Emily Roland

@EmilyRolandBlog

Co-Chief Investment Strategist at John Hancock Investment Management | Dedicated my life to help beginners achieve financial freedom #stocks📈

You might like

$SPY puts are up 7% here 2 speakers are going to be speaking in 15 minutes & then another one in 30 minutes I would set my SL around breakeven to be careful with them invalidating our trade

If $SPY starts closing below 403.40 it could be a sign of more dips to come. If we start bouncing, it could mean the next pump is coming. #spy $spx

Long Watches: $NFLX, $COIN, $MSFT, $NVDA, $ADBE, $WMT, $ROKU, $QCOM, $CRWD, $WAL! Short Watches: $RH, $SMTC!!

Not perfect but... This is where my head is at on $SPY $ES for the upside scenario. Looking for shorts interim and up to the gap probably. This also means #BTC and everything you own will have a good time. Everything is dependent on the indices right now.

$SPY $QQQ Market gaps up two days in a row - $VIX still at 19.30 like it was yesterday, 0 moves in the vix at all - Markets not safe 😰

I'm part of the "some"... U.S. stocks flash rare bull-market signal for first time in nearly 3 years, but some have their doubts marketwatch.com/story/stocks-f…

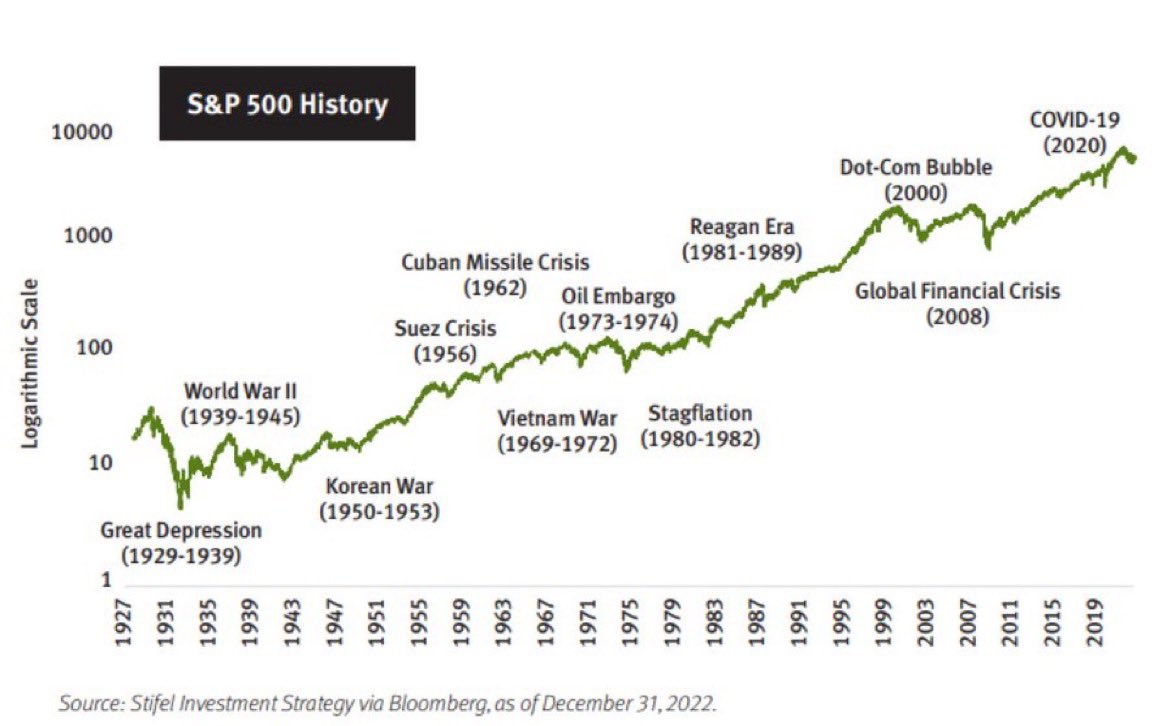

🚨 Over the long haul, these dips look like blips along the way. 📈 Still think we have yet to bottom, but cool graphic to show all that the markets have faced over the years. What names do you like for the long term ? $SPX $QQQ $VIX

I rather sell a stock 3 times with a very small loss than sell it 1 time with a big loss! Hit-rate doesn't matter for me. I not in the game to be right, I am in the game to make money.

Prediction is worthless in #stock #trading. Reacting is the key. There are millions of market participants and you have no idea about their future move. But you can observe their previous move and create scenarios about potential future moves and assign a probability.

Great traders are great risk managers. Most of them have more sell and risk management rules than buy rules! It's difficult to work against deep draw downs, but easy for small draw donws.

A big mistake in #trading: FORCING TRADES! If there is nothing to trade, don't search for trades. Be patient and wait until setups pop up in your screeners and the market offers you a window of opportunity again.

MY personal biggest #trading mistakes: 1) Looking for a short term approach with more profits 2) Spontaneous trades because the chart looks good 3) Trade too much because I want to recover faster from losses 4) Try to catch a top in the market 5) Get distracted by social media

One thing I am always working on: #Trade less! Let profits run, be patient and cut losing trades. That's all I have to do to make money.

Enjoyed the chat tonight with @ScottWapnerCNBC about why we’re all in on #quality and #income!

"Not only are stocks not cheap, they're not priced for a recession right now," says @emilyrroland

$BJ is in a conference call...stay away off the open...

Favs: $BBWI over 37.25, $GS under 377.75, $QCOM under 118.25!

Long Watches: $BBWI, $BJ, $CSCO, $M! Short Watches: $NFLX, $SNOW, $TSLA, $GS, $QCOM, $DIS, $TWLO!

In my opinion, there is no shortcut to become a #successful #trader, just as there is no shortcut to become a successful athlete. Practice, learning from mistakes and building up experience are the only ways.

My #trading looks like that: 1) Small loss 2) Small loss 3) Small loss 4) Small loss 5) Small loss 6) Huge profit I can live with a low hit rate as long as I have huge winners! That's my way of making #money.

If a stock goes 7% against me, I am out. No stock should do that. If a stock needs so much room after I bought it, my timing was wrong or I selected a too volatile name. I want to see that the stock is going into my direction immediately.

United States Trends

- 1. Christmas 6.18M posts

- 2. Knicks 25.3K posts

- 3. Tyler Kolek 6,940 posts

- 4. Donovan Mitchell 5,277 posts

- 5. Brunson 10.5K posts

- 6. Jarrett Allen 1,320 posts

- 7. Deebo 4,859 posts

- 8. #NBAXmas 12K posts

- 9. #NFLonNetflix 6,820 posts

- 10. #NewYorkForever 1,596 posts

- 11. Clarkson 4,823 posts

- 12. Javonte Williams 2,776 posts

- 13. #RaiseHail 1,964 posts

- 14. #DALvsWAS 3,558 posts

- 15. Clinton Portis N/A

- 16. Mobley 2,301 posts

- 17. Caruso 1,563 posts

- 18. Chet 6,404 posts

- 19. Doris Burke N/A

- 20. Happy Holidays 873K posts

Something went wrong.

Something went wrong.