Crossbridge Capital

@CrossbridgeView

Independent, tailored, cross-asset investment solutions for entrepreneurs and families. Global Macro and economics comments.

You might like

Top 10 wealth management trends with Manish Singh, CIO, @CrossbridgeView . Read more: citywealthmag.com/news/top-trend… #Citywealth #privatewealth #privateclient #PrivateWealth #wealthmanagement #Finance

#ETF roundtable: Managing strategic change and tactical concerns with ETFs etfstream.com/articles/round…

Some in the media are suggesting that we are witnessing the “The Great fall of China"… Crossbridge Capital CIO Manish Singh, CFA disagrees…read more in this month’s Market Viewpoints crossbridgecapital.com/?post_type=mar…

Buffett vs Ackman *BUFFETT: WE BOUGHT $10B IN TREASURIES THIS MONDAY, LAST MONDAY *ACKMAN: WE ARE SHORT IN SIZE THE 30-YEAR TREASURYS Who’s right ? Both could be right. Trade is about time frame Ackman could be right in the short term, Buffett in the long term

96% probability of a 0.25% rate hike by the #FOMC at its meeting this week Is it justified ? No Can the FOMC still hike ? yes (as they have even as inflation continues to fall) *GERMANY JULY MANUFACTURING PMI 38.8; F'CAST 41 *EURO-AREA JULY MANUFACTURING PMI 42.7; F'CAST 43.5

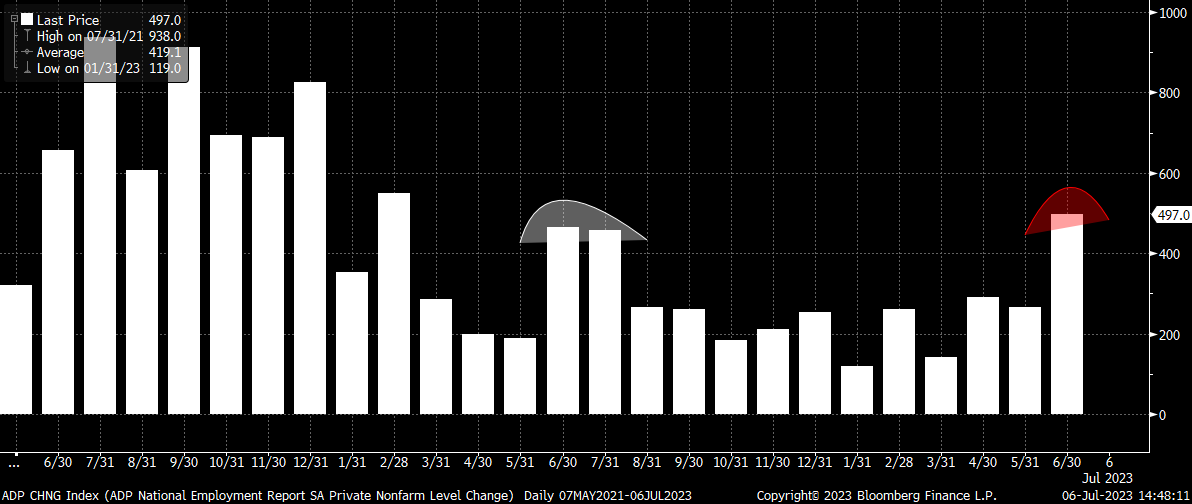

#ADP #PrivatePayrolls June private payrolls jumped to 497k vs. 225K est. and 267k the prior month. Biggest gain since Feb. 2022; leisure and hospitality added most jobs BUT Is it a "June thing" ? We saw it last summer too.

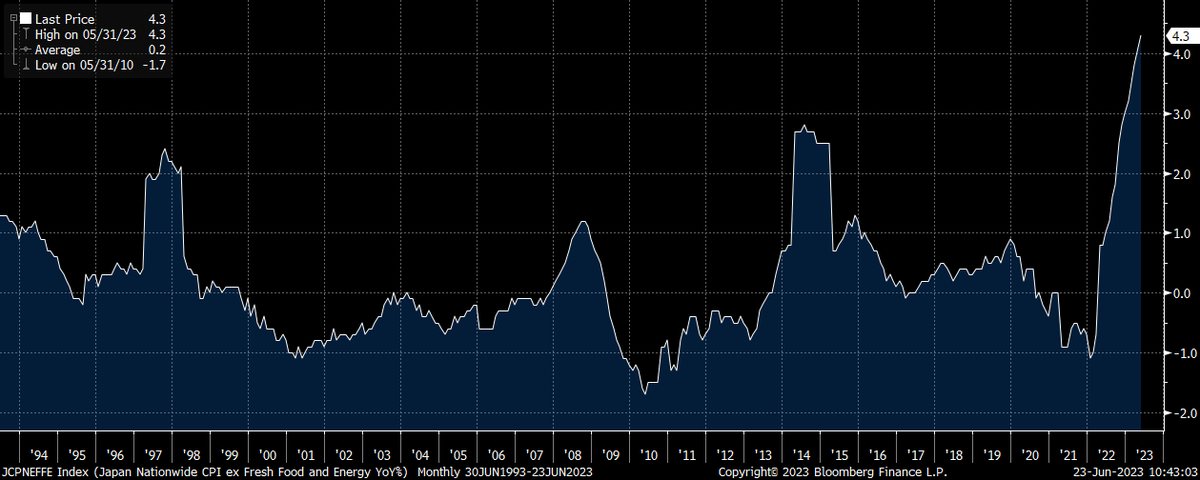

Japan core inflation ( CPI ex CPI ex Fresh Food and energy) +4.3% yoy, a 42-year high. JPY weakness, upside for NKY to continue #Japan #inflation #NKY

Since the Fed’s rate hiking cycle began back in March 2022 - the S&P is now up +3.4% on a total return basis, - QQQ is up +9%, and the Tech sector is up +16.4% Over 5% rates hike at historically fastest rate and still this ? We're at peak rate. #FOMC #Fed #ratehike

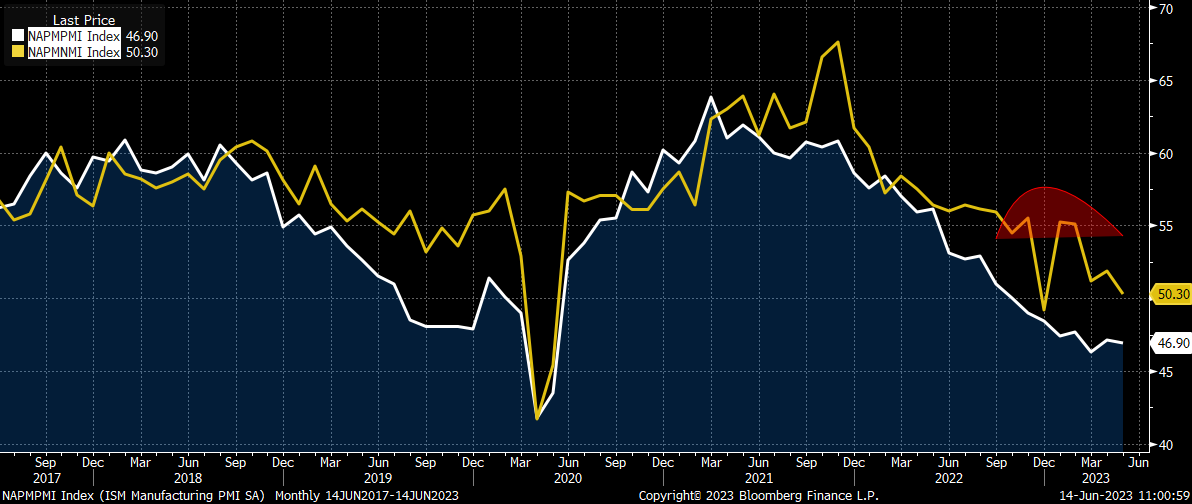

ISM Manufacturing in contraction ( at 46.9),and ISM Services on the verge of contraction (at 50.3) The US Federal Reserve has lost any flimsy excuse it may have had to keep raising rates. Pause now and pivot soon. #FOMC #FederalReserve

S&P 500 Index in a “Bull Market”; US Federal Reserve set to pause Read the June newsletter crossbridgecapital.com/?post_type=mar…

#Gold with inflation expectations falling, gold seems to have run its race this cycle. Gold however is the best "insurance". It has stood the test of time and will stand the test of time if things really get rocky.

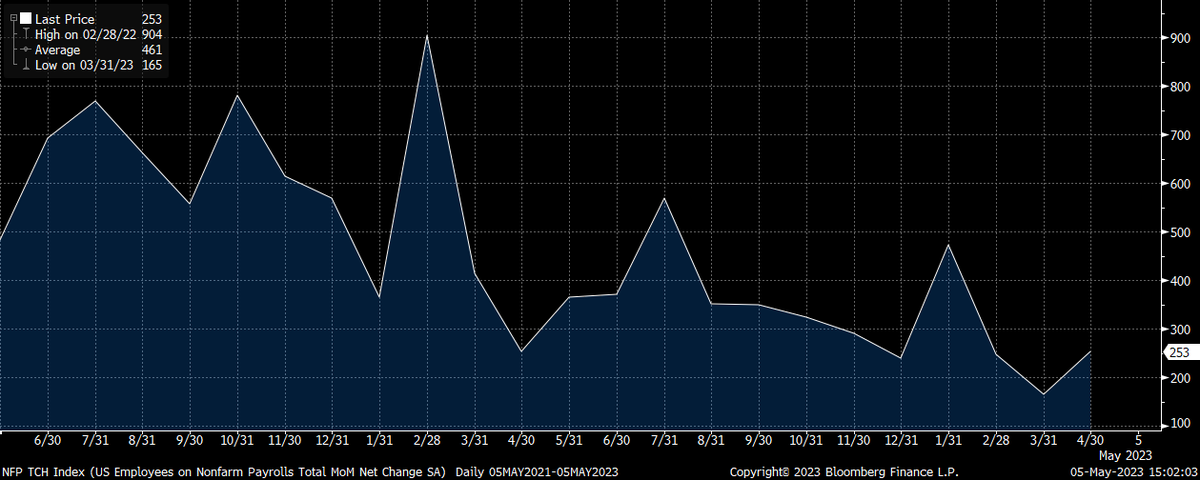

US #nonfarm payroll is clearly decelerating However, it's not a bad number for the overall health of the economy Non-Farm Payrolls: +253K (Est. 180K) Unemployment rate: 3.4% (Est. 3.6%) Average hourly earnings month-on-month: +0.5% (Est. +0.3%)

United States Trends

- 1. Olympics N/A

- 2. #SmackDown N/A

- 3. NDSU N/A

- 4. #TheLastDriveIn N/A

- 5. #River N/A

- 6. #STARDOM N/A

- 7. #OPLive N/A

- 8. St. John N/A

- 9. Hunter Hess N/A

- 10. UConn N/A

- 11. Andrea Bocelli N/A

- 12. Raheem N/A

- 13. Dylan Cardwell N/A

- 14. Athena N/A

- 15. Malik Monk N/A

- 16. Mountain West N/A

- 17. Lion King N/A

- 18. Jordynne N/A

- 19. Chivas N/A

- 20. Jane Don N/A

Something went wrong.

Something went wrong.