FVG

@FVG_RAMPAGE

The World, Chico, And Everything In It. ICT TRADER 💵📉📈

You might like

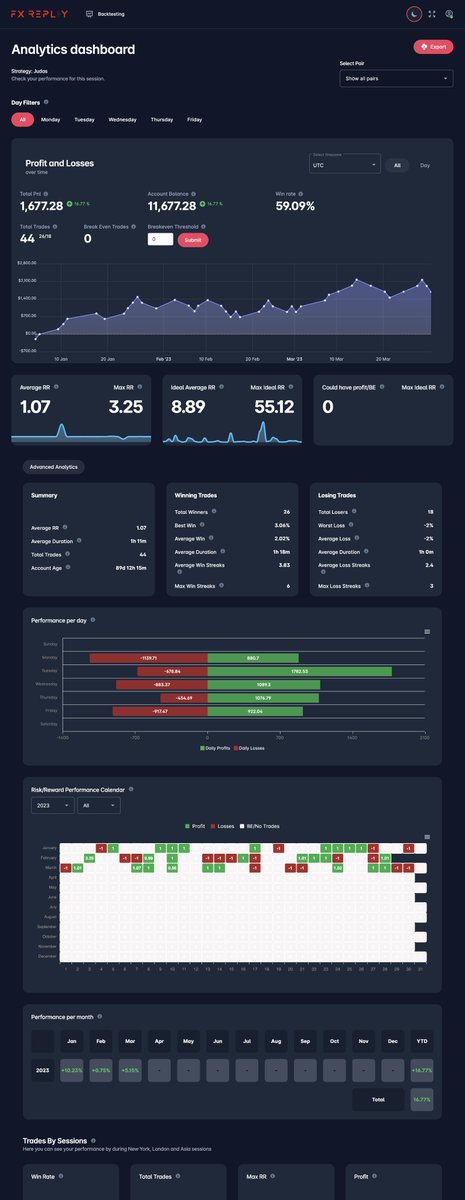

Hi guys🍻 my name is Majid. I'm going to backtest strategies that i find interesting and share the results here. Feel free to share your ideas. also you can check my telegram channel for more details about the backtesting stuff. t.me/FVG_Trader

I love @JunoTrading notion template , all you have to do is to duplicate it and customize it for yourself.

Systems, processes, frameworks, models: they all try to simplify complexity, but they don’t eliminate it. They never can.

‘Learn to love your losses since without them you will never win.’ Mastering the Mental Game

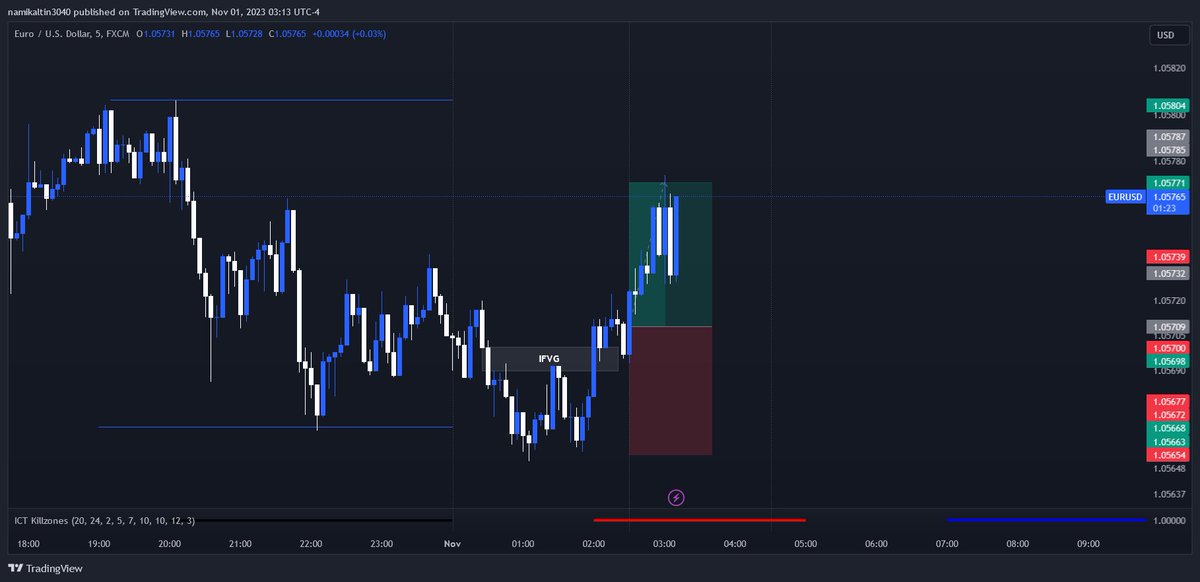

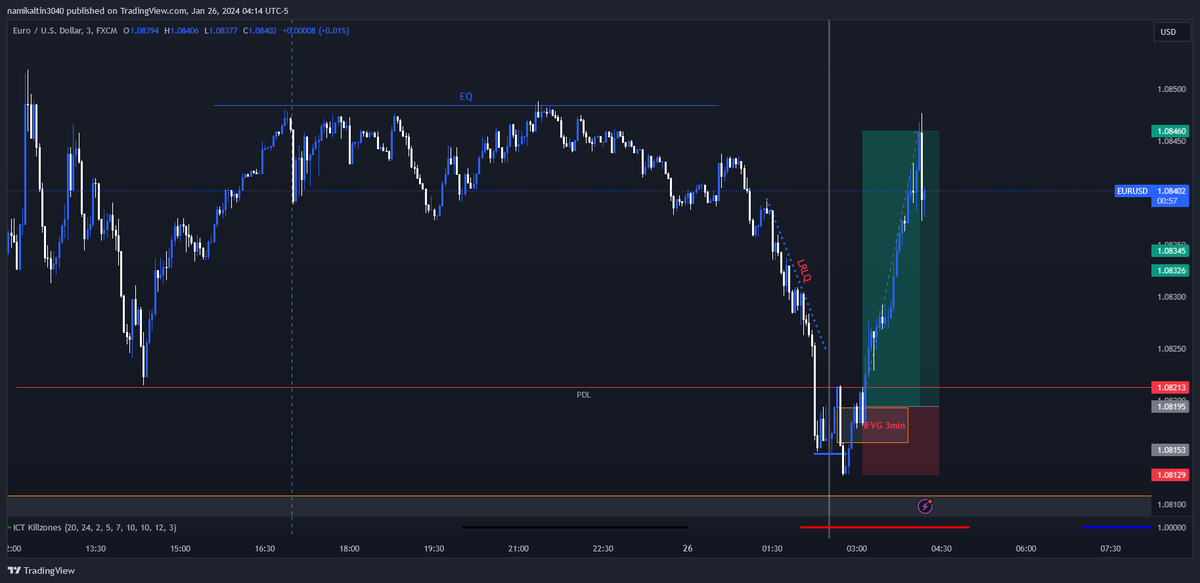

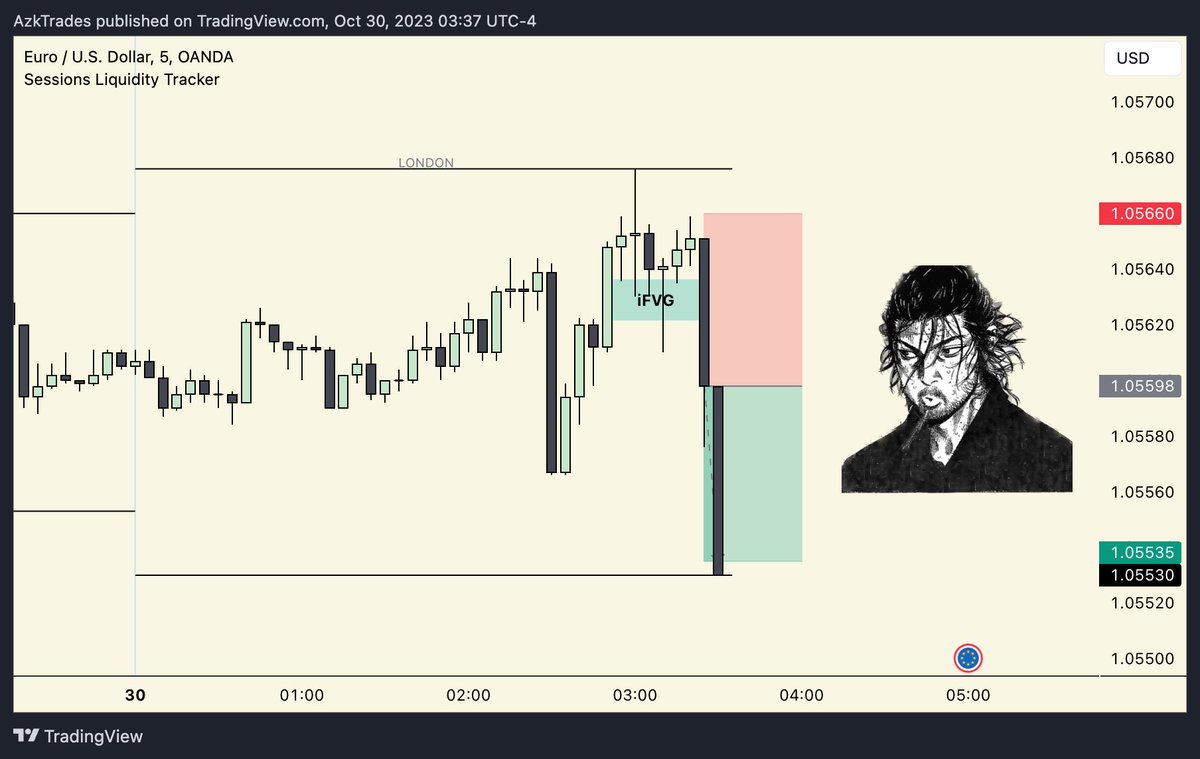

$EURUSD -Inverse_model -previous day low taken -previous swing taken -3min IFVG closed above -closed half position 1R and the second half in 2R couldn't wait for 4R tp 🥲

The most common mistake ICT traders make is becoming a pattern trader. You go from being confused, to finding something so “simple” and you attach to it, maybe even go on a winners steak (luck). Then you are suddenly losing again and again, not understanding why it’s not…

Inverse model results for the second quarter of 2023 on $EURUSD : -total trades : 35 -wining trades : 22 -winrate : 63% -R/R : 1 -consecutive win/loss : 5/2 I only backtested the asian high/low liquidity. entry : 2:30 AM- 4:30 AM Screenshot of trades : t.me/FVG_Trader

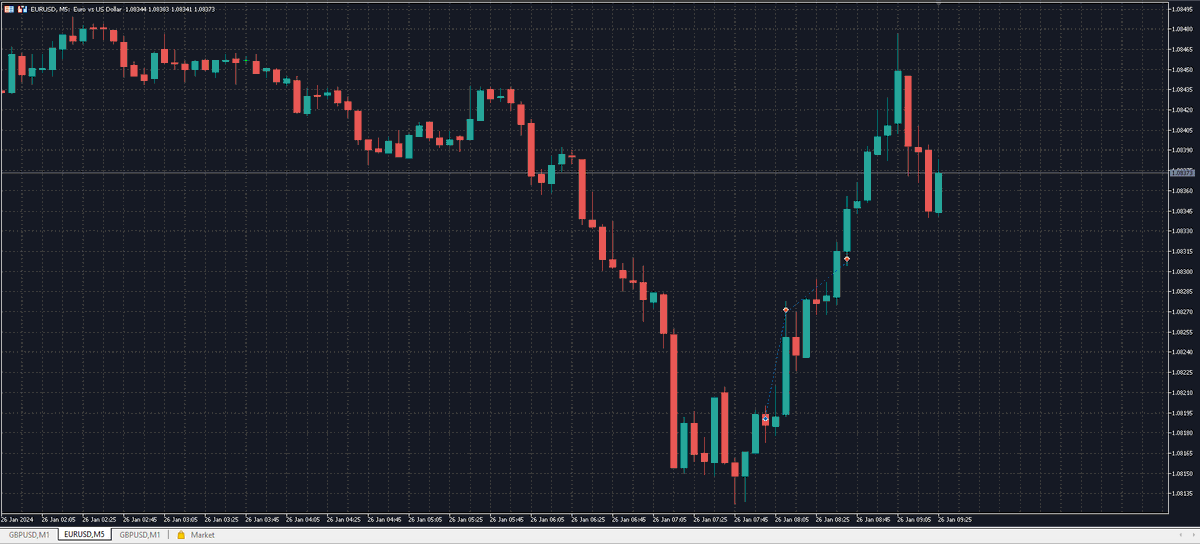

ICT mechanical strategy that delivered a whopping 174% gain in 2023 and 84% in 2022 trading $ES! In this thread, you will find out the secrets behind this strategy and how leveraging previous session liquidity and iFVG on a 5-minute chart can supercharge your trading game.

idk why @JoelCarpenter_ and some other people today took first fvg inverse. I never do that. I always wait for the whole 'leg' to get inversed.

We have no 100% mechanical strategy,there will be always few differences, for example in this model on how we mark ifvgs or in a case where i enterd in 2:20. But with no doubt @AzkTrades model is great. I shared my screenshots of trades on my telegram channel.feel free to share

I've done the first quarter of 2023 matching the model below (1900-0000 accumulation range, 0230-0430 entry window). I did S&P500 and EURUSD. The better of the two results below is the S&P one. I need to go over the difference between my results on EU and @BzingAAAAA's results…

amazing🍻🤞

Thread on data lows and data highs🧵: ICT has his own “one setup for life” This would definitely be my “one setup for life” as it barely ever fails for me personally, but patience is required Let’s begin👇

Results of the inverse model in first quarter of the 2023 on $UERUSD: total trades:44 wining trades:29 winrate:66% R/R : 1 consecutive win/loss : 5/2 I only backtested the asian high/low liquidity. entry : 2:30 AM- 4:30 AM(london session) screenshots : t.me/FVG_Trader

ICT mechanical strategy that delivered a whopping 174% gain in 2023 and 84% in 2022 trading $ES! In this thread, you will find out the secrets behind this strategy and how leveraging previous session liquidity and iFVG on a 5-minute chart can supercharge your trading game.

Enjoying inverse model. I'm going to backtest it on Euro for the whole year.

8th green day in a row with this $EURUSD trade 🔥🔥 Inverse model - Asia High swept - Entry: 3:25 - Quick 5m trade I'm thrilled to share that the Ultimate ICT Mechanical Model, which I've been working on this month, is yielding outstanding results. Stay tuned!

United States Trends

- 1. Ellison N/A

- 2. Real ID N/A

- 3. Marner N/A

- 4. Macklin N/A

- 5. madison wisconsin N/A

- 6. #SpiderNoir N/A

- 7. Augusta N/A

- 8. #thursdayvibes N/A

- 9. Czechia N/A

- 10. Brody King N/A

- 11. Bo Horvat N/A

- 12. Mark Stone N/A

- 13. Hawley N/A

- 14. Gemini 3 Deep Think N/A

- 15. Rotisserie N/A

- 16. Sakkari N/A

- 17. Ron Johnson N/A

- 18. The Dow N/A

- 19. Team Canada N/A

- 20. McDavid N/A

Something went wrong.

Something went wrong.