Crypto Decoder

@Cryptodecoder0x

Decoding crypto with data-driven clarity.

Potrebbero piacerti

During the 2021 cycle, Bitcoin dropped over 15% daily on 10+ occasions from the 2020 halving to the Nov 2021 top. We're 8 months into 2025 and guess how many 15%+ daily drops? ZERO. The only time Bitcoin printed a -15% daily candle since the 2024 halving was during the yen…

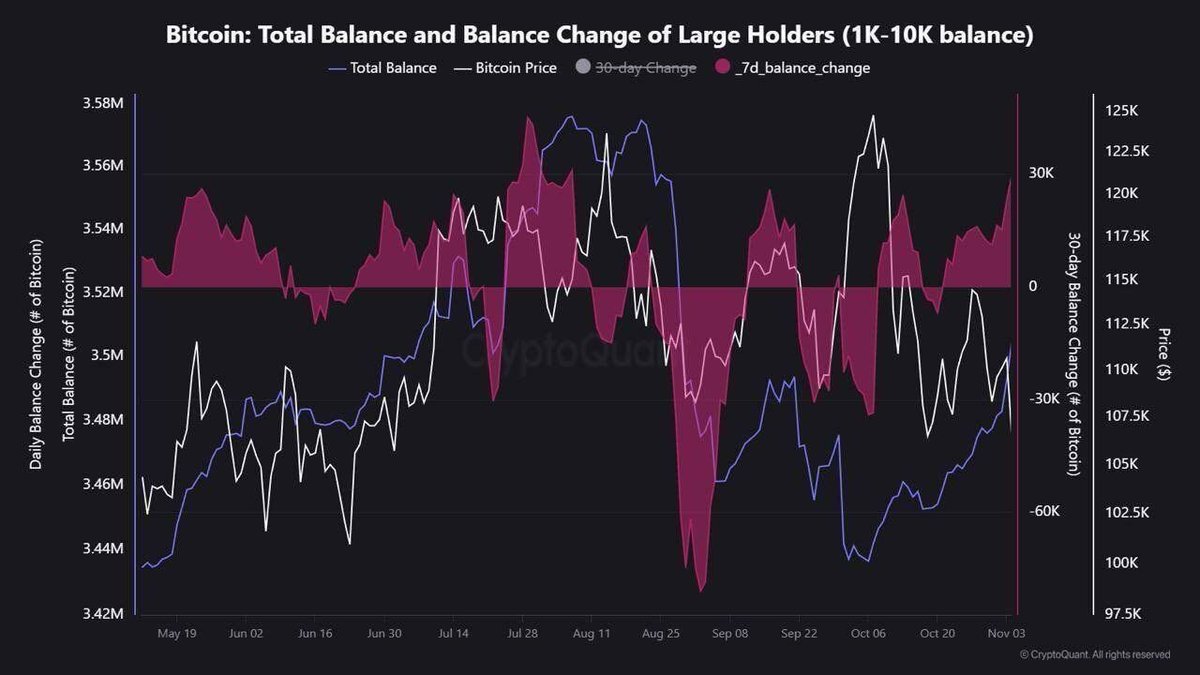

Whales Are Buying the Dip This week, wallets holding 1K-10K BTC accumulated nearly 30K BTC, roughly $3 billion worth. While retail traders are panicking, smart money is quietly stacking. Historically, such aggressive whale accumulation has often come right before major market…

They better or my wife will leave me

If you’ve used Meteora on Solana, check if you got the airdrop. 👇

The future will be tokenized. Every asset, every market, on-chain and it all begins with liquidity. With MET, we’re building the backbone of this tokenized future. The rails, the liquidity, and the army that powers every market. Checker is now live. Met.meteora.ag

The tariff dump shook the market, but Powell hints end of QT. Could Q4 bring a major altcoin rally? We break down the crash, Q4 outlook, ICO and airdrop meta. Watch now: youtu.be/sw5UCrsUvlM

What I’ve learned since these outrageous tariffs began this year is to always buy the tariff dump. Trump always makes a U-turn.

BTC kicks off Uptober with a new ATH, and alts are about to catch up. Trump: Well, China...

BTC is holding steady above 121K after getting rejected near 124.4K. A strong daily close above that zone could trigger another leg higher into new highs. But if bulls fail to defend the 121K region, we could easily see a healthy correction back toward 117K–118K before the next…

Will the shutdown pump keep going, or is a hard dump ahead? History says caution 👀🔍 Breaking down the risks, cycle timing, and what could kill the rally next: youtu.be/gZuRWMt6pbY

Welcome to Uptober! BTC is pumping on US Government Shutdown news. BTC at 116K, ETH 4.3K. Send it!

Bitcoin’s bottom is likely in as altcoins start bouncing back. I just dropped a new video covering whale accumulation, dominance shifts, and my top 3 altcoin picks for Q4. watch now: youtu.be/viJT-xQ5UqE

Here’s the chart of altcoin market cap versus Bitcoin. If you bought a basket of alts at the cycle bottom, when BTC was at $15,500, you’d still be down roughly 50% on average if you just held without rotating. That’s the brutal reality of this market. Those who fade narratives…

Wondering if we even get a banana zone this cycle? Will altseason be broad or just narrative-driven and institution-led? Learn how to spot trends, follow smart money, and hunt profits in this weird cycle: youtu.be/OytPOOOdQhI

Fed just delivered a 25 bps cut with a dovish outlook. Bitcoin is pushing to break 117K and alts are exploding 🚀 👉 4 data-backed signals screaming that altseason is finally here. 👉 One massive volatility warning you can’t ignore! 👉Watch now youtu.be/g8BPKWh3Alw

Portfolio update before FOMC. Most of the pre-meeting dump is done. Waiting for Powell’s comments to set the tone. A dovish press conference could flip my strategy completely. Full portfolio breakdown and gameplan here: youtu.be/BAmmtVn5L_M

Altseason index just broke above 75 for the first time this year, altcoin market cap at ATH, and ETH still holding strong vs BTC. But with FOMC on Sept 17, is this real strength or just another fake-out pump before a reset? My game plan here: youtu.be/4_367KMJNpY

PPI print just flipped the script on inflation and has markets pricing in multiple Fed rate cuts before year-end. That’s the green light for a Q4 altcoin explosion🔥 📺 Watch this deep dive on why BTC, ETH, and alts could rip higher: youtu.be/qPJvDP-UYK0

SOL/ETH has now printed its fourth consecutive weekly green candle, marking a significant shift in momentum. The last time Solana bottomed against Ethereum and kicked off a rally with four straight weekly greens, it surged from $128 to $295, a massive 130% gain over the following…

US PPI falls to 2.6%, lower than expectations. Actual: 2.6% Estimated: 3.3% Prior: 3.3% 50 Bps cut? 👀

United States Tendenze

- 1. Lakers 44K posts

- 2. Spurs 36.3K posts

- 3. Doug Dimmadome 8,883 posts

- 4. Godzilla 19.9K posts

- 5. Michigan 122K posts

- 6. Wemby 5,353 posts

- 7. Marcus Smart 2,144 posts

- 8. Sherrone Moore 62.9K posts

- 9. #Survivor49 5,134 posts

- 10. Dolly Parton 2,281 posts

- 11. #AEWDynamite 26.6K posts

- 12. Erika 176K posts

- 13. #PorVida 1,494 posts

- 14. Gabe Vincent 1,150 posts

- 15. Stephon Castle 3,640 posts

- 16. Jim Ward 9,223 posts

- 17. PETA 24.1K posts

- 18. Candace 218K posts

- 19. Gainax 3,615 posts

- 20. Vando 1,320 posts

Something went wrong.

Something went wrong.