Everyone owns the Korean index in size, right? None of you are seeing the top line and bottom line acceleration by triple digits year over year and a less than 4x FCF multiple on consensus earnings which still underestimates earnings and overthinking past cycles, right?

[Exclusive] Samsung to Supply High-Performance HBM4 to Nvidia First Next Month Samsung Electronics will officially supply the next-generation high-bandwidth memory (HBM), HBM4 (6th generation), to major players in the artificial intelligence (AI) accelerator market such as…

Super excited to announce that I’ve taken the semester off from Penn to join the Economics Lab at @tryramp. Super grateful to be working with @arakharazian and to build on the incredible research he’s producing. I’m fascinated by the way that day-to-day micro-interactions shape…

This “we must mine as much copper in 18 years as in the last 10,000” line is misleading. Large-scale industrial copper mining only really began in the 1900s. Almost all cumulative copper production happened in the last ~120 years due to exponential industrial growth. Comparing to…

You just can't own enough Copper. Billionaire Robert Friedland sums it up perfectly..... You people have no idea whatsoever what we’re facing. “We’re consuming 30m tonnes of copper a year. Only 4m tonnes of which is recycled. That means to maintain 3% GDP growth, with no…

1/12 This talk about Europe's ability to wield its holdings of US Treasuries as a political tool is as divorced from reality as the talk about China's ability to wield its holdings of US Treasuries as a political tool. ft.com/content/7d6436… via @ft

My god yes we need more of this

Jamie Diamond- it’s a swamp- when he’s asked about raising taxes he says it all goes to special interest groups listen to the audience chuckle - they know

Another fun fact about Waymo vs Pony AI (its Chinese comp): Waymo runs 4 Nvidia H200s per car (~$25k each), which is about $100k of compute sitting in the trunk. All-in, each vehicle costs ~$300k. They still lose roughly $5 per km. Pony AI also uses 4 Nvidia chips per car, but…

This will end up destroying the French economy. A highly leveraged nation running trade surpluses is welcoming its biggest competitor to take market share from its local companies. What could go wrong? Macron should focus on protecting domestic industry and moving to a national…

French President Macron: We need more Chinese direct investment in Europe in some key sectors.

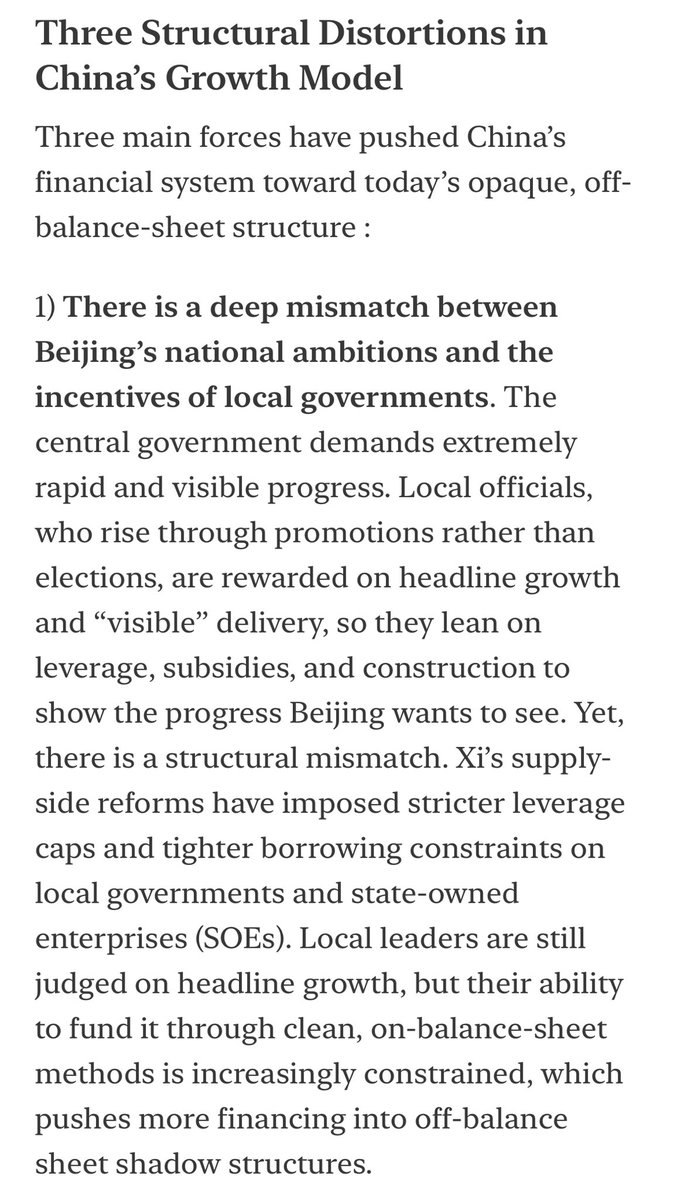

Chinese province officials aren't elected but appointed. A large part of their job evaluation is gdp growth/employment in the province. High-stakes, objective metrics always create unintended consequences, as it does here. But it also produces a govt that is aggressively YIMBY.

Europe is a net exporter, with the U.S. being its biggest buyer. Europe then buys U.S. assets because it has to run a financial account deficit to export its excess savings that emerge from its trade surplus. You can’t change that unless Europe either kills its surplus or…

🇺🇸🇬🇱 Reporter asked Sec Bessent if Europe has any financial weapons the U.S. should fear. He didn’t even dress it up. Just a flat “no.” Like the conversation wasn’t worth finishing, let alone worrying about.

I agree with most of the arguments. But the REEs claim seems far off. The US and allies have significant reserves of rare earths; the challenge is refining, which is extremely capital-intensive and polluting. Right now, MP Materials can only handle light rare earths refining…

China has the fastest-growing debt burden in history and the highest debt in the world after Japan. Yes, the AI race is a marathon, and China is a runner on cocaine who will either collapse upon stopping or have a heart attack if they continue.

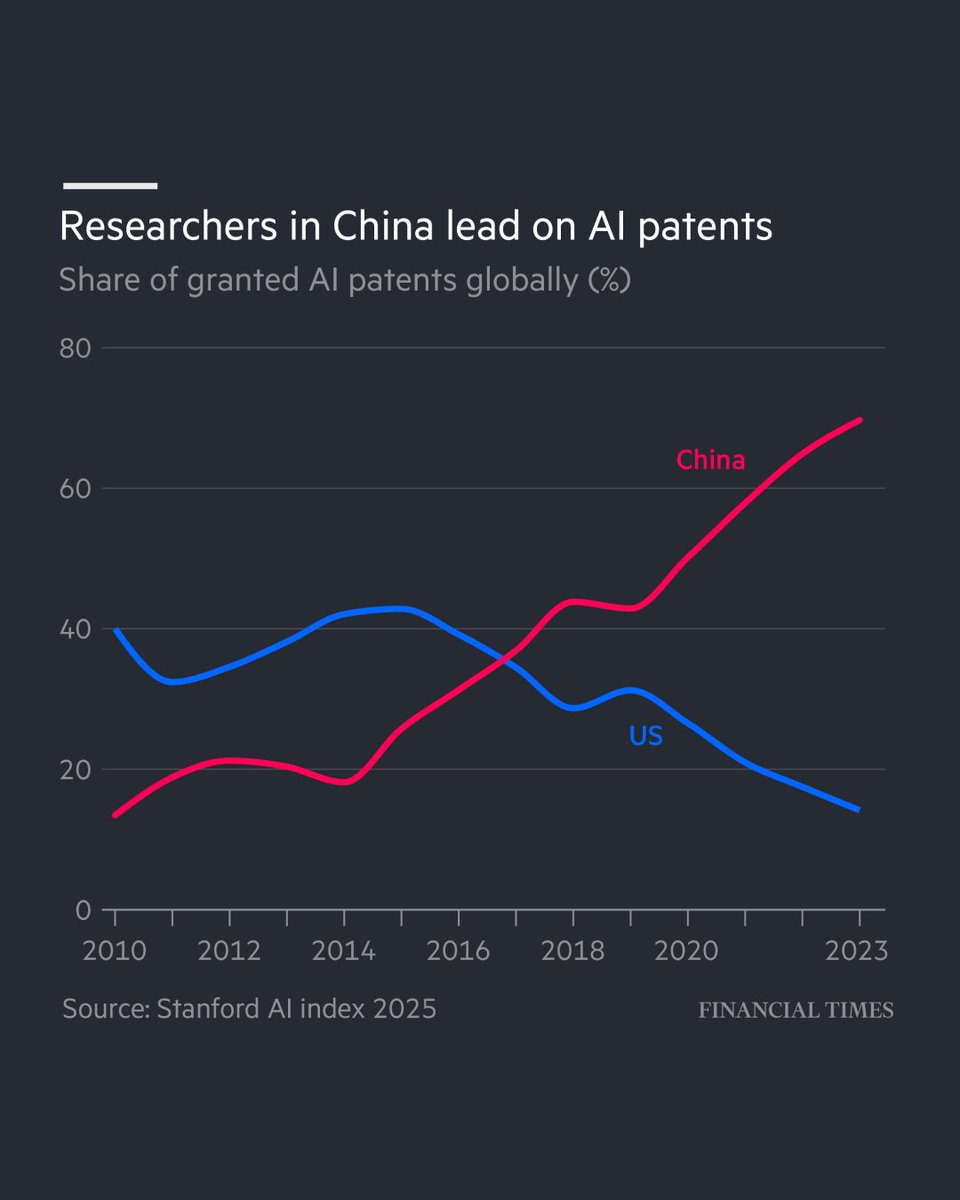

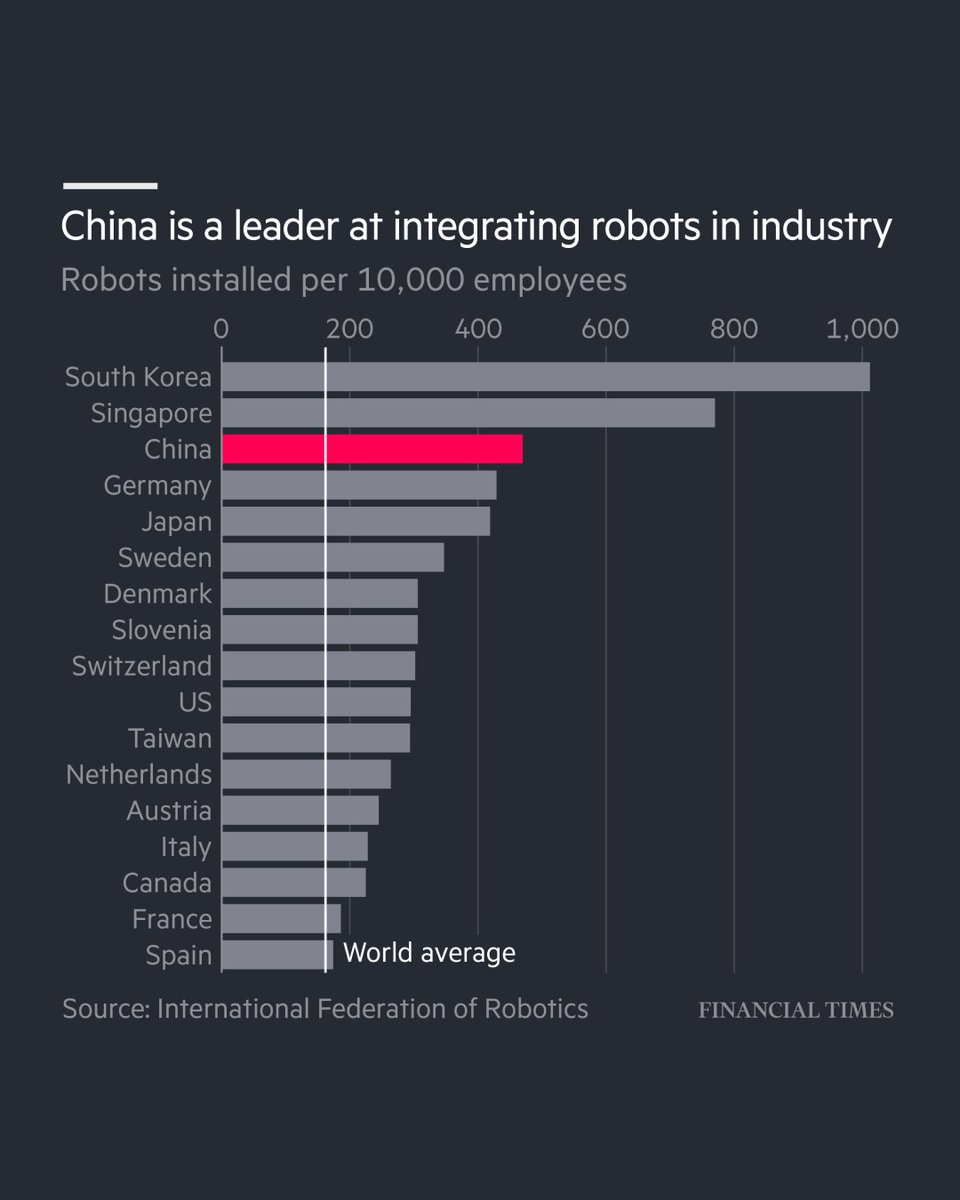

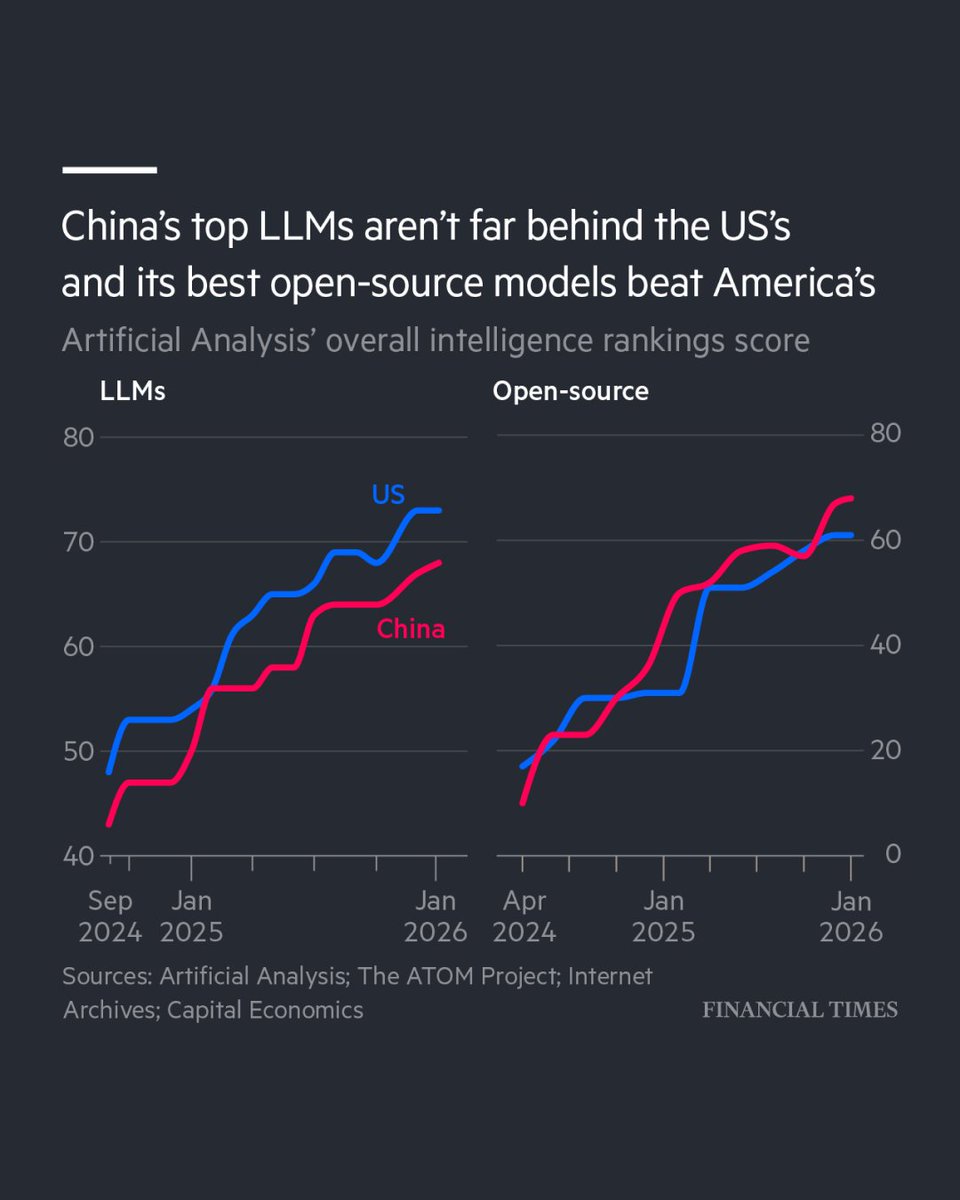

The AI race should be viewed more as a marathon, not a sprint to the most powerful models. And on that basis, I think China will win, writes the FT's economics leader writer Tej Parikh. ft.trib.al/lMtwC0X

Posting it here as well, since it was well received on Substack.

Agree completely. After spending some time in China earlier this month, many investors shared the same theme for the next decade: China go global. As China approaches an asymptote in its trade surplus and runs out of domestic sectors able to absorb national savings through…

We will likely see Chinese EVs being produced locally in basically every major market, including the US. It might be direct investment or JVs. There might be job creation, data security, and tech transfer requirements. But the opportunities are too good to pass up.

United States Trends

- 1. UNLV N/A

- 2. Collin Gillespie N/A

- 3. Fresno State N/A

- 4. Unforgiven N/A

- 5. Pumas N/A

- 6. Generator N/A

- 7. #WWENXT N/A

- 8. Jordan Goodwin N/A

- 9. #Fallout N/A

- 10. #iubb N/A

- 11. Cavs N/A

- 12. Joe Hendry N/A

- 13. Alijah Arenas N/A

- 14. Thune N/A

- 15. Sarah Stock N/A

- 16. Blazers N/A

- 17. WOOYOUNG N/A

- 18. #ProBowlGames N/A

- 19. Tombstone N/A

- 20. Grayson Allen N/A

Something went wrong.

Something went wrong.