Finsights.biz - GST ITC Reco/Tally on the Go

@FinsightsApp

Automate your GST ITC Reconciliation Access, Audit and Post Tally Data from Anywhere GSTR 2A, 2B reconciliation, Tally on Mobile

You might like

Today, let us commemorate India's Constitution, the structure that has made India's fundamentals strong and secure. A Tribute to the laws that shaped India into what it is today. Happy Republic Day to All! #republicday2023 #HappyRepublicDay #republicday #india

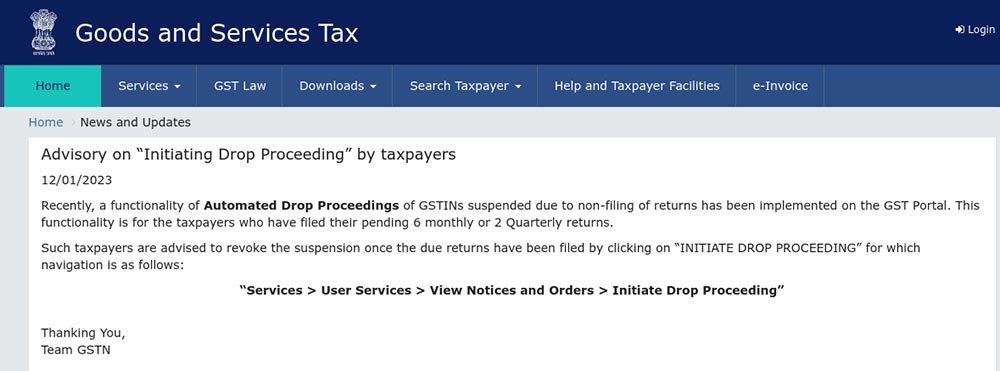

GST Authorities have now implemented the Automated Drop Proceedings (new functionality) on the GST official Portal. #gst #gstupdates #gstindia #gstindia #gstreturns #gstnews #gstr #gstupdate #gstcompliance #gstfiling #gstr #gstportal #gstreturnfiling #finsights #tallyonmobile

To cater to all value chain participants, the SEBI has allowed stock exchanges to launch multiple contracts in the same commodity. The circular has become effective immediately. #sebi #gst #gstupdates #gstindia #incometaxreturn #incometaxindia #incometaxreturnfiling #gstsoftware

To avoid Fat-finger / Big-figure errors by bidders in G-Sec auctions, the @RBI has advised all market participants to use the "Price / Yield range setting" facility available on the e-Kuber platform before placing bids in Primary Market auctions. #rbi #GST

A lot of changes and improvements were made in the GST in 2022. The main changes are listed below for you to review and take into consideration. finsights.biz/blog/gst-chang… Let us know of the largest GST change you believe will occur in 2023. #gst #gstupdates #gstreturns #gst

The GSTN has enabled the functionality on the GST Portal to provide a Letter of Undertaking (LUT) for the F.Y. 2023-2024. #gst #gstupdates #gstreturns #gstindia #incometax #incometaxindia #incometaxfiling #gstr #gstreturnfiling #gstportal #finsights #incometaxfiling #gstfiling

An exposure draft has been issued by the ICAI's Direct Taxes Committee regarding "Guidance Note on Audit of Charitable Institutions u/s Section 12A of the Income Tax Act, 1961" for public comments & suggestions. #taxes #taxes2023 #audit #institutions #public #taxact #section12a

The deadline for submitting a hard copy of a statement containing the salient features of all documents under Regulations 58 and 36 of the SEBI (LODR) Regulations, 2015 has also been extended until September 30th, 2023. #sebi #gst #gstupdates #gstindia #incometax

The West Bengal Authority For Advance Ruling (AAR) bench comprising Brajesh Kumar Singh and Jyojit Banik concluded that the welding of railroad lines with labor services will be treated as a composite provision of services and will be subject to 18% Goods and Service Tax (GST).

e-Pay Tax services with Over Counter & Net Banking options are now available through City Union Bank. UCO Bank IDBI Bank Jammu & Kashmir Bank Union Bank Now can use Protean's e-Pay Tax facility to e-Pay taxes at the e-Filing portal. #tax #banking #bank #taxation #taxfiling

The @RBI increased the interest rate on floating rate savings bonds (issued in 2020) from 7.15% to 7.35% as of January 1, 2023. #ITC #incometaxes #gstr2b #GST #updates #gstupdates #gst #incometax #Update #finsights #taxpayers #incometaxindia #reconciliation #RBI

There is no GST payable if a registered person rents a residential dwelling in his/her personal capacity for use as his/her own residence and on his/her own account, rather than on behalf of his business. #reconciliation #gst #updates #incometaxindia #gstr2a #finsights #GST

Team Finsights wishes you A Happy and Prosperous New Year 2023!

IBBI has specified the reporting proforma for liquidator, who must record reasons for the decision in writing and submit it to Adjudicating Authority, if he makes a decision that differs from the advice of Stakeholders Consultation Committee. #gstr #GST #incometaxreturn

SEBI has issued a consultation paper on improving investor grievance redressal mechanisms through the use of online dispute resolution mechanisms. The deadline for public comments is 09/01/2023. #gstupdates #Sebi #consultation #Finsights #incometaxreturn #incometax

After multiple representations for assignment of new ISNs were made to SEBI, It has clarified that a change in security, creation of additional security, or security in case of unsecured debt securities does not constitute a change in structure of NCDs. #gstupdates #GST

Gross Collection of Direct Taxes for the FY 2022–23 is Rs. 13,63,649 crore up from Rs. 10,83,150 crore in FY 2021–22. This represents an increase of 25.90% over collections of FY 2021–22. #taxes #collection #gst #indianeconomy #taxcollection #finsights #tax #updates #incometax

The CBDT has released new SOPs to file appeals and special leave petitions in the Supreme Court to encourage the use of technology in operations. #gstr2b #reconciliation #incometaxreturn #gst #incometax #taxpayers #updates #gstr2a #finsights #incometaxindia #réconciliation #GST

On December 17, the 48th GST Council convened virtually in New Delhi, presided over by Smt. Nirmala Sitharaman, Union Minister for Finance & Corporate Affairs. #GST #gstupdates #GSTCouncil #gstindia #Finsights #NirmalaSitharaman #UnionMinister #gstr

In SA 230, the basic principles for audit documentation are laid out. The AASB of the ICAI updates the "Implementation Guide to SA 230" publication to provide auditors with helpful implementation guidance on SA 230. #audit #tax #incometax #gst

United States Trends

- 1. #AEWFullGear 50.2K posts

- 2. Benavidez 13.7K posts

- 3. Klay 7,400 posts

- 4. Haney 25.7K posts

- 5. LJ Martin N/A

- 6. Mark Briscoe 3,439 posts

- 7. #LasVegasGP 122K posts

- 8. Georgia Tech 6,397 posts

- 9. Terry Smith 2,655 posts

- 10. #AlianzasAAA 3,293 posts

- 11. Lando 67.2K posts

- 12. Kyle Fletcher 1,992 posts

- 13. Utah 21.4K posts

- 14. #OPLive 2,220 posts

- 15. Nebraska 24.4K posts

- 16. Rhule 2,055 posts

- 17. Narduzzi 1,508 posts

- 18. #LAFC N/A

- 19. Kris Statlander 2,022 posts

- 20. Raleek Brown N/A

You might like

-

CA NIKUNJ GOSAI

CA NIKUNJ GOSAI

@ca_gosai -

CA Ravi Shankar Kr.

CA Ravi Shankar Kr.

@CAravi1979 -

Shru

Shru

@ShrutiS15130663 -

CA. Himanshu Agrawal

CA. Himanshu Agrawal

@CAHimanshuAgra3 -

Ashish Tater

Ashish Tater

@ashish_tater -

KETAN VASOYA

KETAN VASOYA

@KETANVASOYA3 -

ROHIT GANGWANI

ROHIT GANGWANI

@CAROHITGANGWANI -

RAJEEV RAJU KALAWATE

RAJEEV RAJU KALAWATE

@LkoRaju -

🐞

🐞

@Tuti1001 -

Ajay Kumar Maggidi

Ajay Kumar Maggidi

@ajaykumar_magdi -

..

..

@indian_krunal01

Something went wrong.

Something went wrong.