Andrew Kuhn

@FocusedCompound

Focused Compounding / Podcast 🎙/ We spend 99% of our time focused on the 1% of stocks every other fund ignores - All with $GEOFF Gannon. Not advice. DYODD.

You might like

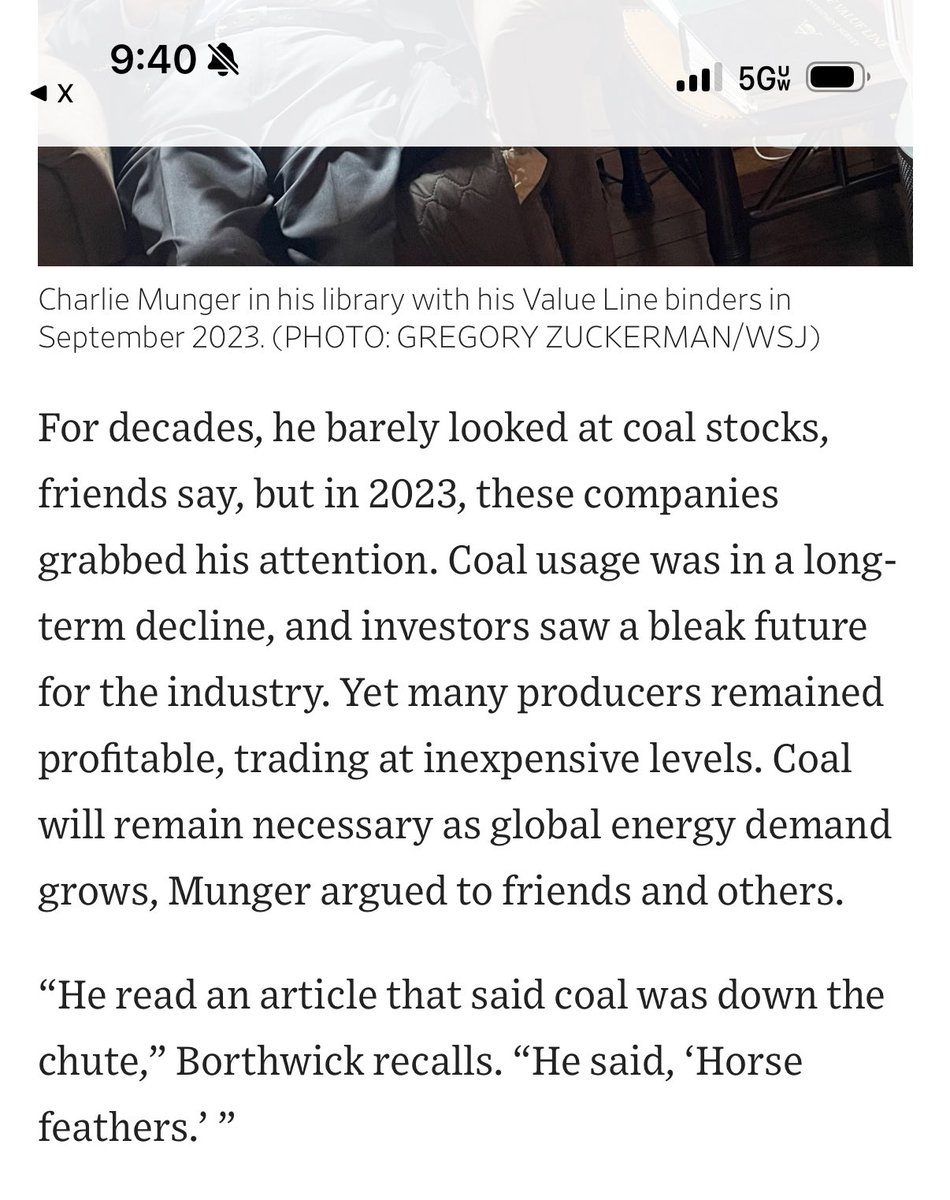

Munger buying coal stocks in his final year. An independent thinker and always learning, right to the very end. Fascinating article by @GZuckerman

Incredible article about Charlie Munger’s final years. An utterly fascinating man until the very end. wsj.com/finance/invest…

It’s been a while since we’ve done this - what’s your current highest-conviction stock idea and why?

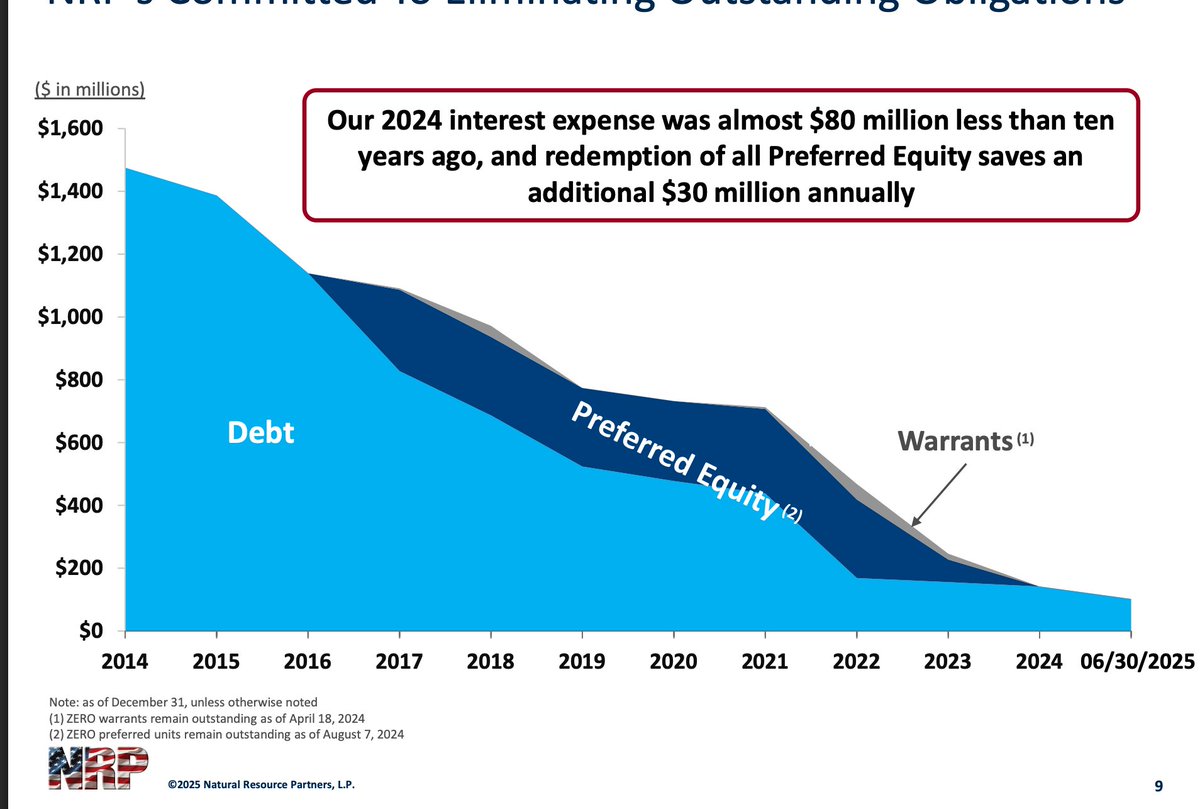

this is a mentally ill level of delevering $NRP #coal #coaltwitter

epic

Episode 1000 goes live a week on Monday and we took Cooper back to his farm for the first time in 11 years. The most insane set we’ve ever built. Hold on tight ;)

MNG submitted a higher offer to DallasNews $DALN for $20 per share in cash, which represents a $1.5 per share increase over its earlier offer of $18.5 per share.

DallasNews $DALN announced that it has amended the merger with Hearst to increase the per share purchase price from $15 to $16.5 per share in cash.

“You’re bearish? The Treasury Secretary is threatening to kick people’s asses and you’re bearish?”

New Pod! Most commodity businesses should be price takers, yet some earn above-average returns. Why? They have moats. Where does this come from? - Common Characteristics - Southern Copper Corporation - Low-Cost Producer in Coal - Aggregates, Lime, Cement - Low…

For your weekend listening pleasure. $GEOFF $ANDRW

New Pod! Most commodity businesses should be price takers, yet some earn above-average returns. Why? They have moats. Where does this come from? - Common Characteristics - Southern Copper Corporation - Low-Cost Producer in Coal - Aggregates, Lime, Cement - Low…

New Pod is up: Howard Marks’ Memo — The Calculus of Value - Market psychology today - Fiscal vs. monetary policy - 493 non-Mag 7 stocks avg P/E at 22x - DEFCON investing scale - Where opportunities exist now

In Emerging Markets, you usually avoid companies with partial government ownership, because those companies tend to underperform…

BIG NEWS: The United States of America now owns 10% of Intel, one of our great American technology companies. This historic agreement strengthens U.S. leadership in semiconductors, which will both grow our economy and help secure America’s technological edge. Thanks to Intel…

United States Trends

- 1. Thanksgiving 2.16M posts

- 2. Dan Campbell 4,895 posts

- 3. Lions 81K posts

- 4. Micah Parsons 4,995 posts

- 5. Goff 9,733 posts

- 6. Jack White 7,624 posts

- 7. #GoPackGo 7,669 posts

- 8. Jordan Love 9,673 posts

- 9. Jamo 4,635 posts

- 10. #GBvsDET 4,243 posts

- 11. Wicks 5,919 posts

- 12. Gibbs 8,430 posts

- 13. Jameson Williams 2,442 posts

- 14. Watson 13.6K posts

- 15. #OnePride 6,272 posts

- 16. Thankful 443K posts

- 17. Green Bay 7,101 posts

- 18. Turkey 278K posts

- 19. Wyatt 5,222 posts

- 20. Nixon 5,425 posts

You might like

-

MOI Global

MOI Global

@manualofideas -

Laughing Water Capital

Laughing Water Capital

@LaughingH20Cap -

Fred Liu

Fred Liu

@HaydenCapital -

Sidecar Investor

Sidecar Investor

@sidecarcap -

In Practise

In Practise

@_inpractise -

Brandon Beylo

Brandon Beylo

@marketplunger1 -

Frederik Gieschen

Frederik Gieschen

@FrederikNeckar -

Idea Hive

Idea Hive

@ideahive -

Alex Morris (TSOH Investment Research)

Alex Morris (TSOH Investment Research)

@TSOH_Investing -

Greenhaven Road

Greenhaven Road

@GreenhavenRoad -

Mike

Mike

@NonGaap -

Implied Expectations

Implied Expectations

@LongHillRoadCap -

ValueStockGeek

ValueStockGeek

@ValueStockGeek -

Upslope Capital

Upslope Capital

@UpslopeCapital -

John Huber

John Huber

@JohnHuber72

Something went wrong.

Something went wrong.