DeepValueInvestor

@DeeperVI

Posts are my opinions and are not financial advice. DYODD.

$WRLG.V $WRLGF youtu.be/4MhnVq7IeIY?si… Risk has been significantly reduced. Growth is next. Multi-bagger potential from here.

youtube.com

YouTube

Madsen: The New High-Grade Canadian Gold Mine

I'm not smart enough to predict what's about to happen to the financial system or how AI is going to reshape the world. But here's what I do understand: Hope is something a lot of people are losing in today's world. People are exhausted, overwhelmed and running on empty.…

Today, $WRLG announced commercial production. Revenue will now be $300M+ in 2026. Using same metrics below, share price calculation is $4.75. This is only based on 50,000 oz. (they are being conservative) and doesn't even take into account the 100,000 oz. target in 2 years.

+500% $WRLGF CEO @minedeveloper "$200 Million in revenue next year. It's a great time to be a gold producer...producers...trading at 6X sales...where we will potentially be this time next year." +500% from US$0.62 US$200Mx6=US$1.2B MC =US$3.45/share m.youtube.com/watch?v=rFCLjO…

youtube.com

YouTube

Ontario Gold Miner Hits Free Cash Flow in Months | West Red Lake CEO

News Release - Jan 12th 2026 - West Red Lake Gold Declares Commercial Production at Madsen Gold Mine $WRLG $WRLG.v $WRLGF West Red Lake Gold Mines is pleased to declare commercial production at its 100% owned Madsen Gold Mine, located in the Red Lake Mining District of…

West Red Lake Gold Declares Commercial Production at Madsen Gold Mine $WRLG.V tinyurl.com/22cwa66v

⏳ Last Few Days to Enter ⏳ Our 50 oz Silver Giveaway is almost over. Five winners. Real, physical silver. 🎁 Five winners will each receive 10 × 1 oz Silver Sprott Rounds 👉 Enter now — gleam.io/ykAeg/sprott-m… 🇨🇦 🇺🇸 Open to Canada & U.S. residents 📅 Ends January 13,…

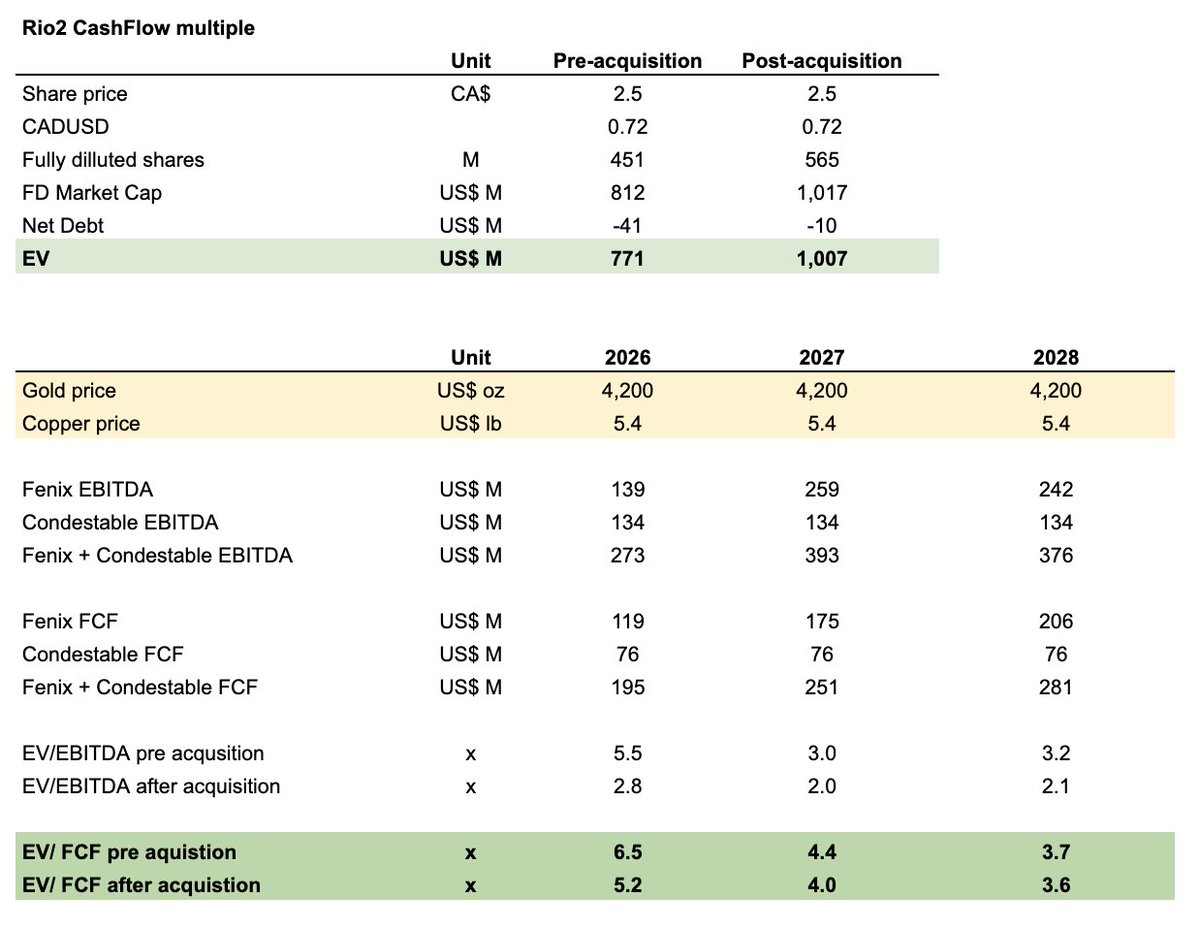

$RIO.to I’ve modeled Rio2 cash flows for the next three years using spot prices of ~$4,200/oz gold and ~$5.40/lb copper, covering both pre- and post-Condestable acquisition. On a cash-flow basis, the acquisition looks accretive. Based on my model, assuming the Fenix Gold…

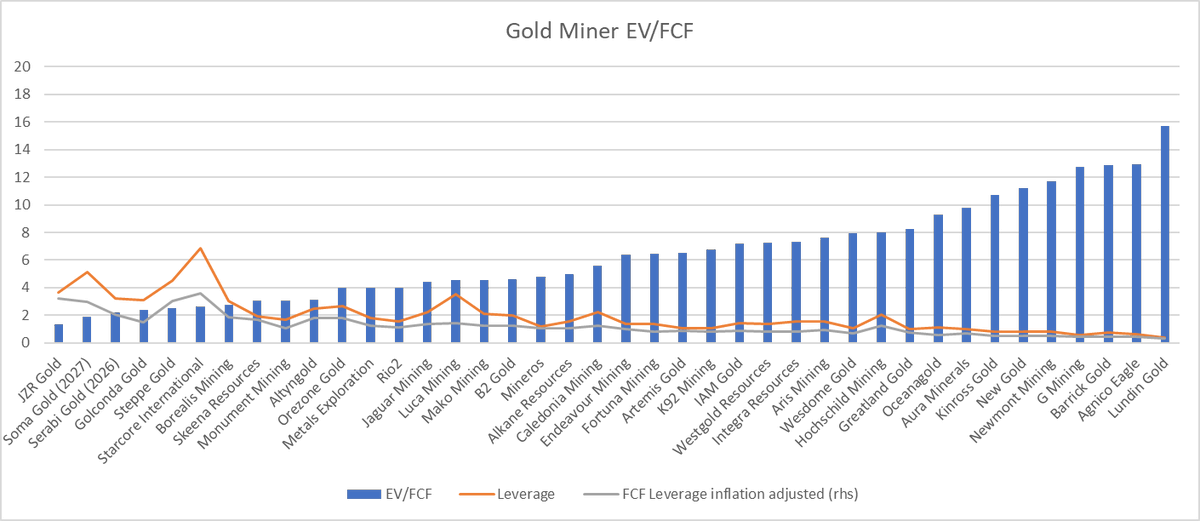

Are you wondering about the gold miner to the far left? That's JZR Gold in Brazil. They have a fully permitted operational plant, CAPEX all paid off, no debt, 30 year mine life and AISC of $500/ounce, looking to produce 20K/y next year (50% ownership).

Can you believe there are still mines out there trading at a PE of 2-3? 🤷♂️

Gold doesn’t need hype. It just waits… until the world remembers what real value is. 2025: repricing begins. #Gold, #GoldPrice, #Gold2025, #GoldRepricing, #Macro, #MacroEconomics, #GlobalMarkets, #Investing, #Finance youtu.be/B89Nijt_d2k

youtube.com

YouTube

Why Gold Is About to Reprice Overnight — Not Gradually

Starcore doesn't need to build a plant, it's already there. The only action is to fill up the plant from 600 tpd to 1000 tpd. Double the grade from 1.5 g/t to 3 g/t. Increase recovery from 78% to 85%. At no extra cost. Capacity, grade and recovery will be merged into a highly…

News Release - Nov 26 2025 - West Red Lake Gold Commences 3,000 Metre Drill Program at Fork Deposit $WRLG $WRLG.v $WRLGF West Red Lake Gold Mines (TSXV: WRLG) (OTCQB: WRLGF) is pleased to announce a fully funded infill drilling program at its 100% owned Fork Deposit located…

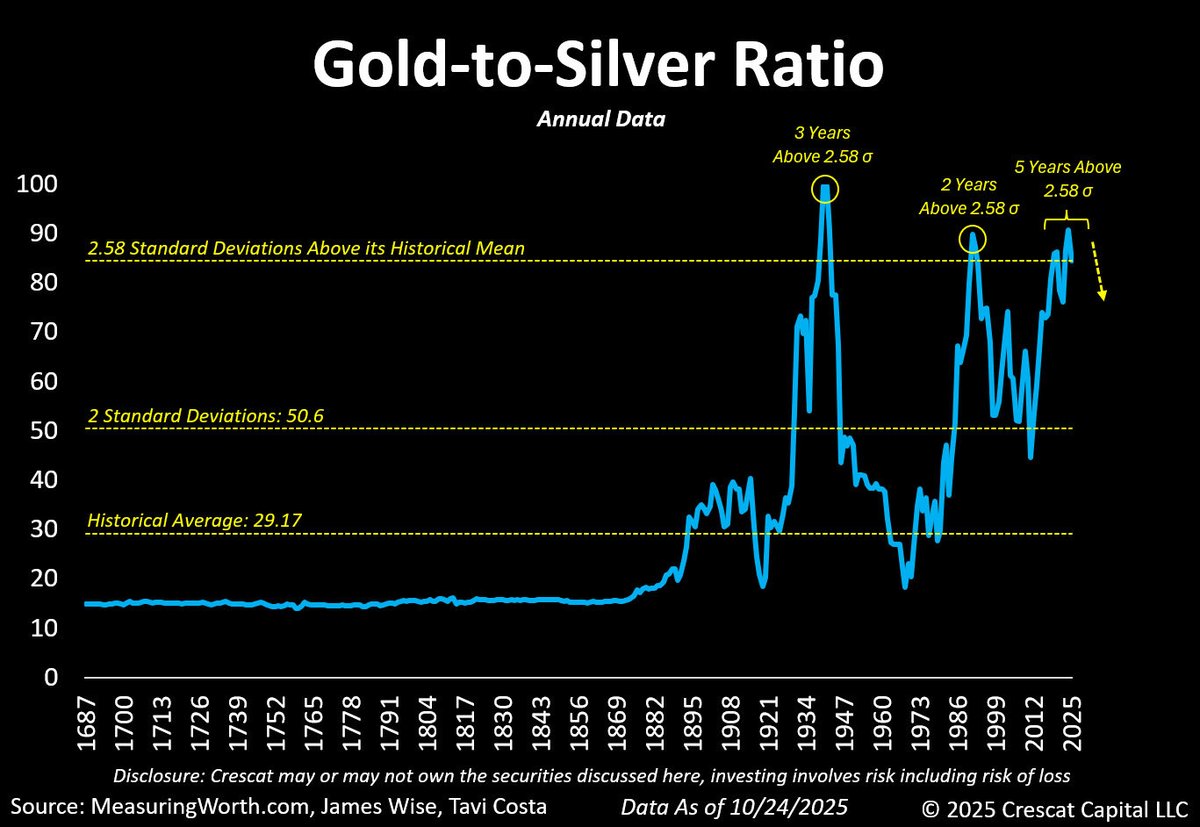

For the first time in 338 years of recorded data, the gold-to-silver ratio has remained more than 2.6 standard deviations above its long-term mean for over five years. How does this ultimately resolve? A sharp correction in this ratio is highly likely, in my view. We have…

Excellent article on the recent silver news at the LBMA and China. 🧐 no01.substack.com/p/when-the-mus…

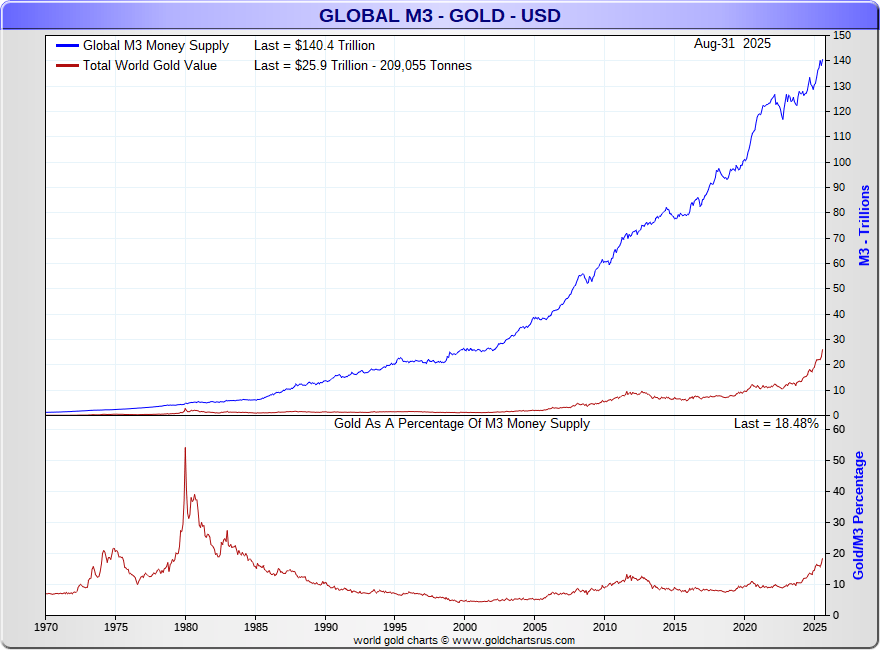

Global M3 broad fiat currency supply $140.4 trillion Total World Gold Value $25.9 trillion Gold spot price could still +3X just to match peak coverage percentage from early 1980 That presumes no more fiat M3 creation (unlikely) No guarantee +50% would be the next mania's top

BREAKING: Global broad money supply surged +6.7% YoY in September, reaching a record $142 trillion. This measure covers 169 economies, representing 99% of global GDP. Year-to-date, money supply has jumped +9.1%, driven by China and the US. Since 2000, global money supply has…

Why did the dollar index jump in response to chairman Powell’s press conference today? Why did the prices of gold and silver fall? I have no idea. The Federal Reserve’s decisions, to cut rates by 25 basis points and to end QT, are extremely dovish. They are probably signaling a…

On Oct. 29, CN Nonferrous Metals Association once again called for the implementation of production capacity limits for copper, lead, and zinc mines. 80% of CN's silver minerals are associated with copper, lead, and zinc. This policy will stimulate silver imports.

The SOFR-IORB spread measures the difference between the Secured Overnight Financing Rate (SOFR, a key repo market benchmark) and the Interest on Reserve Balances (IORB, what the Fed pays banks on reserves). A record +37bps spread suggests potential liquidity strains in…

⚠️The SOFR-IORB is at a record high spread of +37bps. When the FED cut the FFR October 29, IORB dropped to 3.9%, yet SOFR hardly moved (4.31% to 4.27%). Spreads are usually negative, except at month ends (now). If the spread doesn’t moderate soon that will herald urgent Repo…

As we get deeper it’s getting better! linkedin.com/posts/west-red…

United States Trends

- 1. Draymond N/A

- 2. #TNAiMPACT N/A

- 3. Aaliyah Chavez N/A

- 4. Sixers N/A

- 5. Colton N/A

- 6. #Traitors N/A

- 7. #911onABC N/A

- 8. Fanone N/A

- 9. Embiid N/A

- 10. Trey Miguel N/A

- 11. Oliver Moore N/A

- 12. City of Norman N/A

- 13. #RHOBH N/A

- 14. harry styles N/A

- 15. Jack Smith N/A

- 16. Sengun N/A

- 17. Jarry N/A

- 18. Jabari N/A

- 19. 76ers N/A

- 20. Ehlers N/A

Something went wrong.

Something went wrong.