Lawrence McDonald 𝕏

@Convertbnd

NY Times Bestselling Author, “when markets speak” on sale date is march 26, 2024. Long-time @Realvision @CNBC contributor,founder of the @BearTrapsReport

Hard Assets, the revolution has begun!

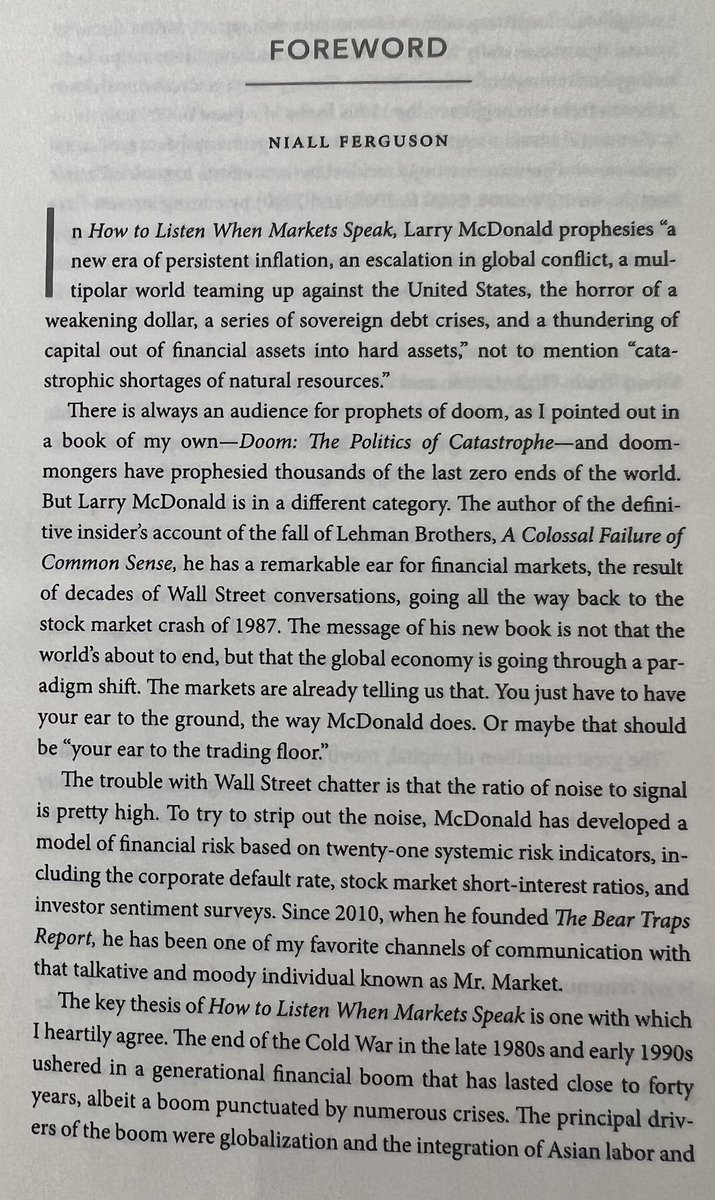

.@nfergus Special thanks to the greatest financial historian that’s ever lived. #SummerReading #Bestseller

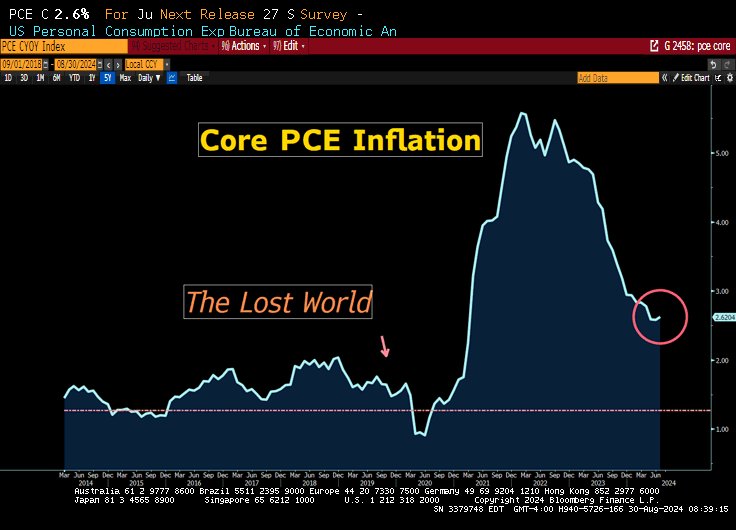

The Federal Reserve is kicking off a rate-cutting cycle with core PCE NO-where even close to the 2014-2019 norm. Clearly, they have chosen a new, higher inflation target in reality. They will publicly say this in the coming years.

When you see a sector like the Semiconductors, the hottest of all last 12 months, up 7% and down 7% in 24 hrs, this is a classic signal.

Street Sheep Alert - They RAISED the SMCI price target to $1000 in April with a "BUY." Now we get a downgrade to hold (equal weight) and a $438 price target in September???

Barclays Downgrades $SMCI to Equalweight, Lowers PT to $438 from $693 Analyst Comments: "Downgrade SMCI shares to EW on our more cautious view, mainly due to a lack of visibility on forward AI server GM trends, ongoing customer erosion (i.e., market share loss), weaker…

Markets are Speaking... US YIELD CURVE TURNS POSITIVE FOR ONLY SECOND TIME SINCE 2022 - Bloomberg.

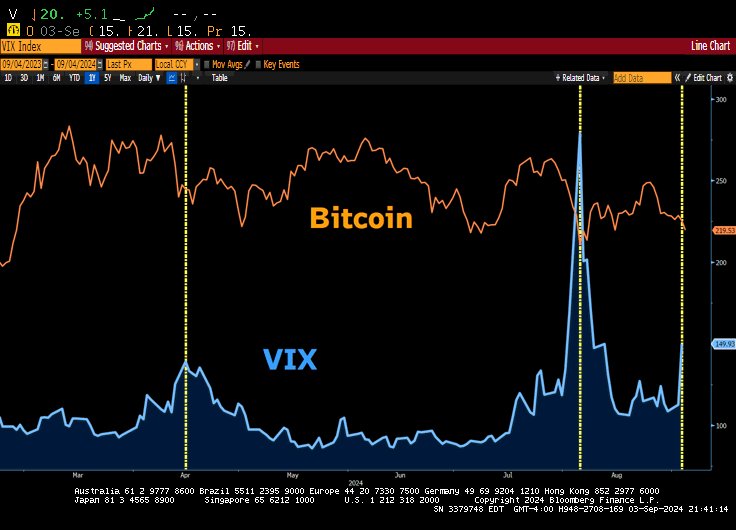

Never, ever forget. When you are long Bitcoin far more times than not, you are actually SHORT the VIX.

New Post --- Bitcoin High Drama - 3 Things You Need to Know Looking Forward thebeartrapsreport.com/blog/2024/08/2…

Hard Assets vs. Financial Assets Gold vs. QQQ 1-Year: +28% vs. +23% 3-Year: +35% vs. +23% Bloomberg data.

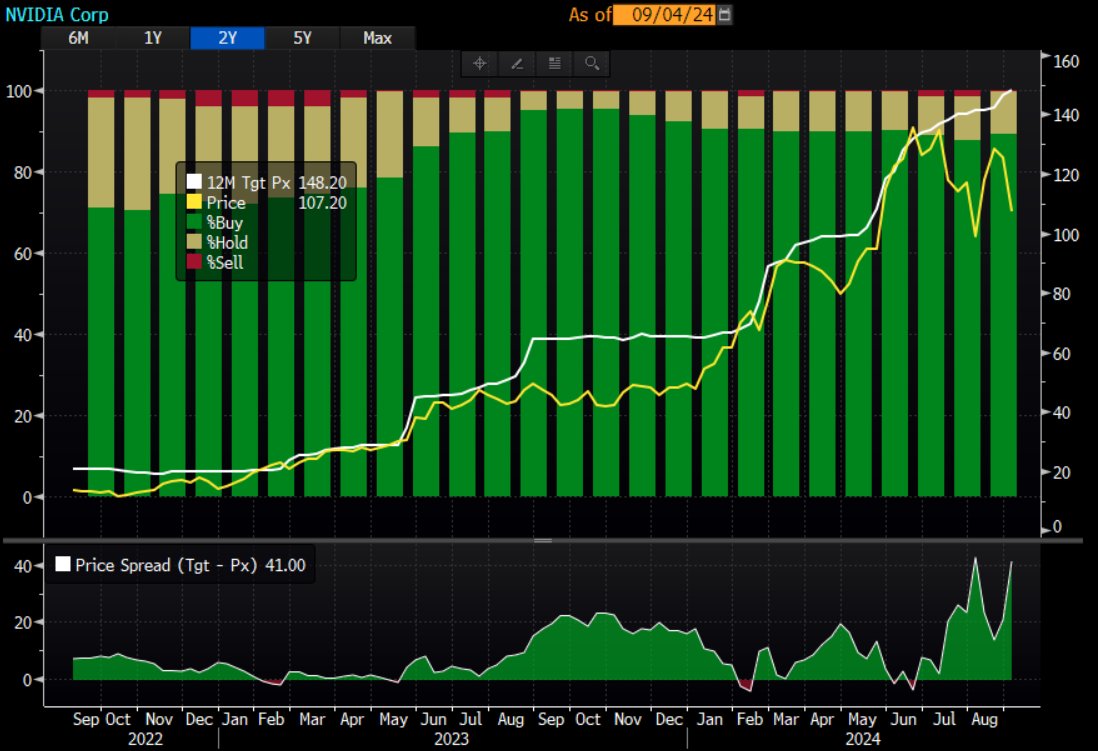

Nvidia $NVDA at $107 Street's 12-Month Forward Price Target Today: $148 Last August 2023: $48 *Sheep's Crossing... 54 Analysts Consensus Rating Buys 89.2% 66 Holds 10.8% 8 Sells 0.0% 0

Continuing Jobless Claims - Powell -- eyes on this data.

New Post --- Bitcoin High Drama - 3 Things You Need to Know Looking Forward thebeartrapsreport.com/blog/2024/08/2…

Let’s look at the S&P 500 “inclusion” scam show. Passive investing idiocy. Market at “all time highs.” Exhibit 1: LULU

Interest payments on debt as a % of tax receipts USA: 25%* AAA Countries: 1-5% *In a higher for longer world. **Don’t believe the bs. Economists say rate cuts are all about economic data when it’s all about the ugly math above.

Excellent thread on the history of, reason for, and impact of gold replacing USTs as primary global reserve asset 👇 “What currency is going to replace the USD? None… but gold IS replacing USTs as primary global reserve asset (and has been for 10 years.)”

1/ WHY DOES THE USD FX AS RESERVES NOT TRANSFER PURCHASING POWER IN TRADE WHILE GOLD/SILVER DO? TRIFFIN/RUEFF EXPLAINED

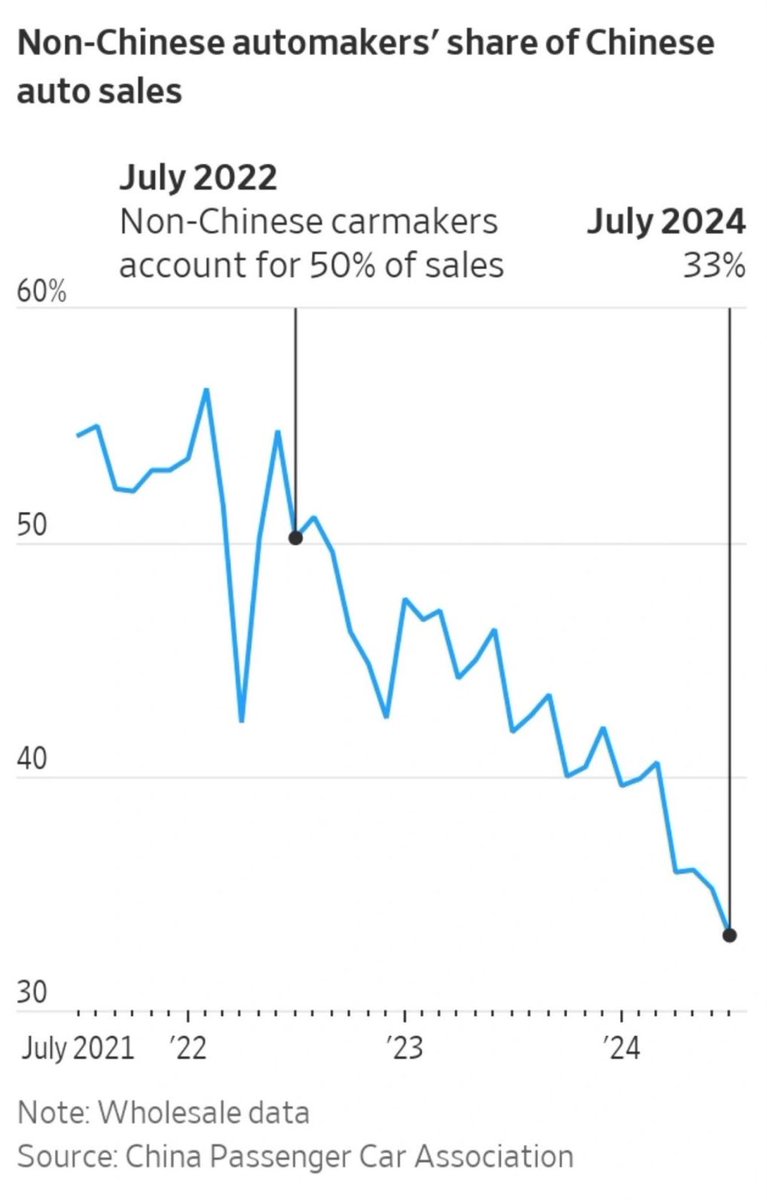

Ouch…especially if (when) it starts happening in other categories.

squid! followan sama daniel

United States Trends

- 1. Giannis 57.1K posts

- 2. Tosin 63.3K posts

- 3. Spotify 1.52M posts

- 4. Leeds 96.7K posts

- 5. Bucks 36.7K posts

- 6. Milwaukee 17.1K posts

- 7. Maresca 48.8K posts

- 8. #WhyIChime 1,975 posts

- 9. Danny Phantom 6,443 posts

- 10. Mark Andrews 1,811 posts

- 11. Wirtz 35.4K posts

- 12. Isaiah Likely N/A

- 13. Poison Ivy 1,792 posts

- 14. Purple 53.6K posts

- 15. Sunderland 45.7K posts

- 16. Steve Cropper N/A

- 17. Delap 17.2K posts

- 18. Chiesa 12.7K posts

- 19. Jack Smith 39.3K posts

- 20. Cedric Mullins N/A

Something went wrong.

Something went wrong.