You might like

Of course, he’s talking about BTC. And what he really means is that Square becomes the trusted third party — the benevolent middleman holding your funds, managing your transfers, and deciding when and how you get to “use” your Bitcoin. The illusion will be neat: low fees,…

Government loves BTC because it behaves. It’s a system of intermediaries wearing digital masks. Exchanges. Custodians. Gateways. Trusted third parties — the very parasites Bitcoin was meant to kill. It gives the illusion of rebellion while quietly rebuilding the same empire of…

I deleted my previous tweet because I couldn’t find any other information to validate the retweet. I posted this a long time ago. After that we saw a bunch of exchanges falter. I just don’t think we’ve seen the last of it. Be safe out there.

I suspect there are number of crypto exchanges that are currently financing their operations by running fractional reserves and utilizing deposits for paying for operations. Ironically, we still need more transparency in crypto. “Not your keys, not your coins”

There's nothing "anti-fiat" about Michael Saylor’s strategy. He’s taking advantage of the banking system’s ability to create money out of thin air, using it to buy Bitcoin and accelerate the very currency debasement he claims to be against.

I’m tired of winning. Please Mr President I’m sick of winning

They will tell you BTC is a huge success at $100,000. What if I told you, that between 2014-2017, the Big Banks, Big Tech and Big Gov took over BTC, gutted its functionality and have HELD DOWN the price to merely $100,000 while also suppressing the stories of the freedom…

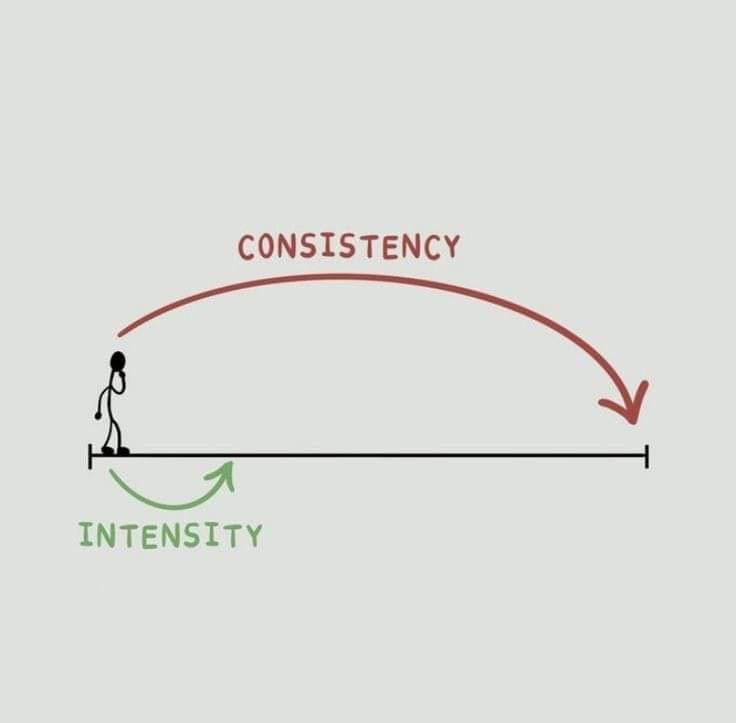

Intensity might get you started, but consistency is the champion.

Craig Wright Wielding The One & Only "SATOSHI SWORD" 😍 @Dr_CSWright #BSV #BitcoinSV #BSVistherealbitcoin #BSVblockchain

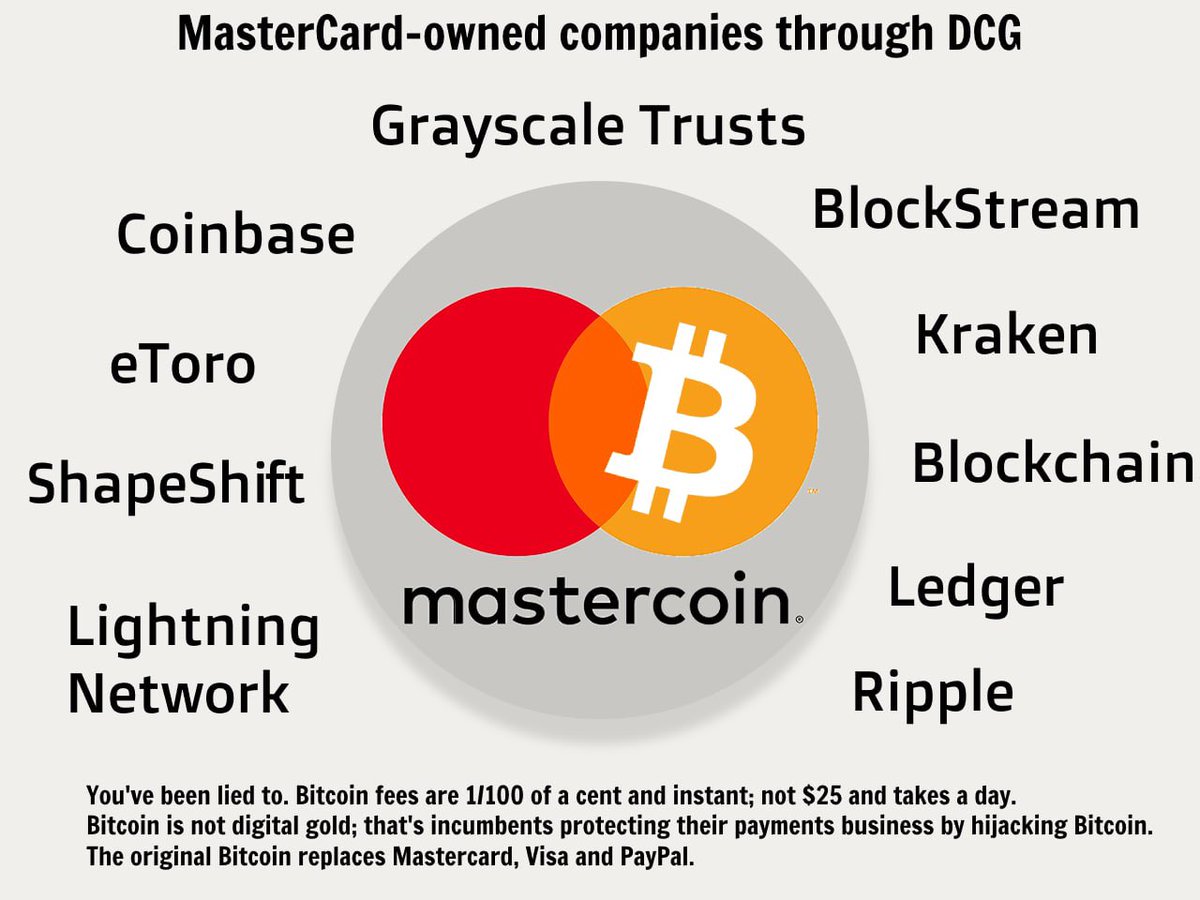

Big payments companies wanted to delay bitcoin’s inevitable victory. They want you to use bitcoin atop MasterCard before you realize that MasterCard should be run atop bitcoin. So they recruited most of the devs in 2013-14 before almost anyone was paying attention.

Client: ''Alf, I don't understand the fractional reserve banking system: could you please explain it to me?'' I can't, because that's not how banks work. Banks don't lend deposits or reserves. Banks create money out of thin air every time they lend.

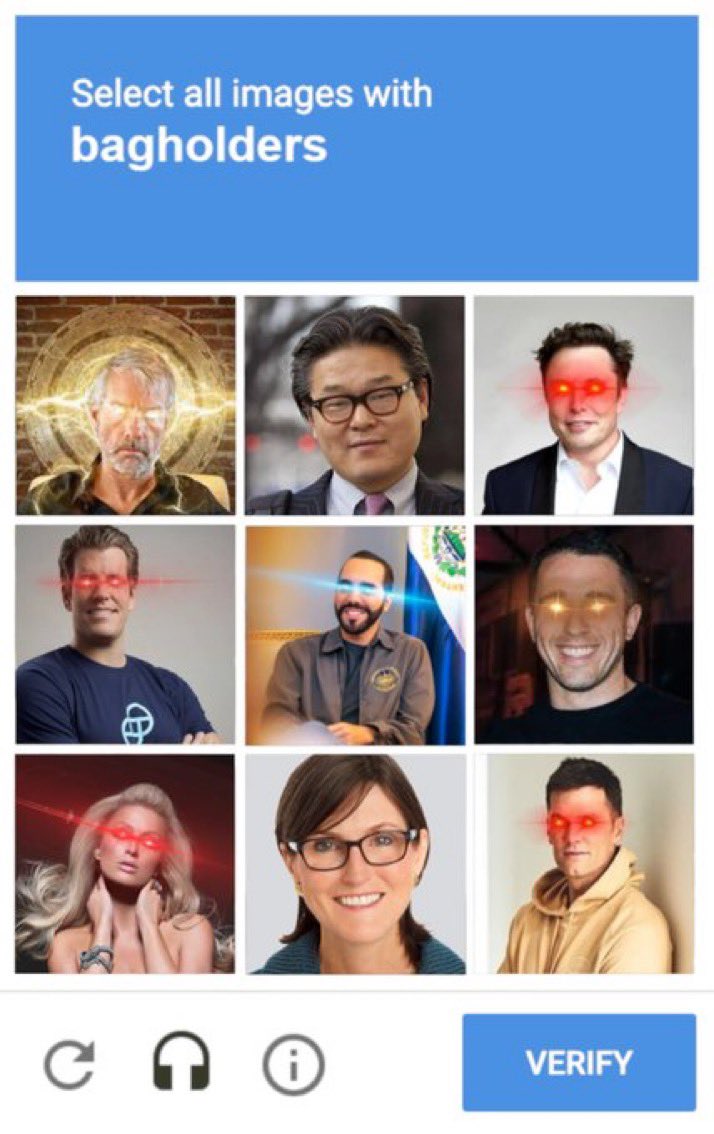

New Google Captcha just dropped

No Jerome, you flooded the system with bank reserves. Reserves are ''money'' only for commercial banks. Bank deposits are money for people, and they are printed by banks (lending) and the government (deficits). You don't print money that people can use, and you know that.

Flashback from May 16, 2021: CBS: “Fair to say you simply flooded the system with money?” POWELL: “Yes. We did. That’s another way to think about it. We did.” CBS: “Where does it come from? Do you just print it?” POWELL: “We print it"

Having been lucky enough to cross paths with the largest institutional investors in the world, I learnt that risk assets become attractive to them if: - Realized volatility is low & dropping - Central Banks are in control Today, none of the two conditions are met yet.

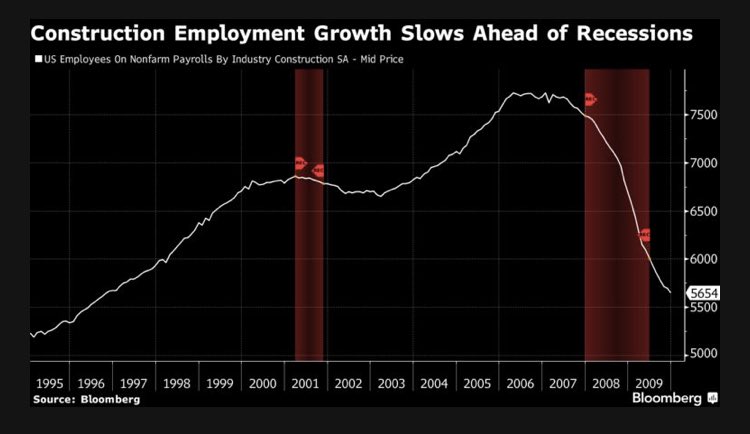

The housing cycle IS the business cycle. The chart below shows how a slowdown in the pace of job creation in the construction sector has preceded both recession in the 2000s. The latest jobs report showed we’re cooling off there - something to monitor going forward.

Re: $BTC/Crypto: The Beginning of the End of the Liquidity Lottery. I’ve been wanting to write a thread about BTC supply/demand for a while now. Here it is. (THREAD)

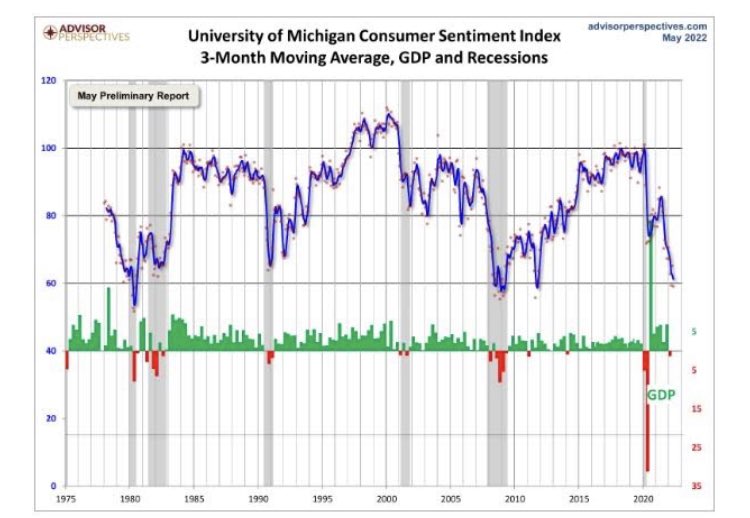

For 40+ years, sharp drops in the University of Michigan consumer sentiment index have preceded either recession or sharp slowdowns in economic activity. And this time will not be different: respect the cycle on the way up and on the way down.

Very often, I get asked about my top macro/investment books. So here is my top 7. 3 books on the functioning of our monetary system 2 broad macro books 2 books on markets & managing risks 1/9

United States Trends

- 1. Christmas 3.22M posts

- 2. Santa 1.64M posts

- 3. JEONGHAN 46.6K posts

- 4. Feliz Navidad 909K posts

- 5. EigenCloud x DataHaven 1,377 posts

- 6. Hawaii 24.7K posts

- 7. Merry Xmas 313K posts

- 8. yeonjun 54.4K posts

- 9. Clavicular 5,595 posts

- 10. God is Great 9,892 posts

- 11. Happy Birthday Jesus 27.5K posts

- 12. Marty Supreme 18.5K posts

- 13. #ShowSVPTheTree N/A

- 14. riki 15.8K posts

- 15. Chan 183K posts

- 16. jisung 44.7K posts

- 17. Die Hard 16.1K posts

- 18. Dan Fouts N/A

- 19. Howard Stern N/A

- 20. Midnight Mass 11.9K posts

Something went wrong.

Something went wrong.