full dozing

@FullDozing

You might like

Absolutely incredible wouldn't you agree? What a perfect way to mark the 75th anniversary of VE day with this amazing sculpture! #VEDay #VEDay75 #VEDay2020

To mark the 75th anniversary of VE Day, here is a preview of our latest community artwork 'The Young Soldier' - visit animatedobjects.org to read the full story. @DiscoverCoast @ScarboroCouncil @Whitby_TC @scarborough_afd ⌗VEDay ⌗VEDay75

The Wealth Redistribution Scam that Is "Inflation" zerohedge.com/economics/weal…

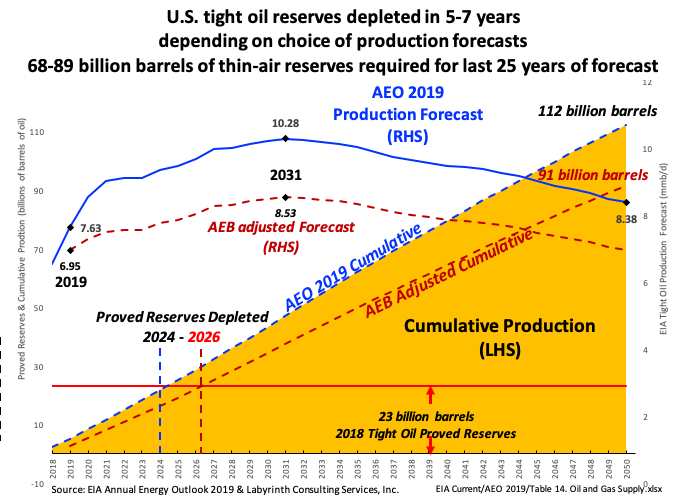

U.S. tight oil reserves depleted in 5-7 years depending on choice of production forecasts. 68-89 billion barrels of thin-air reserves required for last 25 years of forecast. #OOTT #oilandgas #oil #WTI #CrudeOil #fintwit #OPEC

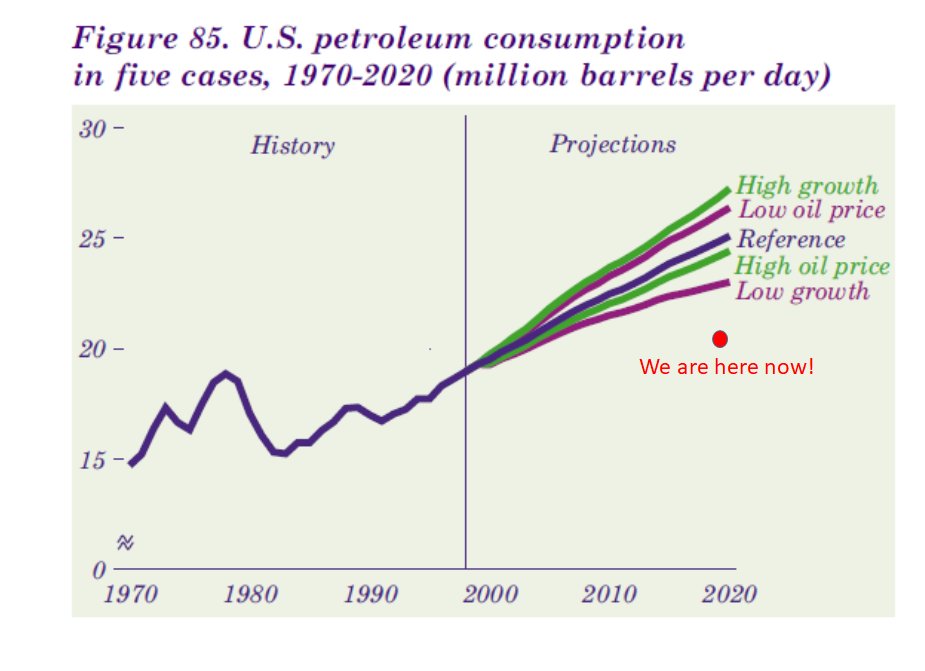

This is stunning! This is the EIA prediction of US petroleum consumption in 2000 to 2020. I added everything in red The population increased, income increased, yet demand for petroleum is lower than all projections.

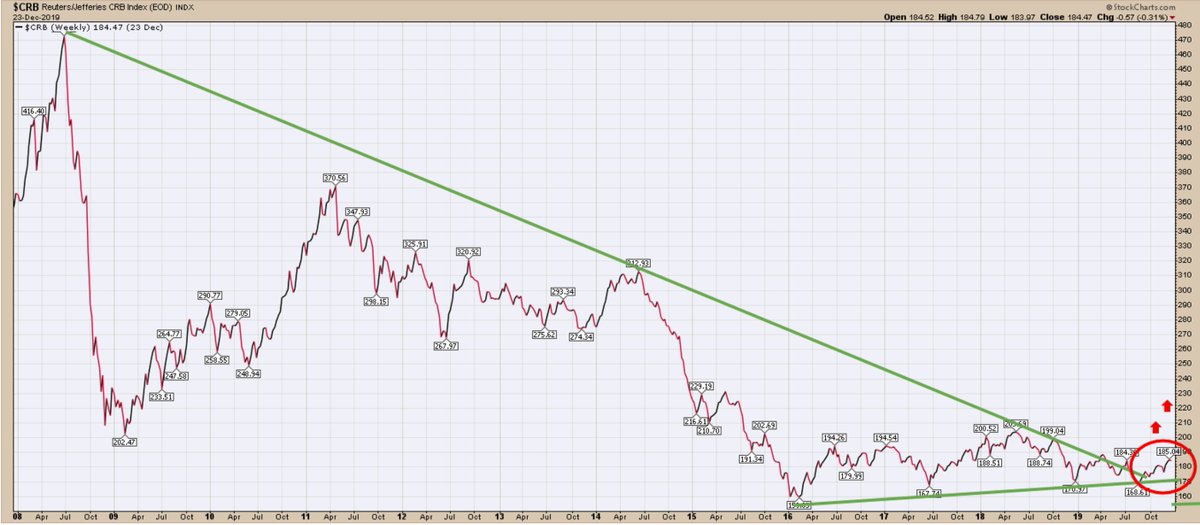

In the summer of 2008 commodities reached a top, after a bull market of eight years. In that same year, we started a Commodity Fund. Now, eleven years later, the CRB Commodity Index finally broke out of a ten-year downtrend, and a four-year bottoming phase. MerryXmas

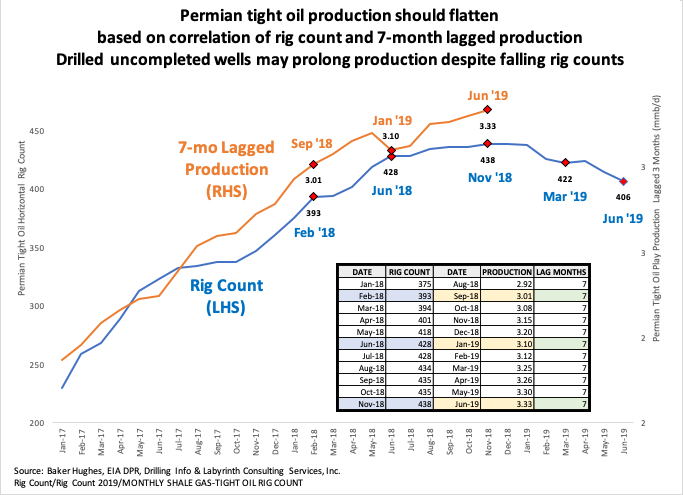

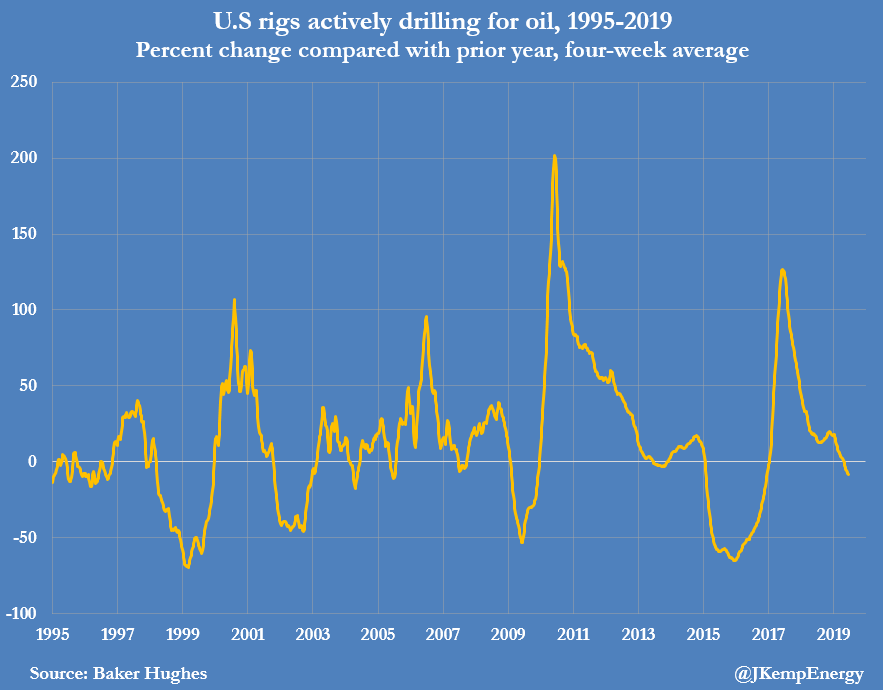

Permian tight oil production should flatten based on correlation of rig count and 7-month lagged production. Drilled uncompleted wells may prolong production despite falling rig counts. #OOTT #oilandgas #oil #WTI #CrudeOil #fintwit #OPEC

Putin has effectively completed his takeover of OPEC bloom.bg/2NlhgSk

PIONEER RESOURCES scales back oil production push to focus on profitability: wsj.com/articles/a-lea…

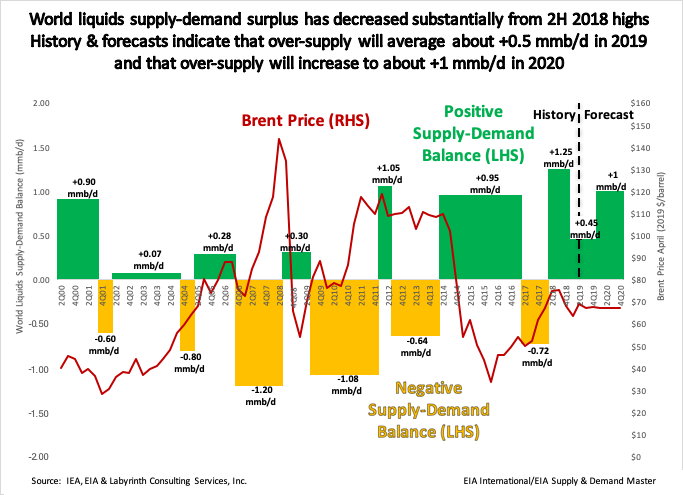

Comment freely but please spare us whining about forecasts in general! History & forecasts indicate that over-supply will average about +0.5 mmb/d in 2019 & that over-supply will increase to about +1 mmb/d in 2020. #OOTT #oilandgas #oil #WTI #CrudeOil #fintwit #OPEC

The best time to invest in an overpriced casino drowning in debt is in the eleventh year of a bull market. Howard Hughes 😉 @DiMartinoBooth @jennablan #Caesars @OpenOutcrier @JonathanHoenig

U.S. OIL RIG COUNT is down -8% compared with the same period last year, the steepest decline since the slump of 2014/15:

Former Shale Gas CEO Says Fracking Revolution Has Been 'A Disaster' For Drillers, Investors desmogblog.com/2019/06/23/for…

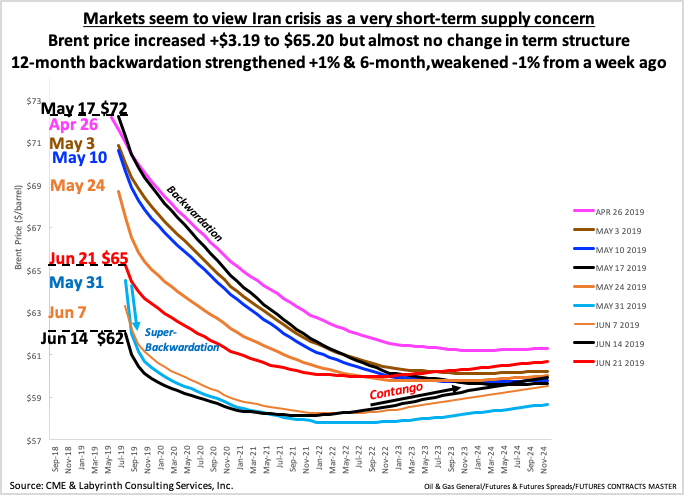

Markets seem to view Iran crisis as a very short-term supply concern. Brent price increased +$3.19 to $65.20 but almost no change in term structure. 12-month backwardation strengthened +1% & 6-month,weakened -1% from week ago. #OOTT #oilandgas #oil #WTI #CrudeOil #fintwit #OPEC

"Demand for oil to grow by about 1.2 mmb/d this year compared with last. That’s down from 1.3 mm a month ago & more than 1.4 mm in forecasts made in January." bloomberg.com/news/articles/… #OOTT #oilandgas #oil #WTI #CrudeOil #fintwit #OPEC

bloomberg.com

Oil Demand Growth Estimates Lurching Ever Lower

Big oil-forecasting agencies get gloomier about demand for this year

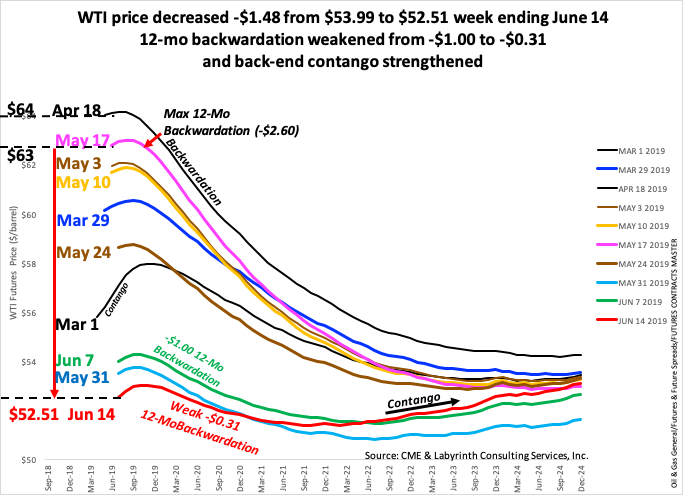

WTI price decreased -$1.48 from $53.99 to $52.51 week ending June 14. 12-mo backwardation weakened from -$1.00 to -$0.31 and back-end contango strengthened. #OOTT #oilandgas #oil #WTI #CrudeOil #fintwit #OPEC

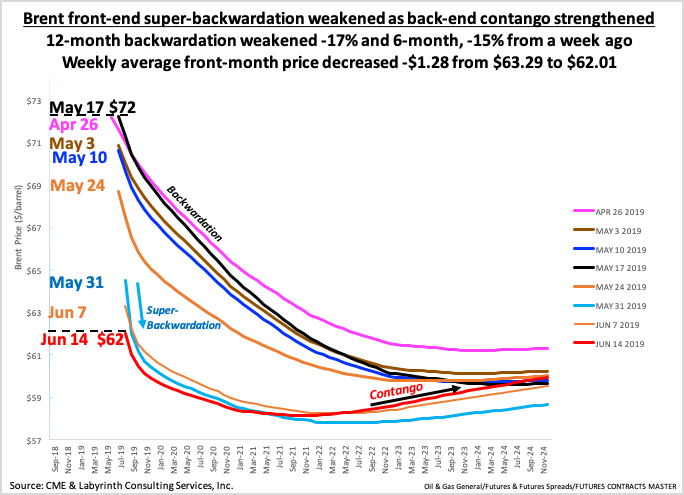

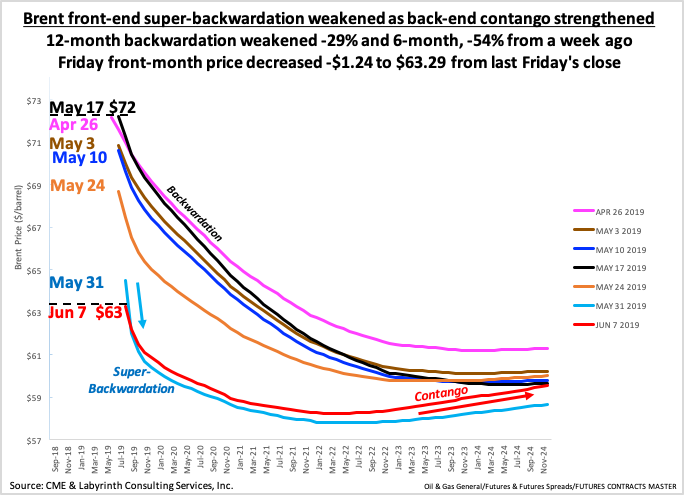

Brent front-end super-backwardation weakened as back-end contango strengthened. 12-month backwardation weakened -17% and 6-month, -15% from a week ago. Weekly average front-month price decreased -$1.28 from $63.29 to $62.01. #OOTT #oilandgas #oil #WTI #CrudeOil #fintwit #OPEC

Non-OPEC production outside of the U.S. and Russia peaked in June 2018 and has since declined by 800,000 b/d. We explore the numbers in this week’s blog: >> hubs.ly/H0jj_7R0 #oilprices #nonopec #shaleoil

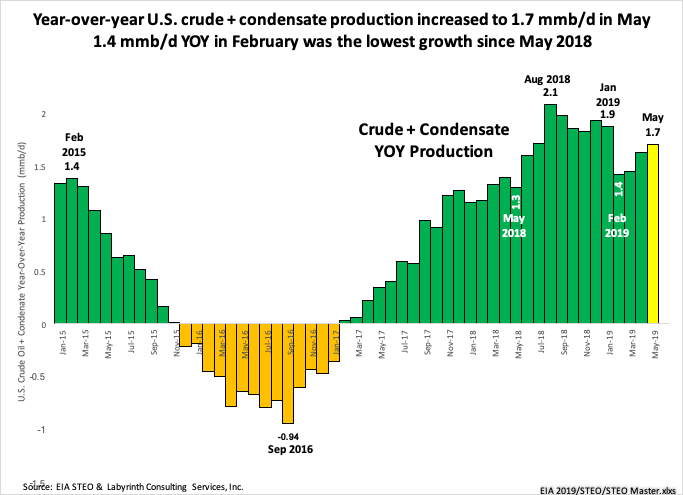

Year-over-year U.S. crude + condensate production increased to 1.7 mmb/d in May. 1.4 mmb/d YOY in February was the lowest growth since May 2018. #OOTT #oilandgas #oil #WTI #CrudeOil #fintwit #OPEC

Brent front-end super-backwardation weakened as back-end contango strengthened. 12-month backwardation weakened -29% and 6-mo, -54% from a week ago. Friday front-month price decreased -$1.24 to $63.29 from last Friday's close. #OOTT #oilandgas #oil #WTI #CrudeOil #fintwit #OPEC

Oil industry will NOT be able to provide the world with the oil needed at current prices. Oil price is political, supply & demand is not.

United States Trends

- 1. Packers 210 B posts

- 2. Caleb 113 B posts

- 3. LaFleur 46,3 B posts

- 4. McManus 19,9 B posts

- 5. Ben Johnson 45,5 B posts

- 6. Jordan Love 20,8 B posts

- 7. Bregman 28 B posts

- 8. The Jito 56,9 B posts

- 9. Cancun 7.372 posts

- 10. Cubs 26,8 B posts

- 11. #Unveiling4Elements 328 B posts

- 12. 4E FIRST FAMILY TIME 342 B posts

- 13. #GMMTVFANDAY28 171 B posts

- 14. WILLIAMEST IN TOKYO 138 B posts

- 15. #Arknights6thAnniv 1.699 posts

- 16. Red Sox 8.102 posts

- 17. Devers 4.372 posts

- 18. #GBvsCHI 6.951 posts

- 19. Loveland 12,6 B posts

- 20. DJ Moore 8.806 posts

Something went wrong.

Something went wrong.