CryptoLeadLists

@CryptoLeadLists

AI-powered crypto influencer lists for DeFi, NFTs & Bitcoin. Shop now at http://gumroad.com/cryptoleadlists #Crypto

99% of alts -20% 📉 $UNI +4.7% today 🟢 $AAVE +2.1% 🟢 $LINK holding $23 like it owes it rent 😭 While everyone stares at BTC candle, DeFi quietly builds the real bottom 🏗️ I’ve been telling my private group to rotate here since $94K 👀 Want the next name before it 3x’s? Drop…

"$SPX finally closed below its 50 day moving average, after 138 days! Here's what $SPX did next after such long rallies ended." @SubuTrade

Tired of getting rekt by noise in this dip? Here are the only 5 accounts I actually read every day (80 %+ hit rate this cycle): @RektCapital – cycle god @CredibleCrypto – TA wizard @intocryptoverse – macro king @Pentosh1 – conviction calls @GVRCALLS – altcoin sniper I…

Everyone crying “AI season over” at $0.28 $FET Same people who sold $SOL at $18, $RNDR at $1.50, and $TAO at $200 I’m just gonna keep buying and mute the timeline for 3 months Follow if you refuse to be the exit liquidity again 💀

$FET $0.281 Whales bought another 12 M tokens this week I just loaded the biggest bag of my life Real question while everyone panic sells: $FET price by March 2026? A) Under $1 (cope) B) $1–$3 (base case) C) $5+ (ASI merger moons) 🌕 D) $10+ (I’m delusional but voting this)…

Crypto isn’t retail-driven anymore. 🏦 Sovereign wealth funds 🌍 Corporates 🏢 Pensions 🧓 ETF demand 📊 Tokenization rails 🔗 Bank-issued stablecoins 💵 Treasury pilots 🏛️ This is not 2017. This is not even 2021. This is the institutional liquidity cycle. 🌐🔥 #Crypto…

Just in: Harvard ↑ 300% BTC exposure via IBIT 🏛️ Stanford quietly added $87M last week 🤫 Yale filing drops tomorrow (already leaked) 👀 They’re not buying the top — they’re buying YOUR panic bags 🩸 Smart money roadmap: Now → ETH + select L1s ✅ Q1 → RWA tokens 🏦 Q2…

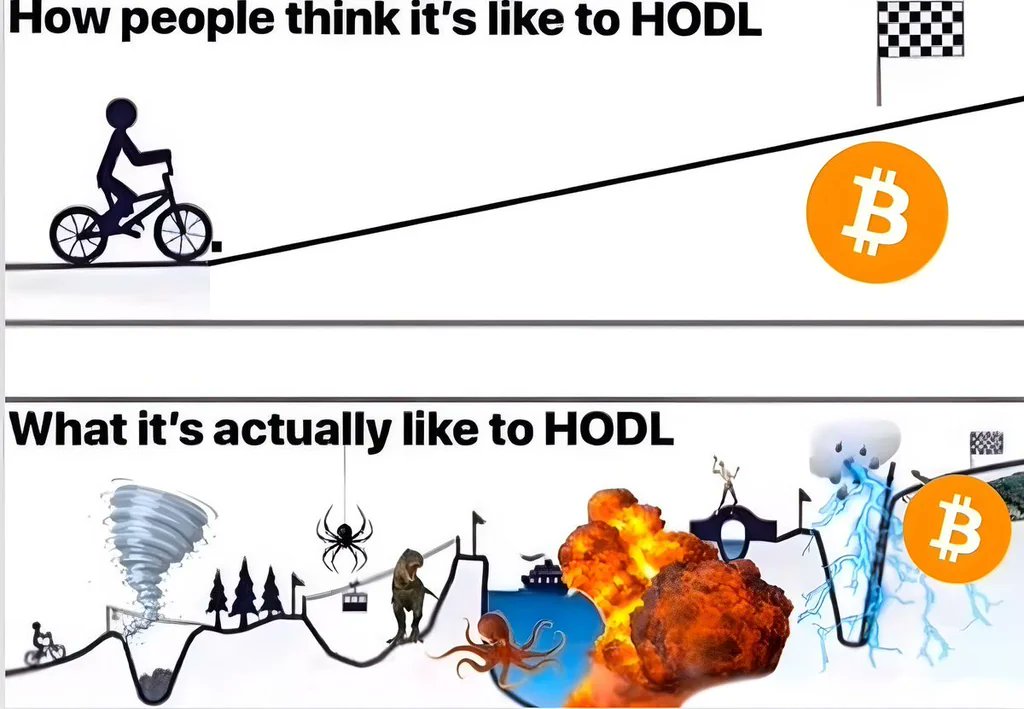

Everyone wants straight lines. Markets move in shockwaves. ⚡️ A -20% to -40% mid-cycle flush has happened in every major crypto run. 📉 It shakes out the impatient so the next leg has room to run. 🚀 Zoom out. Volatility ≠ trend reversal. 🔄 #BTC #Altcoins #MarketCycle

Retail right now: “Looks bad.” Macro right now: “This is the part where upside gets built.” We just had: • Capitulation tweets everywhere • Funding normalized • Leverage flushed • Breadth improving quietly beneath the noise This isn’t euphoria. This is construction. #OnChain…

Everyone’s looking at price. Nobody’s looking at positioning. Last cycle: ETFs didn’t exist. This cycle: • BTC ETFs are absorbing supply • SOL ETFs next • ETH final approvals lined up • Institutions are dollar-cost averaging the dip We’ve never had this structure before.…

Quick poll, no copium: Where does BTC close Dec 31st 2025? 🗓️ • Above $150K 🔥 • $120–150K 📈 • $100–120K 🫠 • Sub $100K (ngmi) 🪦 Voting is public. Let the timeline cook itself 🍿 Follow for the most brutal but honest takes in crypto 😈

The charts look scary. The plumbing looks legendary. 💧 TGA draining → liquidity in 📉 Real yields rolling over 🌐 Global M2 turning up 🪙 BTC funding cooling 📊 ETF flows stabilizing People keep watching red candles. I’m watching the macro tide. Fear = opportunity. Liquidity =…

BTC just rejected $93.2K for the THIRD time and ripped straight to $95.8K in 37 minutes 🔥 This is textbook whale accumulation before the next leg up 📈 Institutions aren’t selling — they’re rotating 💎 $240K EOY still 100% in play 🚀 If you panicked at $93K, this is why you…

As I said many times before: we're in the bull

Why do you think so many people get angry when they see the 10 largest companies represents 40% of the S&P500? Is because they don't own enough of those? These 10 stocks represent less than 20% of the total global stock market. What's the problem?

United States Trends

- 1. Cloudflare 219K posts

- 2. Gemini 3 28K posts

- 3. #AcousticPianoCollection 1,257 posts

- 4. Piggy 60.8K posts

- 5. Saudi 126K posts

- 6. Olivia Dean 4,212 posts

- 7. Salman 35.5K posts

- 8. #LaSayoSeQuedóGuindando N/A

- 9. La Chona 1,423 posts

- 10. CAIR 25.5K posts

- 11. Antigravity 2,192 posts

- 12. Taco Tuesday 15K posts

- 13. Presidential Walk of Fame 2,099 posts

- 14. #ONEPIECE1166 4,686 posts

- 15. Good Tuesday 36.2K posts

- 16. Jamal Khashoggi 2,346 posts

- 17. Anthropic 8,689 posts

- 18. #tuesdayvibe 3,223 posts

- 19. #MSIgnite N/A

- 20. Sam Leavitt N/A

Something went wrong.

Something went wrong.