David Grider

@David_Grid

Partner & Head of @FinalityCap Liquid Opportunities Fund | Ex. Head of Research @Grayscale (@DCGco) | FMR. Head of Digital Asset Strategy @Fundstrat

คุณอาจชื่นชอบ

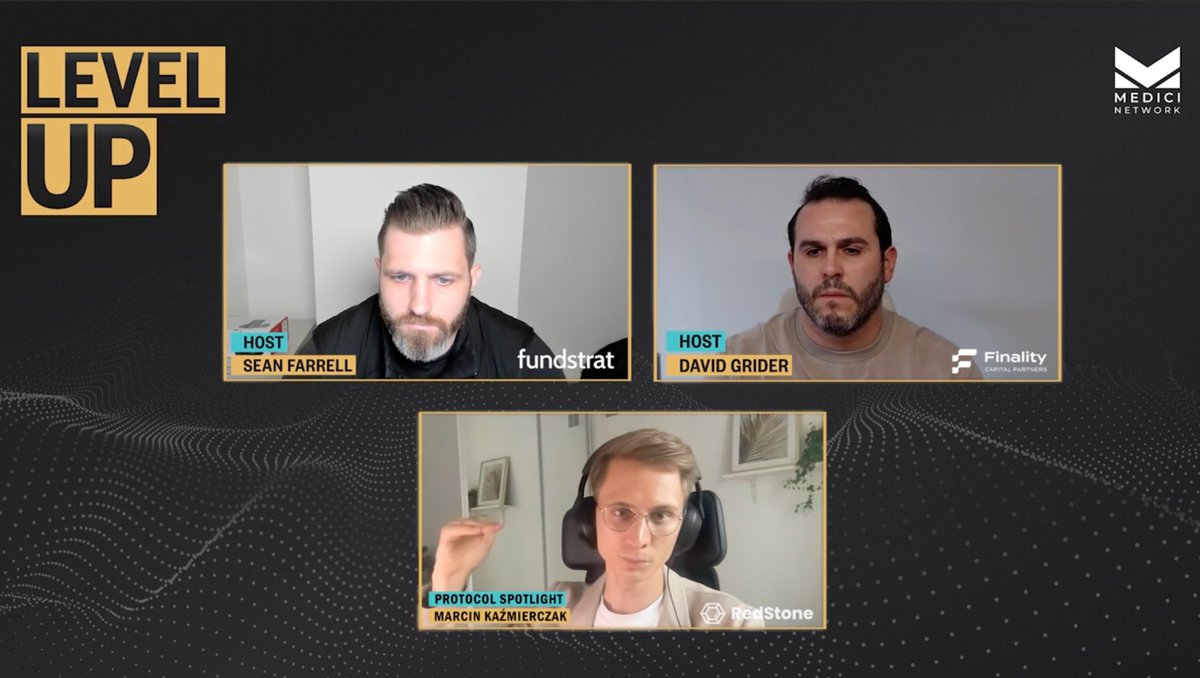

Thanks @David_Grid & @SeanMFarrell for the chat, it was an in interesting one!

1/ 🎙️Level Up - RedStone (RED) episode is LIVE! @David_Grid & @SeanMFarrell chat with @MarcinRedStone, co-founder of @redstone_defi to break down: 🔹 RedStone’s modular oracle design vs competitors 🔹 Why flexibility matters for chains, asset issuers & dApps 🔹 Revenue engines…

The “QT is ending here comes QE crowd” in shambles

Looks like Fed will be reinvesting a lot more of its long dated Treasuries into bills in order for its overall portfolio to mirror Treasury's outstanding. That suggests additional duration the private sector will need to absorb similar in effect to QT.

RIP to everyone who thinks a “Trump Fed will add liquidity and push up crypto prices”

MIRAN SAYS IT'S 'POSSIBLE' THAT FED COULD SHRINK ITS BALANCE SHEET AGAIN IN THE FUTURE

When my partner @KamalMokeddem writes which is not often I strongly encourage people to pay attention. Today’s correction and future ones, combined with positions in new TGE protocols increasingly unlocking / dumping will create one of the most accessible but overlooked…

1/ 🎧 Level Up - Celestia (TIA) episode is LIVE! @David_Grid & @SeanMFarrell sit down with @nickwh8te from @celestia on: 🔹 The modular thesis & "AWS for blockchains" 🔹 DA Competitive Landscape 🔹 Throughput/cost trade-offs 🔹 Current adoption and revenue potential 🔹 Token…

Had a great time chatting with @nickwh8te from @celestia about all things DA on the latest pod - be sure to give it a watch 👇🏻

1/ 🎧 Level Up - Celestia (TIA) episode is LIVE! @David_Grid & @SeanMFarrell sit down with @nickwh8te from @celestia on: 🔹 The modular thesis & "AWS for blockchains" 🔹 DA Competitive Landscape 🔹 Throughput/cost trade-offs 🔹 Current adoption and revenue potential 🔹 Token…

1/ 🚨 New Episode on Level Up – Live at SG 25! @David_Grid & @SeanMFarrell hosted three flash interviews from our conference booth with: • Rebekah Woo ( @FarroCapital ) • @Arthur_0x ( @DeFianceCapital) • @Dschamis ( @HypeStrat / Atlas Merchant Capital) They unpack how…

Our Co-Founder and Managing Partner @adam_winnick joins the stage at @money2020 today to discuss how internet business models are evolving through identity ownership. If you’re in Vegas, be sure to stop by his panel at 2:10PM PT. #Money2020 #DataOwnership #Web3

DATs will be the next bear market “death spiral” narrative: -2018: “ICO treasuries are selling” -2022: “DeFi protocols are liquidating” -2026: “DATs are selling” History doesn’t repeat… but it rhymes

BREAKING. This is an open letter to the management of $ETHZ.

This was a great conversation with @AK_EtherMachine of @TheEtherMachine - check it out 👇🏻

1/ 🎧Medici Presents: Level Up - ETHM episode is LIVE! @David_Grid and @SeanMFarrell speak with @AK_EtherMachine, co-founder & chairman of @TheEtherMachine (ETHM) on: 🔹 Why ETFs miss staking yield & how a DAT captures it 🔹 ETHM’s approach: targets 100% staking + restaking…

Have a lot of respect for @jdorman81 - but when markets can’t rally on “good news” it’s actually bearish - it means all the good news is priced in and you’re running out of skeptical buyers

Nothing but positive headlines today - JPM calls for end of QT - crypto market structure bill moving forward - HYPE listed on Robinhood (proof that good assets can get listed) - Trump scheduled to meet with Xi - macro fears abating Good crypto assets either at, or close, to…

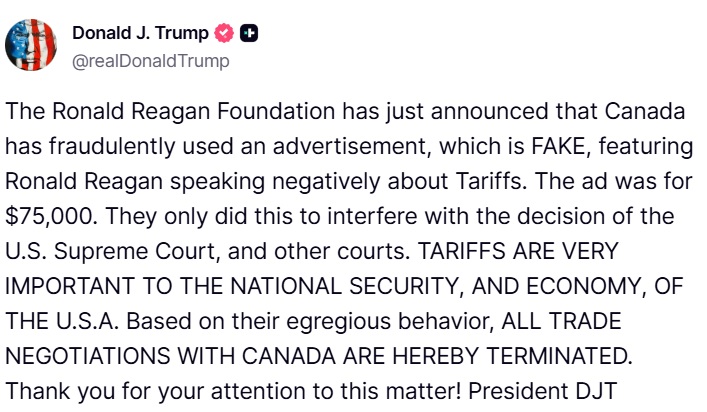

Canada runs an advertisement Trump doesn’t like and trade negotiations are terminated - and people think Trump and Xi will strike a deal after one meeting. They might, who knows, but at 80% Polymarket odds, that’s consensus and priced, which means the risk/reward isn’t great.

Donald J. Trump Truth Social Post 10:39 PM EST 10/23/25

United States เทรนด์

- 1. Panthers 13.7K posts

- 2. Ole Miss 70.6K posts

- 3. Stafford 10.9K posts

- 4. #KeepPounding 2,233 posts

- 5. #Browns 3,508 posts

- 6. Lane Kiffin 79.5K posts

- 7. Arsenal 458K posts

- 8. Chelsea 399K posts

- 9. McLaren 132K posts

- 10. Reece James 78.8K posts

- 11. Caicedo 103K posts

- 12. #FTTB 2,481 posts

- 13. Chuba 1,820 posts

- 14. Davante Adams 2,240 posts

- 15. #DawgPound 3,799 posts

- 16. Josh Downs N/A

- 17. AD Mitchell N/A

- 18. CJ Stroud 1,365 posts

- 19. #Colts 1,934 posts

- 20. Bijan 2,248 posts

คุณอาจชื่นชอบ

-

The Block

The Block

@TheBlock__ -

Dan Morehead

Dan Morehead

@dan_pantera -

AriannaSimpson.eth

AriannaSimpson.eth

@AriannaSimpson -

Dragonfly >|<

Dragonfly >|<

@dragonfly_xyz -

Art of The CMS

Art of The CMS

@cmsholdings -

Jeremy Allaire - jda.eth / jdallaire.sol

Jeremy Allaire - jda.eth / jdallaire.sol

@jerallaire -

CoinShares

CoinShares

@CoinSharesCo -

intern (mainnet arc)

intern (mainnet arc)

@intern -

Jason Choi

Jason Choi

@mrjasonchoi -

Haseeb >|<

Haseeb >|<

@hosseeb -

Ken Xuan

Ken Xuan

@tirelessken -

Dan Tapiero

Dan Tapiero

@DTAPCAP -

FS Insight

FS Insight

@fs_insight -

qw

qw

@QwQiao -

Travis Kling

Travis Kling

@Travis_Kling

Something went wrong.

Something went wrong.