Dylan Marma

@DylanMarma

Vertically Integrated Real Estate GP. Operating 3,000+ units of mobile home, RV, and apartment communities #ccim

You might like

Portfolio Yield on Cost: 8.6% Total Cost: $136.1M (all-in debt + equity) T12 NOI: $11.6M Portfolio DSCR: 2.24 Measuring our yield on cost is our guiding North Star, as it indicates the yield generated to service debt, produce cash flow, and create long-term value for our…

Q2 Portfolio Yield on Cost: 8.5% Total Cost: $117.4M (all-in debt + equity) T12 NOI: $10M This metric is our guiding North Star, as it indicates the yield generated to service debt, produce cash flow, and create long-term value for our investor parters.

301 sites added in Pigeon Forge. This brings us to 1,000 sites in Tennessee. Excited about this project and our increased presence in the smokies. Grateful for our investors, team members, and vendors who make this possible.

Officially sold my first syndication and multifamily deal! Very thankful for our investors who believed in us Very thankful for my partners who helped me get into multifamily (@DylanMarma) LP Returns: 17% IRR 1.8X Equity Multiple Cheers to a good deal and on to the next!

Any recommendations for AI chat bots for property websites (leasing + service support)?

Deferred maintainence is an overlooked component of real estate valuations. Owners who invest heavily back into their properties are often penalized by the market vs. those who patch and repair everything. A sad reality that also leads to some great opportunities.

Wrapping up the year with a 7.9% portfolio wide yield on cost. $15.57M Total Income $7.1M Total expenses $8.47M NOI $107M total cost Considering one property included in this was bought in Q2 and most of them are still under 2 years in, I’m overall pleased with our results.…

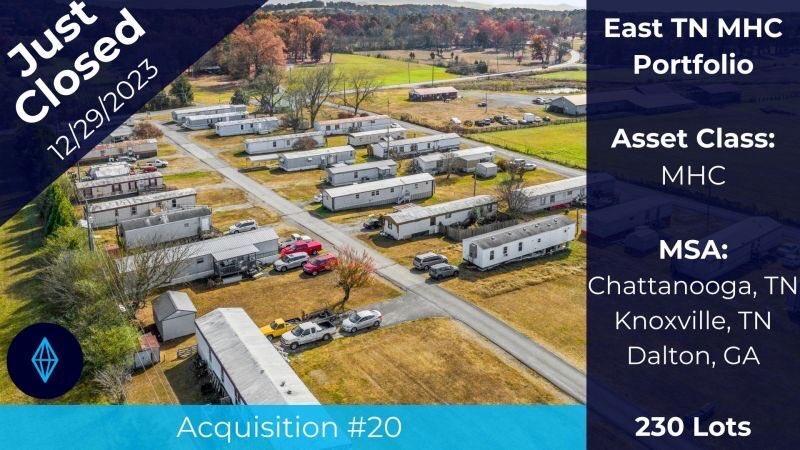

Closed just before the buzzer to wrap up a solid 2023!

Title co getting hacked on day of closing goes to show it’s truly never over til it’s over.

“The big money is not in the buying or selling, but in the waiting” A Munger quote that often plays through my head.

If you focus on solving for a durable stream of cash flow, the rest of the equation takes care of itself.

Reasons to have longer term hold period in sub institutional real estate: You gain serious economies of scale as your portfolio grows bigger. You are able to share resources across multiple assets allowing you to run each property much more efficiently. As a result of being…

I’ve come to really appreciate the compounding process improvements and understanding of each business that only comes with time. Crawl, walk, run

Huge fan of coastal RV campgrounds bc they provide the benefits/draw of being coastal without the same level of storm/flood/insurance risk as owning most other more structure heavy property types.

When mortgage constants are equal to or greater than preferred returns it really changes the way you think about structuring a deal.

That feeling when your tax bill comes in well below underwritten taxes >>>

With in house property management that we’re very involved with, we have the ability to gauge the execution risk on deals to a degree that would not be possible without. Knowing your talent in a particular market, their bandwidth, vendors, strengths/weaknesses, and factoring that…

Warren Buffett talks about the “institutional imperative” as the tendency for executives to mindlessly imitate the behavior of their peers, no matter how foolish it may be to do so. Even he admits to falling victim to this in his early career. No one is above this, we must…

2024 property budgets complete ✅ Grateful to be able to say I’m feeling good about next year. (Knock on wood) Also slowly feeling the tide shifting to a buyers market.

I genuinely enjoy sending out our quarterly reports to investors. It is a chance to showcase the work going on behind the scenes. Over time through iteration and investor feedback we have crafted a format that serves our company well. Here it is: Property overview: Name of the…

United States Trends

- 1. #GMMTV2026 2.9M posts

- 2. Good Tuesday 30.6K posts

- 3. MILKLOVE BORN TO SHINE 450K posts

- 4. #tuesdayvibe 2,310 posts

- 5. WILLIAMEST MAGIC VIBES 60.3K posts

- 6. Mark Kelly 219K posts

- 7. Barcelona 168K posts

- 8. TOP CALL 9,644 posts

- 9. MAGIC VIBES WITH JIMMYSEA 76.8K posts

- 10. JOSSGAWIN MAGIC VIBES 26.1K posts

- 11. Alan Dershowitz 3,443 posts

- 12. AI Alert 8,447 posts

- 13. #JoongDunk 116K posts

- 14. Naps 2,961 posts

- 15. Hegseth 101K posts

- 16. #ONEPIECE1167 8,872 posts

- 17. Maddow 15.9K posts

- 18. Check Analyze 2,570 posts

- 19. Token Signal 8,902 posts

- 20. Unforgiven 1,222 posts

You might like

-

Barrett Linburg

Barrett Linburg

@DallasAptGP -

CRE Cole

CRE Cole

@cre_cole -

CRE Romans

CRE Romans

@creromans -

Jake

Jake

@JakeStoutland -

Jason Richards

Jason Richards

@SimpleCRE -

Andrew Kirsh

Andrew Kirsh

@atkirsh -

Mason Fiascone

Mason Fiascone

@MultifamMason -

Michael Lewin | CRE

Michael Lewin | CRE

@LiferRealestate -

Trailer Park Guy

Trailer Park Guy

@TrailerParkGuy -

Jonathan Barr

Jonathan Barr

@Jb2Investments -

Weiss Advice

Weiss Advice

@YonahWeiss -

Adam Rose

Adam Rose

@AdamRose_RE -

Jason Dillard

Jason Dillard

@REExchangor -

Ben Gallant

Ben Gallant

@benrgallant -

Matt | RV Park & Campground Ops & Growth

Matt | RV Park & Campground Ops & Growth

@ibuyrvparks

Something went wrong.

Something went wrong.