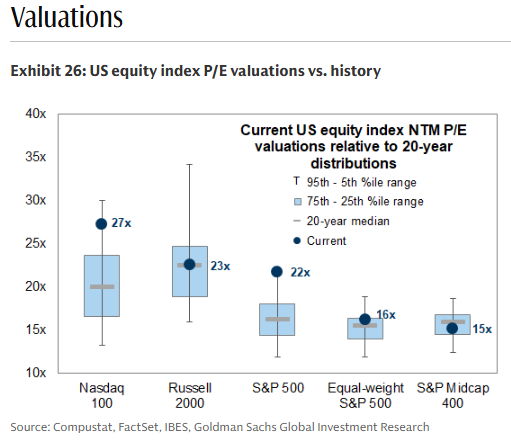

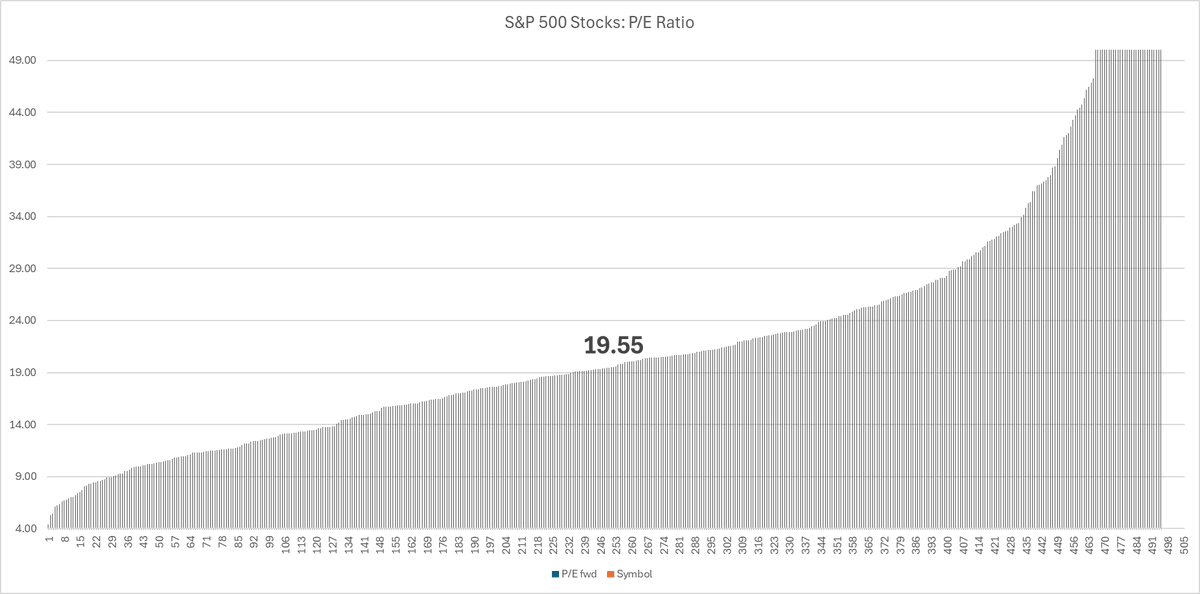

"Meme stocks have lost some 60 P/E points, while the big players (Mag 7) trade at a reasonable 32.6x and the S&P 493 at 20.7x. For the large caps these are not bubble valuations." -Jurrien Timmer, Fidelity @TimmerFidelity

"Investors' short-term valuation concerns should be offset by the ongoing strength of S&P 500 earnings. Over the past three quarters, earnings growth was about twice as strong as analysts' consensus estimates." Yardeni Research 11/23/25

Nasdaq P/E has cooled to 27x.. was > 30x just not long ago GS

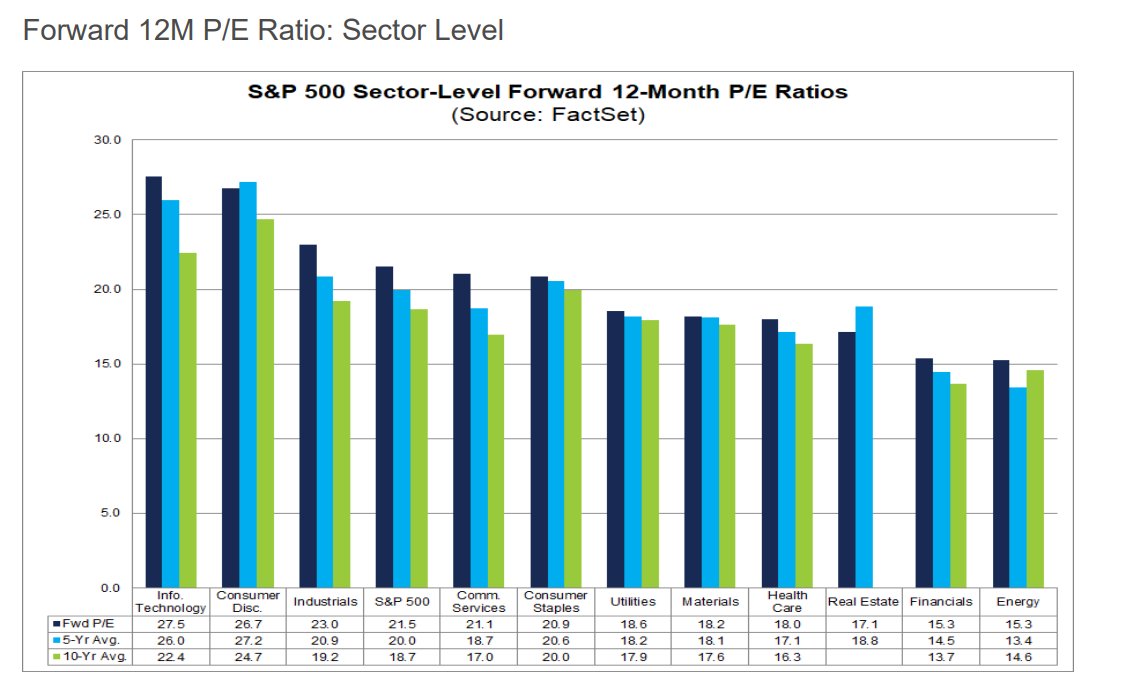

S&P 500 sector valuations.. Tech now just 27x, Financials/Energy 15x GS

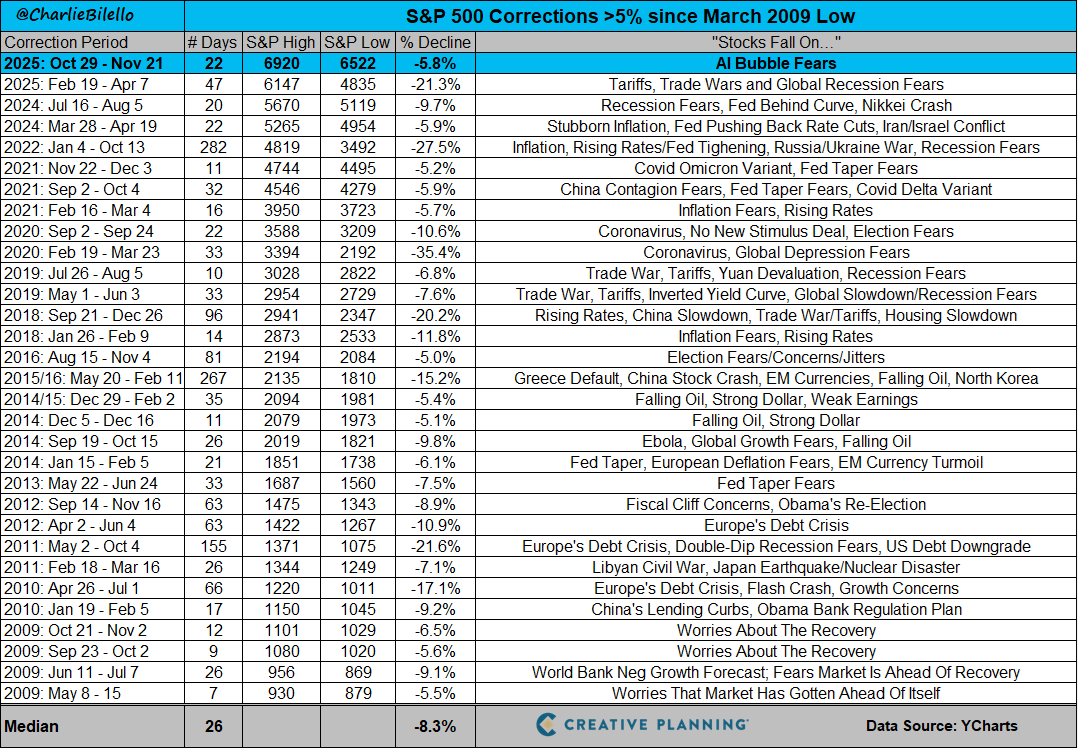

At today's low, the S&P 500 was down 5.8% from its Oct 29 peak, the 31st pullback >5% since the March 2009 low. Each one came with a scary headline. Each one felt like the end of the world. And yet ... the world didn’t end and the market eventually recovered to hit new highs.

Here’s a look at how all those 100-700% gainers from August to mid-October have done since. Down an average of 40%.

I think there’s a decent chance tech stocks flush quite aggressively early next week ~$6,425 $SPX ~ Sub $575 $QQQ If it happens it’ll be short lived

The median S&P 500 stock is in a 16% drawdown.

S&P 500 median stock P/E ratio? 19.55x

Gold's bull market turns 10 years old next month! $GLD

Full-blown meltdown in the AI boom’s supporting cast of speculative, volatile stocks sherwood.news/markets/theres…

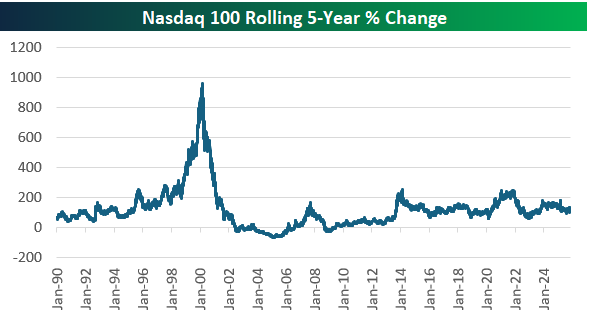

Here's a look at the Nasdaq 100's rolling 5-year percentage change, which peaked just below 1,000% in early 2000 at the peak of the Dot Com Bubble. Thoughts?

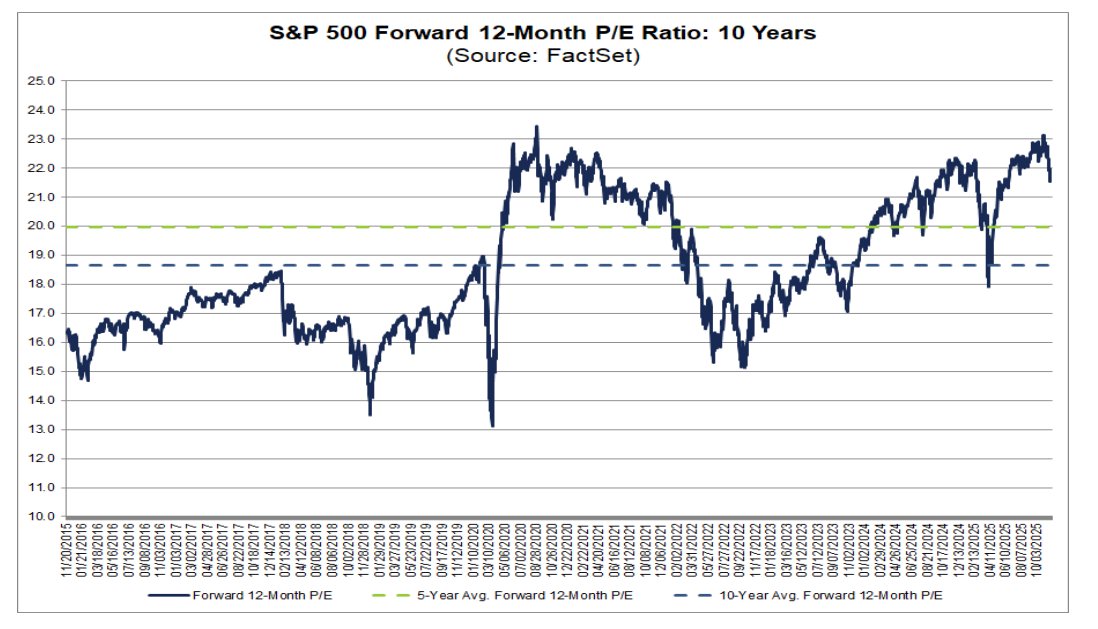

The forward 12-month P/E ratio for the S&P 500 is 21.5. This P/E ratio is above the 5-year average (20.0) and above the 10-year average (18.7). @factset

The $VXN, the VIX for the Nasdaq-100, spiked to 32.7 Thurs the highest since April. BBG also notes that Goldman's most shorted stocks basket was -3.5%, while its profitless tech baset was -3.7%.

“Why should I own anything other than the S&P 500?” That was the most common question investors were asking at the start of the year. Now they have the answer…

TTM Net Income... Google $GOOGL: $124 Billion Apple $AAPL: $112 Billion Microsoft $MSFT: $105 Billion Nvidia $NVDA: $99 Billion Amazon $AMZN: $76 Billion Berkshire Hathaway $BRK.B: $68 Billion Meta $META: $59 Billion Russell 2000 (Combined) $IWM: -$12 Billion

There’s like 50 names in this thread and most will go to zero in the next bear market. 1. Most are still trading higher than the day I tweeted this 2. Most will go up 30-50% during the first bear market rally 3. They’re all highly correlated with each other Shorting is fun.

What has 70-90% downside when this risk cycle ends? $ACHR $AFRM $ASTS $CHYM $COIN $CRCL $CRWV $CVNA $HIMS $IONQ $JOBY $PLTR $NBIS $OKLO $QBTS Give me the dumbest momo names you’ve got, please and thank you.

Today was just the 4th time in the S&P 500 ETF's $SPY history that it opened up more than 1.5% and then closed down more than 1.5%. Here are the four dates: 10/7/08 10/9/08 4/8/25 11/20/25 Make of it what you will!

Private Equity stocks are imploding. 🐤 Starting to look like a bit of a canary in the coalmine moment... 🤔 Discussed this and a few other key issues in the latest Weekly ChartStorm chartstorm.info/p/weekly-s-and…

United States Trends

- 1. Comey 51.2K posts

- 2. Thanksgiving 155K posts

- 3. Jimmy Cliff 28.2K posts

- 4. #WooSoxWishList 5,059 posts

- 5. #IDontWantToOverreactBUT 1,439 posts

- 6. #NutramentHolidayPromotion N/A

- 7. Pentagon 10.4K posts

- 8. DISMISSED 26K posts

- 9. Lindsey Halligan 9,067 posts

- 10. The Department of War 12.2K posts

- 11. #MondayMotivation 14.4K posts

- 12. Sen. Mark Kelly 16.9K posts

- 13. DOGE 242K posts

- 14. #stayselcaday 4,731 posts

- 15. TOP CALL 5,190 posts

- 16. Monad 182K posts

- 17. Hal Steinbrenner N/A

- 18. Victory Monday 5,224 posts

- 19. Justin Tucker N/A

- 20. Zach Bryan N/A

Something went wrong.

Something went wrong.