You might like

The ratio of price of an oz of gold to the S&P is still only 0.72. That ratio was as high as 2.75 when Paul Volcker became Fed Chair in August 1979, the last time we saw stagflation. A 2.75 ratio would equal over $19,000 (!) per oz gold with the S&P 500 at its current levels.

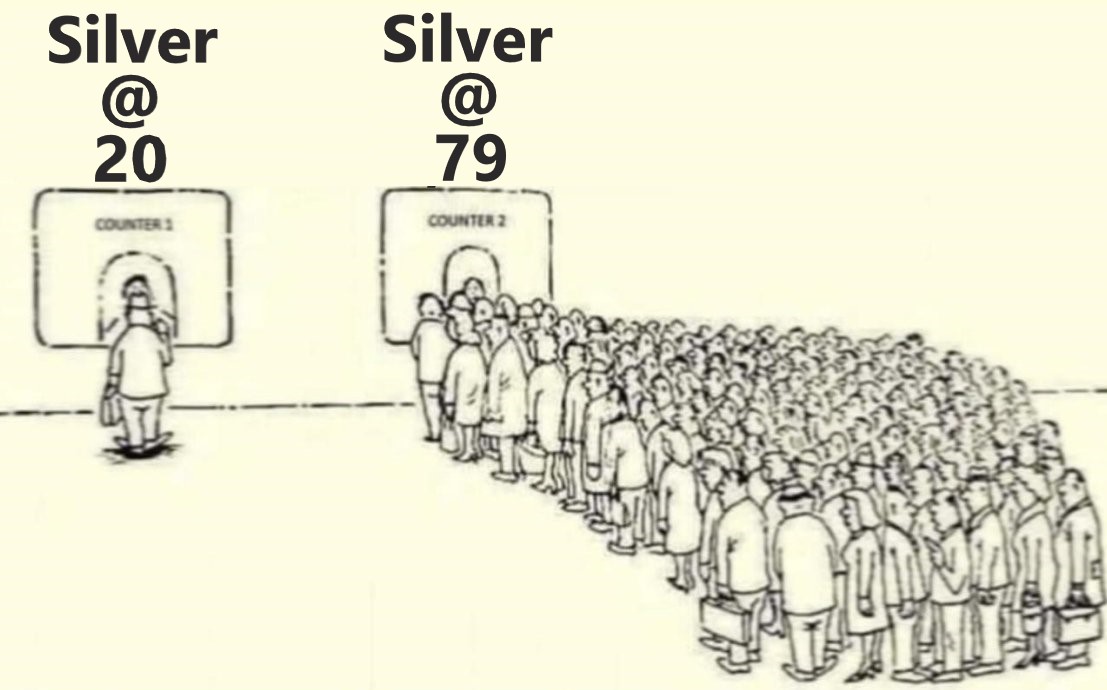

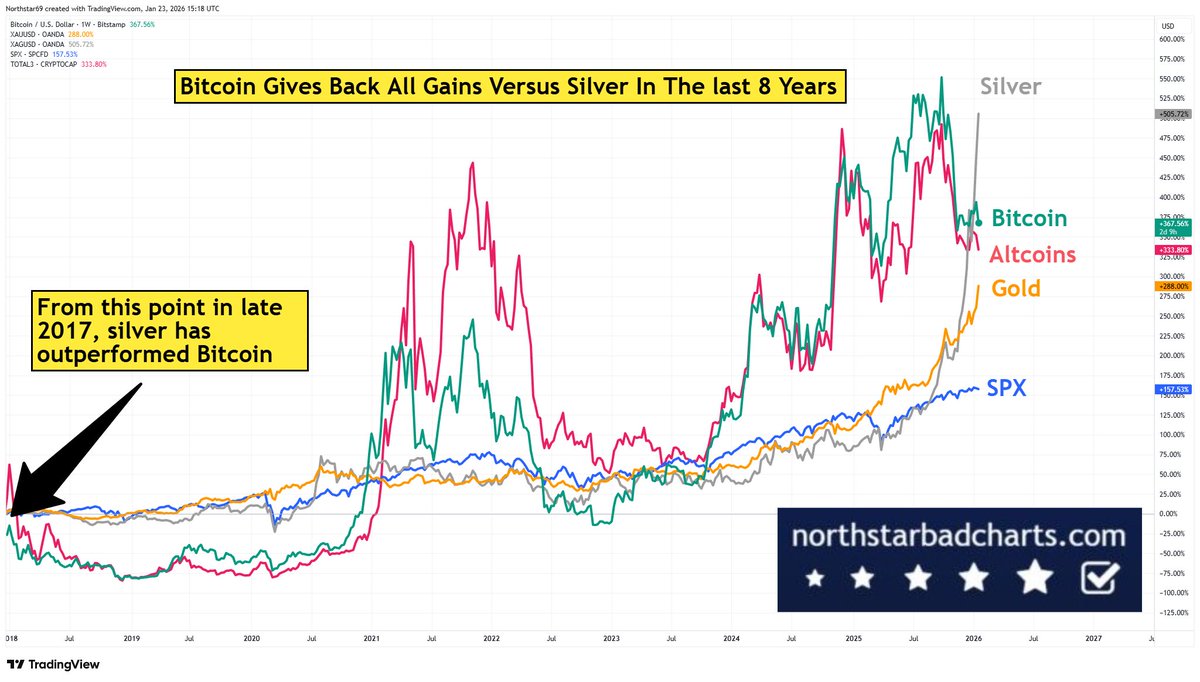

Silver has eaten up 8 years worth of Bitcoins gains. Most of that in the last 2 years, as secular CAPITAL ROTATION takes hold. The crypto community (sadly), are mostly unaware of the world before Bitcoin, so they didn't see it coming.

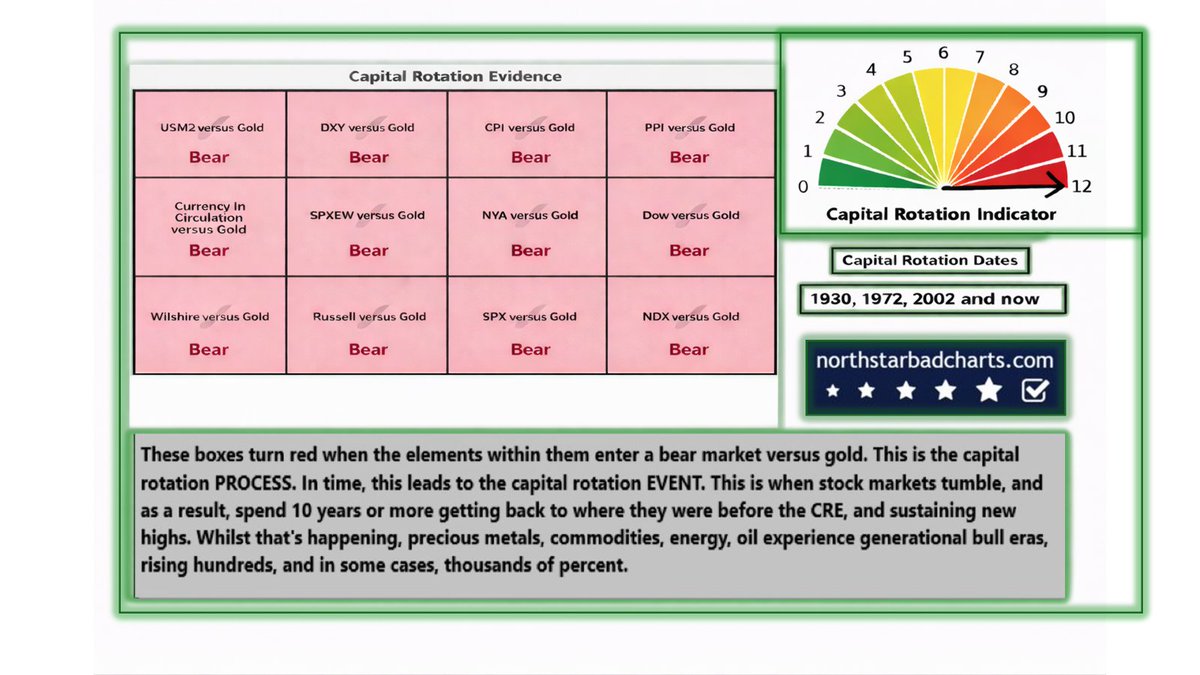

It hit us between the eyes in 2025 - Gold & silver soared. Crypto stagnated. Golds capital rotation evidence is complete. This is a new era. Now we wait. The clock is ticking. The CRE may be days, weeks, or many, many months away. It is coming though. Be ready.

Ben Affleck is clearly a smart guy. So this does not surprise me. It sounds familiar and on point. Delivered much better than I ever could.

Honestly, Ben Affleck actually knowing AI and the landscape caught me off guard, but as a writer, makes sense. Great takes across the board.

China Dumping US Treasuries Stockpiling Gold China Treasury Holdings Down To $680B 18 Year Low Gold Reserves Near 74M Ounces Record High

🇺🇸 President Trump just said: The United States stock market will double in a short period of time

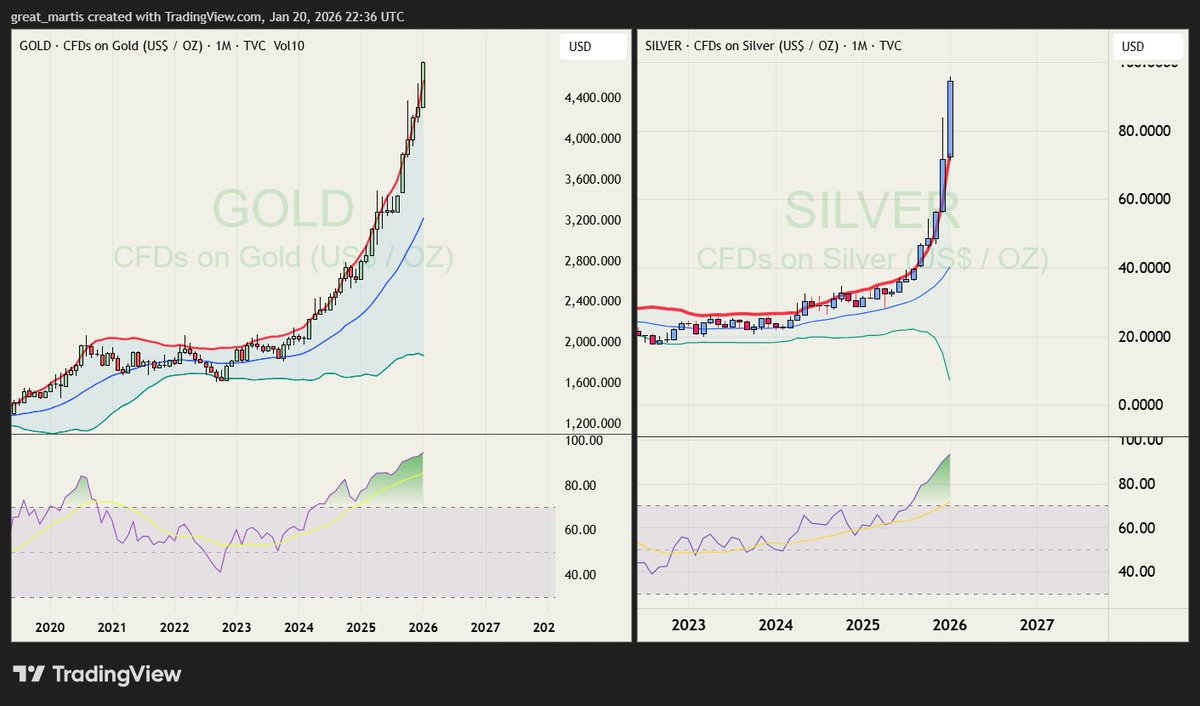

Gold.✨ Silver. The last time gold's RSI hit 94 was in 1968. Silver's RSI levels are at Hunt Brothers extremes from the late 1970s. Bollinger Bands on the monthly chart show silver hyper-extended, with gold now playing catch-up. These extreme moves are highly alarming for…

Honestly, Ben Affleck actually knowing AI and the landscape caught me off guard, but as a writer, makes sense. Great takes across the board.

Trump has it backwards. The U.S. doesn’t subsidize the world; the world subsidizes the U.S. The dollar’s reserve-currency status allows us to live beyond our means. Soaring debt, tariffs, and military threats jeopardize that status. When it’s lost, economic collapse will follow.

Sen. Mitch McConnell: “I have yet to hear from this administration a single thing we need from Greenland that this sovereign people is not already willing to grant us.”

SILVER From $100, Silver should start moving to the left.

I JUST CRUNCHED THE NUMBERS ON TRUMP'S VENEZUELA OIL PLAN And there's a huge problem. Everyone's expecting Venezuela to pump 3M+ barrels per day and crash oil prices. But here's what nobody's talking about: The infrastructure is DEAD. 30 years of socialist mismanagement…

*WALMART TO JOIN THE NASDAQ-100 INDEX. Have passive indexers become brainless bots, you tell me???

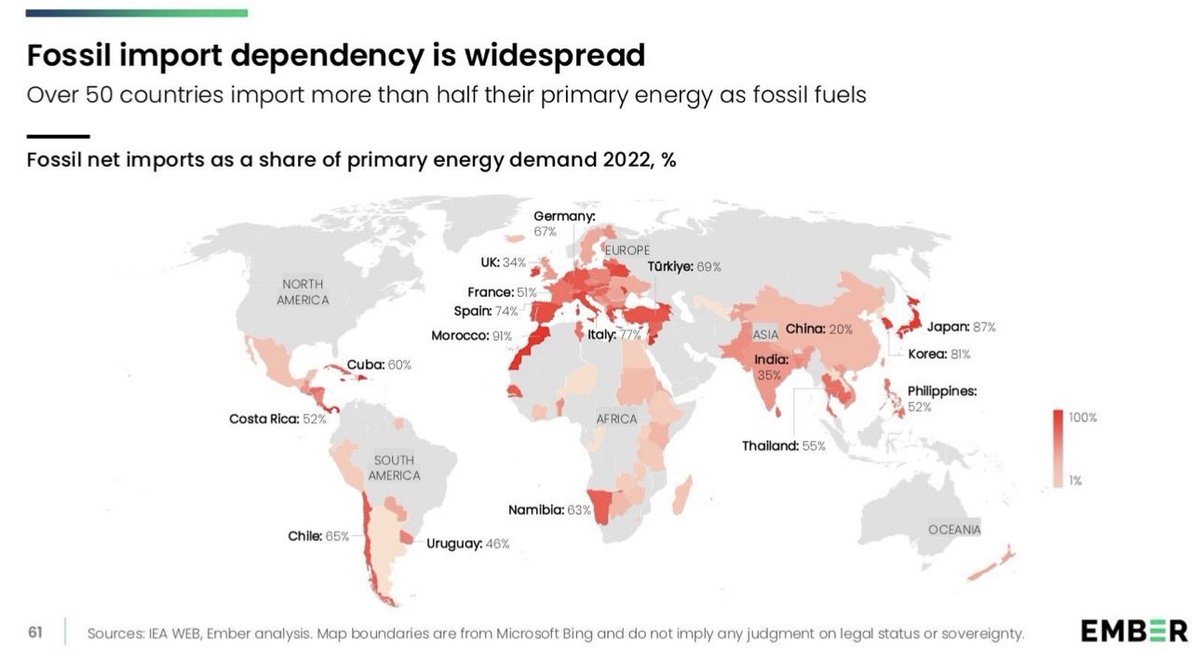

LOOK at this map: Over 50 countries import MORE THAN HALF their energy as fossil fuels. Japan: 87% Korea: 81% Italy: 77% Germany: 67% Turkey: 69% Even Morocco: 91% Most of the world is STILL hopelessly addicted to oil, gas & coal imports. Meanwhile... America…

January 1, 2026. Silver trades at $130 in Tokyo. Silver trades at $80 in Shanghai. Silver trades at $71 in New York. Same metal. Same day. Same ounce. One of these prices is a lie. Today China locked the vault. Export licenses now required. 44 approved firms. 80-tonne…

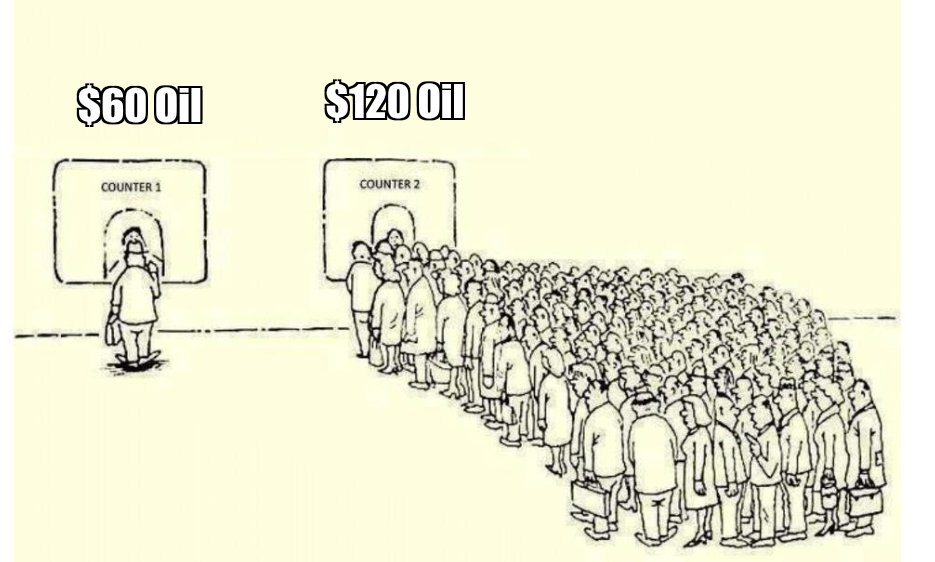

Many oil pundits do not understand this: ❄️Prices, costs, revenues, and profits are determined at the margin, not by averages. ❄️Algos increase volatility, but do not create trends & cycles. Trends and cycles are created by fundamentals.

Rate cuts into this? U.S. GDP for Q3 comes in much stronger than expected at 4.3% vs 3.3% expected—consumption at 3.5% vs 2.7% exp. Core PCE inflation came in at 2.9%, WAY above the Fed's 2% target!

Never, Ever Forget The Fed restarted QE and cut interest rates in December 2025 to 3.75% from 5.5% in September 2024, with: 1. Atlanta Fed GDP at +3.5% 2. $1.2T of AI Capex spending, gushing out in 2025-2026. 3. Core PCE inflation at 2.8% vs. the 1.5% 2010-2020 average.

Two ways out of a $38T debt hole: 1. Debt jubilee, default, reset. 2. Monetize the debt, massage interest rates below the rate of inflation. Got hard assets? Peter does.

The yield on 10-year JGBs is above 2% for the first time in twenty-seven years. More significantly, yields will likely head substantially higher from here, putting upward pressure on long-term interest rates worldwide. That means the Fed will soon extend QE to longer maturities.

United States Trends

- 1. Jasper Johnson N/A

- 2. Another ICE N/A

- 3. Burnley N/A

- 4. Romero N/A

- 5. Good Saturday N/A

- 6. Jose Ramirez N/A

- 7. #saturdaymorning N/A

- 8. Travis Perry N/A

- 9. MetLife N/A

- 10. Thomas Frank N/A

- 11. Gigi N/A

- 12. Harry Wilson N/A

- 13. #Caturday N/A

- 14. The Discombobulator N/A

- 15. #COYS N/A

- 16. Tottenham N/A

- 17. Nicollet Ave N/A

- 18. Vicario N/A

- 19. #วิวาห์ปฐพีตอนที่1 N/A

- 20. Marmoush N/A

Something went wrong.

Something went wrong.