Nikhil H. Joshi

@CSNikhilHJoshi

Company Secretary

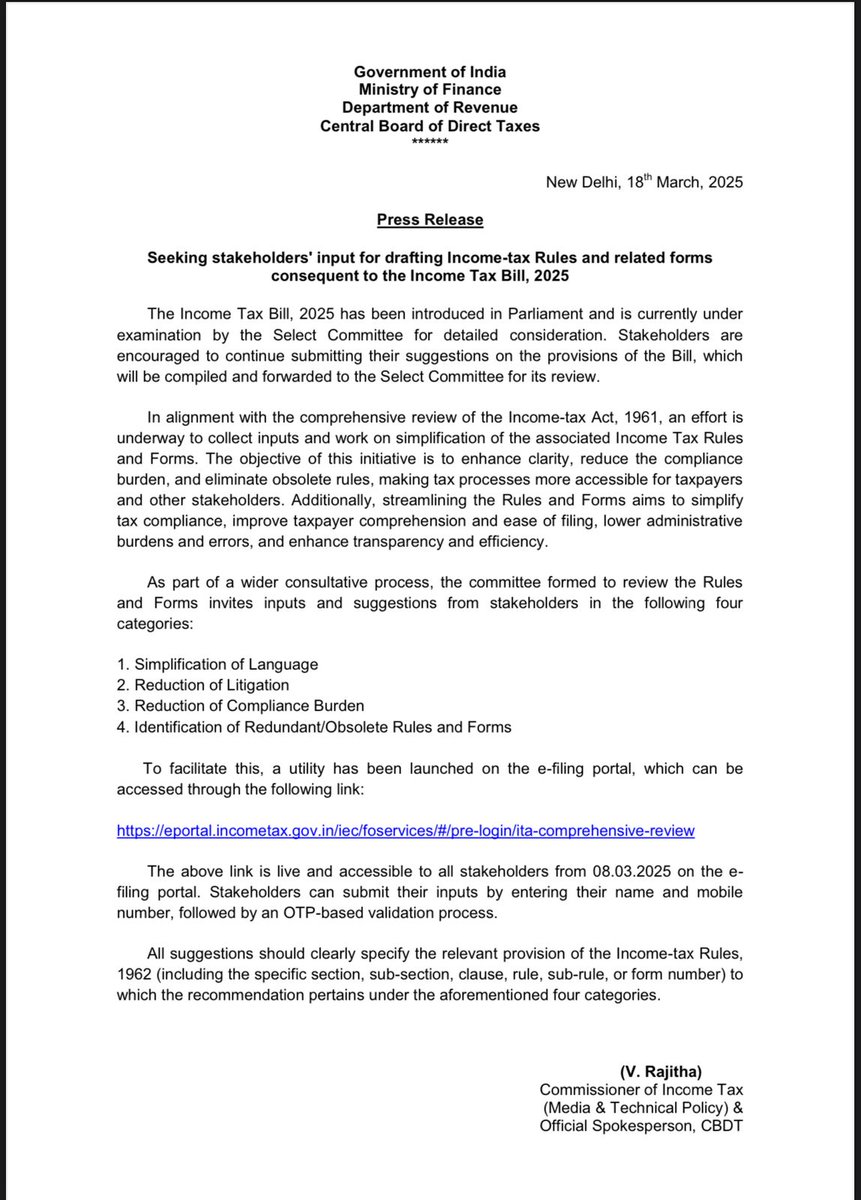

🔹 CDBT (@IncomeTaxIndia) Seeking Stakeholders' Input for Drafting Income-tax Rules & Forms 🔹 The Income Tax Bill, 2025, is currently under examination, and as part of a comprehensive review, CBDT invites stakeholders to provide their valuable inputs on simplifying tax rules…

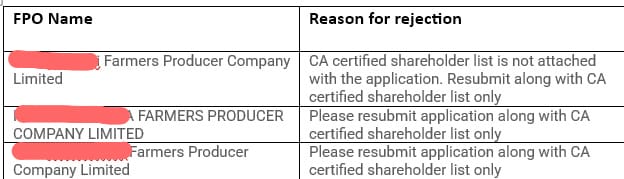

SFAC excluding Company Secretaries (CS) from issuing shareholding certificates & allowing only CAs violates the Companies Act, 2013. CS are legally empowered for such work. Urgent correction needed to uphold professional parity & law. @sfacindia @MCA21India @icsi_cs @FinMinIndia

#CS Dhananjay Shukla, President, #ICSI & #CS Pawan G Chandak, Vice President, #ICSI met Smt. Nirmala Sitharaman, Hon'ble Minister of Finance and Corporate Affairs, to apprise her on the significant role of #CS in #secretarial, #financial and #statutorycompliance domain

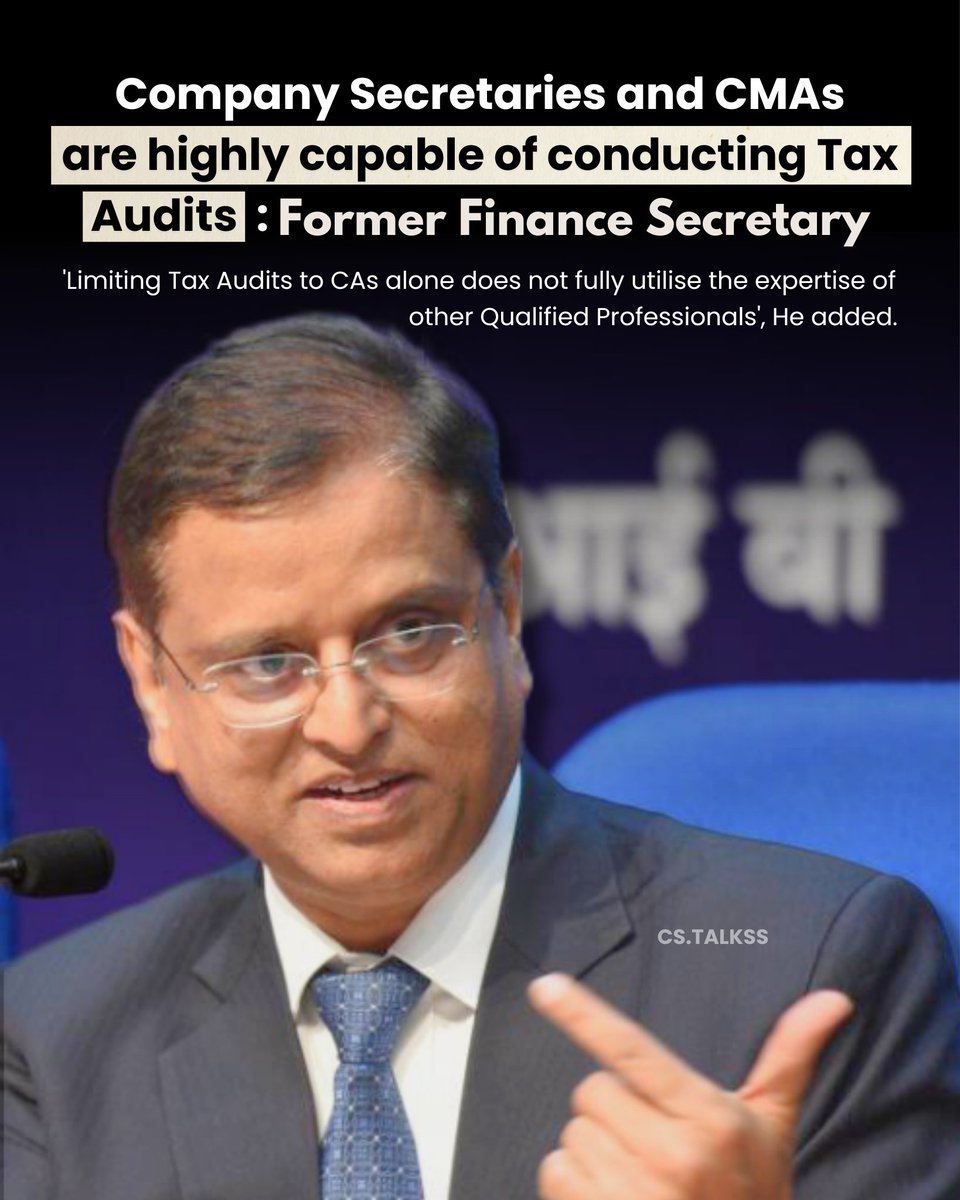

🚨 Former Finance Secretary of India, Subhash Chandra Garg amidst rising debate on #TaxAuditControversy under the Income Tax Bill, 2025

Today is the last day of Posting 🚨 #TAXAUDITFORCSCMA Tomorrow the new bill is going to be tabled in the Parliament. Plz 10000 Tweets today 🙏 @icsi_cs @ICMAICMA @narendramodi @nsitharaman @nsitharamanoffc @narendramodi @FinMinIndia @PandaJay @ppchaudharybjp

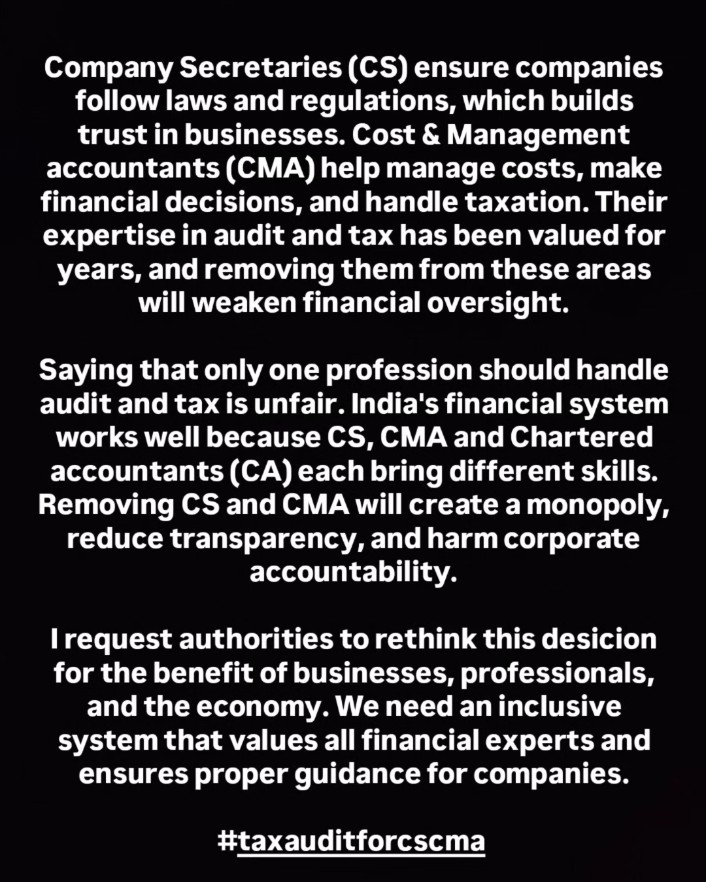

🚨 Tax Bill 2025 = Not Merit🚨 CS & CMA unjustly excluded due to power play. not industry needs. Govt must uphold equality 🔹 DTC Drafts included all 3 professions 🔹 MSME need fair competition, not 1 dominance 📢 Fix this injustice @FinMinIndia @PMOIndia #TAXAUDITFORCSCMA

CS, CA, and CMA study the same level of curriculum for tax. It is high time the roles of CS and CMA professionals in income tax audit are recognized. We are not asking for the CA statutory audit. #TAXAUDITFORCSCMA #taxaudit @MCA21India @nsitharaman @icsi_cs @ICMAICMA

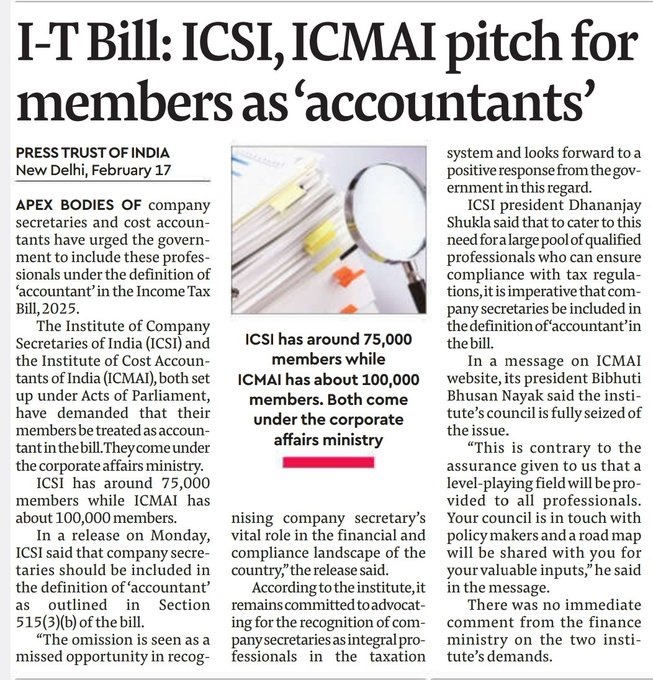

#TAXAUDITFORCSCMA The definition of 'Accountant' under the Income Tax Bill 2025 should include Company Secretaries and Cost Accountants. The monopoly of CA's in the field of Tax Audits should be stopped.

#TAXAUDITFORCSCMA monopoly is root cause of failing audit reliability in Nation CS AND CMAs must be allowed to provide rescue to the deficiency of ICAI @nsitharaman @narendramodi @IncomeTaxIndia @MCA21India @PMOIndia @icsi_cs @ICMAICMA @AmitShah

Friends , *As you aware Govt has made I big miss this time also in new income Tax Bill 2025 by not allowing CMAs to authorised for I Tax audit although repeated promised by authorities since last 15 years at least* in 2012 & latest in 2019 when new DTC was drafted but never…

Today is the last day of Posting #TAXAUDITFORCSCMA Tomorrow the new bill is going to be tabled in the Parliament. Plz 10000 Tweets today 🙏 @icsi_cs @ICMAICMA @narendramodi @nsitharaman

#CMACSfortaxaudit #TaxauditforCSandCMA #taxaudit #ICSI #ICAI #NirmalaSitharaman ICAI claims 'Tax Audits' are their forte. At the same time they also claim that 'Highest number of CA's penalised this 2024-25 fiscal' & 'Disciplinary actions against 241 CA's, a new record'.🤣

Knock Knock ! Madam @nsitharaman & @FinMinIndia wake from deep slumber. Please understand Cost Accountants are also Accountant & created by an act of parliament ONLY. Accountant scope is not patent by @theicai so Nail Down ICAI right now & save nation from financial frauds 🙏

I request all students and members of @icsi_cs and @ICMAICMA to tweet and trend #CMACSfortaxaudit It's high time that monopoly of one profession @theicai should end and every qualified professional should get equal opportunity and level playing field. #CMACSfortaxaudit

🚨 ICMAI Press Meet Alert! 🚨 The Institute of Cost Accountants of India (@ICMAICMA) invites you to a Press Meet for the Release of Memorandum on the inclusion of Cost Accountant in the definition of Accountant under Section 515(3)(b) of the Income-Tax Bill, 2025. 📅 Date:…

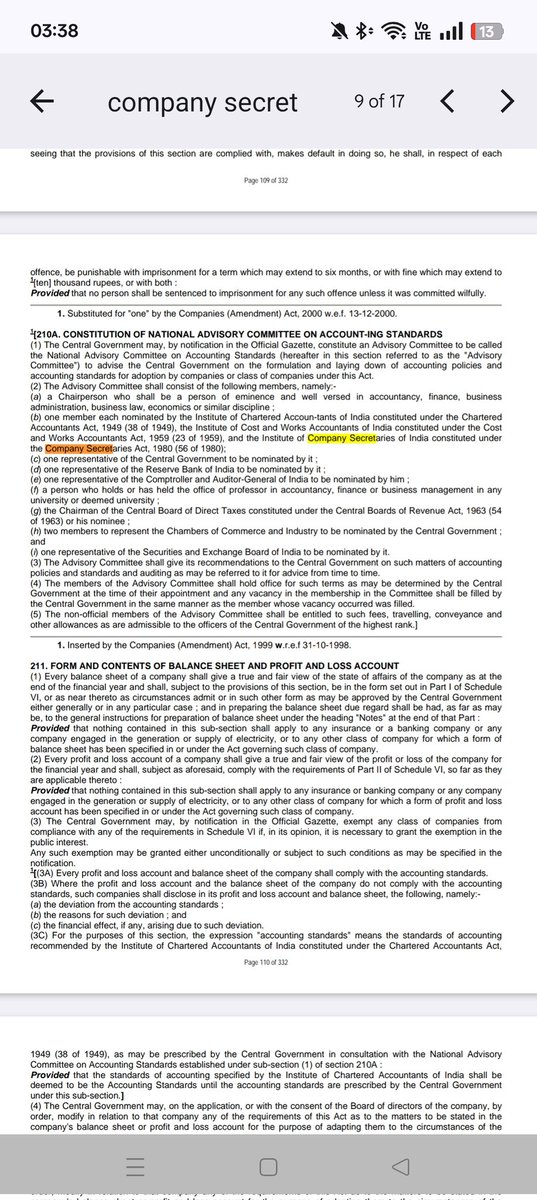

#CMACSfortaxaudit #taxaudits Formulation of Accounting Standards: In comparison with the Companies Act, 1956 and 2013. The CS, CMA and various experts were involved under the Companies Act, 1956. Later everyone was removed completely. This is Monopoly.

Dear CMA Colleagues & CS Friends, *Today, I am just to inform you that I have submitted my concerns on “Accountants Definition “as an Individual Citizen serving / served in various organisations* This mail has been sent to all *relevant authorities, including Shri Bijayant…

#CMACSfortaxaudit #taxaudit When monopoly exists, this is what it will lead to. Wake up call for all CMA and CS members to fight against such monopoly. the420.in/two-chartered-…

United States الاتجاهات

- 1. Black Friday 461K posts

- 2. Bears 52.9K posts

- 3. Nebraska 11.5K posts

- 4. Swift 56.7K posts

- 5. Sydney Brown N/A

- 6. Iowa 13K posts

- 7. Lane Kiffin 8,761 posts

- 8. Rhule 2,469 posts

- 9. Jalon Daniels N/A

- 10. Black Ops 7 Blueprint 10.3K posts

- 11. Sumrall 3,372 posts

- 12. Ben Johnson 2,590 posts

- 13. Go Birds 11.6K posts

- 14. #SoleRetriever N/A

- 15. Egg Bowl 7,860 posts

- 16. Kansas 16.6K posts

- 17. #kufball N/A

- 18. #Huskers 1,280 posts

- 19. #CHIvsPHI N/A

- 20. Mississippi State 5,225 posts

Something went wrong.

Something went wrong.