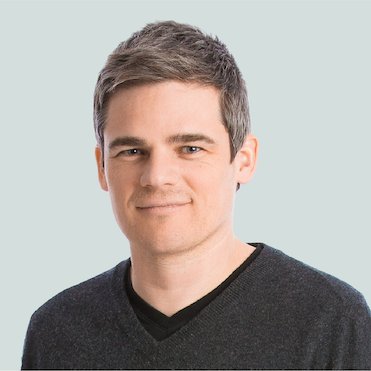

Been DCA’ing $50 a day into $BTC on Robinhood. Just crossed 0.1 BTC. Boring consistency works

Sold Jan 30 $15.50 cash-secured puts on $OSCR. $247 in premium. Risk defined, entry defined

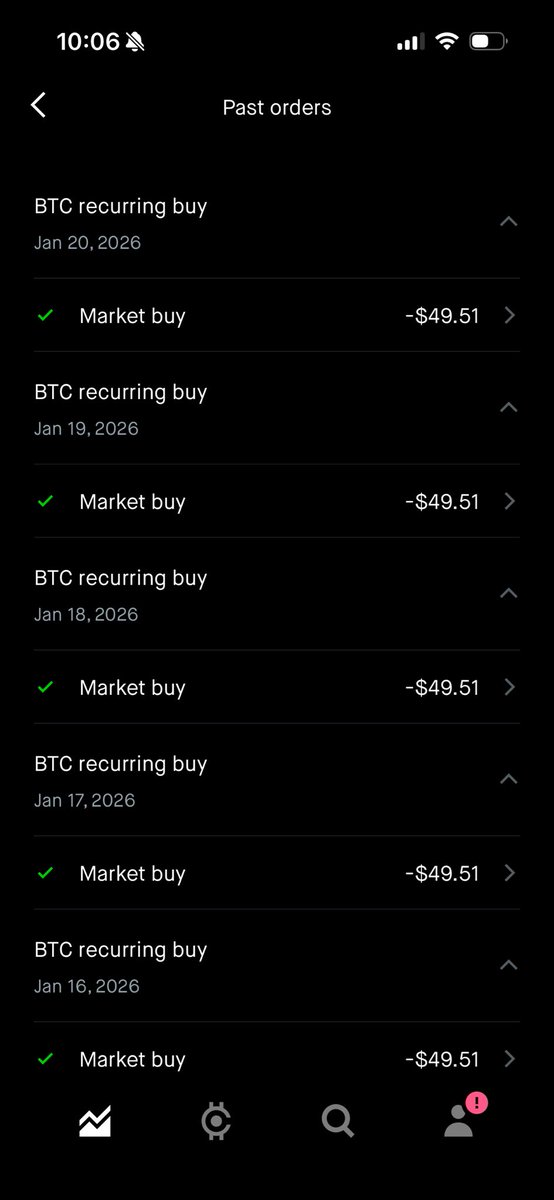

$OSCR — why the tech stack matters Oscar rolled out Oswell back in October, an AI health agent built into the member app. It uses real claims and care data to help members understand symptoms, coverage, and costs, and to get to the right care faster. Legacy insurers talk about…

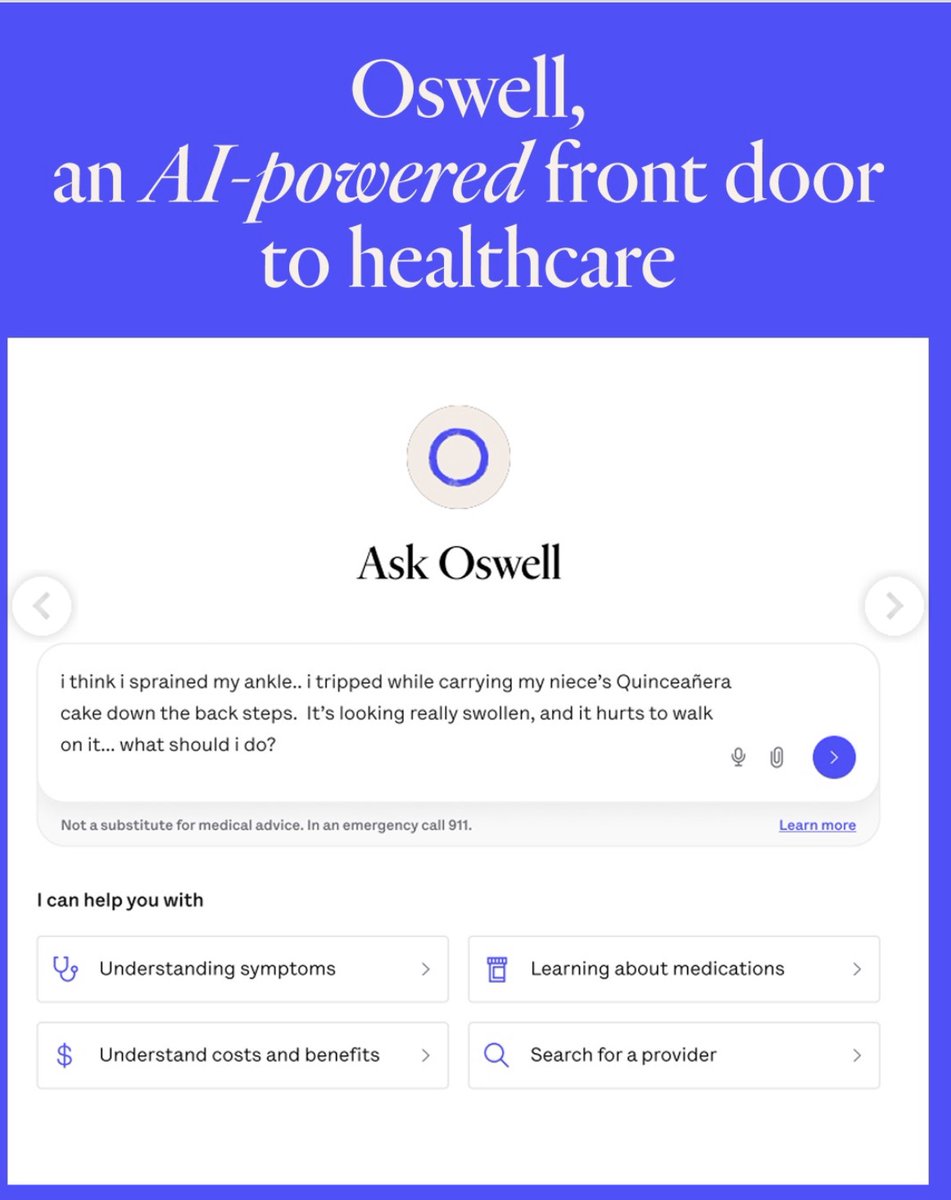

$OSCR MLR (Medical loss ratio) = % of premiums spent on care. Lower is better because it creates operating leverage. Oscar is improving it faster than legacy insurers. That’s the business model.

The $HOOD thesis is simple: all the new money is flowing into Robinhood, and the old money is starting to follow. Every billion $HOOD adds to its AUC is a billion leaking out of a legacy firm. Which legacy brokerage loses the most AUM to Robinhood in 2026? Charles Schwab (The…

Overheard on an NYC bus today. A perfect snapshot of the 2026 wealth gap. The Scene: Two professional class renters in their 30s. The Reveal: My landlord offered me a grand piano. To keep. For free. The Reaction: Pure shock. "He’s giving away a $20k asset for nothing? Why not…

Susquehanna has a sports trading desk now. Read that again

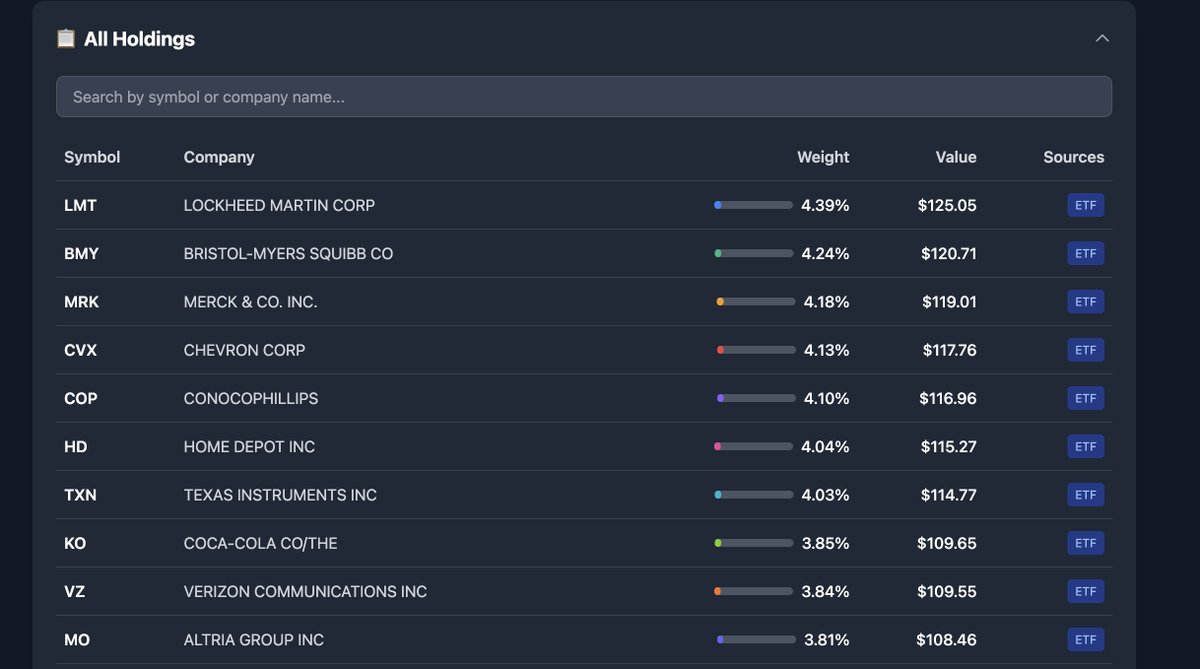

What 100 shares of SCHD actually looks like broken down. Not a single Mag 7 stock in the top 10

Own QQQ, VOO, and VTI? You probably have 15%+ exposure to just NVIDIA and Apple without realizing it. See your actual portfolio breakdown → fundbreakdown.com Free, no login required.

fundbreakdown.com

Fund Breakdown

See your true portfolio exposure across ETFs and stocks

XLF's top 2 holdings: 1. Berkshire Hathaway - 11.5% 2. JPMorgan - 11.2% That's 22.7% in just two stocks. Buffett and Dimon run the financial sector ETF. $XLF $BRK.B $JPM

Coinbase ($COIN) short interest jumped 29% in 2 months Oct 31: 13.4M shares Dec 31: 17.3M shares Days to cover: 2.51 (highest among major tech) Crypto rally has bears nervous. $COIN $BTC

Robinhood ($HOOD) shorts are covering Short interest dropped from 46.4M (Oct) to 36.5M (Dec) That's a 21% reduction in 2 months. Bears giving up on betting against retail trading. $HOOD

United States Trends

- 1. #TheMaskedSinger N/A

- 2. #AEWDynamite N/A

- 3. Speedway N/A

- 4. Hornets N/A

- 5. Fredo N/A

- 6. Brody King N/A

- 7. Iceland N/A

- 8. Shibata N/A

- 9. #ChicagoMed N/A

- 10. Samoa Joe N/A

- 11. #AbbottElementary N/A

- 12. Cuomo N/A

- 13. Lamelo N/A

- 14. Al Harris N/A

- 15. TACO N/A

- 16. Al Gore N/A

- 17. Speedball N/A

- 18. Gavin N/A

- 19. Hangman N/A

- 20. Tone Loc N/A

Something went wrong.

Something went wrong.