Compounding Lab

@CompoundingLab

Chief accountant, ACCA, MSc in finance & portfolio manager on Etoro. Fundamentals-based dynamic asset allocation. Fin charts and opinions, but not an advice.

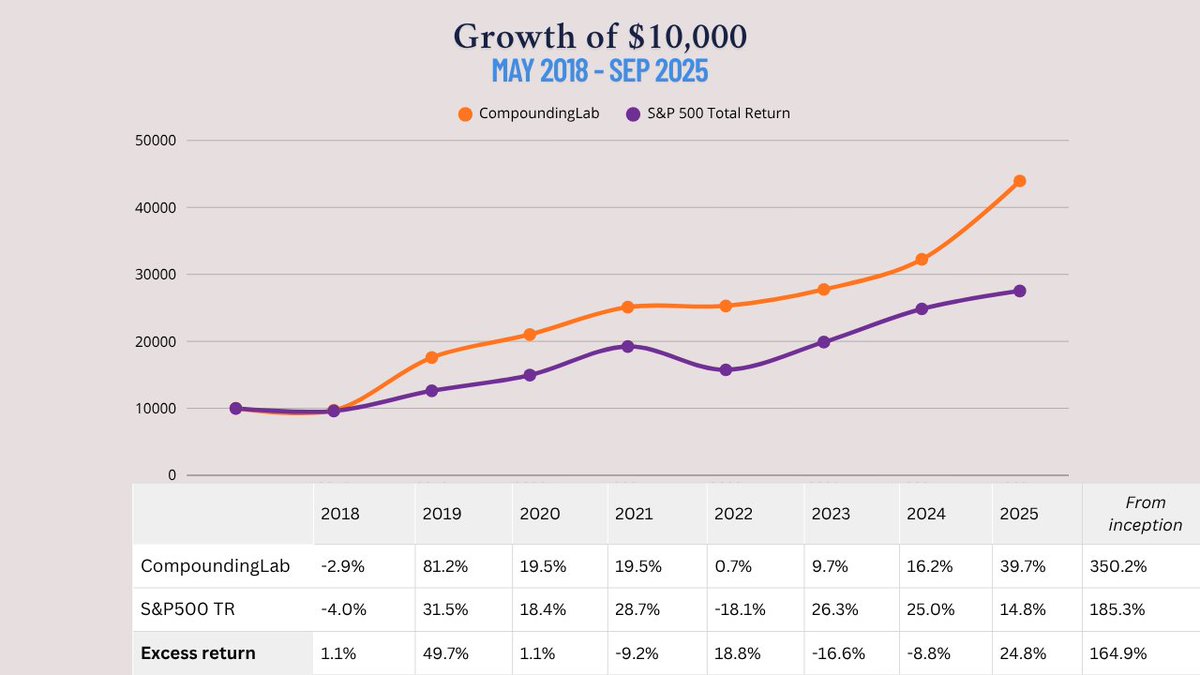

𝗣𝗼𝗿𝘁𝗳𝗼𝗹𝗶𝗼 𝘂𝗽𝗱𝗮𝘁𝗲 - 𝗦𝗲𝗽𝘁𝗲𝗺𝗯𝗲𝗿 𝟮𝟬𝟮𝟱 Last month, our portfolio delivered 2.44% while the S&P500 gained 3.65%. YTD, we are beating the index by 25%. With this result, my task is becoming more tilted towards defending gains, rather than achieving new…

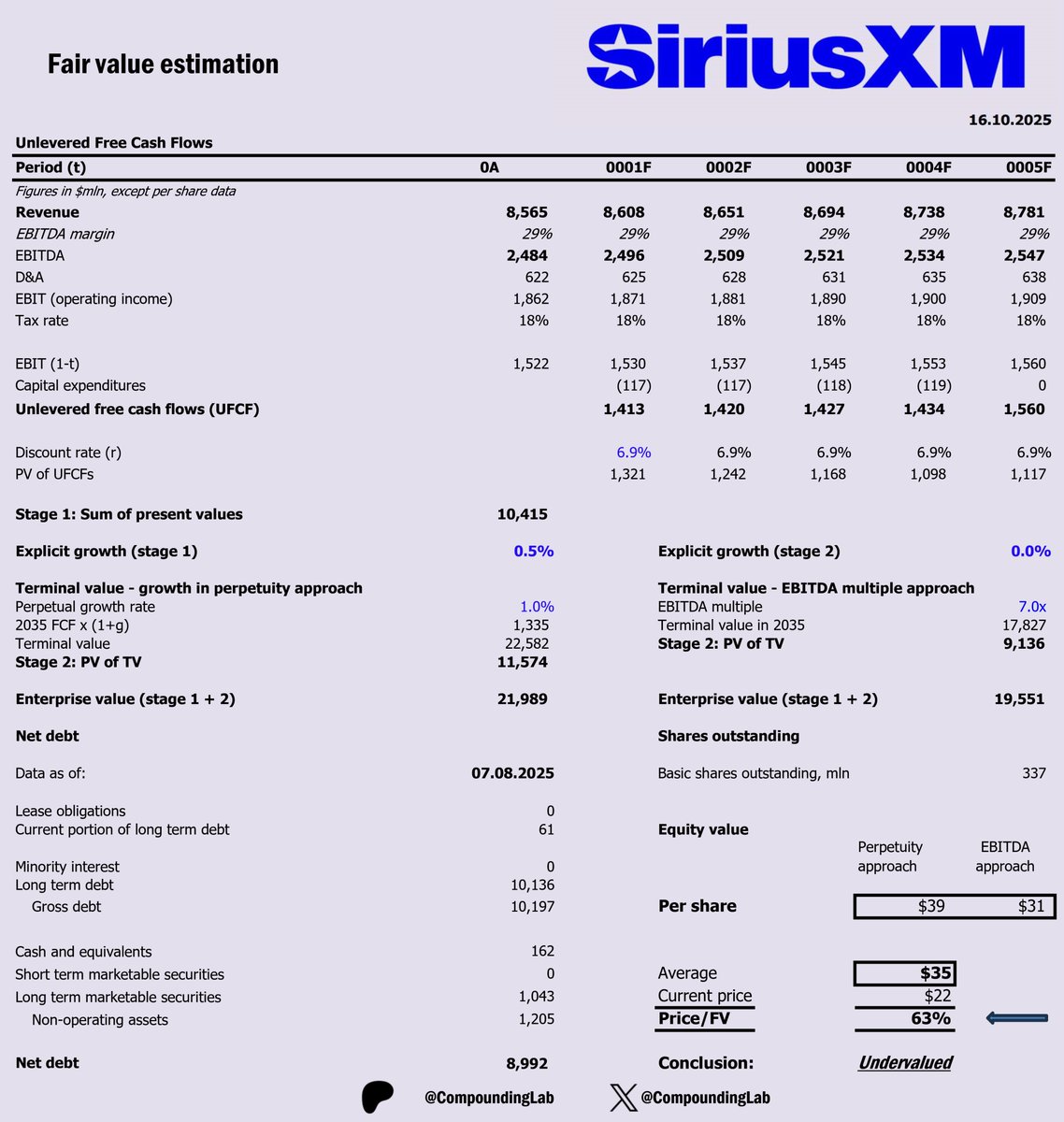

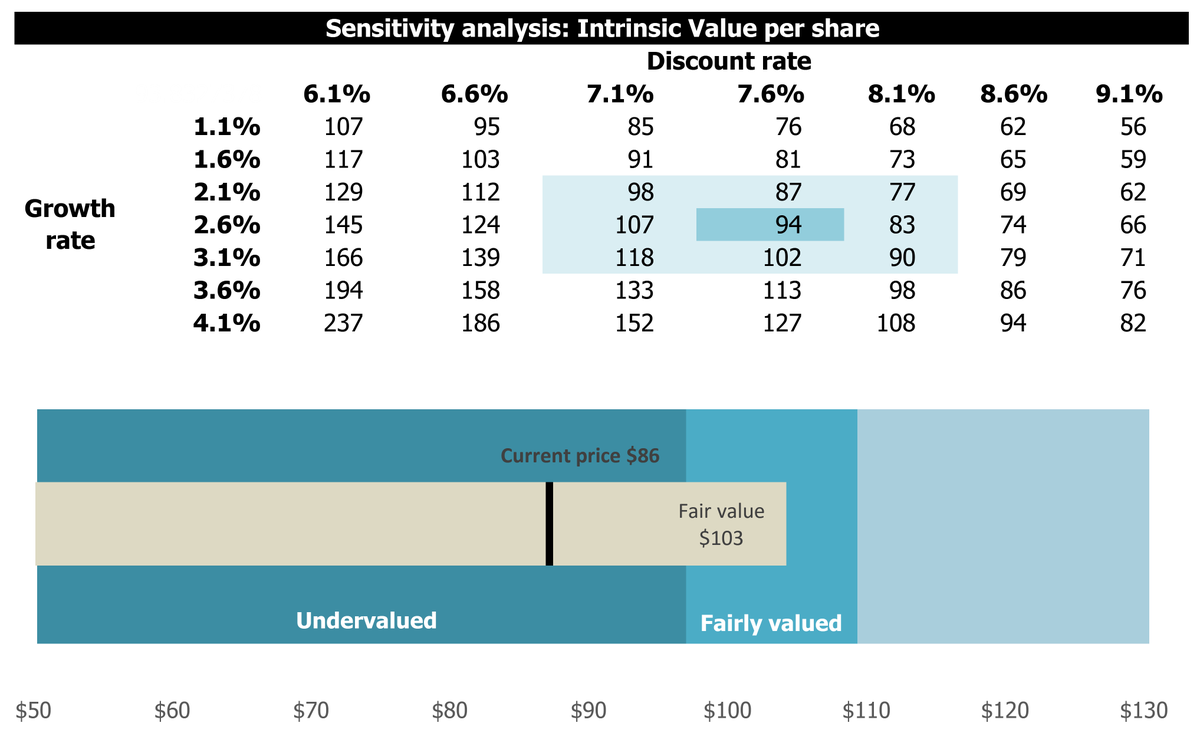

$SIRI – valuation As per request from one of my followers, here is a DCF model for Sirius XM Holdings Inc - an interesting small-cap in the entertainment industry. Valuation suggests that the stock is trading at 37% discount to fair value. If adjusted to FV within 3 years, it…

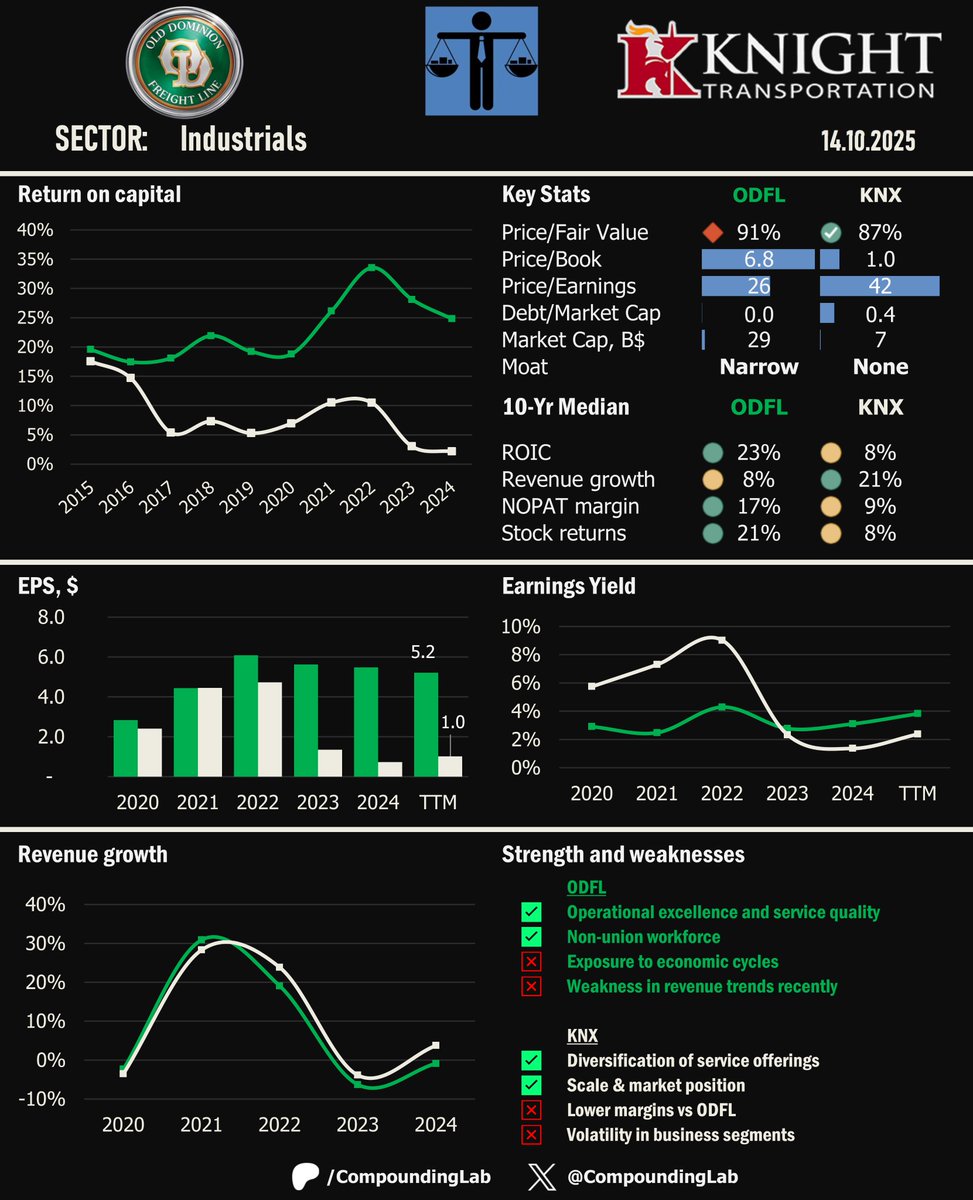

$ODFL vs $KNX: The Trucking Clash 🔥 Summary: ✔️ ODFL dominates with industry-leading margins and return on capital. ✔️ KNX shows stronger historical top-line growth and diversification. ✔️ Valuations suggest both stocks trade below fair value, but with very different quality…

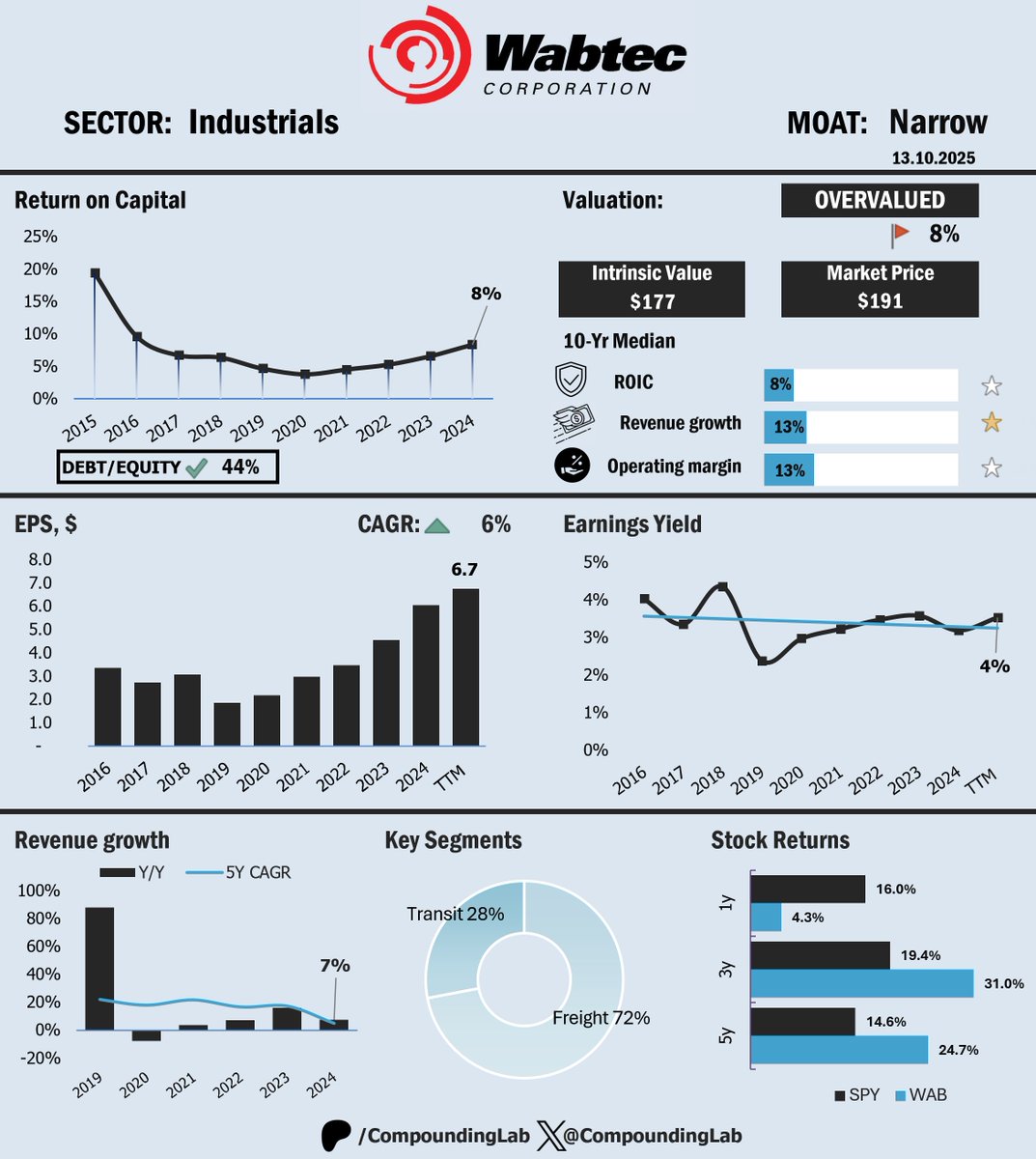

$WAB: Why This Industrial Compounder Keeps Chugging Ahead Westinghouse Air Brake Technologies is one of those industrial names that rarely makes headlines but quietly powers critical infrastructure across global freight and transit markets. The company sits at the intersection…

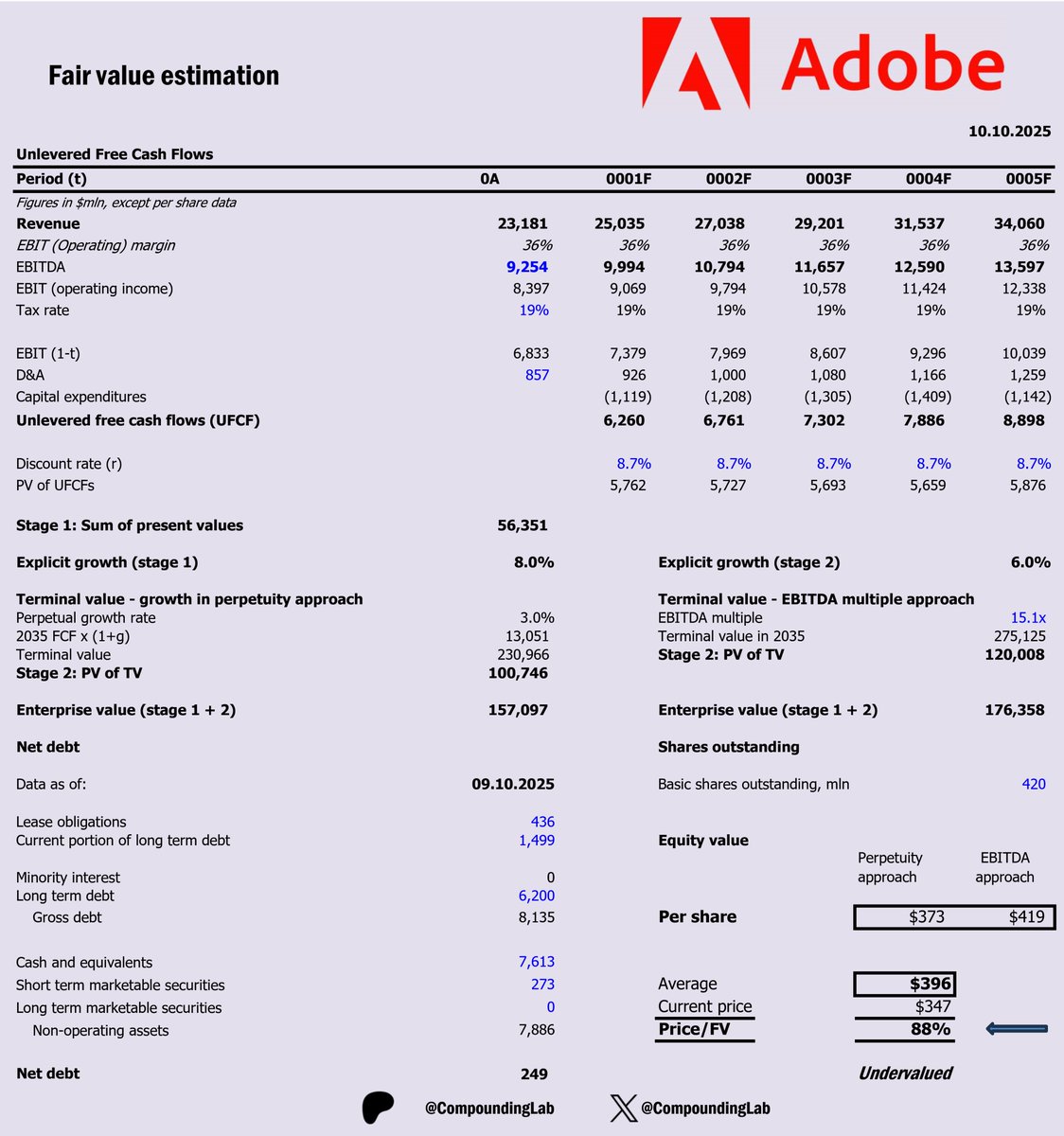

Finally, my $ADBE model was updated with the figures from the most recent quarter. Discount to intrinsic value: 12%. Changes made: - Updated tax rate. Credit to one of my followers who spotted this error. - Unlevered free cash flow formula updated as it was adding back…

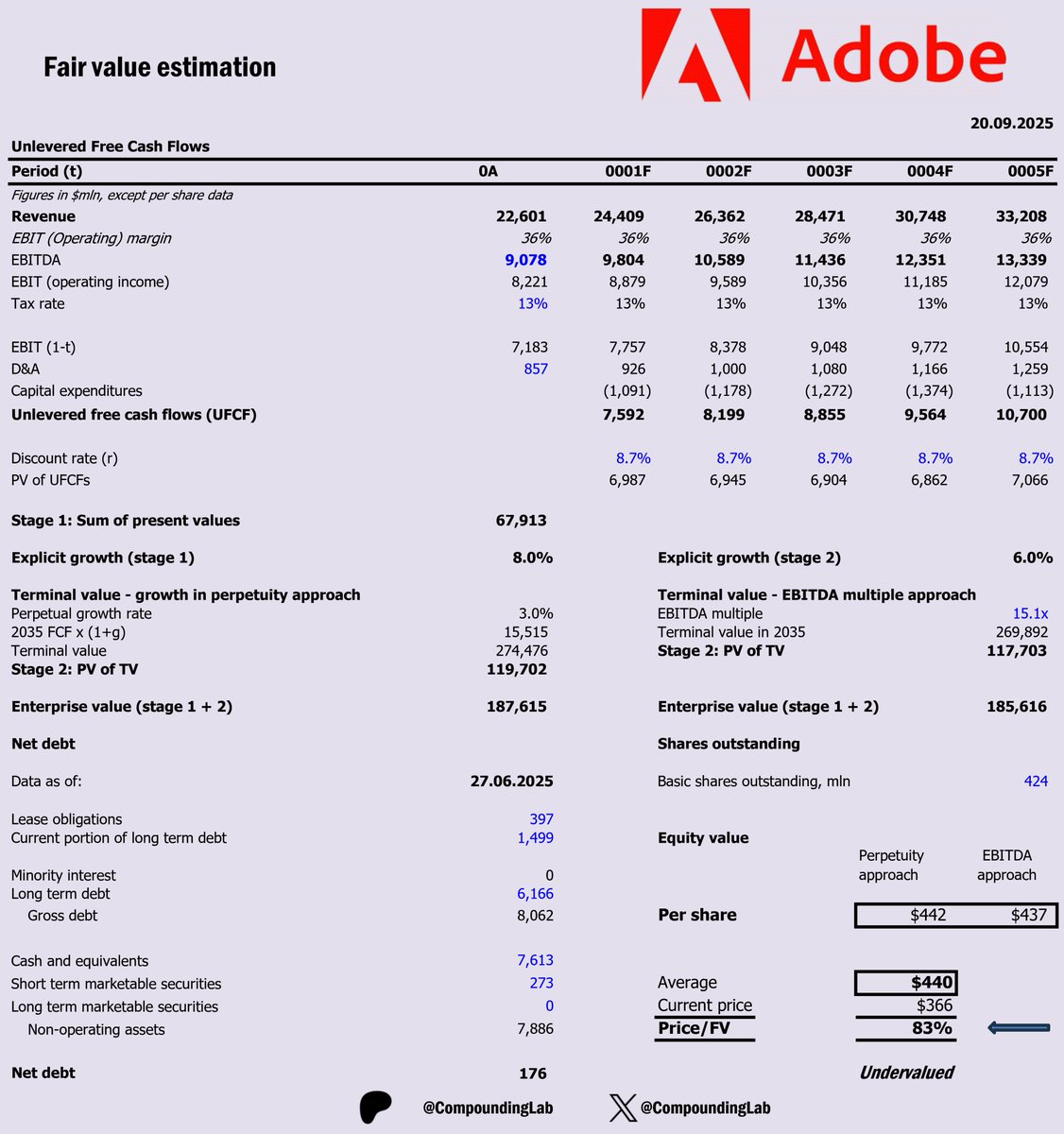

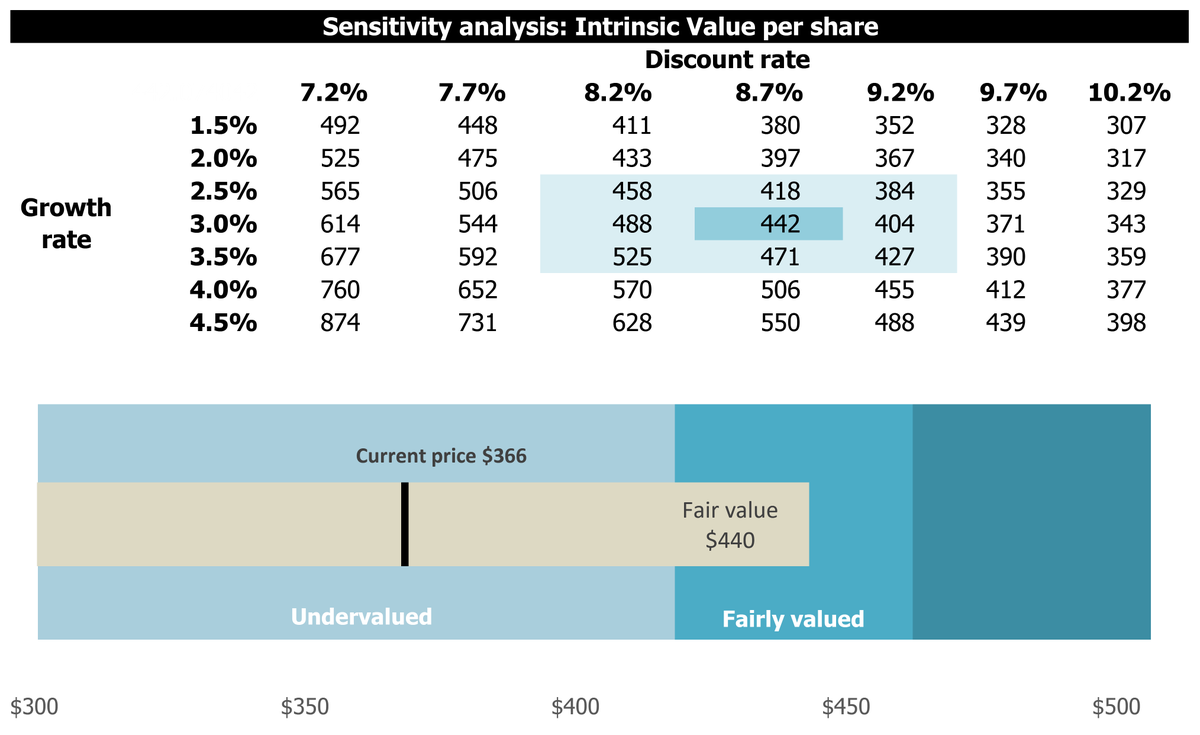

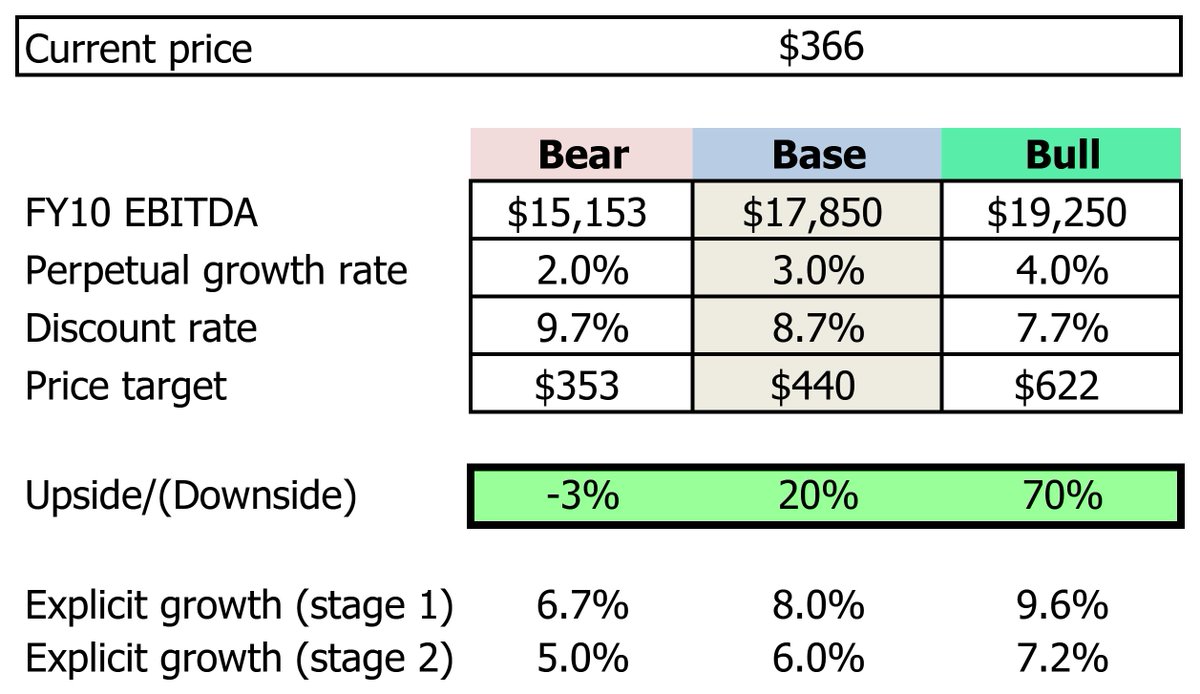

You asked – I deliver. Here is my actionable DCF model for $ADBE. Base case scenario suggests that the stock is trading at 17% discount to fair value. If adjusted to FV within 3 years, it will generate an annual alpha ~ 6%. Key assumptions: Explicit 5Y growth @ 8%. Most…

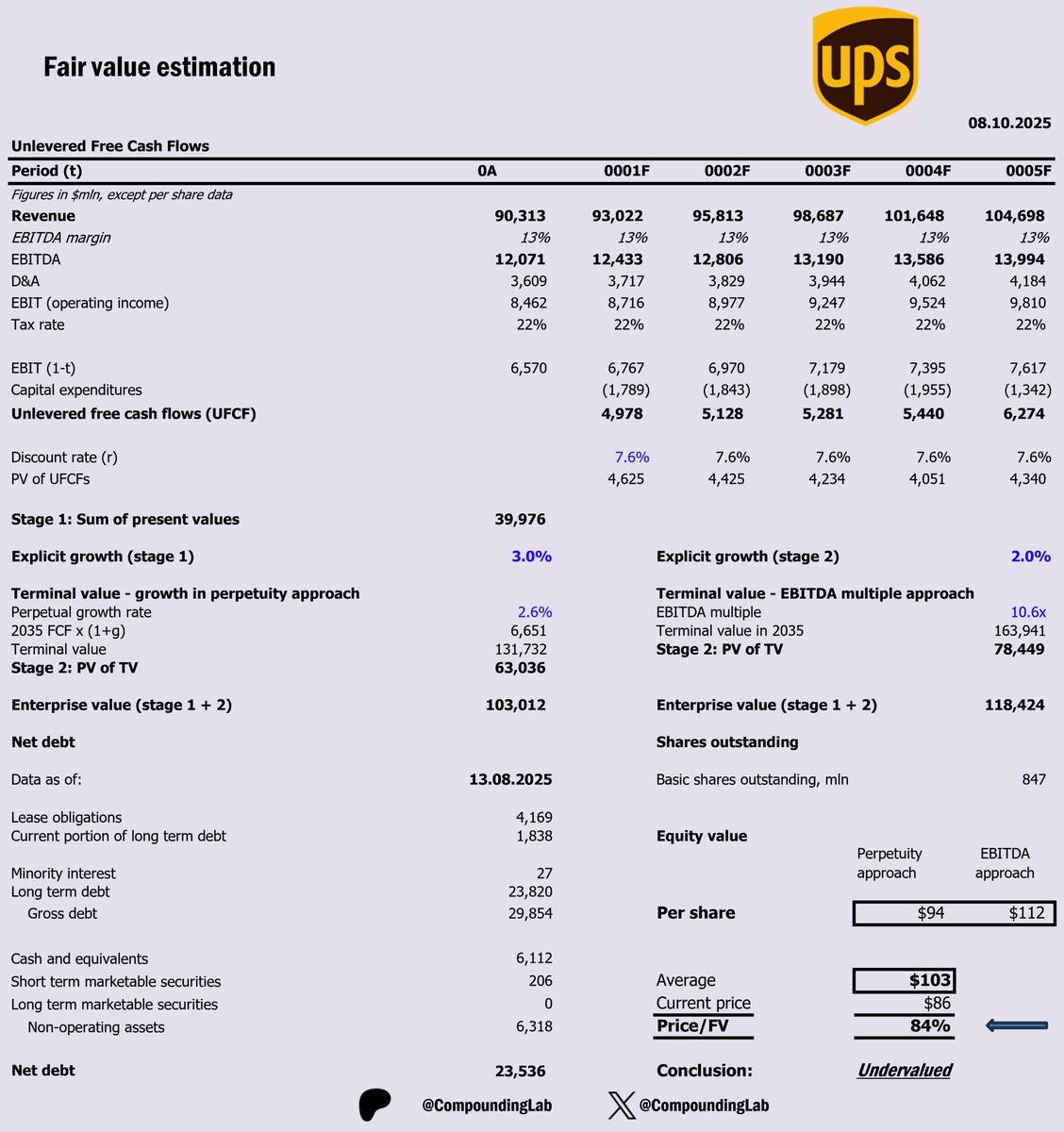

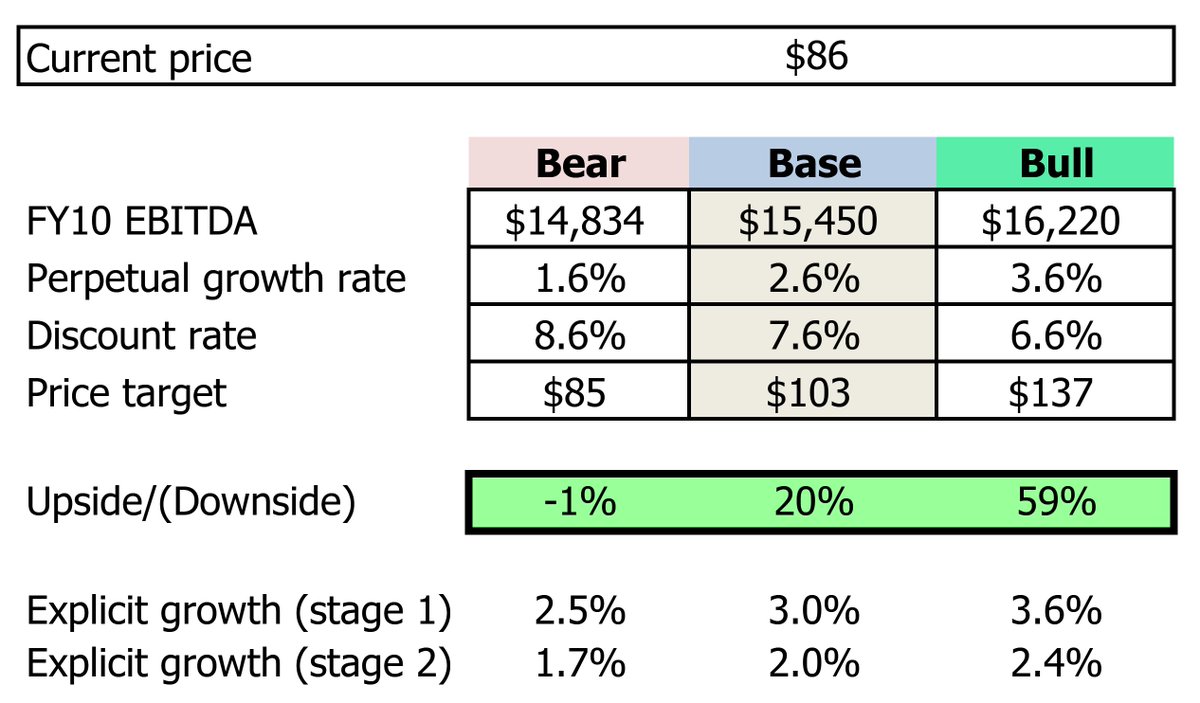

$UPS - DCF valuation model. UPS is down, not out — here’s why the market may be mispricing It. Key assumptions: 1. Explicit 10Y growth @ 2-3% (investors.ups.com/news-events/pr…) Historically, United Parcel Service (UPS) has experienced steady but moderate revenue growth, reflecting its…

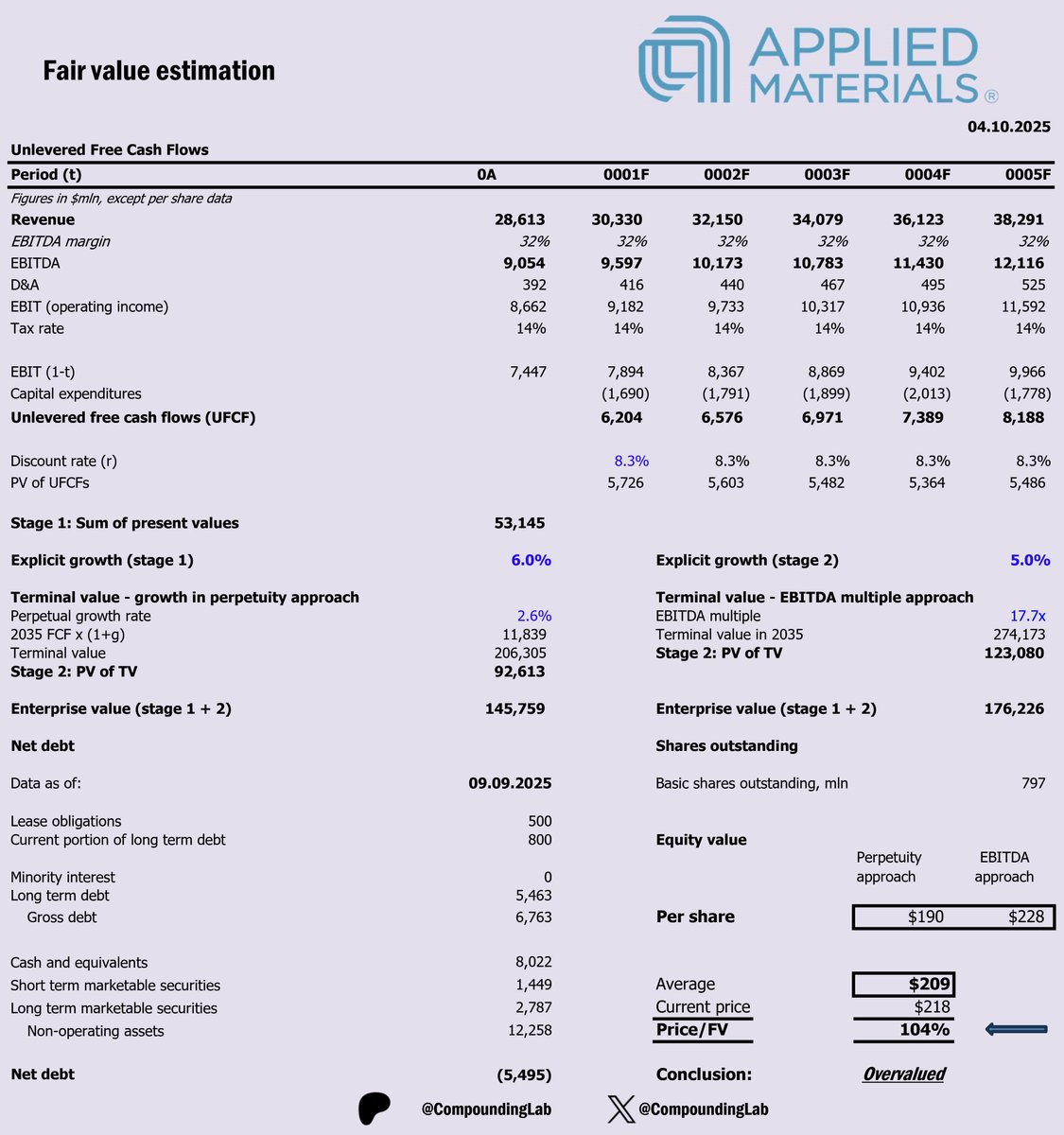

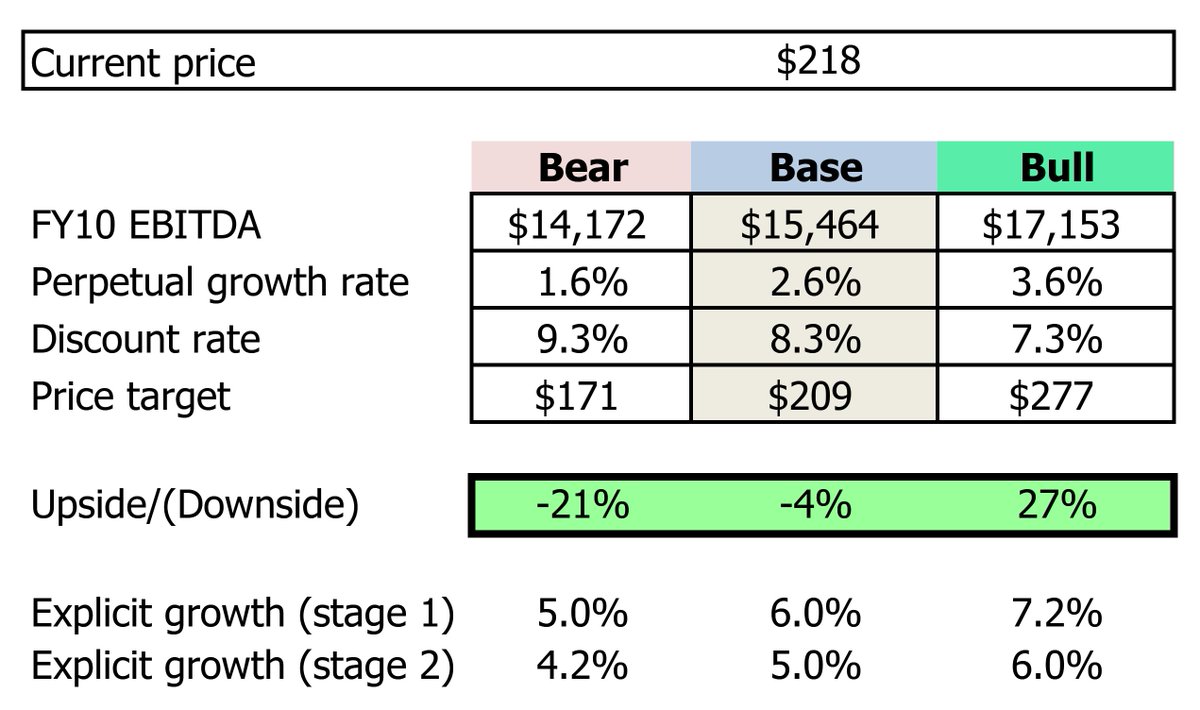

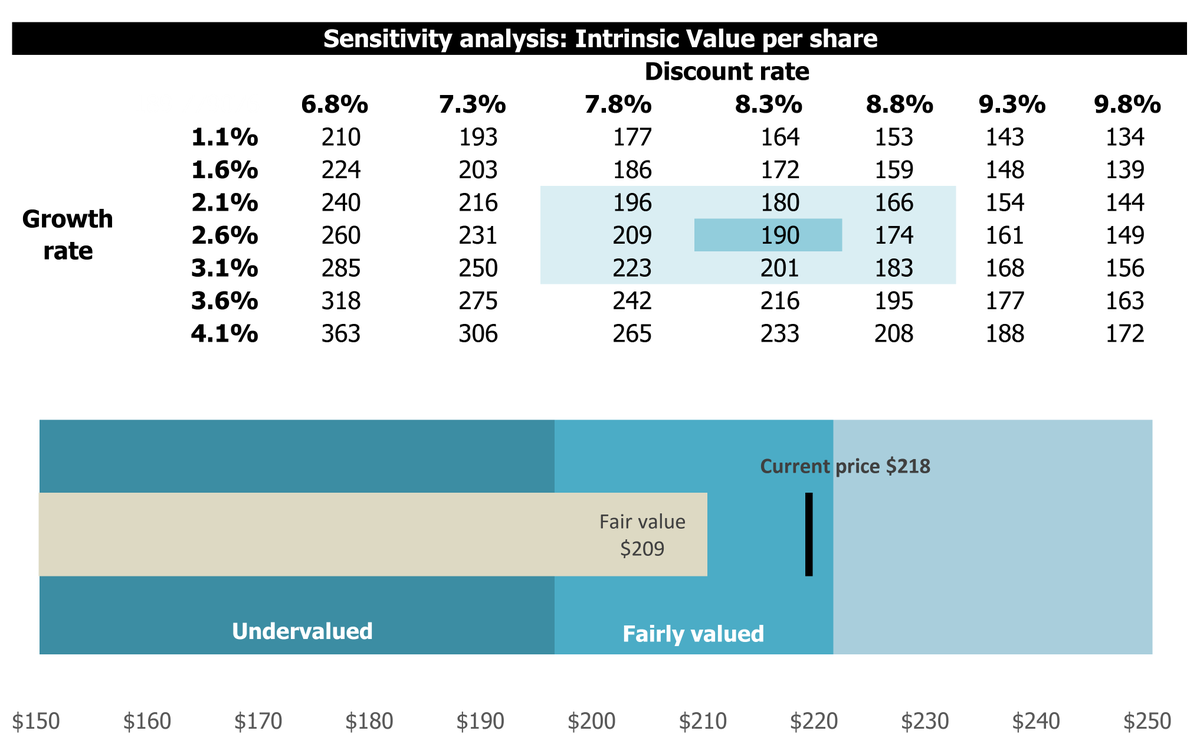

Applied Materials Inc Folks, DCF model for $AMAT has arrived. Valuation suggests that the stock is trading at 4% premium to my fair value estimate. No alpha is expected to be generated from this stock. Key assumptions 1. Explicit initial 5Y growth @ 6%, subsequent 5Y-10Y @ 5%…

Busy with some projects at work, but planning to share AMAT by the end of this week.

"Where do you see yourself when your 75 years old?" Me:

Covered calls are NOT like creating rent for your stocks. When you rent a home your upside home value is not capped. Covered calls should always be seen as giving up something for something else. Giving up upside growth for income today. I shudder when I see people thinking…

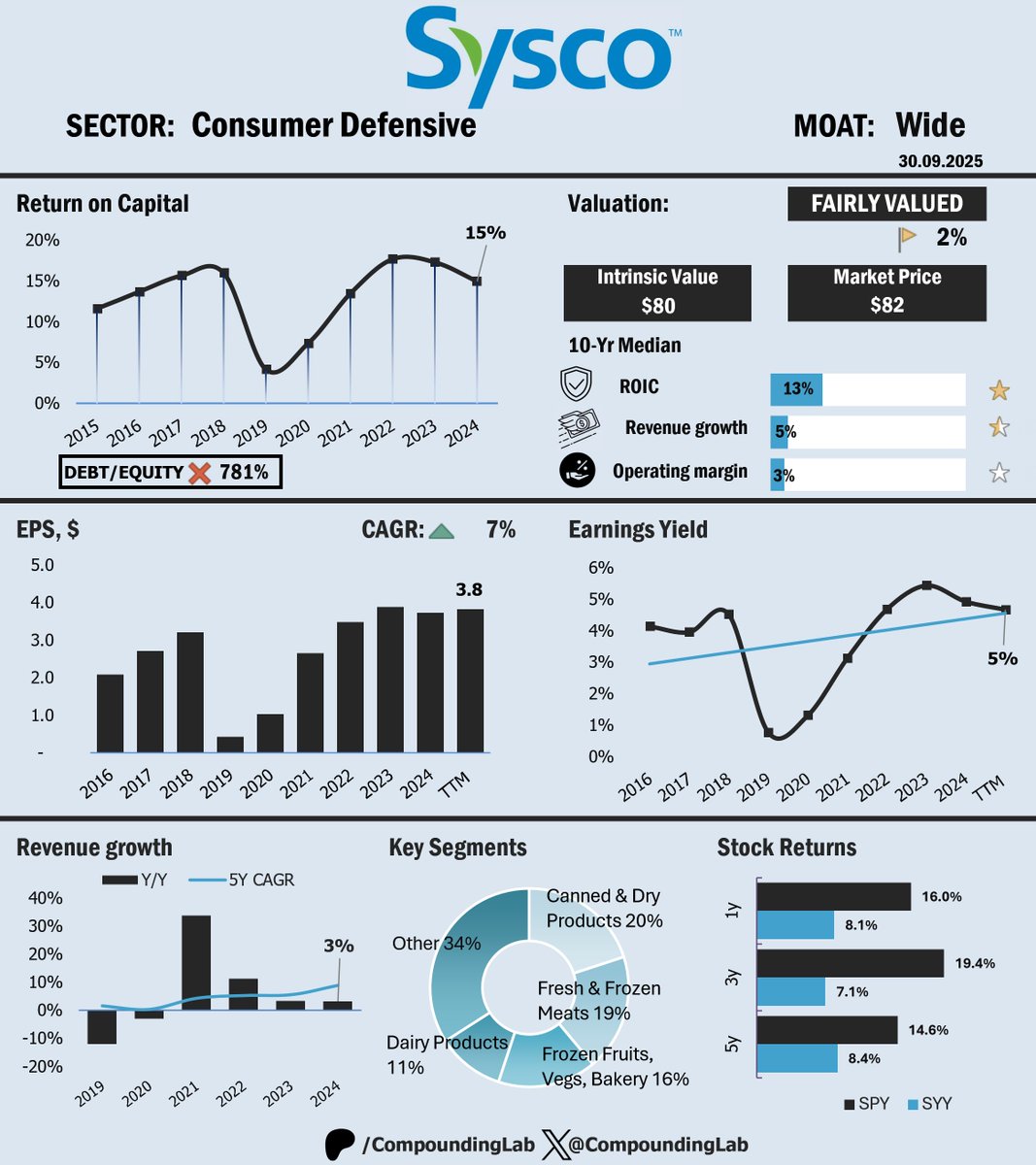

$SYY: The Quiet Giant Feeding America — But Will It Feed Your Portfolio? Sysco Corporation rarely grabs headlines, but it quietly anchors one of the most critical supply chains in the economy. As the world’s largest foodservice distributor, its performance offers a lens into…

I don't read and don't prepare deep dives. To understand whether to invest in a stock or not, you don't need to read 5000 words. 100 words max should be enough to make a decision.

Congrats! If your perception of wealth wasn't already focused on legacy, it will possibly become that way very quickly. Building this wealth less for me, but more so that I can pass this on to my son and his descendants that he may have in the future :)

United States Trendy

- 1. Flacco 88.7K posts

- 2. Bengals 82.6K posts

- 3. Bengals 82.6K posts

- 4. #clubironmouse 3,642 posts

- 5. #Talisman 8,825 posts

- 6. #criticalrolespoilers 8,732 posts

- 7. Tomlin 22.5K posts

- 8. #SEVENTEEN_NEW_IN_LA 54.4K posts

- 9. #WhoDidTheBody 1,660 posts

- 10. yeonjun 120K posts

- 11. Cuomo 90K posts

- 12. Ramsey 19.7K posts

- 13. Chase 108K posts

- 14. Chase 108K posts

- 15. Teryl Austin 2,892 posts

- 16. Xenoverse 3 1,048 posts

- 17. Pence 77.1K posts

- 18. Mousey 1,301 posts

- 19. Sliwa 39.3K posts

- 20. Brandy 8,990 posts

Something went wrong.

Something went wrong.