Ryan

@CryanTech

Catching waves, growing wallets

The "Network Effect" is one of the most powerful forces in #Crypto, explaining exponential growth. Simply put: the more users or participants a network has, the more valuable it becomes for every user. We witnessed this phenomenon propel $BNB to prominence, and now, $CHEX is…

Delighted to announce that $CHEX will be listing on @krakenfx! The @ChintaiNexus network token has been added to the roadmap today, which represents a major milestone both for the importance of RWA, as well our first T1 exchange listing. We have move exchange listings coming,…

Most people still think we’re the “degen” generation throwing money at memes. Nah. We’re the first generation that grew up watching every institution glitch in real time. We don’t trust less we just refuse to trust blindly. RWAs aren’t a vibe. They’re the antidote.

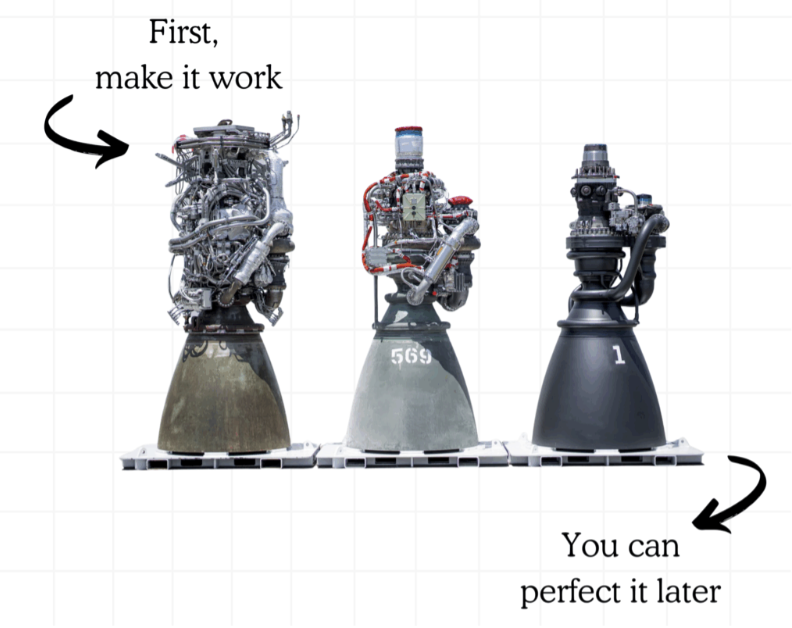

I think about this at least 1x a week.

Most people have no idea how big private credit really is. Here’s the scale behind one of our first private credit yield partners: - $2.3 trillion U.S. multifamily market - $500 million+ lending capacity - $4.9 billion+ active credit pipeline Soon accessible as one of the…

You don’t need a marketing team. Just post this and go viral: SOLANA

The next decade of finance won’t be about “crypto vs traditional.” It will be about who owns the pipes that move trillions in tokenized real-world yield to millions of people. @ChintaiNetwork & @ChintaiNexus ( $CHEX ) is building the regulated, institutional-grade rails, with…

FULL Interview with Matt Mudano of Arch Network & Josh Gordon of HoneyB. – Why Bitcoin’s security budget is at risk – Unlocking yield on BTC & making it programmable – Why institutions & whales are bullish on BTC – There’s a private credit renaissance coming onchain

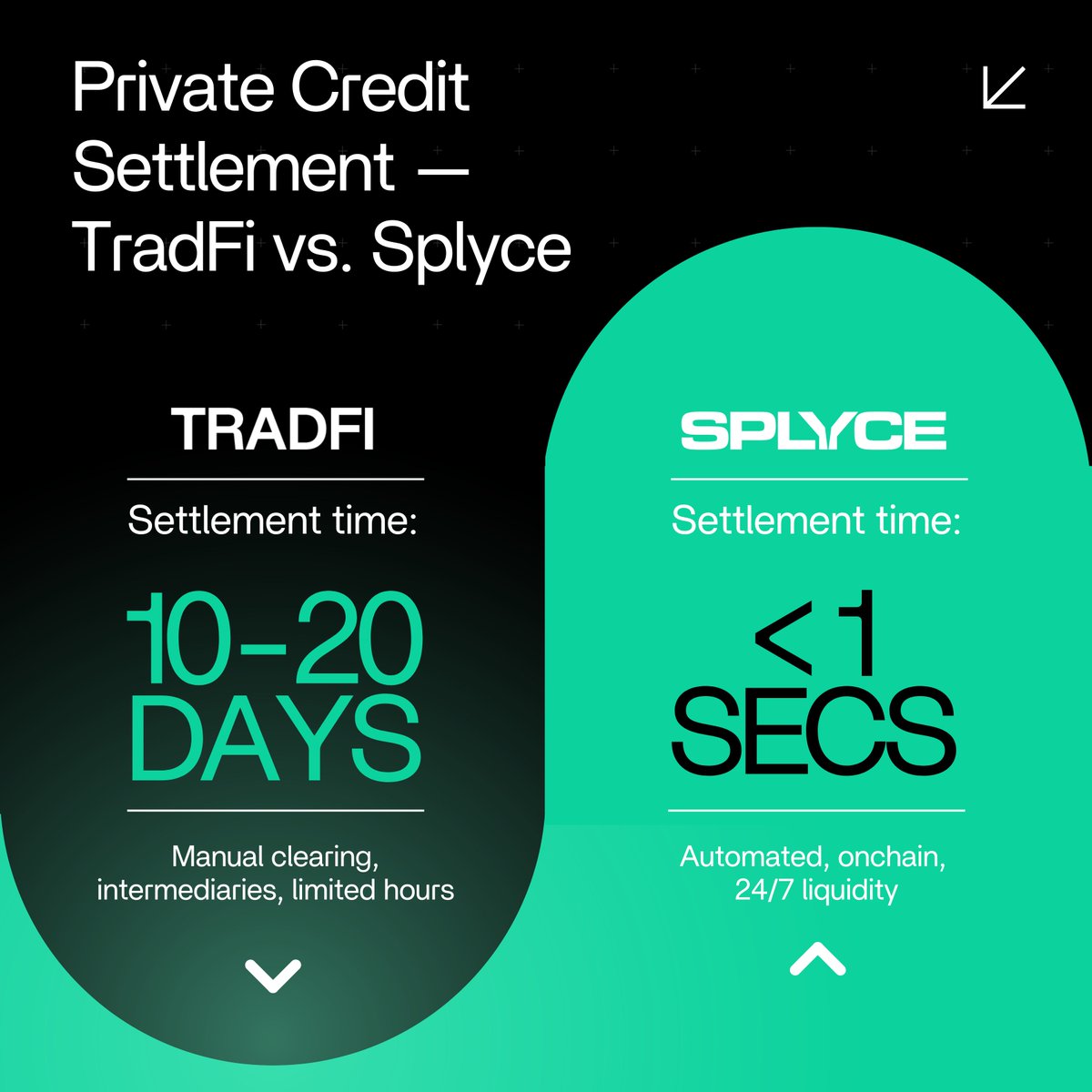

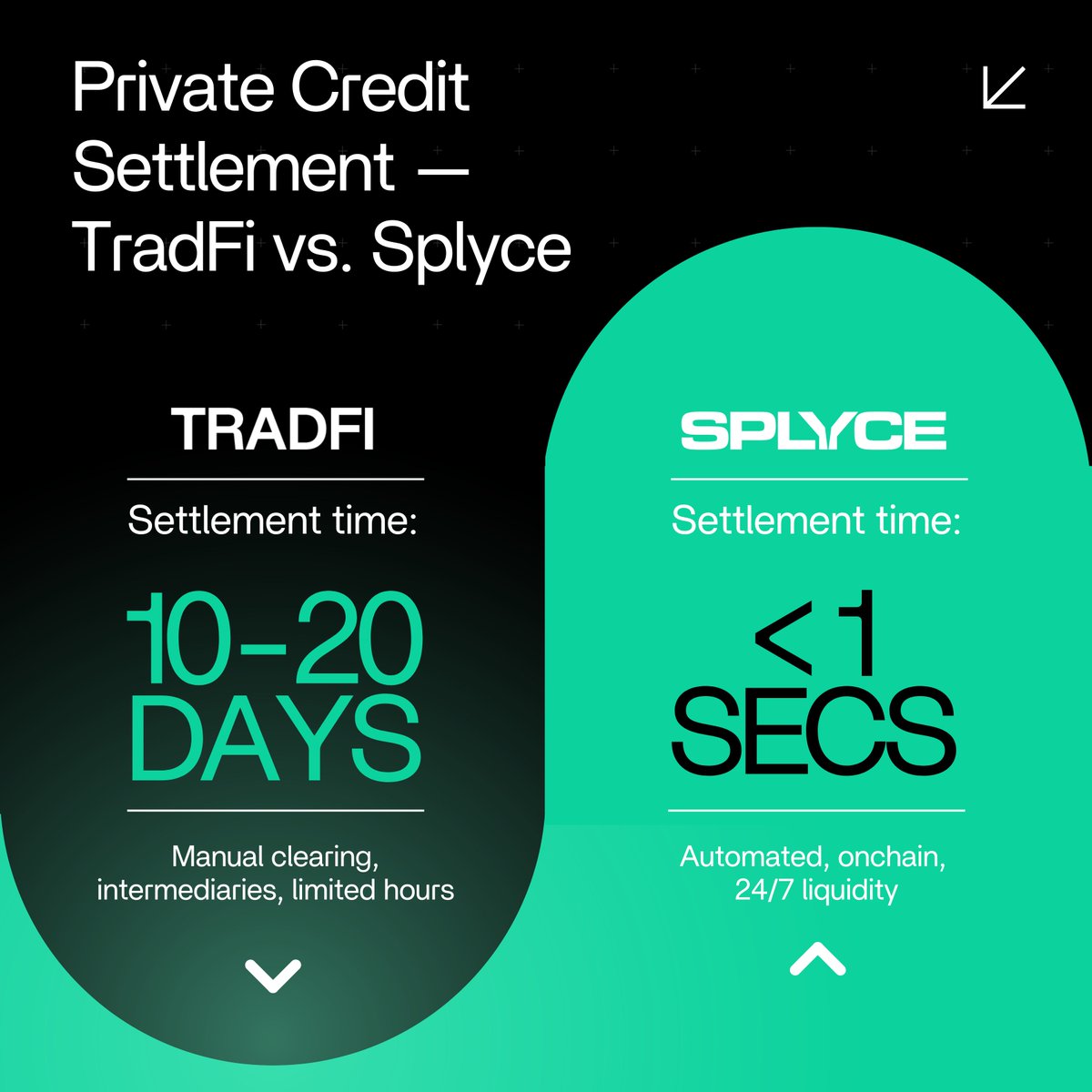

10–20 days in TradFi. Less than a second on Solana. This is what finance looks like when it’s built for the internet.

solana turns a weeks-long process into an instant that’s how new rails beat old ones

10–20 days in TradFi. Less than a second on Solana. This is what finance looks like when it’s built for the internet.

Now, imagine hundreds of clients doing the same thing Imagine Top-5, Top-20 and eventually a good chunk of the S&P 500 doing the same thing (thanks @EYnews) That's the flywheel effect being fully exploited by Chintai white label infrastructure powered by $CHEX

United States Trends

- 1. GeForce Season 4,228 posts

- 2. Comey 193K posts

- 3. Everton 147K posts

- 4. Mark Kelly 128K posts

- 5. St. John 8,795 posts

- 6. Amorim 63.1K posts

- 7. 49ers 20.5K posts

- 8. #sjubb N/A

- 9. Seton Hall 2,469 posts

- 10. Iowa State 3,682 posts

- 11. UCMJ 19.2K posts

- 12. Opus 4.5 9,617 posts

- 13. Genesis Mission 2,824 posts

- 14. Dealing 31.2K posts

- 15. Manchester United 85K posts

- 16. Hegseth 51.7K posts

- 17. #LightningStrikes N/A

- 18. Benedict Arnold 4,307 posts

- 19. Pickford 11.5K posts

- 20. Galarza 22.9K posts

Something went wrong.

Something went wrong.