Undervalued Assets

@DecodeTheSignal

Decoding capital rotation, systemic cracks & revaluations. Sovereign Signal reports featured daily in @TheTradeXchange. 📡 http://lukas-newsletter.beehiiv.com/

The Department of Health & Human Services demands Med Schools Teach Nutrition: "Master The Language Of Prevention" As someone from a family of doctors & nurses and as a former pre-med student who nearly followed suit, I 1000% support this zerohedge.com/medical/rfk-jr…

China’s PBOC Could Inject More Liquidity in Coming Months: Paper oh good

*PAUL TUDOR JONES: 'I SEE CONCENTRATION RISK EVERYWHERE I LOOK'

RFK Jr. Demands Med Schools Teach Nutrition: "Master The Language Of Prevention" zerohedge.com/medical/rfk-jr…

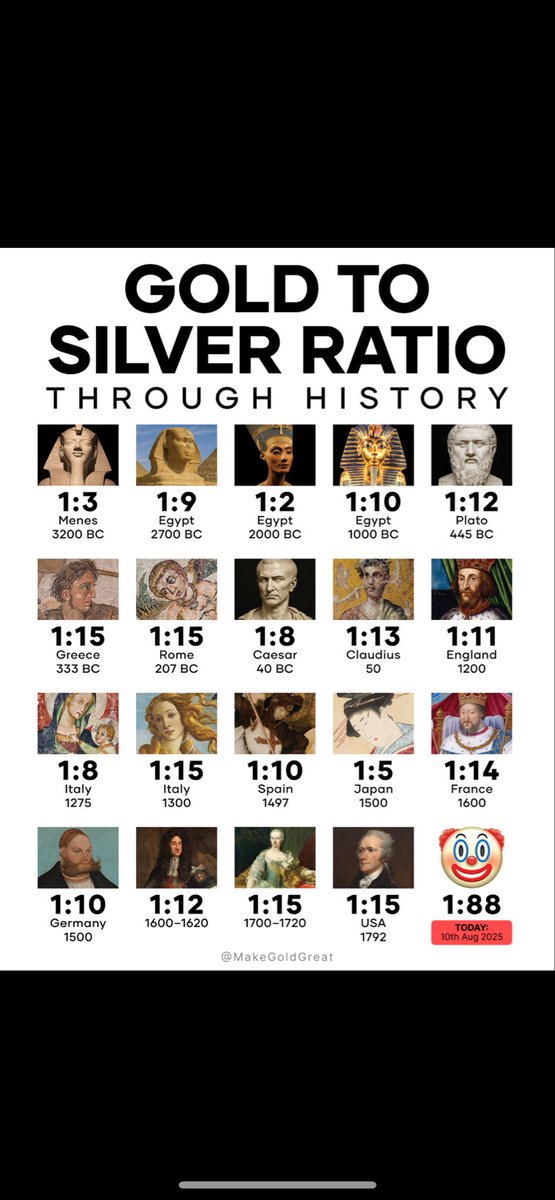

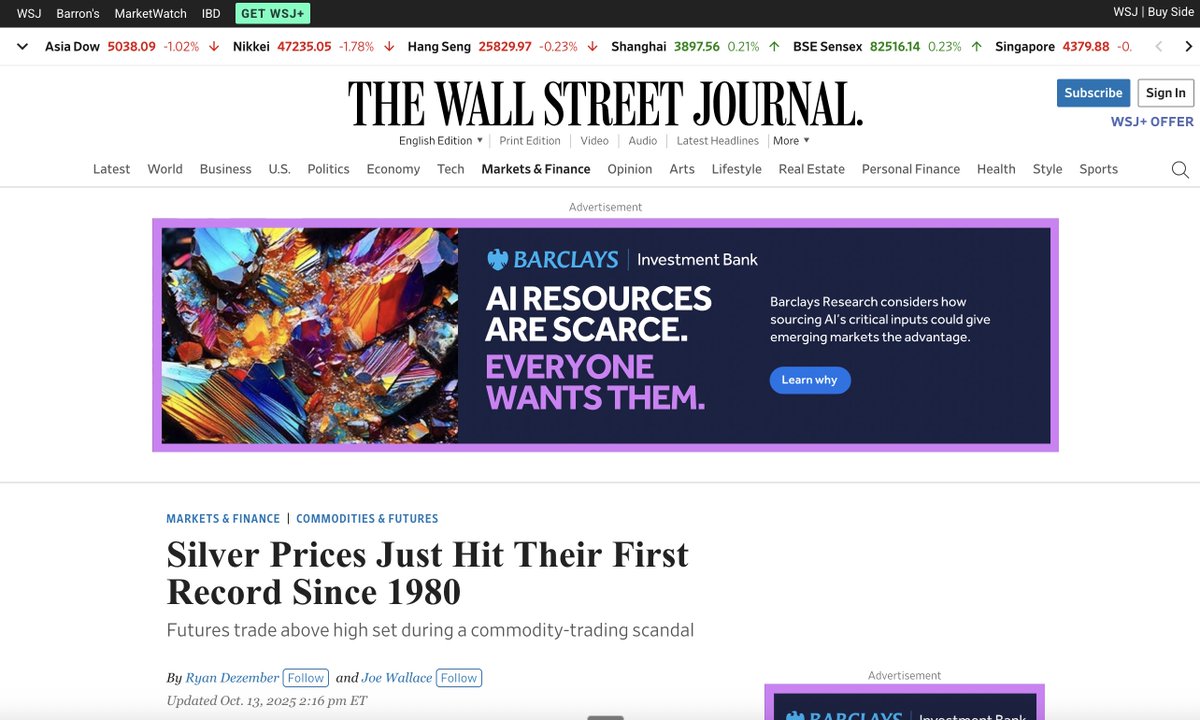

🚨 SILVER RIPS BACK ABOVE $52 💥 Bulls back in control. Strap in. Want to beat the market? 📈 Join our Substack. wallstreetgold.substack.com

Yes, When Gold's spot price rises +$1,500 oz in this year where Central Banks are now forecast to have bought another record +1300 metric tonnes in the face of $2600 oz to $4,100 spot Well, the fiat holdings of this Century's mostly positive Gold Reserves stacking also rises

Who's waited a few decades to see the Wall Street Journal say this?

Saw some well-timed (given London shortages) & somewhat sophisticated FAKE NEWS floating around SILVER nerd TwitterX today ———— Just silver jewelry restrictions: “There was a surge of up to 40 tonnes of silver coming from Thailand in an attempt to evade duty.” said an official.

72% of S&P 500 companies disclosed AI as a ‘material risk’ on their 10-Ks this year

Exter's pyramid should support a gold/silver ratio of 1:3, or even parity.

No single country or institution has reduced its Treasury holdings more significantly than the Fed in the past three years. Eventually, the Fed — or another arm of the U.S. government — will need to step back in as the dominant buyer of Treasuries, in my view. Ending…

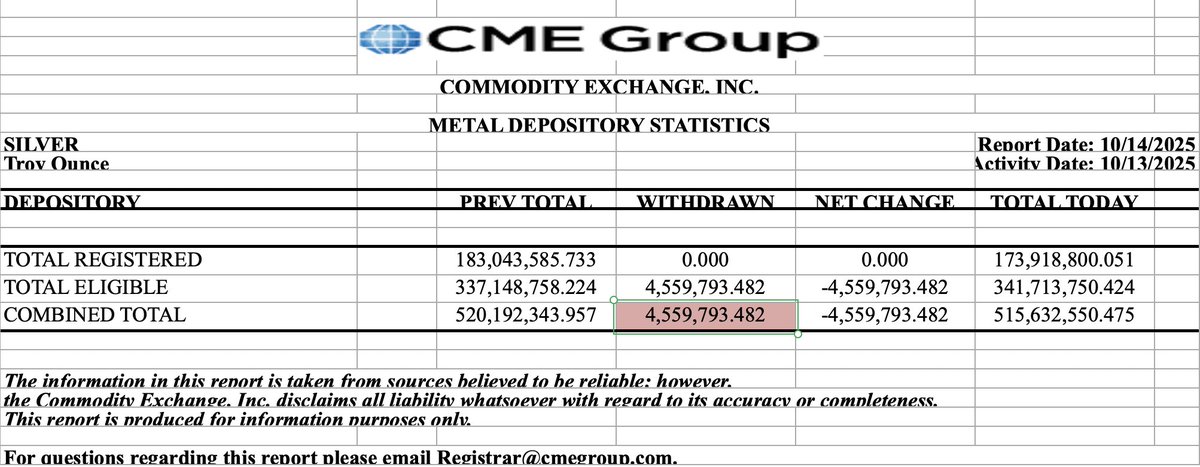

Silver leaves the COMEX again on Tuesday, for at least the fourth day in a row now, since the London spot price surged above the New York futures. This time 4.56 million ounces.

🔥Gold prices are experiencing a HISTORIC RUN: Gold prices have jumped 58% year-over-year marking the second-best run over the last 35 YEARS. This is only below the surge seen in 2006 at much lower prices. Gold has hit another all-time high of $4,190. Remarkable.

The commodity market just woke up With a vengeance

Fed funds rate dropping to 2.5% looks like this. Gold will soar.

*PAUL TUDOR JONES SEES FED FUND RATE AT 2.5 OR 2.75 IN A YEAR Bitcoin at $250K you say?

Silver lease rates have spiked above 100% annualized, hitting an all-time high. WILD.

The silver market is getting very interesting… Liquidity has collapsed. Silver lease rates have spiked to as high as 35%. Those short silver are now scrambling to find metal. Silver is up over 60% the past 1 year in US dollar terms…

Global Central Banks now own the most Gold this century 🚨🚨🚨

Silver Price Discovery Freezes For 1.5 Hours; Fed's Powell Refuses To Answer Question About Gold's Price Movement open.substack.com/pub/jensendavi…

Peak lunacy? Trump threatens to tariff cooking oils and every "risk asset" immediately shits the bed.

LBMA’s Spot Markets are naked short 👇

READ THIS CAREFULLY: “David Jensen argues that since the LBMA’s creation in 1987 under Bank of England oversight, the cash/spot market shifted from requiring physical bars to trading “unallocated” contracts—essentially IOUs or promissory notes promising delivery on demand but…

United States Trends

- 1. #DWTS 36.4K posts

- 2. Yamamoto 21.1K posts

- 3. #DWCS 6,788 posts

- 4. Ohtani 12.6K posts

- 5. #WWENXT 16.8K posts

- 6. #Dodgers 13.3K posts

- 7. Robert 104K posts

- 8. Carrie Ann 4,329 posts

- 9. Haji Wright N/A

- 10. #RHOSLC 3,906 posts

- 11. Roldan 2,310 posts

- 12. Brewers 36.3K posts

- 13. Young Republicans 55.8K posts

- 14. Elaine 57K posts

- 15. Whitney 14.9K posts

- 16. Max Muncy 3,877 posts

- 17. Yelich 1,595 posts

- 18. Dylan 32.3K posts

- 19. Politico 273K posts

- 20. Mr. Feeny 1,596 posts

Something went wrong.

Something went wrong.