Michael Garber Financial Planning

@GarberPlanning

Holistic financial planning and investment advice in California and beyond. Specializing in serving technology professionals. Simplify everything.

You might like

Owning stocks is one of the best long-term inflation hedges.

It's 1989: You're 45, working in management at Sony Life's good- your real estate is booming, bonuses are fat & the Nikkei's unstoppable You pour savings into stocks like Honda & Sony "Just a few years" 3yrs later-you're down 62% & won't get back to break even until you're 80

Passive Indexing has attracted substantially all the new investments made by ordinary people. It's easy to see why: lower costs, and performance generally better than actively managed funds. But despite this, most ordinary investors are not nearly as well diversified as they…

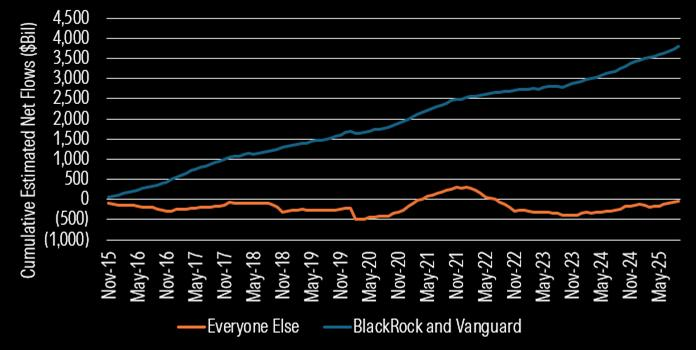

Over the past 10 years, BlackRock and Vanguard have combined to bring in $3.8 trillion in cumulative estimated net new flows into their mutual funds and ETFs. Everyone else combined has seen a combined $33 billion go out the door on a cumulative basis. Source: Morningstar…

“Consumers don't produce inflation. Producers don't produce inflation. Inflation is produced only by too much government spending and too much government creation of money, and nothing else.” — Milton Friedman

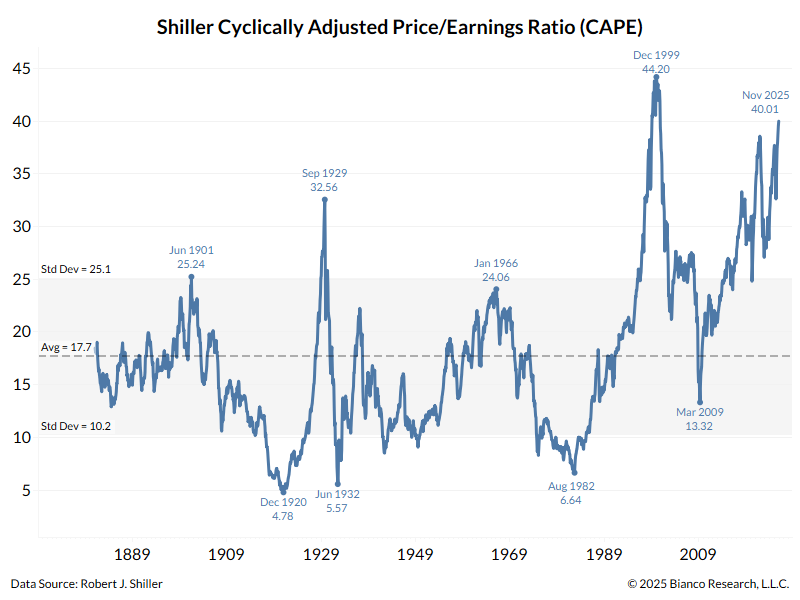

1/4 I assume Marks is referring to the 1-year forward P/E ratio for the S&P 500, the standard Wall Street valuation metric (which is closer to 25 now, but was 23 a few weeks ago). Here is a long-term proxy for that ... the Shiller Cyclically Adjusted Price/Earnings (CAPE) ratio…

Howard Marks on the Markets: “When you buy the S&P 500 at a 23x P/E, your 10-yr annualized return has always fallen between +2% and –2%, IN EVERY CASE, EVERY CASE.” Today, the market sits at a 25x P/E. Add inflation… and your “returns” are negative. The chart shows Shiller…

Wealth is built in market crashes. You just won’t realize it until years later.

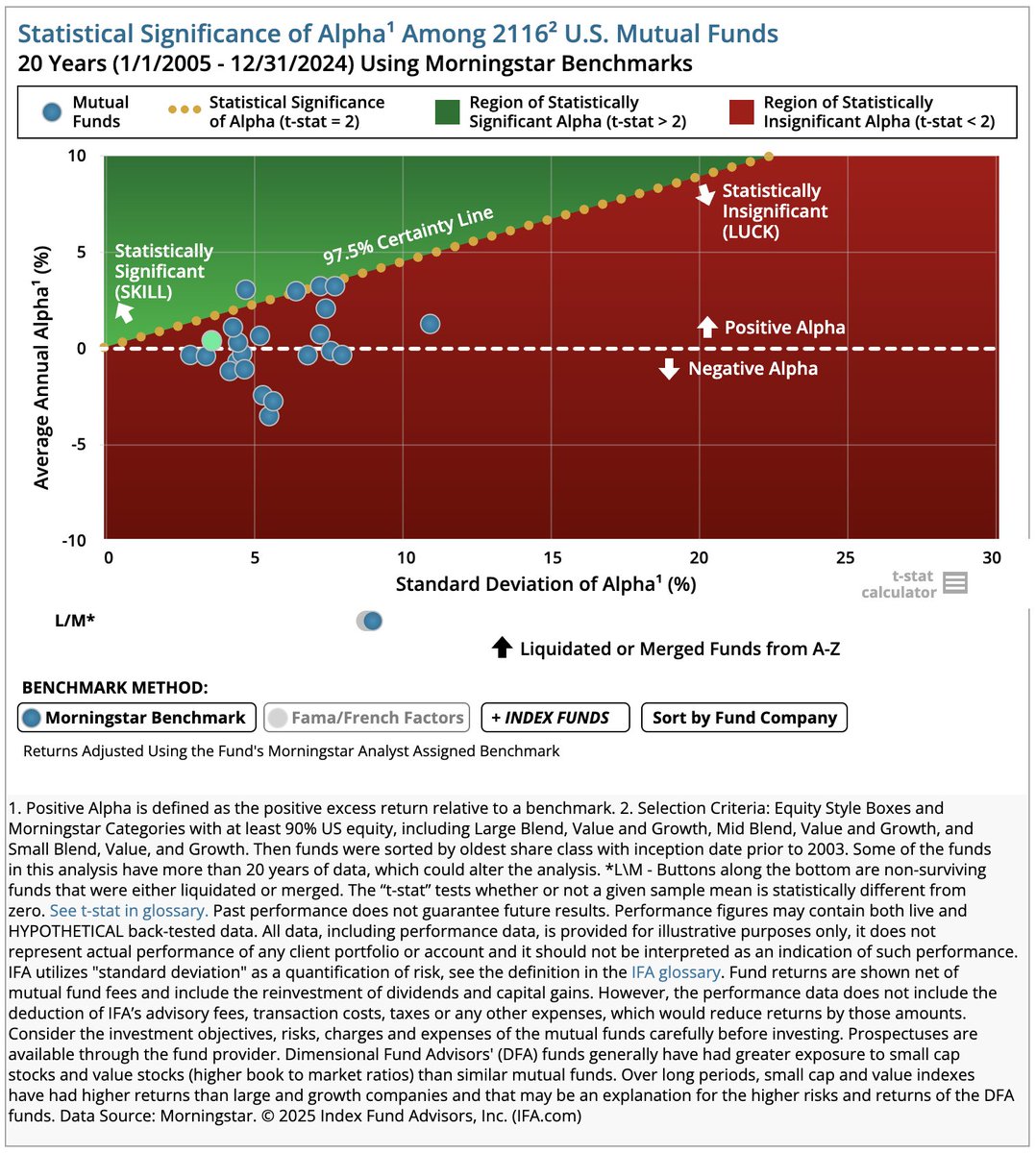

The name Fidelity is synonymous with active fund management. But how good are its active funds in reality? @IFAdotcom analysed 136 Fidelity funds with 30+ years of performance data. How many showed statistically significant skill at beating benchmarks? Zero. 🔗…

Accidental death and dismemberment insurance is not the same as a normal term insurance. You don’t want to have to have to pass away a certain way for your life insurance benefit to pay out… AD&D policies are way to limited to make sense for the vast majority of situations.

When it's hard to stomach the premiums of insurance policies, here is a good way to think of it: "I want the insurance company to win, because that means I am not disabled and I'm still alive." There is a way bigger problem if you need the coverage but never got it.

Today is a good day to buy stocks.

The need to look rich is what keeps most people from getting rich.

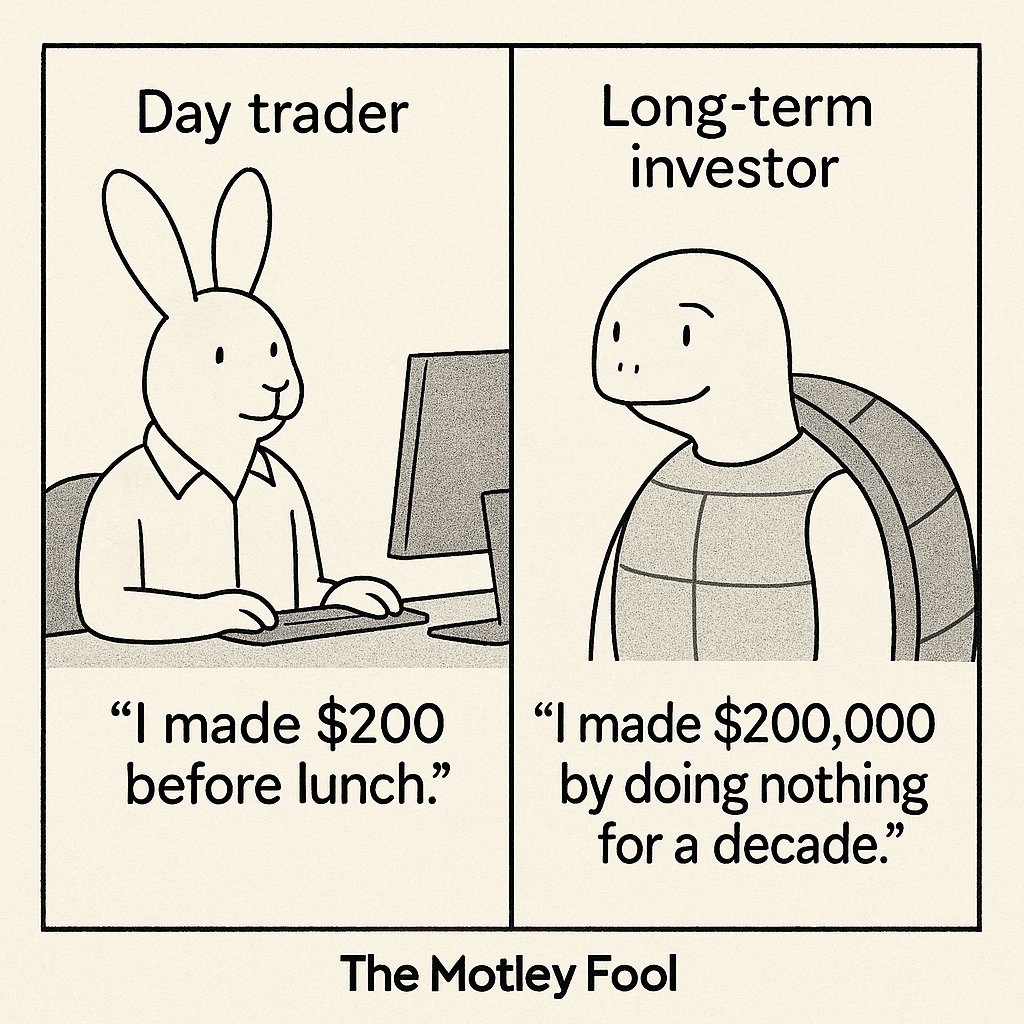

He bought puts, sold calls, opened a spread, added leverage… Still underperformed the S&P 500.

Boring portfolios build exciting lives.

Inflation is always and everywhere a monetary phenomenon.

Inflation is defined as a rise in prices across an economy. When this happens, money doesn't go as far as it used to. s.hbr.org/3Wvjh0a

hbr.org

What Causes Inflation?

What causes inflation? There is no one answer, but like so much of macroeconomics it comes down to a mix of output, money, and expectations. Supply shocks can lower an economy’s potential output,...

🧐 44% of American Workers Delaying or Canceling a Major Purchase Like a Home or Car Due to Feelings About Job Security

Vanguard “fundamental” analysis of crypto… “It’s an immature asset class that has little history, no inherent economic value, no cash flow, & can create havoc within a portfolio.” Makes you think.

Since 1928, the stock market has delivered positive returns in: 88% of all 5-year periods 94% of 10-year periods 100% of 20-year periods History shows that the longer you hold your stocks, the greater your chances of long-term success.

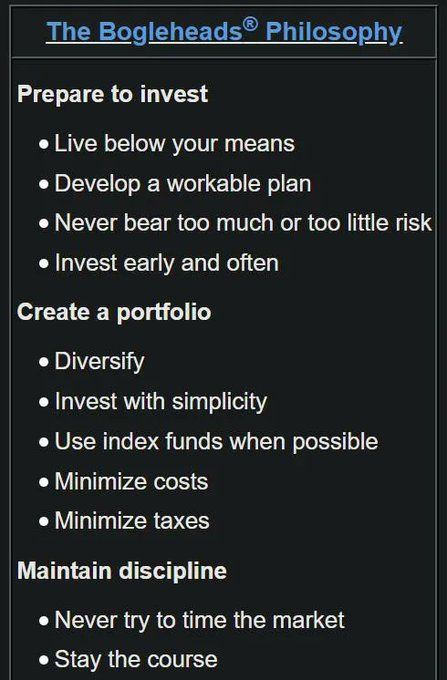

#Investing success isn't complicated. It all comes down to a few key principles. Link below:

Smart investing quotes for more #Investing wisdom visit our website evidenceinvestor.com #Finance #StockMarket #MoneyTalk

United States Trends

- 1. Jonathan Ross 30,2 B posts

- 2. Martinelli 11,8 B posts

- 3. JD Vance 219 B posts

- 4. Renee 1,27 Mn posts

- 5. Liverpool 171 B posts

- 6. #ARSLIV 25 B posts

- 7. Arsenal 326 B posts

- 8. Frimpong 7.981 posts

- 9. McDaniel 39,9 B posts

- 10. Charlie Kirk 196 B posts

- 11. Simeone 27,6 B posts

- 12. Josh Hawley 15,4 B posts

- 13. Vini 30,2 B posts

- 14. Isiah 5.249 posts

- 15. Saka 39,6 B posts

- 16. Valverde 54,5 B posts

- 17. Bradley 15,3 B posts

- 18. Lewis Skelly 2.509 posts

- 19. PTSD 11,9 B posts

- 20. #Minneapolisprotests 4.977 posts

Something went wrong.

Something went wrong.