Compound Capital

@CompoundCaps

OpenAI is valued at $500 billion. If it was public, it would have negative EPS. A lot of analysts keep pointing to the fact that the AI stocks make money (unlike .com era companies), but THE BIGGEST player is not profitable despite all the capex. Is this bubble-like?

Couple of Iron Condors cooking right now $SLV $PEP $BIDU

Profit taken on $ORCL 💰💰

Call Credit Spread open on $ORCL Need to close below 290 on Friday and will collect full premium Collected .62 risking 250 $SPY $QQQ

Call Credit Spread open on $ORCL Need to close below 290 on Friday and will collect full premium Collected .62 risking 250 $SPY $QQQ

“GME moment” This will be crazy!

$HIMS holding above $61 should be the 2025 $GME moment Where the retail investors stick it to the Institutional Short sellers here. $HIMS short interest is c. 35%, lead by BofA. Holding above $61 and they are GOOSED!

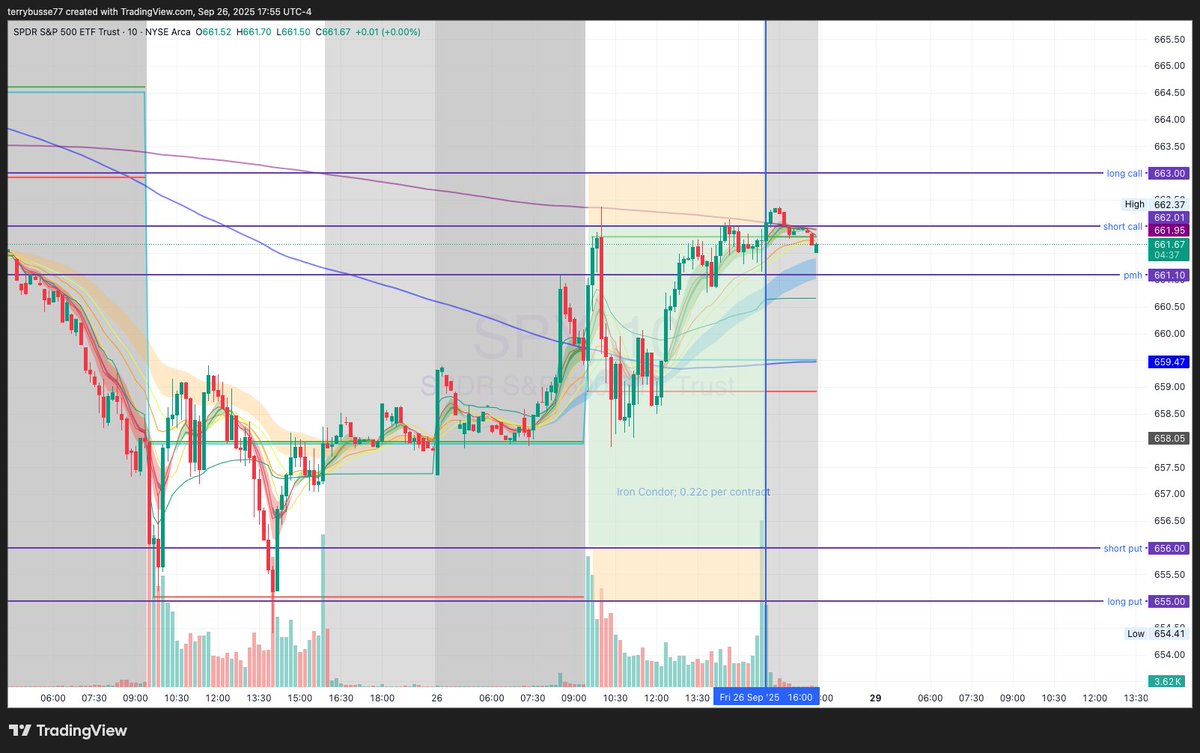

$SPY Iron Condor Max Profit hit just barely

$SPY Short Iron Condor Looking to profit as long as SPY closes between 662 and 656 today Premium selling, taking advantage of the chop

HAVE THE ABILITY TO MAKE MONEY NO MATTER WHAT THE MARKT IS GIVING YOU

$SPY Short Iron Condor Looking to profit as long as SPY closes between 662 and 656 today Premium selling, taking advantage of the chop

MARKETS IN TURMOIL 🚨 $SPX down 1.4% from all time highs

Profit Target Hit! Read the chart like a book $MA $SPY $QQQ

$MA solid swing trade here on Mastercard. Played bounce off the trendline with additional support from 50dayma

Bullish

$ONDS just locked in the current offering with Akerman LLP - straight up BigLaw stamp of approval. When firms like that sign off on deals, you know this ain’t no penny stock play anymore🚀 #ONDS

$JD 12/2026 exp. put credit spread just opened: Short 30puts Long 27puts 1.29credit with 3.00 collateral

$MA solid swing trade here on Mastercard. Played bounce off the trendline with additional support from 50dayma

Which sectors would you be overweight right now? Probably the laggard right? HEALTHCARE lowest PEG sector with the lowest YTD performance in the SP500. Right now that is HEALTHCARE. The best sector to be overweight right now $XLV $SPY $QQQ

Does anyone follow Ben Grahams 25% bonds and 75% stocks rule nowadays lol?

1 vote · Final results

Hims did a nice job reclaiming the 50dma. The previous times it has done this, it starts flying. $hims $spy $qqq

I'm thinking about possible swing trades, once bulls are able to regain the fifty day moving average. On my backtesting there is always a big move once they are able to claim this, and also with the short interest, I think it is likely to be a short squeeze. $HIMS $SPY $QQQ

United States Trends

- 1. D’Angelo 334K posts

- 2. Charlie 636K posts

- 3. Erika Kirk 64.4K posts

- 4. Young Republicans 22.6K posts

- 5. Politico 201K posts

- 6. #AriZZona N/A

- 7. #PortfolioDay 20.9K posts

- 8. Jason Kelce 6,868 posts

- 9. Pentagon 114K posts

- 10. Presidential Medal of Freedom 86.1K posts

- 11. Big 12 14.4K posts

- 12. George Strait 4,870 posts

- 13. Burl Ives N/A

- 14. Drew Struzan 35.1K posts

- 15. Brown Sugar 24.1K posts

- 16. Kai Correa N/A

- 17. Scream 5 N/A

- 18. Angie Stone 37.3K posts

- 19. #LightningStrikes N/A

- 20. Milei 314K posts

Something went wrong.

Something went wrong.