Tim

@CryptoTsmith

Crypto Warrior Monk— Trained in the Art of the HODL, explorer of “The Path” to the Moon. | “So let it be tweeted, so let it be sent!”

You might like

What I learned from the comments is that both conservatives and liberals are fine with American rights being violated, so long as it’s their side doing the violating That mindset is exactly why extremism keeps growing. When rights become conditional, nobody is actually safe.…

We have 5,000 ounces of physical silver for sale. Kilo bars. Located in Florida. Current dealer is not buying at this time. If any nearby dealers happen to see this and are interested please let me know. Thanks.

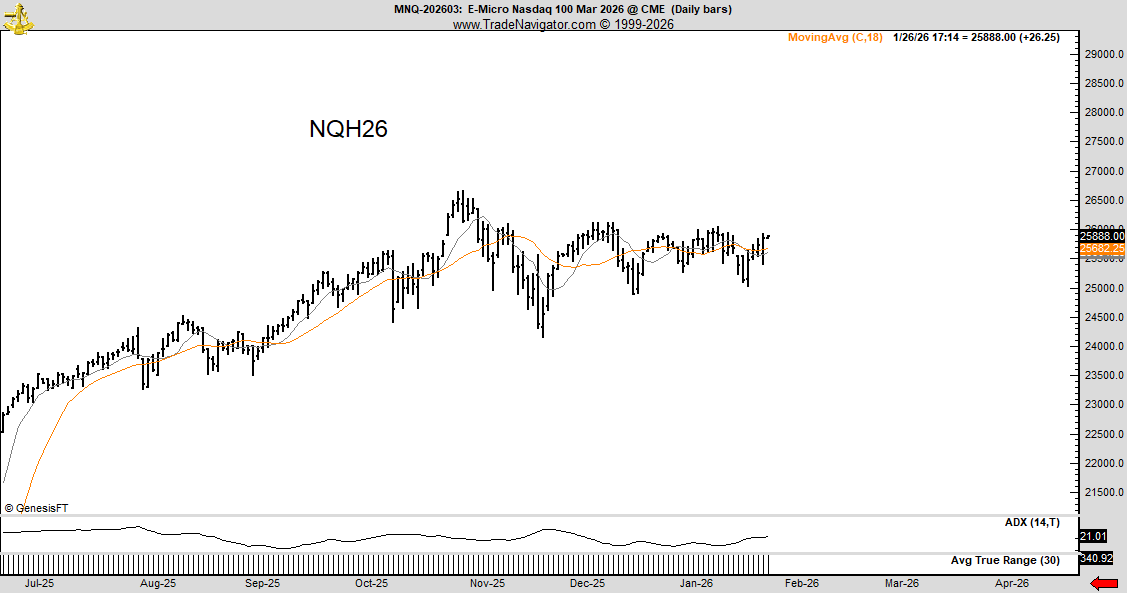

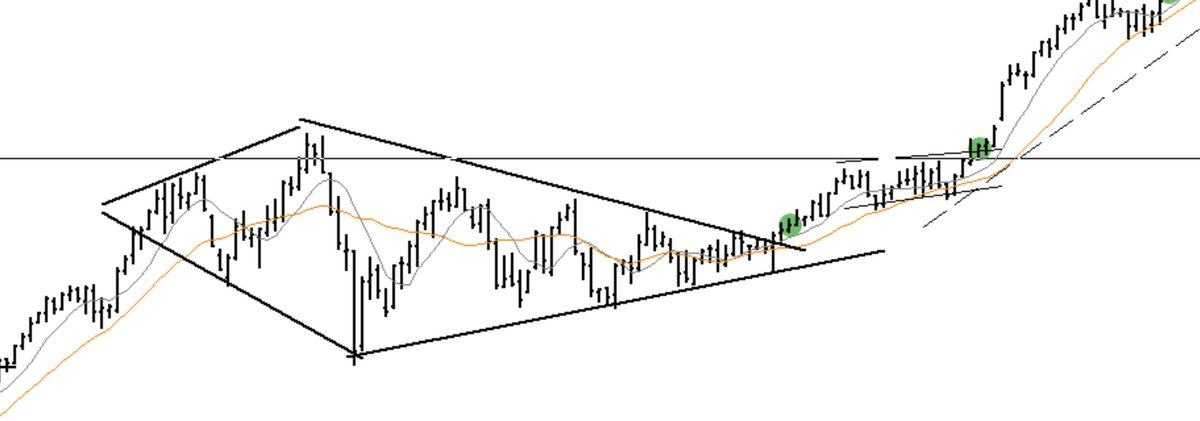

Charts of the day NASDAQ $NQ_F I've seen this structure before in recent years (right chart) The coordinated activity of whales can leave breadcrumbs Detecting the crumbs is what classical charting principles are all about

Confirmation that if the JGB market goes belly up, the @USTreasury market is next.

🇺🇸 THE FED IS PREPARING TO SELL U.S. DOLLARS AND BUY JAPANESE YEN FOR THE FIRST TIME THIS CENTURY. The New York Fed has already done rate checks, which is the exact step taken before real currency intervention. That means the U.S. is preparing to sell dollars and buy yen. This…

Imagine equities get weird for a few weeks, and SPX gives back a clean double digit pullback, drifting toward the longer-term averages, call it 6k and below. If that happens right as Trump’s Fed nominee steps in, you’re going to get the loudest “Fed put is back” narrative in…

OK, I will end this poll now rather than to wait Volume in the index futures is only of coincidental value The same rules used for individual equities do NOT NOT apply to indexes Reason: The indexes are a derivative of hundreds of other prices You have the right to disagree of…

Brain tester for all the new Wonder Kids in chart trading Volume is an important reading on the charts of individual equities Does volume have the same importance on the charts of $NQ, $YM and $ES

Friendly reminder that you should be using this button aggressively when you spot nonsense on the timeline. Specifically, if you’re a momentum trader in 2026 and you spend the whole year just sitting there waiting for alts and most of crypto to “come back,” instead of going…

Habits stick when you tie them to your identity. “I am the kind of person who can (fill in new desired habit)” The data say this isn’t a semantic-psychological hack. It works because you stake your ego (and people will work very hard to protect ego.)

The new Huberman Lab episode is out: Best Ways to Build Better Habits & Break Bad Ones | @JamesClear 0:00 James Clear 2:57 Common Habits, Tool: Habit Success & Getting Started 6:16 Make Starting a Habit Easier, Tool: 4 Laws of Behavior Change 10:18 Sponsors: Lingo & Wealthfront…

A friend of mine used to say: "Confidence isn’t built by thinking positive thoughts. It’s built by doing difficult things while your brain screams at you to stop." Damn, was he right.

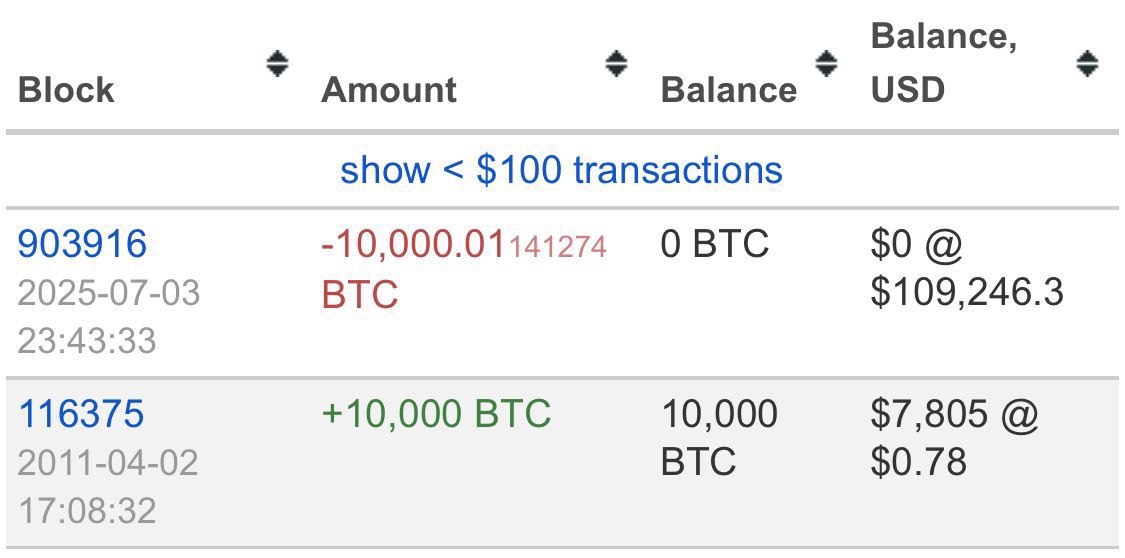

Imagine the stomach it takes to not only hodl what is now $1.1 Billion worth of Bitcoin for 14 years from a $7800 cost basis, but to just send it all out with a single click and no test transaction before hand.

It’s that day when I make you all look at this

Say it with me! In 2026, -I will cut my losses quickly -Follow the trend for the majority of my trades -Always be patient -Never let emotions drive my decisions -Take full responsibility for all of my trades -Journal my trades for self-reflection -Be flexible to changing…

A couple months ago crypto bros kept repeating that the last leg of a trend is where the biggest returns are, “just hold on”, even as crypto was clearly distributing. Ironically, you can watch that adage play out in real time in silver right now. This is how parabolic blow offs…

Here you go, my friends: Paradigm A: The 2020–21 lurching into fiscal dominance which helped catalyze the geopolitically driven supply-demand imbalance in the US Treasury bond market that is likely to persist – and widen – throughout the duration of this Fourth Turning.…

Yo DD, first of all THANK U. Second, could you please put a definition of K Shaped, A Shaped, D Shaped, C Shaped economies in the 42M Glossary? I can’t remember which from which.

Bottoms take months and even years to form. You always get multiple attempts. Many were trying to buy every dip worried it'd take off without them but now that we have a long period of consolidation no one wants to buy anymore.

There's almost never been a time where Bitcoin didn't give you months to aggressively buy an actual bottom. Sometimes it's an entire year. Don't lose all your money going for the glory bids to look cool to your internet friends.

In 2009 you saw commercials where companies were offering to buy your gold. Cash4Gold ran a Superbowl ad. Central banks were the biggest buyers (Russia, India, and China). In 2025 every commercial/ad you see is companies selling Gold to retail. You are exit liquidity.

You’re not bigger than the market, and fighting the tape is a battle you lose more often than you win. Want a simple way to stay on the right side of it? A couple moving averages and longer-period VWAPs. They’re boring, but they keep you honest. Merry Christmas.🎄

In downtrends pumps retrace. In uptrends dip retrace. I don't think this price action is that unusual unless you refuse to accept the direction it's been heading.

United States Trends

- 1. Giannis N/A

- 2. Nicki N/A

- 3. #OlandriaxRobertWun N/A

- 4. Apple cider vinegar N/A

- 5. Schwartz N/A

- 6. Powell N/A

- 7. Ms. Shirley N/A

- 8. Bucks N/A

- 9. Monken N/A

- 10. Fulton County N/A

- 11. Rubio N/A

- 12. Browns N/A

- 13. Rand Paul N/A

- 14. Milwaukee N/A

- 15. Trump Accounts N/A

- 16. Havertz N/A

- 17. Omar N/A

- 18. Streets of Minneapolis N/A

- 19. #dressdanandphil N/A

- 20. Unexpected N/A

Something went wrong.

Something went wrong.