025 Federal Taxes - CPA Solutions

Most people know to file there taxes by April 15th. However sometimes that isn't possible and here is a guide to file a Federal Tax Extension

United States เทรนด์

- 1. Happy Birthday Charlie Kirk 7,468 posts

- 2. Bears 90.7K posts

- 3. #Worlds2025 20.5K posts

- 4. Jake Moody 14.1K posts

- 5. Snell 25.1K posts

- 6. Falcons 52.2K posts

- 7. Bills 145K posts

- 8. Josh Allen 27.2K posts

- 9. Caleb 50.1K posts

- 10. Joji 32.9K posts

- 11. Jayden 23.1K posts

- 12. #BearDown 2,421 posts

- 13. Swift 292K posts

- 14. Ben Johnson 4,515 posts

- 15. #Dodgers 15.5K posts

- 16. Treinen 4,746 posts

- 17. Turang 4,417 posts

- 18. Roki 6,171 posts

- 19. Bijan 33.7K posts

- 20. #RaiseHail 8,471 posts

Something went wrong.

Something went wrong.