Ben Goette

@Compass_Capital

Technology, Deals, Markets and Health #Technology #MergersAcquisitions #CorporateFinance #Deals #Markets #Macro #TectonicShifts #Health #Longevity

You might like

„Happy New Year! 🥂 2025 ist der perfekte Zeitpunkt für Wachstum, Nachfolge oder Unternehmensverkauf. 🚀 Wir unterstützen Sie mit klarem Fokus und persönlicher Beratung. Auf ein erfolgreiches Jahr! 🎯 #M&A #Nachfolgeplanung #Wachstum“

🚨#BREAKING: PFIZER WHISTLEBLOWER JUST EXPOSED IT ALL ⚠️FDA WANTED THIS HIDDEN FOR 75 YEARS ⚠️Pfizer whistleblower releases internal documents showing over 158,000 reports of SERIOUS adverse reactions within two months of the release of their COVID vaccine.

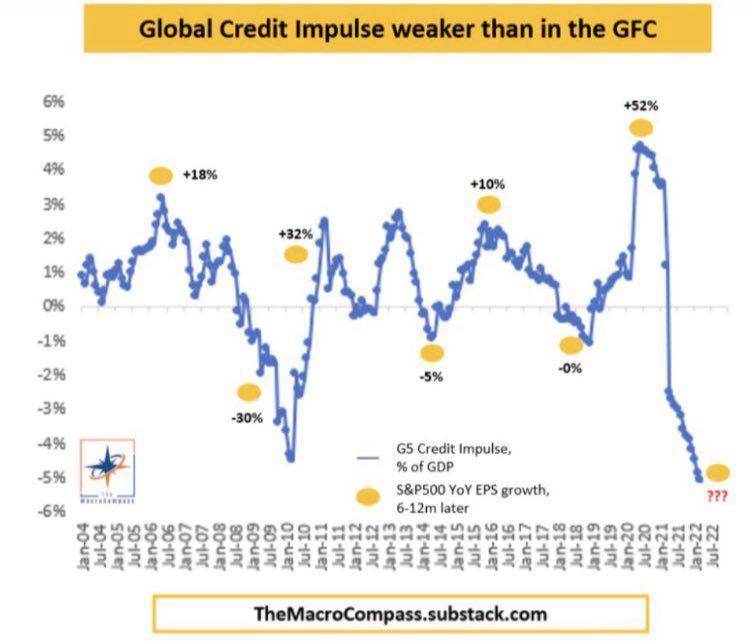

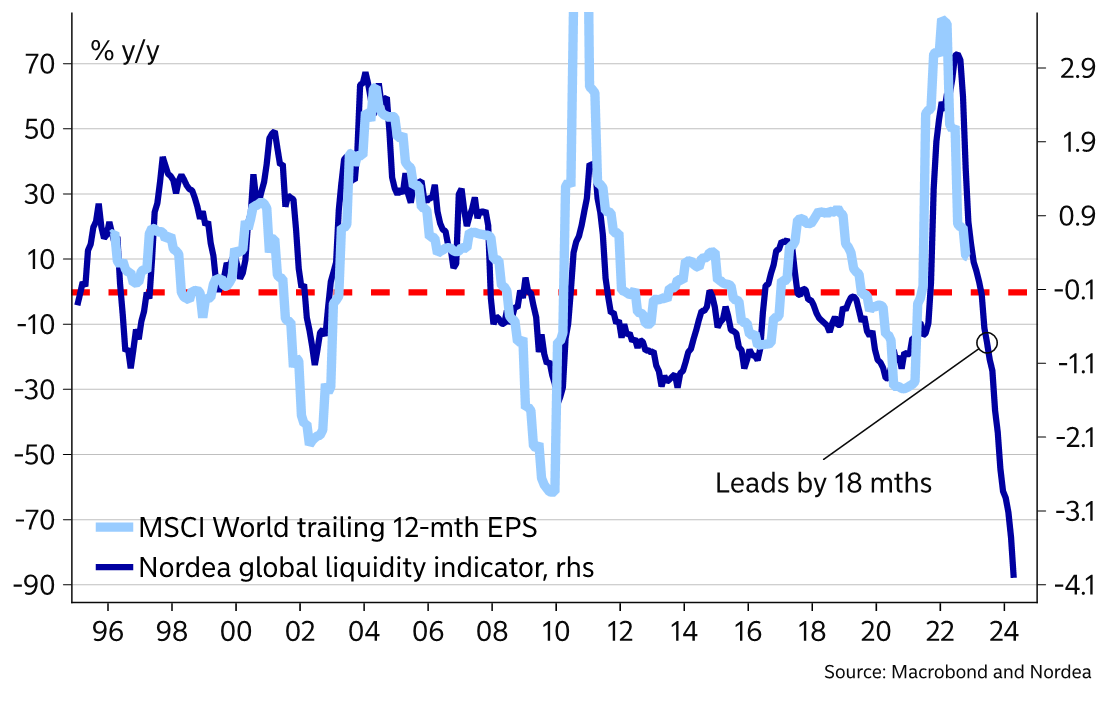

🌎 I have in my 30 years as an economist, strategist and portfolio manager NEVER seen any monetary tightening like this. Welcome to 2023...

There are >800 privately-held, venture-backed companies worth a billion dollars. These companies are generally too big to be acquired (particularly with new antitrust rules) so they have to IPO. The public markets used to absorb around 100-150 companies/year.

Some interesting Stats on Social Preconditions for Unrest from BCA: marketwatch.com/story/strategi…

marketwatch.com

Strategist who predicted the U.S. would ‘see a revolt of some kind by the 2020 election’ says U.S....

America was ripe for social upheaval, says this analyst, who called it as far back as 2017. Having it bubble over just as an already divisive presidential election was drawing closer makes it all the...

“The challenge of leadership is to be strong, but not rude; be kind, but not weak; be bold, but not a bully; be thoughtful, but not lazy; be humble, but not timid; be proud, but not arrogant; have humor, but without folly.” Jim Rohn

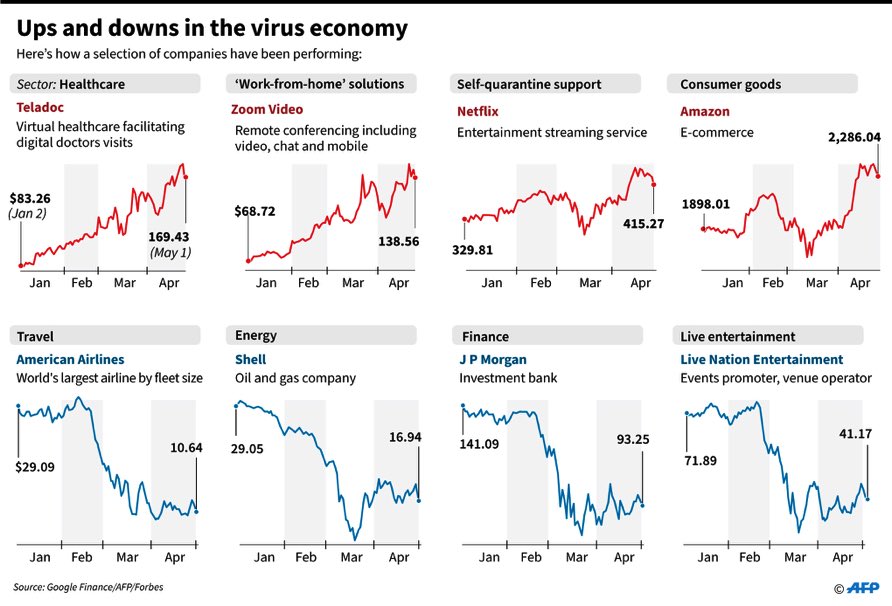

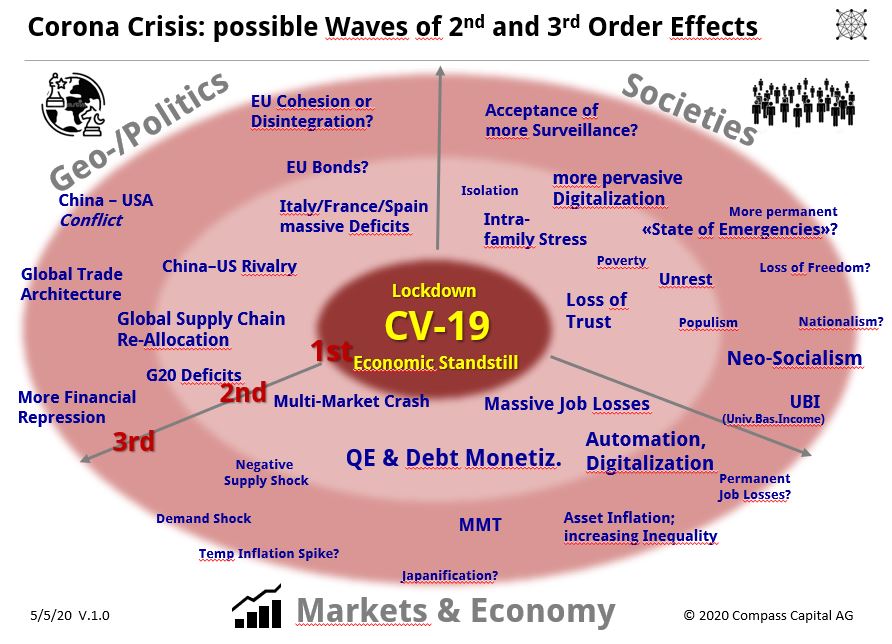

Corona Crisis Waves: let's think about the 2nd and 3rd order consequences ! linkedin.com/pulse/corona-c…

Meanwhile, the tensions in the #SouthChinaSea are increasing again. Chinese media portray the US as "troublemaker" while the PLA seeks to extend its influence.

Frequent US, Australian military activities in the #SouthChinaSea are not conducive to regional stability. US is the biggest pusher of militarization in region. Chinese PLA is on high alert to safeguard national sovereignty and peace in the region: Chinese Defense Ministry

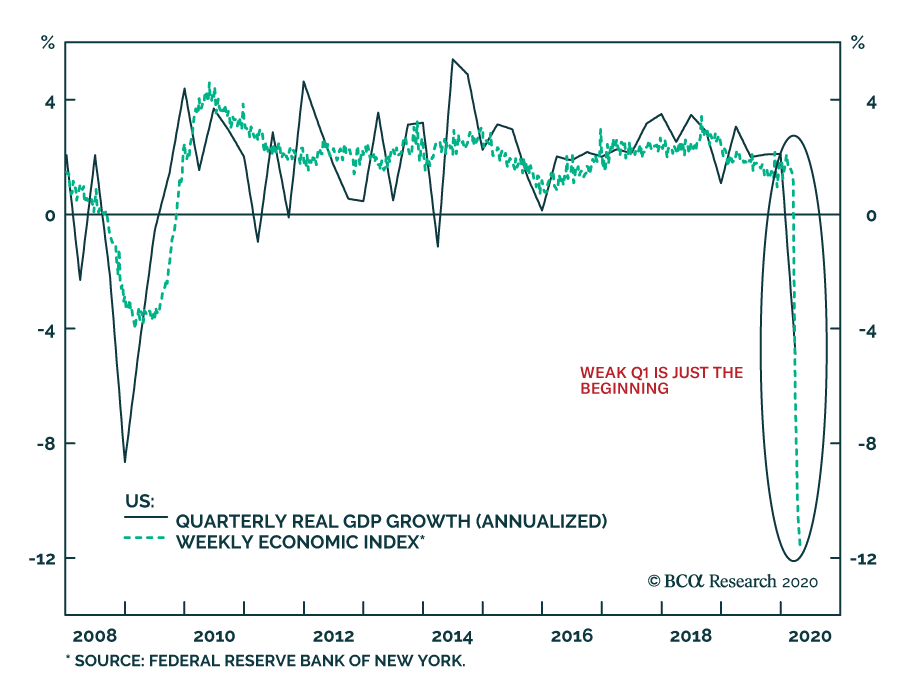

Leading Indicators predict strong GDP contraction; due to rapidly shrinking earnings, stock markets are getting more expensive by the day.

This is the typical post-crash early recession P/E spike - when earnings collapse but stock prices rebound too sharply after shock.... Note: Markets aren't cheap.

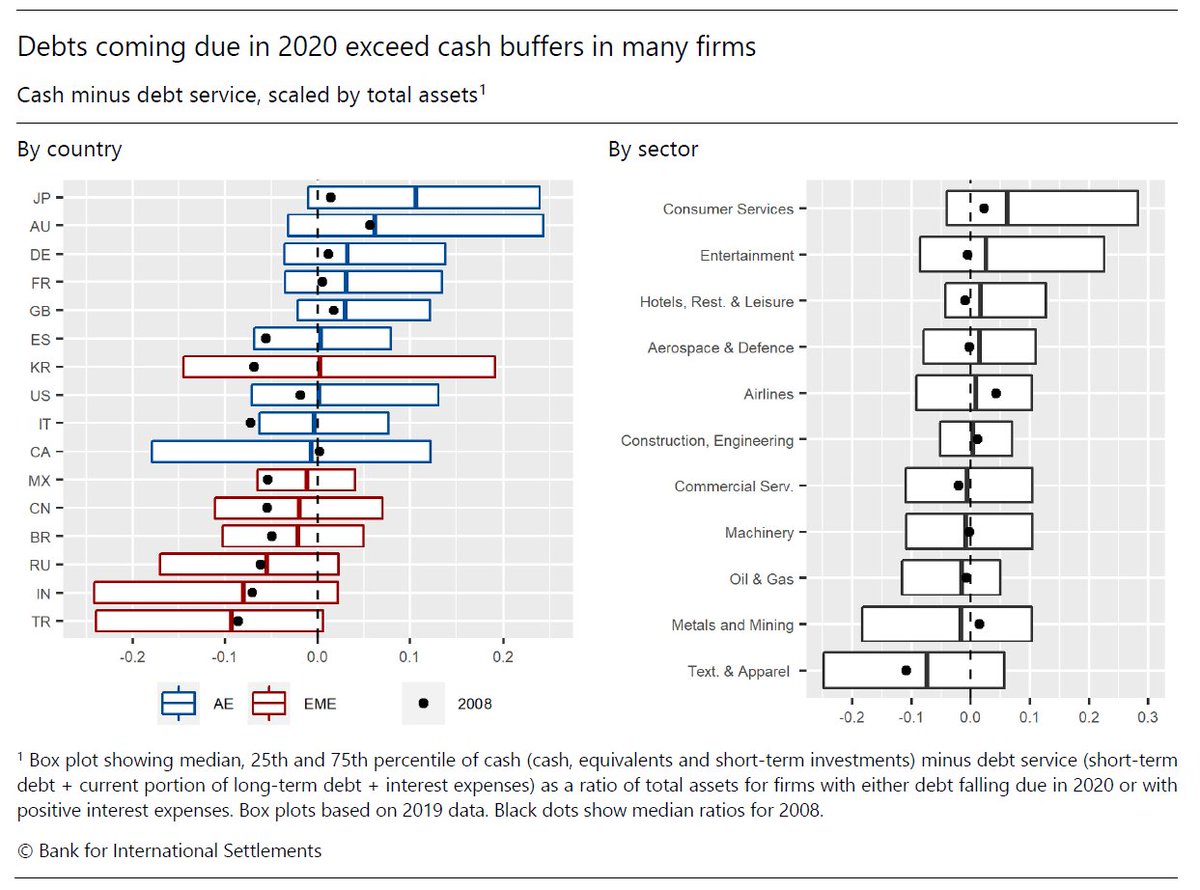

BIS research shows how sustained revenue collapse from #CV-19 will endanger #debt service coming due:

Covid-19 is placing huge strains on corporate #CashBuffers: if revenues fall 25%, 50% of firms might not have enough liquidity to cover total debt servicing costs over the coming year #DebtServicing #CashFlow #Covid19 #BISBulletin bis.org/publ/bisbull10…

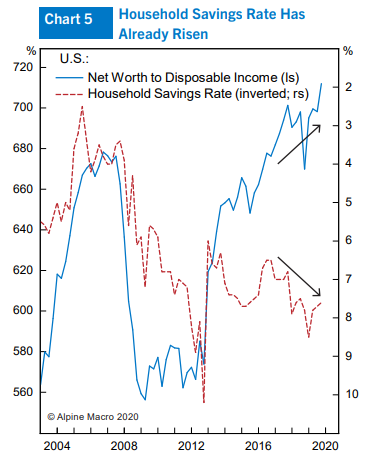

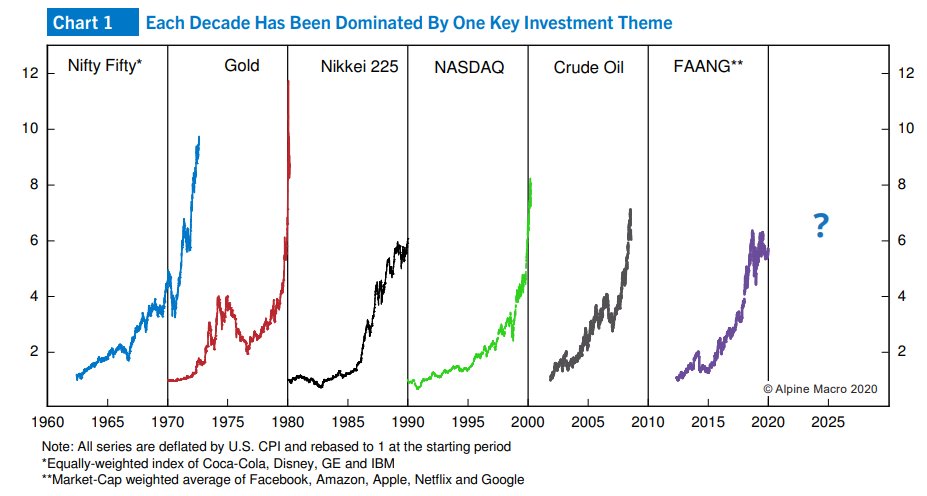

The question every investor needs to think about: what will be the new big investment theme of the next decade? (Graph courtesy of Alpine Macro)

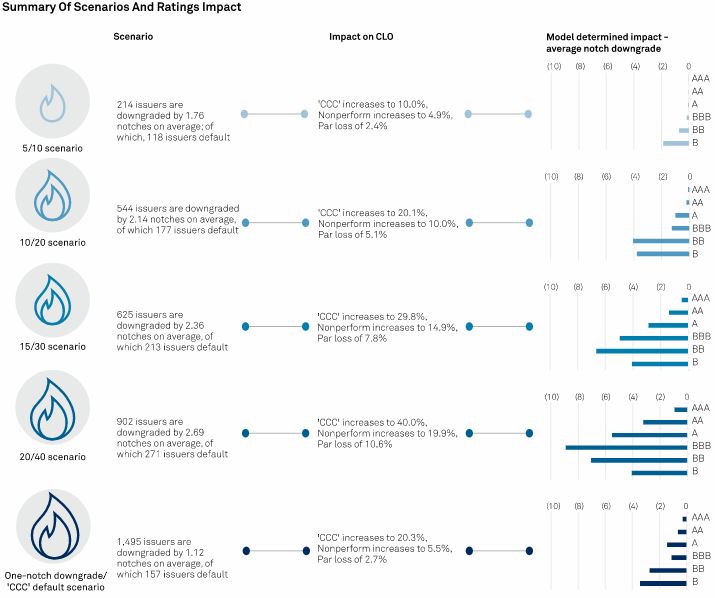

Oil industry on the brink of a downgrading cascade:

The combined impact of covid-19 and the collapse in oil prices present speculative-grade debt issuers with a challenge unlike anything seen in the history of the leveraged lending market. How will U.S. CLO ratings fare? Read more: ow.ly/spCX50zpH4s

Strong Surge in Money Growth - what does the evidence suggest about the future? The evidence is mixed! Inflation usually fell, commodities and yields usually rose. Other than that, very inconsistent results.

Interesting: US Savings rate higher than what one would think. Beginning of Japanization....?

United States Trends

- 1. Notre Dame N/A

- 2. Rivers N/A

- 3. Lobo N/A

- 4. Ryan Wedding N/A

- 5. #TALON N/A

- 6. Blades Brown N/A

- 7. benson boone N/A

- 8. March for Life N/A

- 9. #FursuitFriday N/A

- 10. Jassi N/A

- 11. #RepublicanHealthcareDisaster N/A

- 12. Marc Anthony N/A

- 13. Cameron Smotherman N/A

- 14. Deion N/A

- 15. Bricillo N/A

- 16. #Supergirl N/A

- 17. Afghanistan N/A

- 18. Jason Momoa N/A

- 19. Jeff Saturday N/A

- 20. Nate Oats N/A

Something went wrong.

Something went wrong.