not DBook

@DDBookTTrading

Options Trader 📊 | 25 | Volume Guy| #NotAFinancialAdvisor

Don’t quit. It’s scary to feel like you might be wasting time & money. That’s the hardest part. You’re gaining things you don’t realize tho. Growing as a person each day. Don’t quit.

If I don’t buy $BYND 8/18 20c .55 for Earnings… who will? Might do 5x for “fun” open.spotify.com/track/7py4IFxS…

We are all wired to view things with a negative bias, and that's why fear is stronger than greed. I've found that optimism is one of the most important assets I've had when trading. Yes, it sounds like a soft skill that doesn't matter in a rough and tough business, but it is…

📍 New Smyrna Beach Fun fact: it’s been called the “shark attack capital of the world” Going for a swim. If I don’t make it back, buy more $TDOC in my memory 🪦

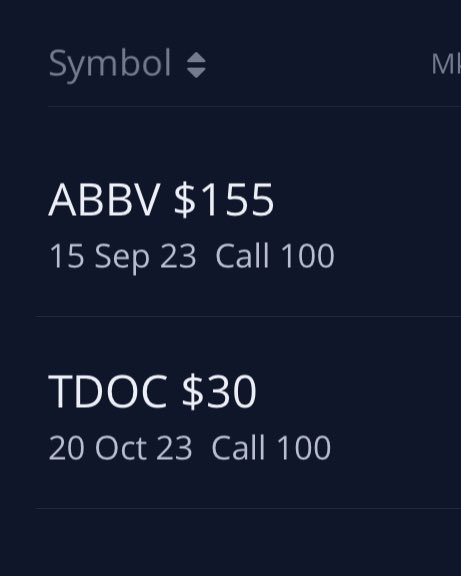

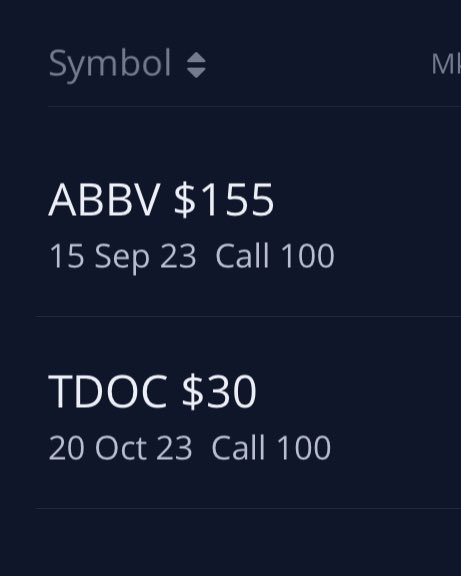

Calling too many losers on here lately $FSR $ABBV $RBLX recent ones Doesn’t make me happy. I like winning We do that next week

Took loss ❌ Disappointing action after opening rip. $ABBV Not thrilled about it but moving on. Sticking to familiar names next week. Setup isn’t invalidated yet. But I’m letting it go

$TDOC crappy action today. Sticking to -19% stop loss on my swing. Popped +15% several times holding if stop not hit

.89 stop loss set on $TDOC (1.11 avg) $ABBV +24% so far

Portfolio update: Almost time to get busy. Want to run 3-4 ‘swings’ at a time this fall. 1-2 months out expiry Both of these are 1/2 size, due to Earnings + shaky market Not pictured: RBLX 42c -95% Will be daytrading smaller positions around full-size swings (5-10% of…

Portfolio update: Almost time to get busy. Want to run 3-4 ‘swings’ at a time this fall. 1-2 months out expiry Both of these are 1/2 size, due to Earnings + shaky market Not pictured: RBLX 42c -95% Will be daytrading smaller positions around full-size swings (5-10% of…

Gonna use standard risk management on these. -25% max drawdown, ideally 15-20. I’m buying them near key supports, so avg downs won’t be common. Levels are levels

$2.2 Billion dollars deleted, on the clearest setup of the year. Wild times Yes, I should be retired. It is what it is 😹

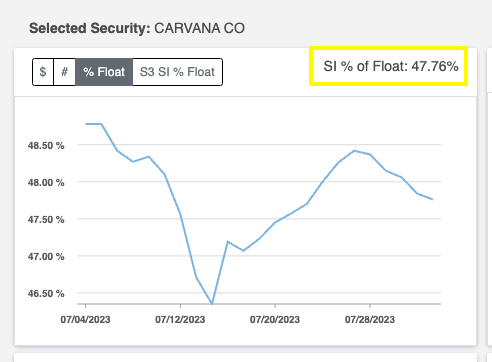

I want higher on $CVNA tomorrow. Here’s a graphic that explains why

the most fucked up part about $CVNA 47% of the float is STILL sold short?? After a 1500% run off bottom Where does this end? Anybody more knowledgeable on this situation than me? Do fundamentals just catch up? Or does it go to 100 lmao

$CVNA magic 🪄 now time for handle? interesting setup into Lotto Friday

$CVNA will anybody ever sell? Another nice low volume pullback into the 9EMA Unsure if I'll touch. But still an insane look

$M Daily on #SwingList Nice lower wick off trendline today. Key pivot 15.90 reclaimed. Overall great volume/price structure

If $AAPL $AMZN gap up, my Friday daytrade will be $GOOGL calls

$ORCL Weekly -- added to #SwingList Sitting on flag/gap support with clear risk levels $AAPL $AMZN ahead so will look for adds tomorrow

United States Trends

- 1. #DMDCHARITY2025 634K posts

- 2. #TusksUp N/A

- 3. #AEWDynamite 20.8K posts

- 4. #TheChallenge41 2,206 posts

- 5. Ryan Leonard N/A

- 6. #Survivor49 2,881 posts

- 7. Skyy Clark N/A

- 8. Diddy 74.2K posts

- 9. Jamal Murray 7,189 posts

- 10. seokjin 155K posts

- 11. Claudio 29K posts

- 12. Yeremi N/A

- 13. Earl Campbell 2,130 posts

- 14. Steve Cropper 6,333 posts

- 15. Hannes Steinbach N/A

- 16. Free Tina 13.4K posts

- 17. Klingberg N/A

- 18. Monkey Wards N/A

- 19. Milo 12.6K posts

- 20. Hilux 6,651 posts

Something went wrong.

Something went wrong.