おすすめツイート

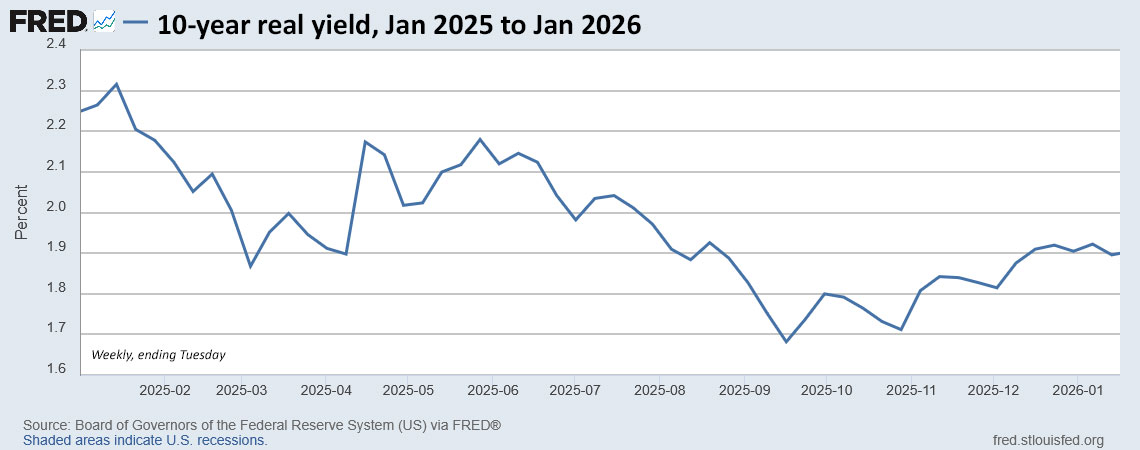

In a volatile week, auction of new 10-year TIPS gets a real yield of 1.940%, a nice result for investors tipswatch.com/2026/01/22/in-…

SCOTT BESSENT: Markets are going down because Japan's bond market just suffered a six-standard-deviation move in ten-year bonds over the past two days. This has nothing to do with Greenland; it's all about the Japanese bond blowout. @SecScottBessent

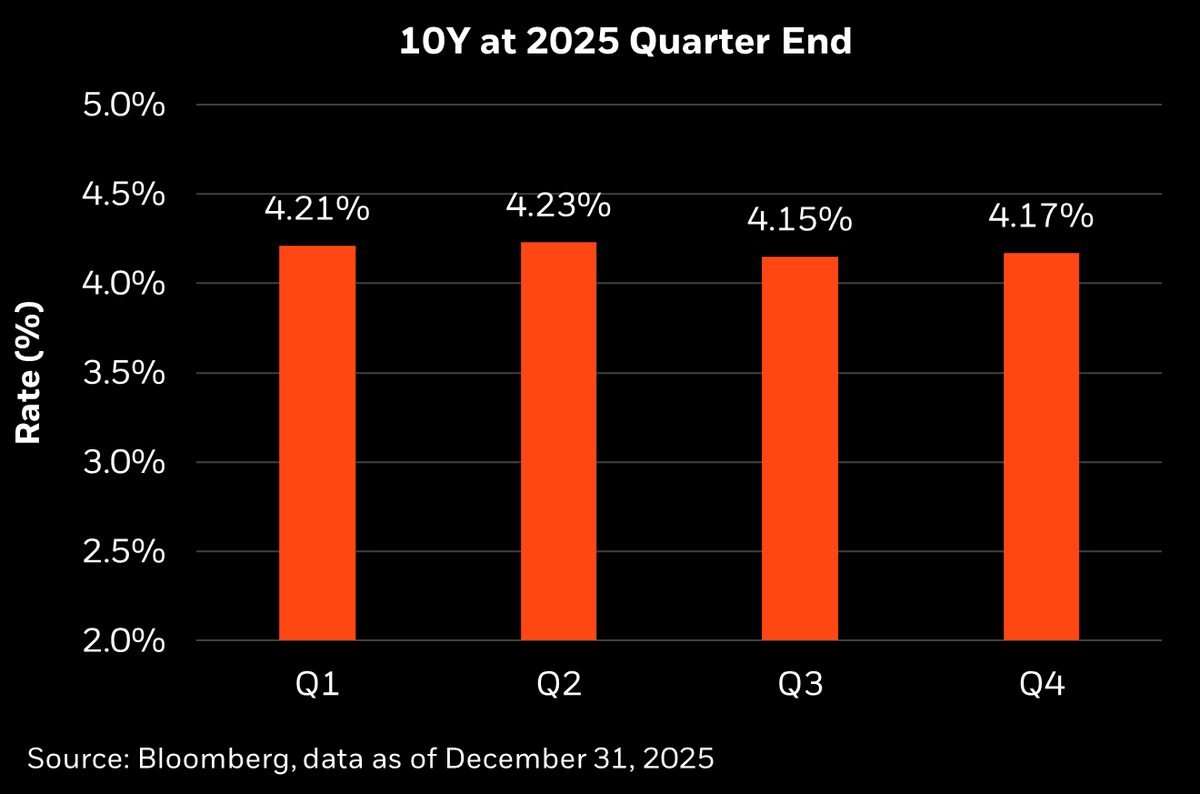

CIO Chart of the Week: A reminder amid all the daily noise that the US 10Y has spent more than two years oscillating around a remarkably stable center. While headlines jump, markets react, and every data point feels pivotal, since touching 4.0% in Oct ’22, the US 10Y has averaged…

Japon es el principal tenedor de bonos del tesoro. Si no reinvierte o deja de comprarlos el problema de su deficit se contagia.

The constraint isn’t deficit spending per se, it’s who anchors global funding. When Japan reprices duration, the world loses its cheapest carry and term premia rise everywhere. That’s the channel markets are reacting to.

iShares 0-5 Year TIPS Bond ETF (STIP) -0.04 pct Following 102.41-0.04(-0.04%

Japanese 30-year yields have risen 38bp in the past two trading sessions, the second-largest ever behind the 42bp after "Liberation Day" last April. Since the new Prime Minister Sanae Takaichi took over in October, 20- & 40-year yields have risen about 80bp.

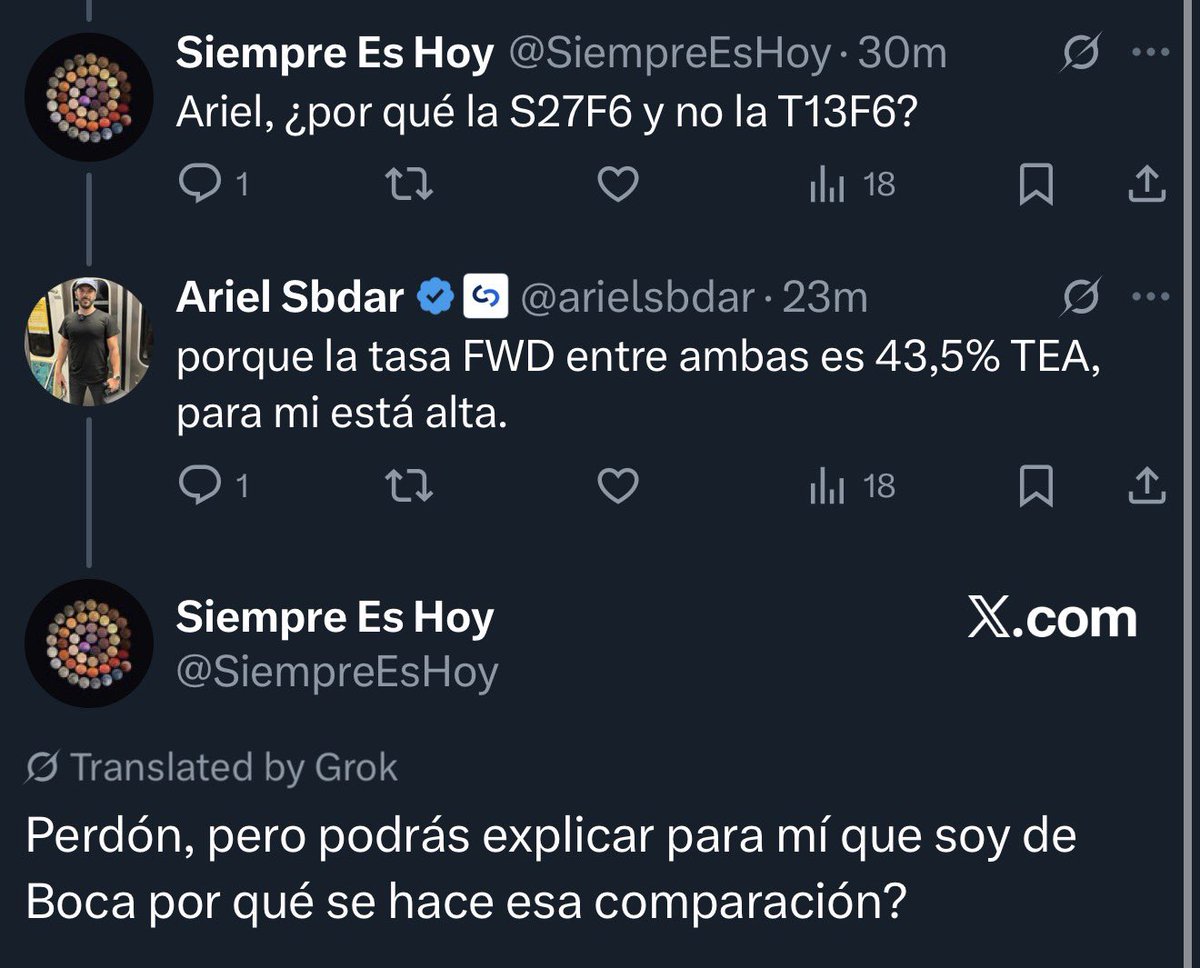

Me parece buenísima la pregunta de @SiempreEsHoy, así que voy a explicar por qué, a veces, conviene comprar una LECAP más larga y con tasa más baja en lugar de una más corta y con tasa más alta (PARA LOS DE BOCA). La duda es lógica: ¿por qué prefiero la letra del 27/2 al 45% TEA…

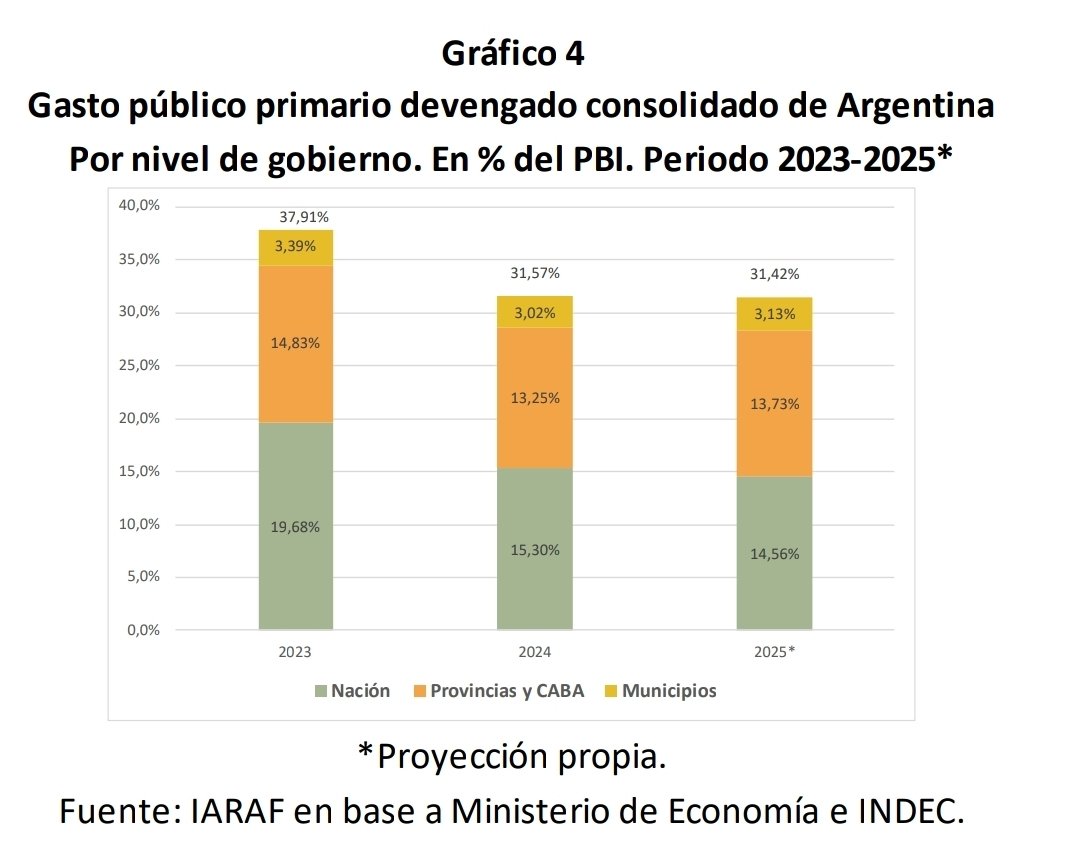

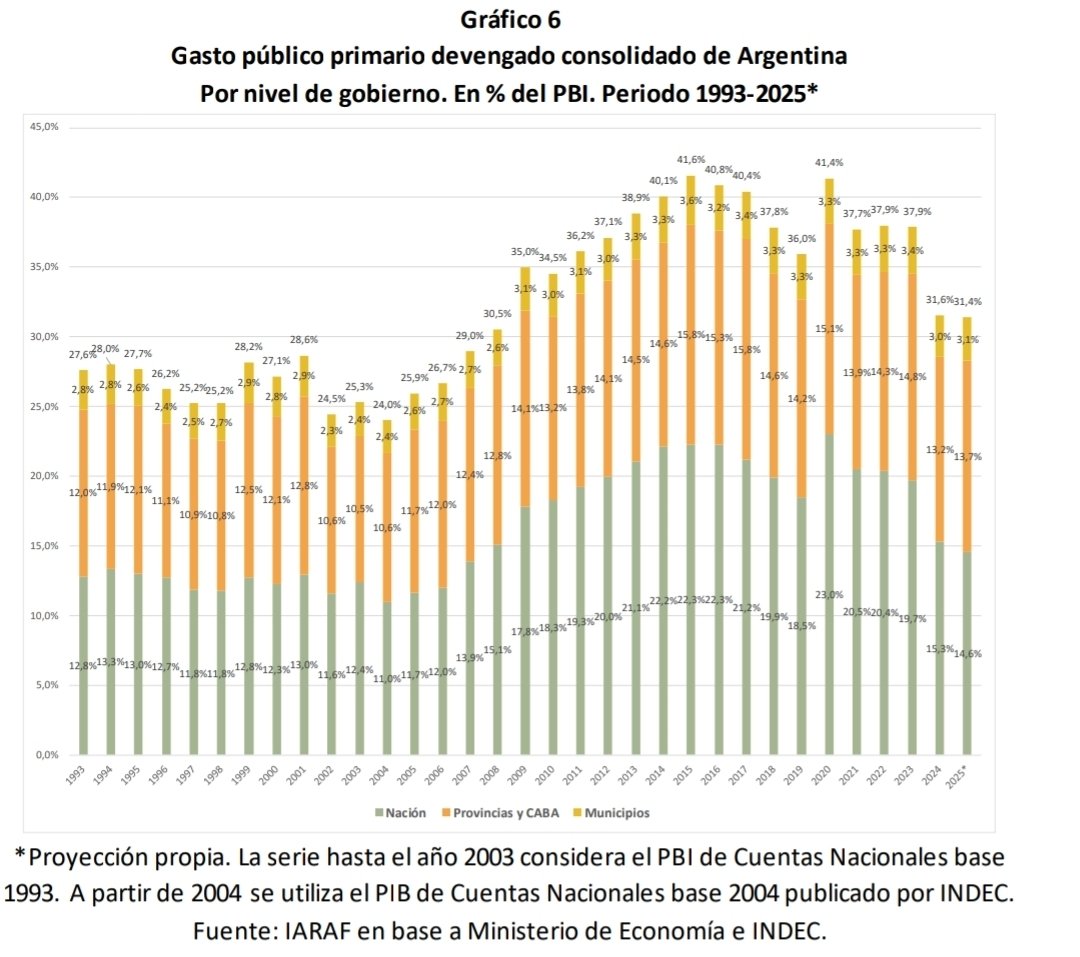

🪚🇦🇷 Motosierra: el gasto público nacional volvió a caer en 2025 hasta el 14,56% del PBI y alcanza su nivel más bajo en 18 años, según el IARAF

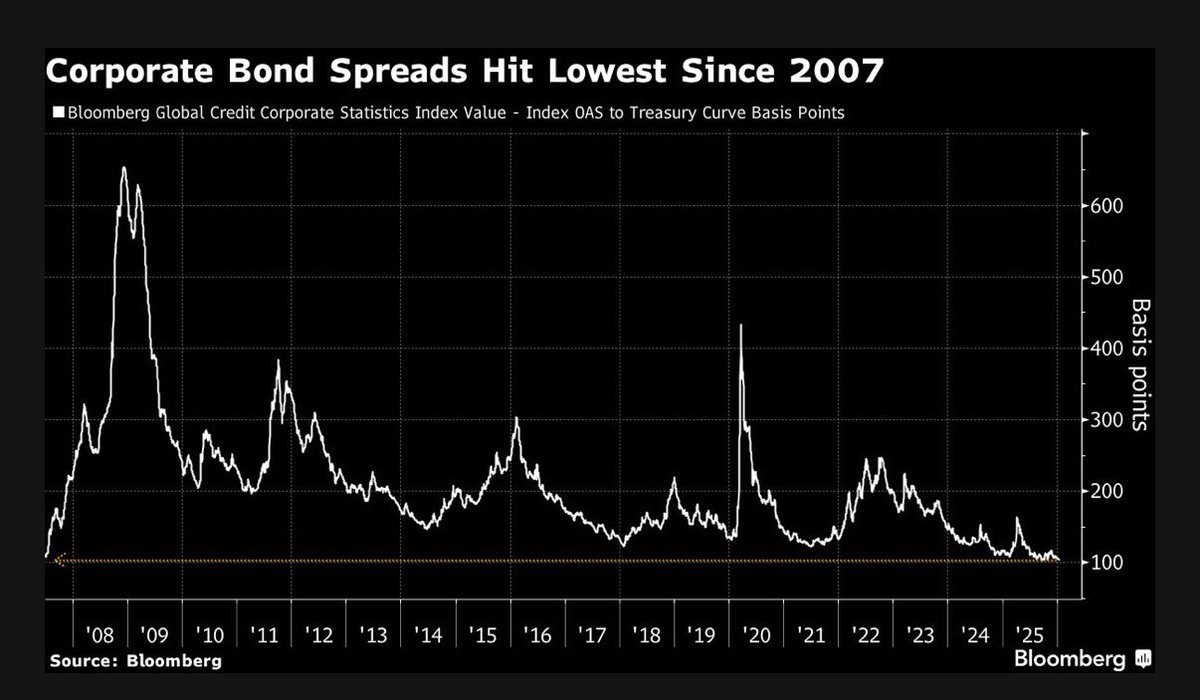

Per Bloomberg: “Global credit markets are running at their hottest in two decades…. Yield premiums on corporate debt have narrowed to 103 basis points, the least since June 2007 amid a resilient economic outlook.” #economy #markets #bonds

Spreads on corporate bonds globally have fallen to the lowest since 2007. @TheTerminal

Japan Ready to Take Action Against Excessive Yen Movements, Finance Minister Says on.wsj.com/3LJMQrT

Breaking: Inflation held steady in December with consumer prices rising 2.7% on the year on.wsj.com/49lO9GB

*TRUMP SAYS DOJ SUBPOENAS NOTHING TO DO WITH INTEREST RATES: NBC *TRUMP DENIES INVOLVEMENT IN DOJ'S FED SUBPOENAS: NBC

Video message from Federal Reserve Chair Jerome H. Powell: federalreserve.gov/newsevents/spe…

.@POTUS’s policy of Peace Through Economic Strength is transforming Latin America in ways that are America First, surrounding the United States with stability and prosperity. President @JMilei continues to deliver with full force on his renewed mandate from the Argentine people…

As the Bank of Japan is forced to retreat from decades of Yield Curve Control, a new and far more dangerous phase begins. To defend the yen and prevent a complete collapse of their own bond market, Japanese financial institutions will be forced to repatriate capital. They need to…

United States トレンド

- 1. Super Bowl N/A

- 2. Super Bowl N/A

- 3. Super Bowl N/A

- 4. Rams N/A

- 5. Pats N/A

- 6. Drake Maye N/A

- 7. Sean Payton N/A

- 8. Denver N/A

- 9. Sam Darnold N/A

- 10. Stidham N/A

- 11. Vrabel N/A

- 12. Kenneth Walker N/A

- 13. #NFCChampionship N/A

- 14. Puka N/A

- 15. Jaxon Smith N/A

- 16. Tom Brady N/A

- 17. Seattle N/A

- 18. #LARvsSEA N/A

- 19. Diggs N/A

- 20. Shaheed N/A

おすすめツイート

-

Leonardo Chialva

Leonardo Chialva

@leochialva -

José Siaba Serrate

José Siaba Serrate

@JSiabaSerrate -

Juan Jose Vazquez

Juan Jose Vazquez

@juanjovazquez57 -

Pablo E Guidotti

Pablo E Guidotti

@peguidotti -

Alejandro Kowalczuk

Alejandro Kowalczuk

@AKowalczuk -

Alejandro Bianchi, CFA

Alejandro Bianchi, CFA

@aleebianchi -

Jose P Dapena

Jose P Dapena

@JoseDape70 -

Allaria

Allaria

@Allaria_SA -

Daiana Fernandez Molero

Daiana Fernandez Molero

@daianamol -

Santiago Lopez Alfaro

Santiago Lopez Alfaro

@Slopezalfaro -

Juan José Cruces #Ni1–

Juan José Cruces #Ni1–

@jjcruces -

Pedro Siaba Serrate

Pedro Siaba Serrate

@pei555 -

Alejandro Rodríguez

Alejandro Rodríguez

@alerodri1976 -

Arriazu Macro

Arriazu Macro

@macroanalistas -

Marcelo Elbaum

Marcelo Elbaum

@marceloelbaum

Something went wrong.

Something went wrong.