The Daily Profiler

@DailyProfilerCo

We don’t guess the candle,we profile its probability. HOD/LOD stats • OHLC modeling • Time-based range sequencing Prop-Firm Ready:Monte Carlo risk+Postion size

You might like

Slow down. Read what real traders are saying: whop.com/packbootcamp/r… Our student results speak for themselves — consistent growth, clarity, and full independence. It’s not your strategy — it’s your ability to align the market environment and volatility condition and turn the…

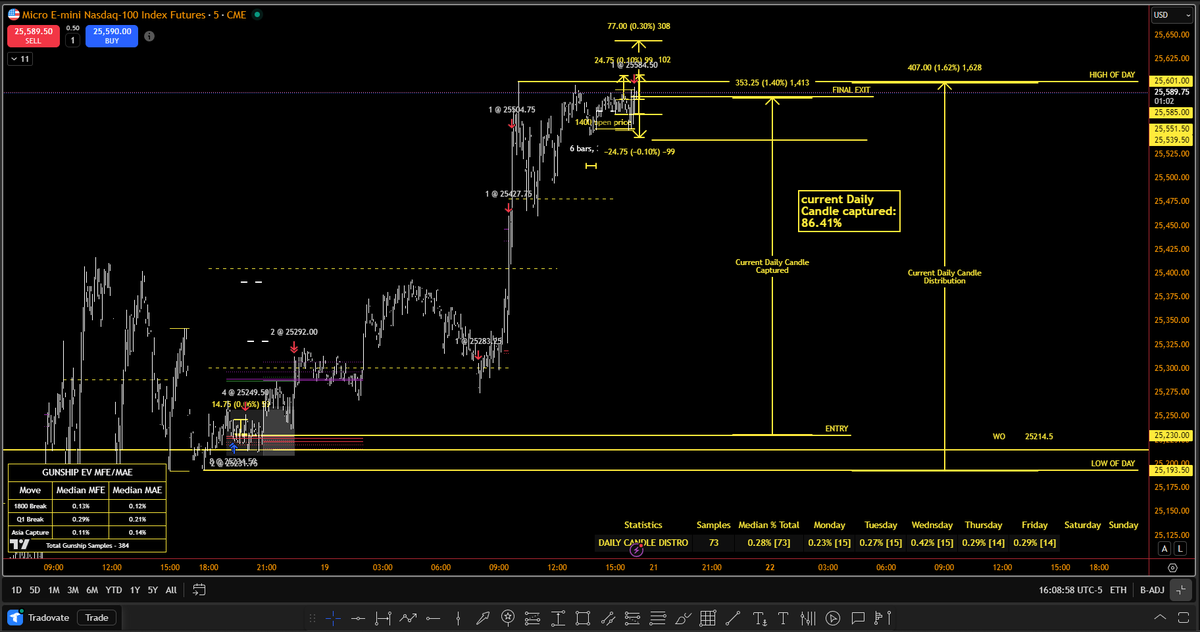

We know at settlement every day where the highest probability for the next day location and direction for the next day will lie. We captured the majority of the daily candle multiple times this week — pure process, no guessing, just build the plan and aligning live price with…

Done for the year and there we have it. I captured 86.41% of the daily candle with one execution. Stats on this challenge: The challenge - Capture a minimum 60-70% of the daily candle Stats: - 7 full attempts - of those 7 attempts only 3 attempts had full stop losses - 4 of the…

It’s you versus you. When you compete against others, you grow bitter. When you compete against yourself, you get better.

@LeadersJunction This video is spot on—delay isn't denial, it's preparation for something bigger. It resonates with my trading journey: years of battling the 0930 open on US100, turning losses into lessons until I mastered NQ, RTY, YM, and GC. The grind was real, but quitting…

youtube.com

YouTube

The 4 step reversal

Former Apache pilot & combat vet Ryan drops 🔥 on decision-making using the OODA Loop (Observe → Orient → Decide → Act) + how it translates directly to trading discipline, risk management & avoiding tilt. How it lets us align live price with historical data and make decision…

youtube.com

YouTube

BootCamp Special Guest Episode - Decision Making Dec 17

This tweet from @ZenomTrader hit harder than most people realize. He is one of the best prop firm quants in the game. Too many traders think payouts = skill. But in prop, sometimes it’s: variance + big risk + short window not edge + structure + consistency. Prop firms are a…

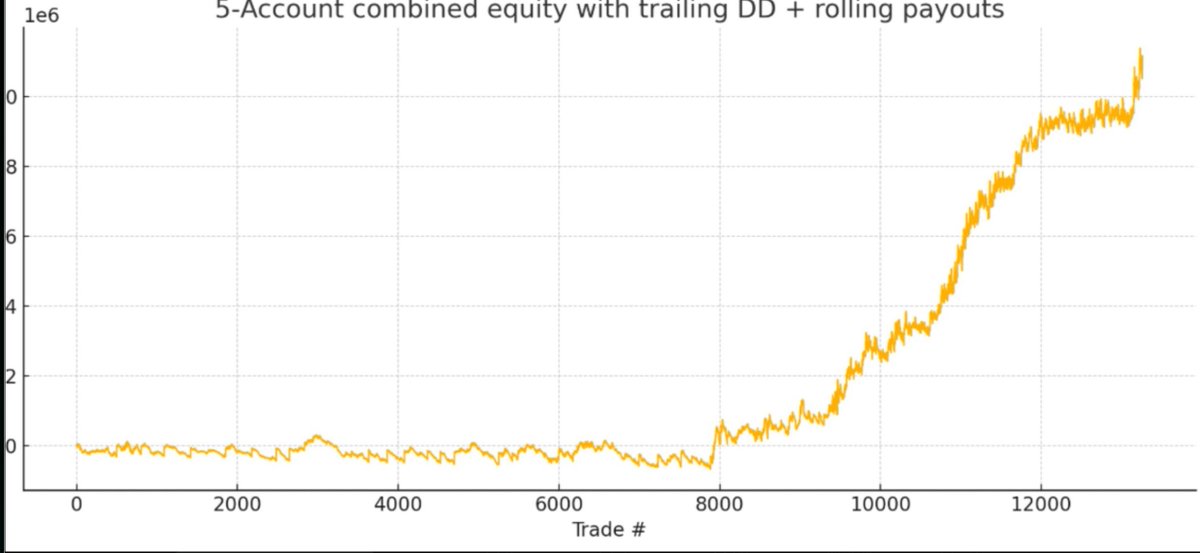

I’ve already proved statistically that you don’t need a profitable strategy to make money with prop firms. We ran simulations based on prop firm rules using breakeven and even losing equity curves. Another thing I discovered is that if you risk big Really big, it actually…

We don't predict the market we predict our losses and trade live price with the highest probabilities. @AC_Trades

Trade management + Position sizing =compounding phase Position sizing is the backbone: risk per trade,fixed %, volatility-based, or Kelly—get it wrong, blow the account. Why ES is better then NQ especially during the risk of ruin for many: lower cost = more contracts = better…

As I do with all trading systems, I say: prove it with statistics. If it's high probability, I'll see it in historical data. We built a database with 20 years of data across timeframes from M15 to monthly, then conducted a deep study. I've got to say—spot on, @TTrades_edu. Very…

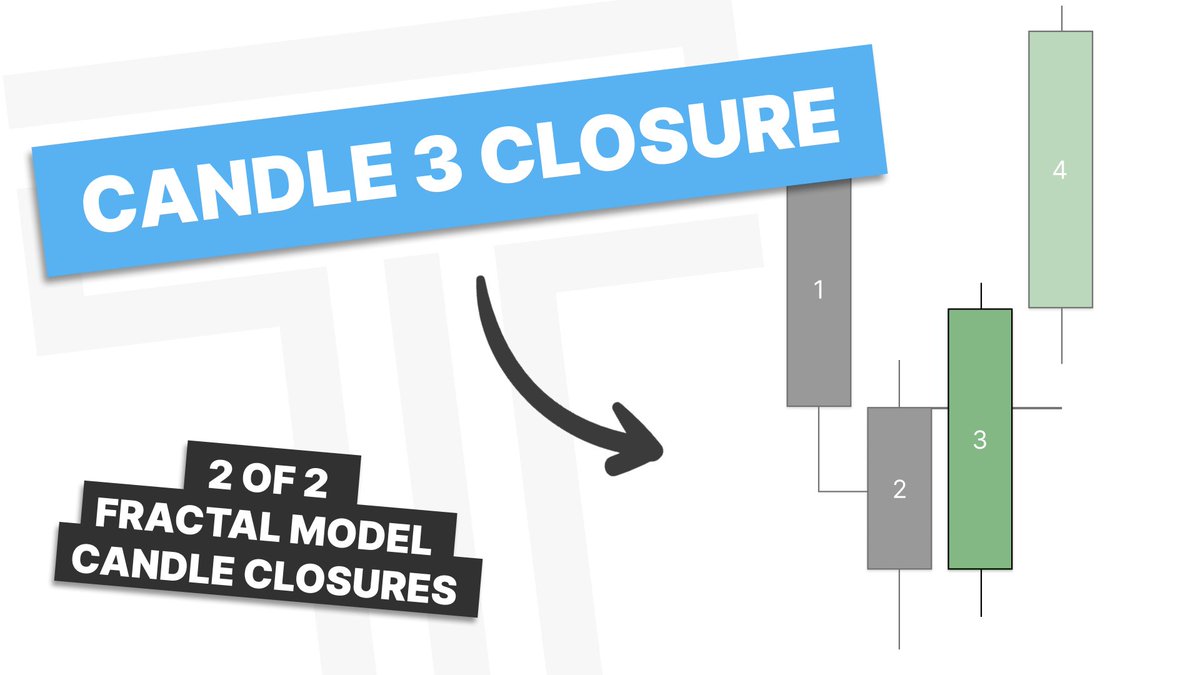

Candle 3 Closure: TTrades Fractal Model Wednesday December 3, 11am EST

Hmm, two things: 1. I guess it isn't about buying and selling pressure if system overheating can halt the markets. Duh, old news. 2. We just gave our adversary the keys and location to controlling our markets. Nah, I'm putting the tin foil hat on with this haha. Back to Black…

Happy Thanksgiving! Remember, in 40 years you'll be dead or on your deathbed. Enjoy life, remove drama, and leave a positive footprint for humanity, you fat turkeys!

A perfect example of a dude that did it on his own. He went and found out what worked for him what risk profile he was comfortable with learned discipline and he is owning it. Great work man no one can take credit for this beside you and the hours you into this. Keep going…

FOR NY RTH IS ALL YOU NEED !!!!!! EASY MONEY BABY !!!!! RTY ON RTH !!!!!!!

Well said. At the end of the day, no one cares if you make it in trading, and no one should care more than you. Here's the catch: your work ethic in the beginning and discipline over time will show how much you really care. Then it's just a matter of time before you figure it…

The angry people just do not want to put in the work to learn, GRIND, or blame themselves for anything. When I lose money it's always the same guy's fault -- mine.

United States Trends

- 1. Christmas 3.54M posts

- 2. Santa 1.37M posts

- 3. Feliz Navidad 671K posts

- 4. Hawaii 16.9K posts

- 5. Dan Fouts N/A

- 6. #AEWDynamite 11.8K posts

- 7. Merry Xmas 247K posts

- 8. #ShowSVPTheTree N/A

- 9. Rudolph 27.9K posts

- 10. Drew Brees N/A

- 11. Home Alone 34.3K posts

- 12. Radical Left Scum 12.4K posts

- 13. Marty Supreme 14.7K posts

- 14. Groq 6,540 posts

- 15. Ray Lewis 1,056 posts

- 16. Wonderful Life 12.7K posts

- 17. Stan Humphries N/A

- 18. Keep Shough N/A

- 19. Phil Donahue N/A

- 20. Elton John 1,836 posts

You might like

-

too°

too°

@toodegrees -

HYDRA

HYDRA

@Hydra_Thahmid -

The Surgical Trader / TST

The Surgical Trader / TST

@surgicalTRDR -

Frank369

Frank369

@FrankOf369 -

The pragmatic

The pragmatic

@NWM667 -

Sir Pickle

Sir Pickle

@SirPickle_ -

A+

A+

@theAplustrades -

Stoic Trader

Stoic Trader

@StoicTA -

I13c79y

I13c79y

@h1d3c -

Menda

Menda

@mendatrades -

Arjo

Arjo

@arjoio -

Mantaraya

Mantaraya

@deepsaturno -

The RusTick Trader

The RusTick Trader

@mr_rustickwicks -

💎Bambz💎

💎Bambz💎

@traderb_fx -

Shadow

Shadow

@Tru_Trades

Something went wrong.

Something went wrong.