Caleb Mutua

@CalMutua

Corporate Finance Reporter at @business | Haiku Poet | Urban/ Street Photographer | @columbiajourn alumnus | Opinions Are My Own

You might like

Wall Street is still mostly run by white men. But in investment-grade bond market, some companies are trying to level this long-lopsided playing field by pushing the biggest and richest banks to support smaller women- and minority-owned banks. My latest! bloomberg.com/news/articles/…

NEW: We followed one man through the deportation process. 129 days, 6 facilities, 3 flights. For the first time, we've calculated what his experience cost taxpayers (1/2) w/ @elena___mejia @irencs @FolaAk: bit.ly/3KfNInl

JPMorgan Chase reports that $1.2T of debt is now tied to AI-related companies, making it the largest segment in the investment-grade market (@calmutua / Bloomberg) bloomberg.com/news/articles/… techmeme.com/251007/p15#a25… 📫 Subscribe: techmeme.com/newsletter?fro…

Credit portfolio trading is booming -- closing in on ETFs. The two feed off each other, says Barclays: “Take ETFs out of the picture, and portfolio trading wouldn’t exist.” @CalMutua @luwangnyc bloomberg.com/news/articles/…

Apollo, Ares and Carlyle purchased the first bond that offloads risk from bank loans extended to private credit funds known as business development companies. Another twist for SRT markets and BDCs. With @CalMutua

“No government—regardless of which party is in power—should dictate what private universities can teach, whom they can admit and hire, and which areas of study and inquiry they can pursue.” - President Alan Garber hrvd.me/GarberRespond3…

It's getting more expensive to trade corporate bonds. bloomberg.com/news/articles/…

bloomberg.com

Apollo Says Corporate-Bond Trading Costs Surged in Market Tumult

Bond dealers started demanding higher compensation for the risk of trading investment-grade corporate debt after President Donald Trump’s trade war sent volatility racing through markets, according...

Latest: Some of the biggest banks on Wall Street are taking advantage of relative calm in credit markets to borrow billions of dollars while they still can. bloomberg.com/news/articles/…

bloomberg.com

Morgan Stanley, JPMorgan Lead $16.5 Billion Bank Borrowing Spree

Morgan Stanley and rival JPMorgan Chase & Co. raised a combined $14 billion in the US investment-grade market on Monday, the first of the six biggest banks on Wall Street to tap primary debt markets...

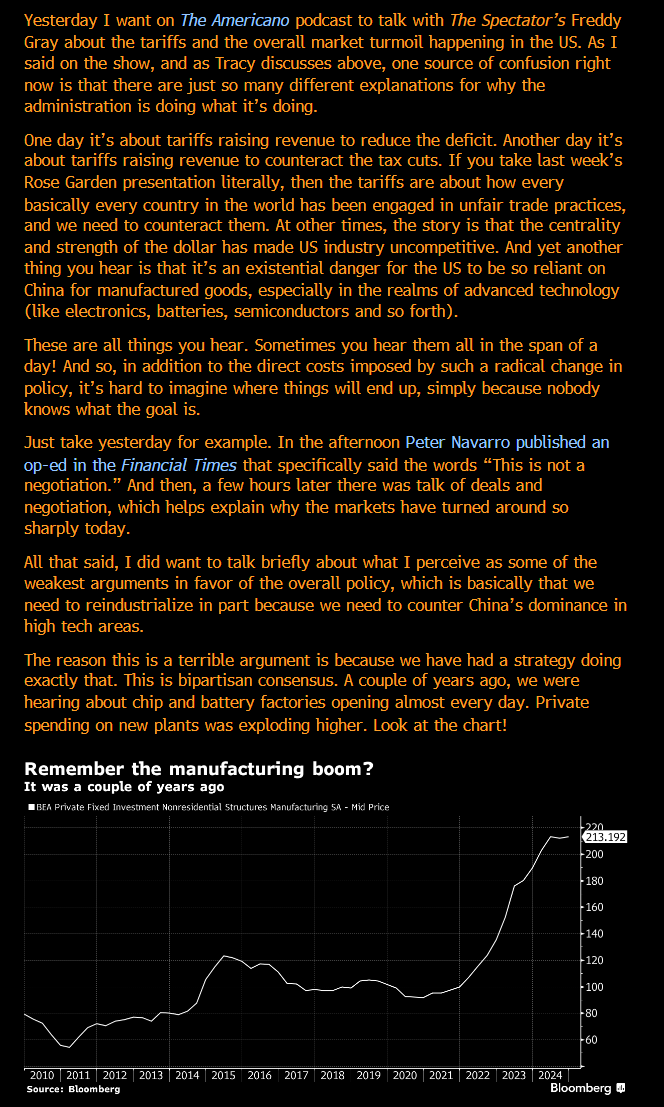

THE WORST DEFENSE OF THE TRUMP TARIFFS In today's Odd Lots newsletter, I wrote about how there are so many different arguments being put forth to explain or defend the tariffs. But the stuff about countering China's strategic tech dominance has to be the most egregiously bad.

The additional yield over Treasury bonds that investors demand to hold debt from the largest and strongest US corporations could reach levels last seen during the 2020 financial turmoil caused by the global virus pandemic. bloomberg.com/news/articles/…

Bank of America put it best: “The biggest shock to global trade in modern times.” And there’s more pain ahead. bloomberg.com/news/articles/…

Credit markets are now finally beginning to confirm the angst that has fueled a more than $5 trillion equity wipeout since late February @denitsa_tsekova @CalMutua bloomberg.com/news/articles/…

"An average of $46 billion of high-grade and junk bonds changed hands every trading day last year, up 21% from 2023, according to a report by @CoalitionGrnwch" bloomberg.com/news/articles/… via @markets @CalMutua

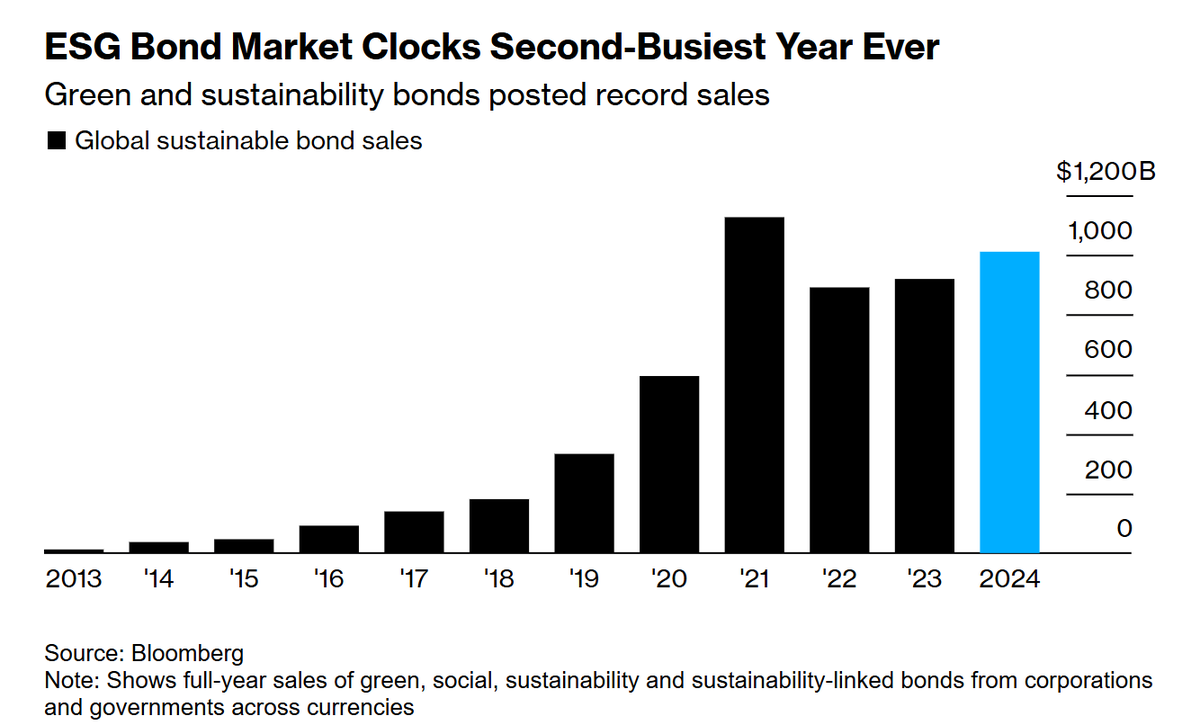

Global sustainable bond sales reach $1 trillion in 2024 🟢4,490 offerings 🟢Green bonds $571 billion 🟢#Sustainability bonds $239.7 billion 🟢Issuance of sustainability-linked bonds dropped for a third year Story ➡️tinyurl.com/mvfzzz7v (via @CalMutua @climate)

A slew of blue-chip firms kicked off issuance in the US investment-grade primary debt market, as underwriters brace for what’s expected to be one of the busiest Januaries for bond sales trib.al/WlPcTEs

BREAKING: *NVIDIA 3Q DATA CENTER REVENUE $30.8B, EST. $29.14B *NVIDIA SEES 4Q REV. $37.5B PLUS OR MINUS 2%, EST. $37.1B *THE AGE OF AI IS IN FULL STEAM SAYS NVIDIA'S HUANG bloomberg.com/news/live-blog…

Tight corporate bond spreads are here to stay! bloomberg.com/news/articles/…

bloomberg.com

Goldman Says Rich Credit Valuations Unlikely to Cheapen in 2025

US corporate bond investors will likely start 2025 with the most challenging valuation backdrop in decades, but attractive yields should keep the asset class compelling, according to analysts at...

Boeing will be the biggest US corporate borrower to ever be stripped of its investment-grade ratings if it is cut to junk status trib.al/LFoeXSb

The US high-grade primary market has gone from 0-100 fast! My latest: bloomberg.com/news/articles/…

United States Trends

- 1. Valentines Day N/A

- 2. Rubio N/A

- 3. Jordan Stolz N/A

- 4. Forever Young N/A

- 5. Maher N/A

- 6. Ungrateful N/A

- 7. Clemson N/A

- 8. Finland N/A

- 9. #Caturday N/A

- 10. Roses N/A

- 11. #ด้วงกับเธอEP3 N/A

- 12. Carbon Monoxide N/A

- 13. DUANG WITH YOU EP3 N/A

- 14. Nysos N/A

- 15. Padres N/A

- 16. CO and CO2 N/A

- 17. #saturdaymorning N/A

- 18. Alexei Navalny N/A

- 19. #HWCafe N/A

- 20. Happy Love N/A

You might like

-

Nonini 🇰🇪🇺🇲

Nonini 🇰🇪🇺🇲

@Noninimgenge2ru -

Anne Riley Moffat

Anne Riley Moffat

@A_Riley17 -

Maseme Machuka, MPRSK

Maseme Machuka, MPRSK

@MasemeMachuka -

Chris Kirwa

Chris Kirwa

@chriskirwa -

Alfred Ng'ang'a

Alfred Ng'ang'a

@Alfienganga -

Molly Smith

Molly Smith

@MollySmithNews -

Josyana

Josyana

@josyanajoshua -

Laura Benitez

Laura Benitez

@lauralevfinance -

Tim Njiru ✈️

Tim Njiru ✈️

@timnjiru -

Ng'endo

Ng'endo

@Ngendo87 -

Kelsey Butler

Kelsey Butler

@itskelseybutler -

james Anyona

james Anyona

@jimlik -

Lisa Lee

Lisa Lee

@LisaLeereporter -

Carol Merab

Carol Merab

@carol_merab -

Danielle Moran

Danielle Moran

@danielle_moran

Something went wrong.

Something went wrong.