Dan Westervelt

@DanWestervelt

On an investment team allocating to absolute return strategies across the liquidity spectrum. Previously family office for legendary investor. Views are my own.

You might like

Apparently there were cuneiform spreadsheets Truly nothing new under the sun lol

That wonderful feeling when the hotel’s direct currency conversion rate is far and favorably out of date. 👌

Some final points: 1. There is value in Tail Risk Hedging. It increases the growth rate of a fund, and limits the damage of its worst-case scenario. 2. ...and it can increase its Sharpe as well, although that is not an essential feature. 19/

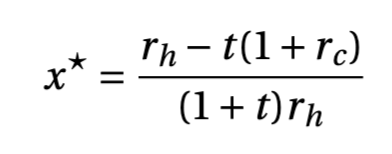

And the solution is below. Let us consider monthly rollovers. And let us assume that a r_c=-40% drawdown occurs about every 10 years, to t = 120. We buy 10% OOM puts. The optimal hedging is x^*=0.38%. 12/

Happy 88th birthday, Thomas Pynchon! Looking forward to adding Shadow Ticket to this shelf.

The joy of reading fiction is finding out that your most personal feelings and fears aren't personal at all, but universal. Many have walked this road. It's like how C. S. Lewis described the beginning of true friendship, a feeling of "What? You too? I thought I was the only one"

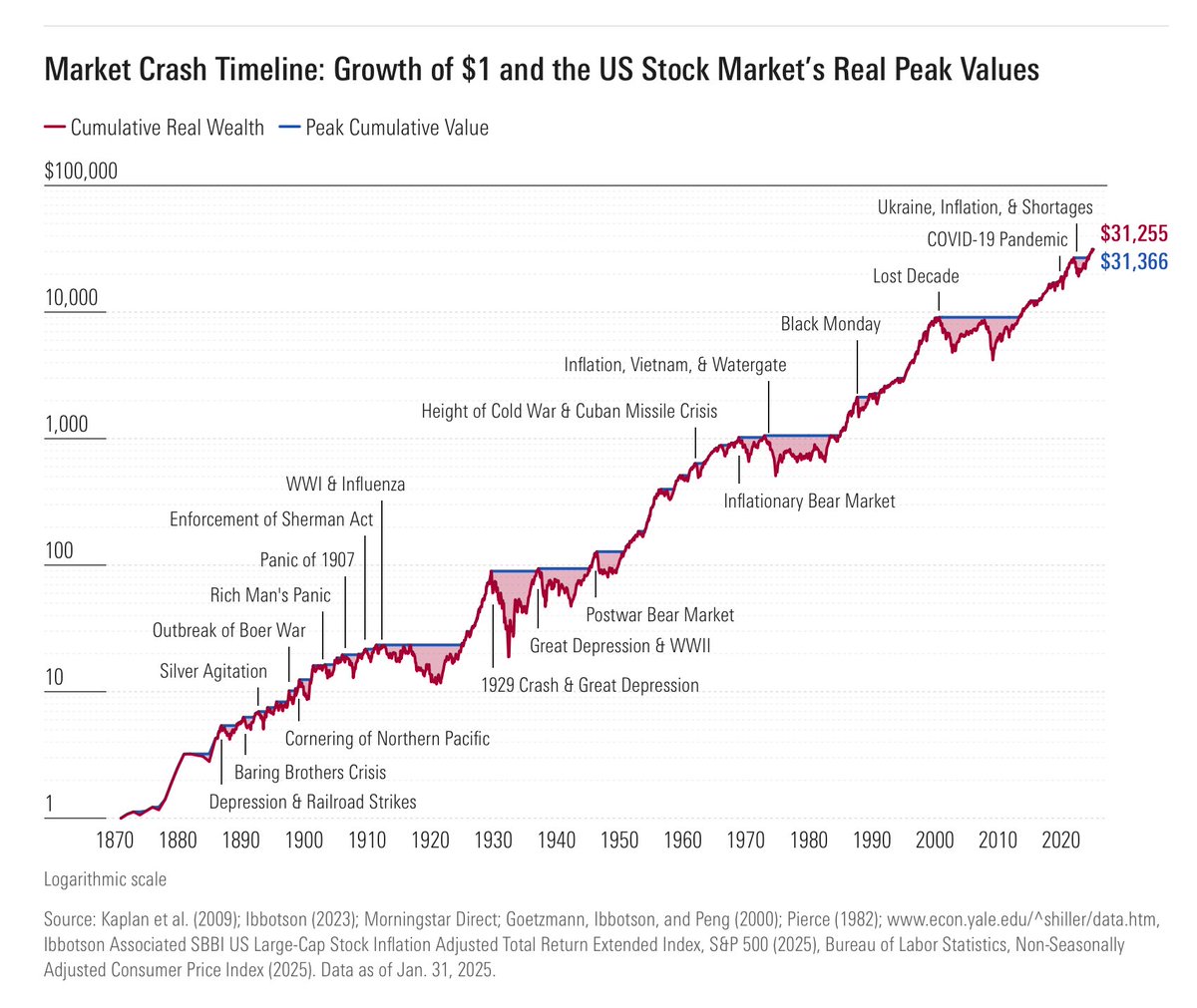

In investing, one has to be able to endure the reds to enjoy the greens.

I think about this daily. Life’s work. Ikigai.

Great post from a pioneer in the sustainable investment industry (@CleanYield): cleanyield.com/2025/03/taking…

Inflation came in below expectations but still a touch on the high side. Core CPI annual rate: 1 month: 2.7% 3 months: 3.3% 6 months: 3.2% 12 months: 3.2%

Some misinformation in today's US presidential debate about who bears the cost of tariffs. So let's talk about how tariffs affect what you pay for a suit. 🧵

If you change your mind too frequently, it suggests that you do not think carefully and responsibly before formulating an opinion & don't know when to remain silent or neutral. If you never change your mind on anything, it indicates that you are an intellectually dishonest.

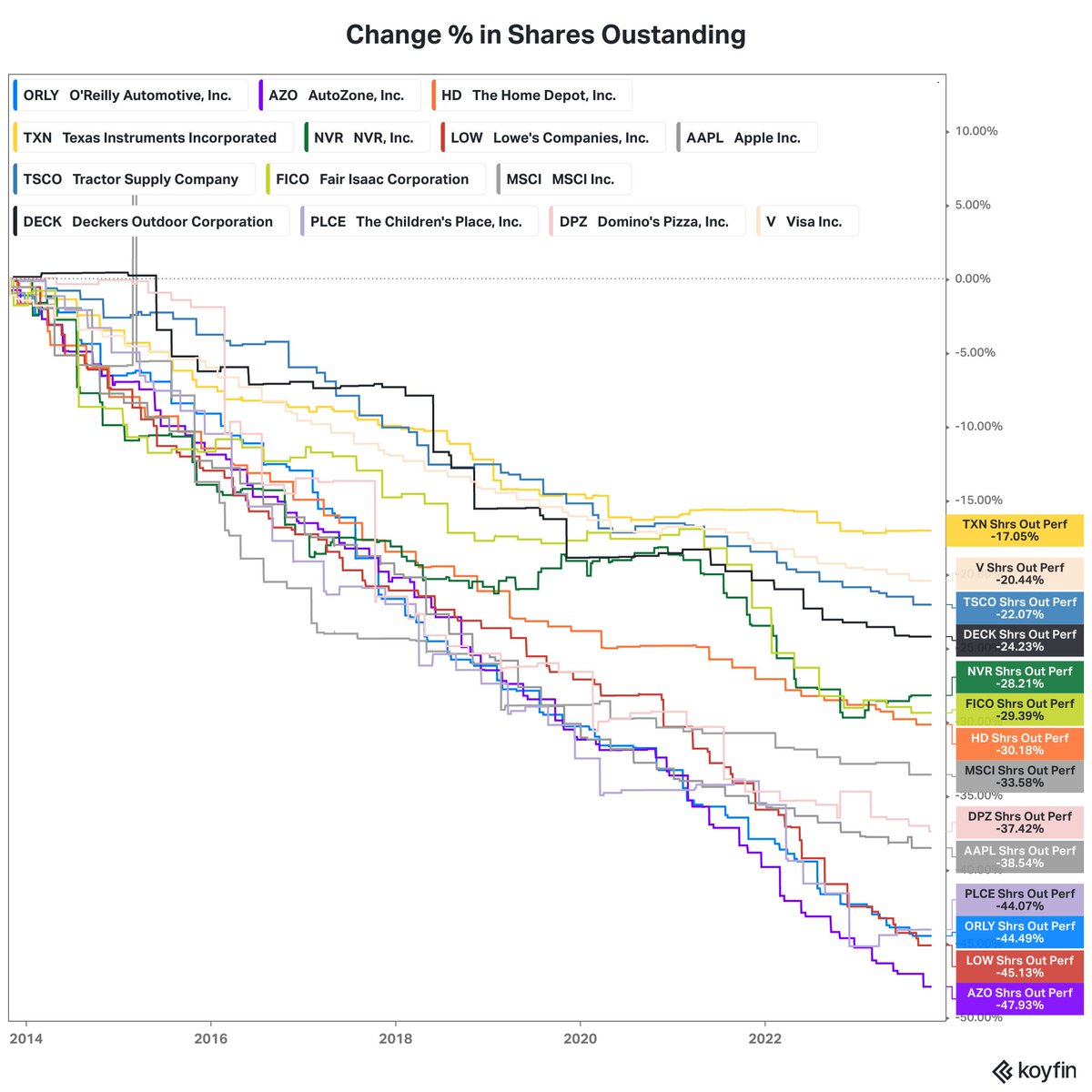

Warren Buffett loves share cannibals. "The math isn't complicated. When the share count goes down, your interest in the businesses goes up. Every small bit helps if repurchases are made at value-accretive prices". 1/ We wanted to put them to the test in a model portfolio 👇

Austrian bond holders at the BFTP facility

United States Trends

- 1. Good Saturday 26,1 B posts

- 2. Indiana 163 B posts

- 3. #STARDOM 7.325 posts

- 4. #SaturdayVibes 1.896 posts

- 5. #JennieRulesGDA 82,4 B posts

- 6. Bless the Lord 2.510 posts

- 7. Whale - Buy 4.878 posts

- 8. QUEEN JENNIE HAS ARRIVED 61 B posts

- 9. Steve Kerr 14,5 B posts

- 10. Mendoza 54,1 B posts

- 11. 5m TXs 2.243 posts

- 12. Giannis 15,1 B posts

- 13. 10m TXs N/A

- 14. 2019 LSU 4.431 posts

- 15. Usury 11,6 B posts

- 16. Cignetti 28,6 B posts

- 17. #IranRevolution2026 271 B posts

- 18. Jabari 4.006 posts

- 19. Dan Lanning 9.595 posts

- 20. #DigitalBlackoutIran 783 B posts

You might like

-

Bucket Shop Capital

Bucket Shop Capital

@bucketshopcap -

David Rosenthal

David Rosenthal

@djrosent -

Cory Levy

Cory Levy

@cory -

Pear VC

Pear VC

@pearvc -

Brian Lee

Brian Lee

@BrianLeeTrades -

Art Capital

Art Capital

@crazyjoedavola_ -

em herrera

em herrera

@EmilyHerrera -

Jessica Nutt

Jessica Nutt

@JessicaNutt96 -

Rick Zullo

Rick Zullo

@Rick_Zullo -

Seth Rosenberg

Seth Rosenberg

@SethGRosenberg -

Chris Sommers

Chris Sommers

@ChrisSommers79 -

Michael Jordaan

Michael Jordaan

@MichaelJordaan -

Joseph Arthur

Joseph Arthur

@josepharthur -

Adam D. Wyden

Adam D. Wyden

@Adam_Wyden -

Gold Mansacks

Gold Mansacks

@Gold_Mansack

Something went wrong.

Something went wrong.