Vilien Gomez

@EngineeringVill

Blessed | Sales Engineer | #LSUAlum | Automation Expert | SMB Searcher http://www.geauxmezgroup.com

You might like

What's the sentiment of first time business buyers this year?

Does anyone know if there any ETA events in San Antonio today or tomorrow?

I wonder what's the quickest anyone has seen a SBA 7a loan process, is 30 days even possible?

It gives me joy to see folks like @therobertbrooks who comes from a technical background searching for non-sexy Service Based SMBs! It gives me hope.

Vertical software is such an interesting space. There are many lessons learned that will be picked up by Vertical AI Agent founders. Looking forward to see who will be the next Veeva or Service Titan.

What's the best way for searchers to find investors for deals that are in the $700k-$1M EBITDA range?

Being from Louisiana makes this even more funnier!!! Such a sweetheart deal!

If one spouse is buying a SMB and the other has a 9-5, does SBA allow the buying spouse to not take a salary in order to have a positive SDE moving forward?

I was told by a broker today that it will be difficult to get a SBA loan on a business that's under $300k. Can someone confirm if that's correct?

$5 through June 30, 2024

Honestly, I focus so much on finding home run opportunities and completely ignore base hits. Maybe the base hits and a basis to action would eventually lead to a home run. I am thinking out loud here.

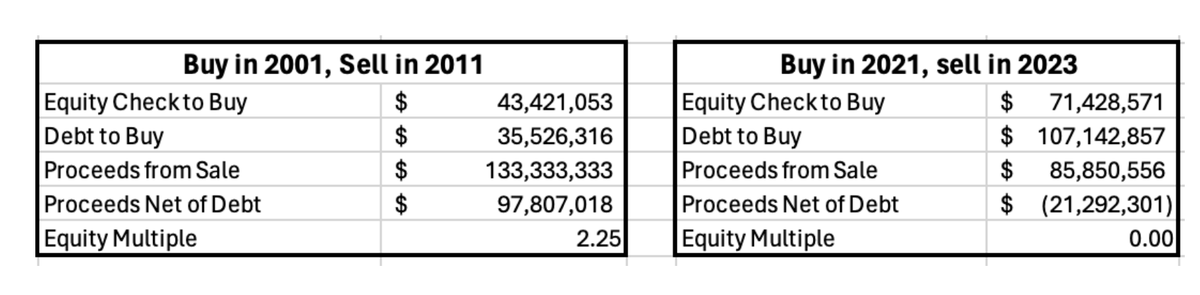

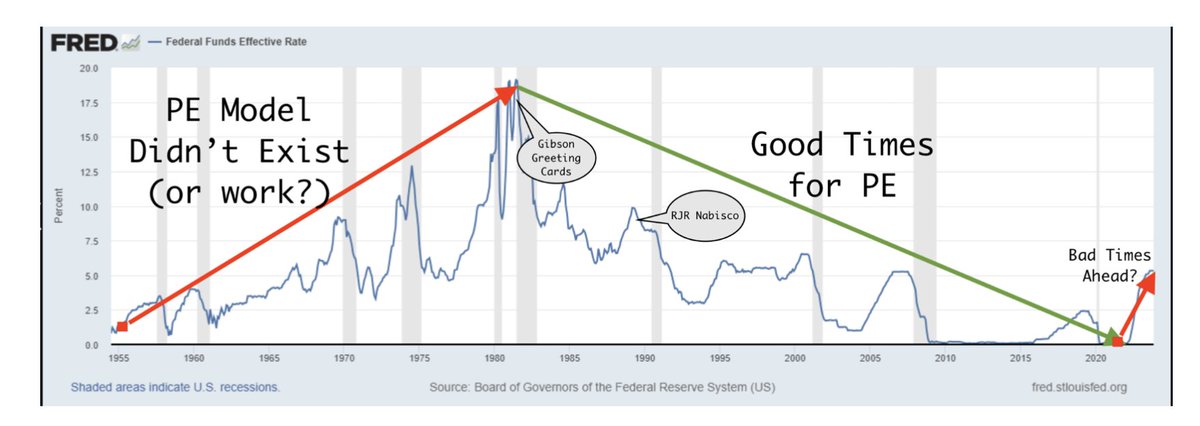

Great thought piece on the current state of PE and what history tells us. Thanks Xavier.

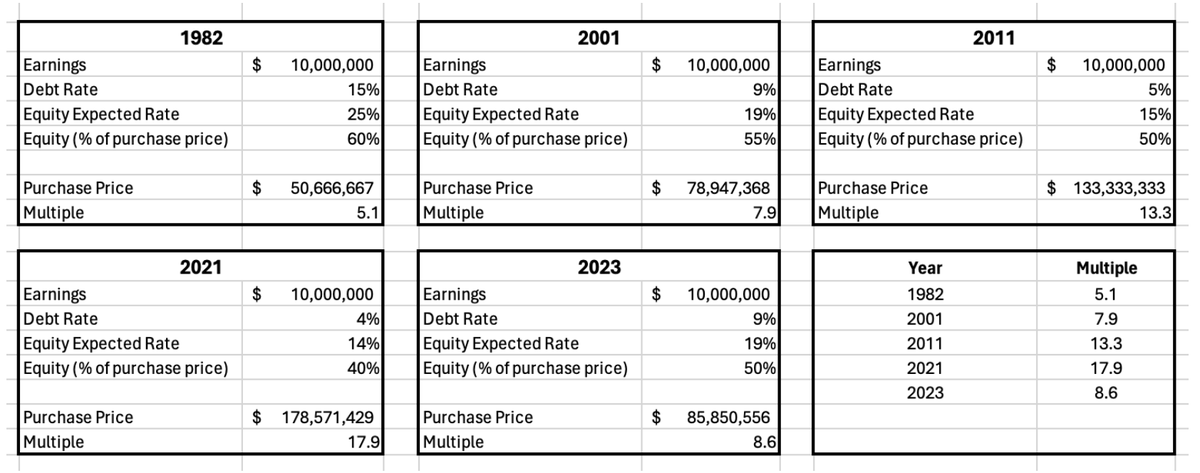

Thoughts on Private Equity tldr; Private Equity funds use highly optimistic assumptions. They only make their investors money when interest rates decline - like big, illiquid, leveraged shorts on Treasuries. It's gonna get ugly this decade with rising rates. Most people don't…

I wish lenders would just share buy boxes of acquisitions with scenarios that they would fund 100%. Could this be a 2024 version of a tombstone? #smb #acquisitions #financings

Realizing that it's perfectly okay if the first acquisition isn't a true "platform". I'm not PE and I'm okay with that. #SMBJourney

What are some great ways to find debt or equity investors who will write smaller check sizes for deals that are under $600k SDE? Outside of the family.

It's really interesting how a majority of the businesses that sound so fun, and cool are all in or near the red in terms of financial strength. Having looked at many P&Ls and Balance Sheets over the last year, the true gems are boring/unattractive/sweaty/lame industries.

I deleted my Twitter(X) app for a while to focus on improving my workflow. I'm thankful that I did.

United States Trends

- 1. DeepNodeAI 60,3 B posts

- 2. #جائزة_زايد_للاستدامة 2.171 posts

- 3. #أسبوع_أبوظبي_للاستدامة 2.205 posts

- 4. #ADSW2026 2.115 posts

- 5. Good Monday 42,4 B posts

- 6. #MondayMotivation 7.652 posts

- 7. Powell 223 B posts

- 8. #YUniverseAwards2025xDMD 608 B posts

- 9. JIMMYSEA GROWTH TOGETHER 116 B posts

- 10. Herbert 72,8 B posts

- 11. Chargers 92,8 B posts

- 12. Federal Reserve 126 B posts

- 13. Victory Monday N/A

- 14. Y AWARDS 25 X ZEENUNEW 191 B posts

- 15. Mark Ruffalo 49,8 B posts

- 16. Greg Roman 12,3 B posts

- 17. Sinners 105 B posts

- 18. seungkwan 55 B posts

- 19. Golden Globes 926 B posts

- 20. Jihyo 43,5 B posts

Something went wrong.

Something went wrong.