Global Alpha Pulse

@GlobalAPulse

Former banker. Unpacking global macro trends, financial markets & investment themes

AI is already reshaping the stock market. 70% of trading volume is now algorithmic. Real-time sentiment analysis, predictive models, and automated portfolio management are the new normal. Retail investors get AI-powered insights once reserved for Wall Street.

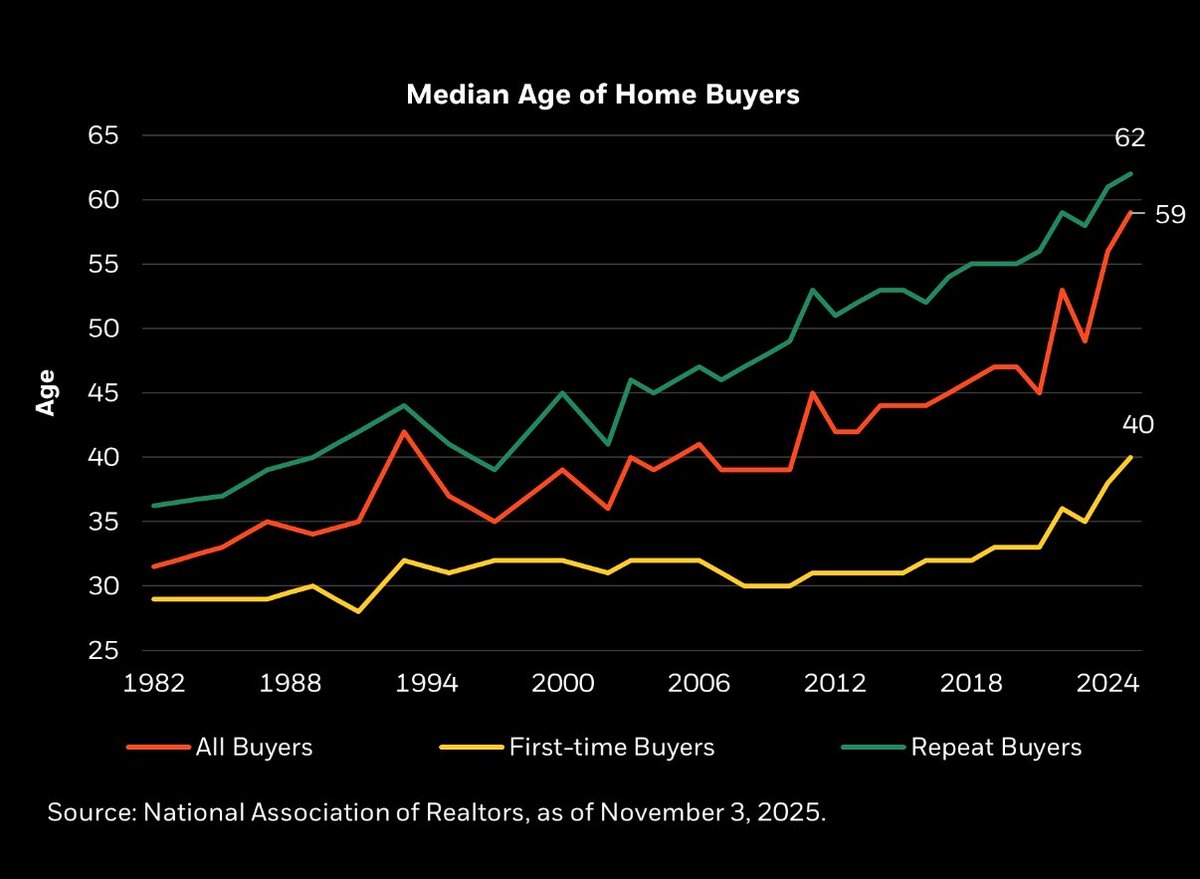

If 56 is the new median homebuyer age, what does that mean for the next generation?

An important chart from @RickRieder showing the across-the-board increase in the median age of home buyers which, in turn, is a reflection of the growing housing affordability pressures … and, associated with that, both a “lock-out” effect (i.e., harder for first time buyers to…

Market update: S&P 500 down 0.8% to 6,917, Nasdaq fell 1.4% to 23,255. Tech stocks led the decline with Nvidia and Microsoft dropping. Gold rebounded while Treasury yields eased. Volatility continues as investors reassess risk.

Palantir's Q4 2025 earnings are phenomenal: $1.4B revenue (+70% YoY), U.S. commercial revenue up 137%, and a Rule of 40 score at 127%. Guiding for 61% growth in FY26. Truly becoming a software powerhouse.

$PLTR PALANTIR Q4 2025 EARNINGS: - $1.4B Revenue, +70% YoY - U.S. Revenue $1.71B, +93% YoY - U.S. Comm Revenue $507M, +137% - U.S. Gov Revenue $570M, +66% - Rule of 40: 127% - Guiding for 61% FY 26 growth Palantir is becoming one of the greatest software companies in history.

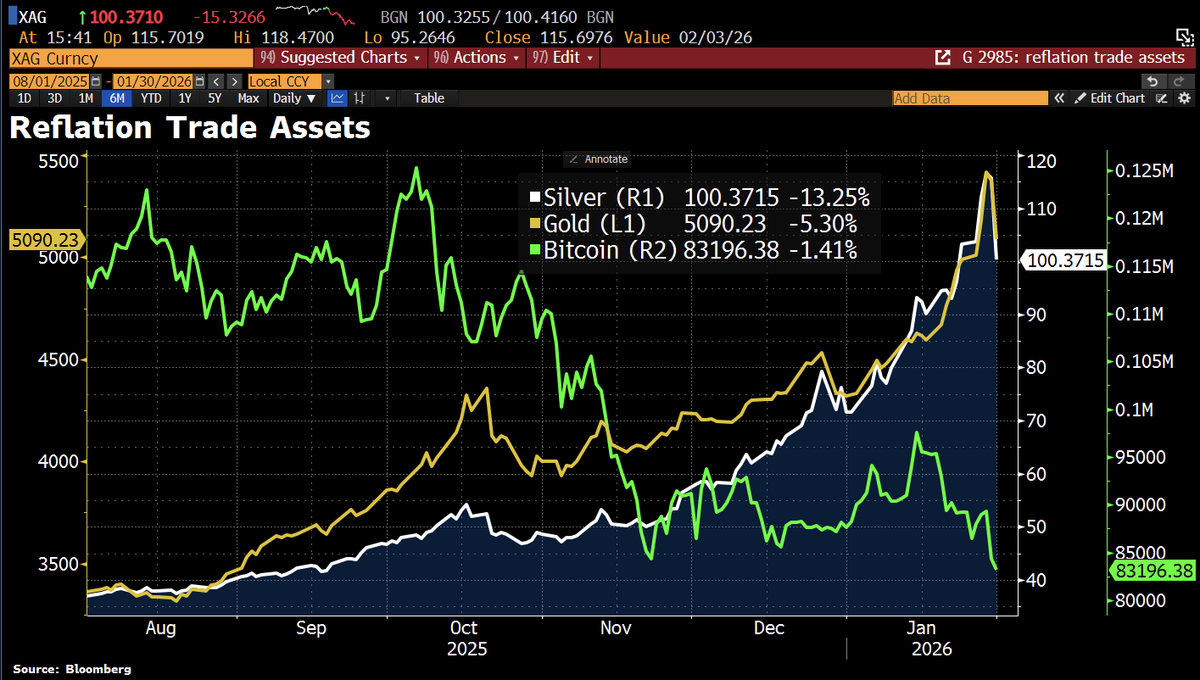

Precious metals getting crushed. Gold -5% Silver -10% Oil -5% Speculators drove the rally. Now they're driving the selloff. Institutions? Still waiting on the sidelines.

This chart from the Financial Times illustrates the significant ongoing volatility in precious metals, as speculators have effectively sidelined institutional investors for the time being. Gold is currently trading down 5%, while silver has slumped 10%. The pressing question is…

Warsh nomination creating chaos. He wants: Lower interest rates (good for assets) Smaller Fed balance sheet (terrible for assets) Pick one. You can't drain liquidity while cutting rates.

Investors betting on reflation don’t seem thrilled by Kevin Warsh’s Fed nomination. Gold, Silver and Bitcoin – assets that benefit from abundant Fed liquidity – are all down today. While Warsh supports lower interest rates, he also wants the Fed to shrink its balance sheet, which…

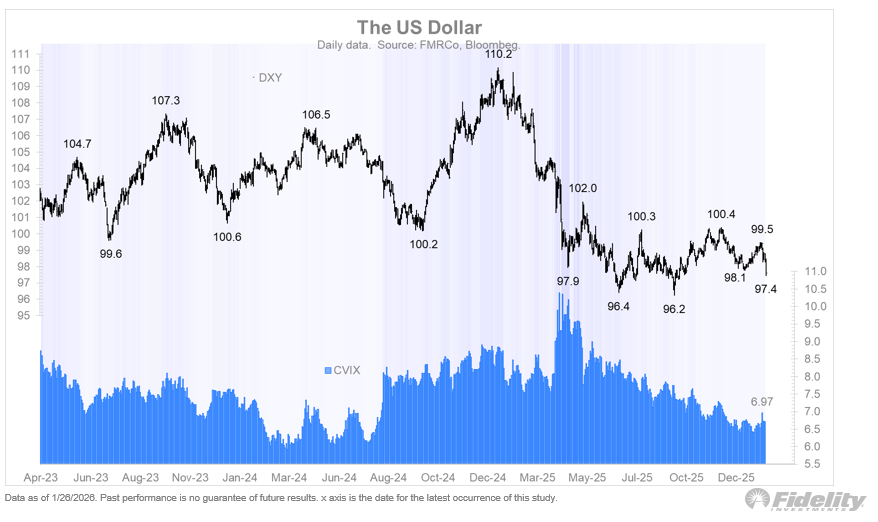

$5.9T evaporated in 30 minutes DXY down 2% in January World exiting dollar hegemony This is transformation.

🔥 THE FIAT MIRAGE COLLAPSE: $5.9 TRILLION IN GOLD & SILVER EVAPORATED FASTER THAN JEROME POWELL’S DIGNITY AT A PRESSER 🔥 $5.9 TRILLION. Gone. In 30 minutes. Meme stocks? No. In precious metals. This is a structural cardiovascular failure in the global monetary circulatory…

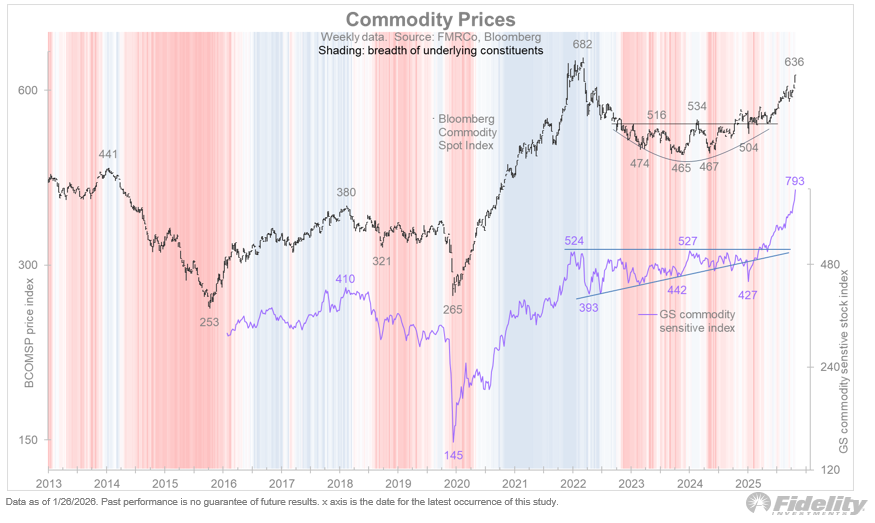

"All commodities becoming strategic assets in a multipolar world" This hits different. When everything becomes geopolitical, everything becomes an investment thesis Gold, oil, copper - it's all national security now

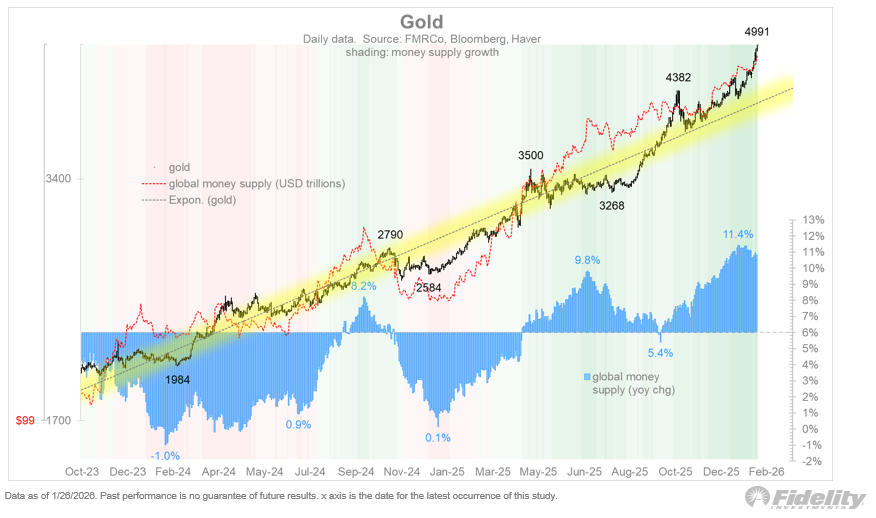

The bond market, precious metals, and currencies seem on edge, and as the chart shows below, there’s a bit of déjà vu with regards to the interplay of the 10-year Treasury yield, the dollar index, and gold. Tariffs or not, the world order is changing from a dollar-only standard…

Rate checks don't mean intervention. NY Fed does this stuff all the time. Markets front-running something that might not happen. Plaza Accord comparisons are a stretch

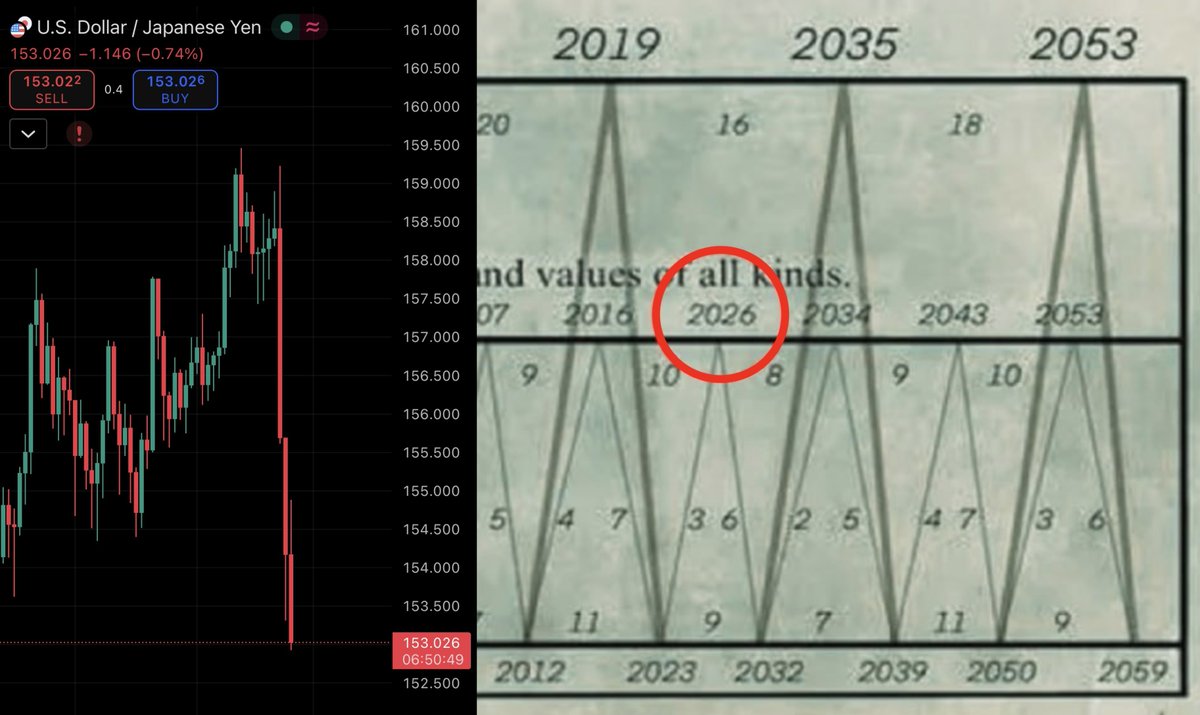

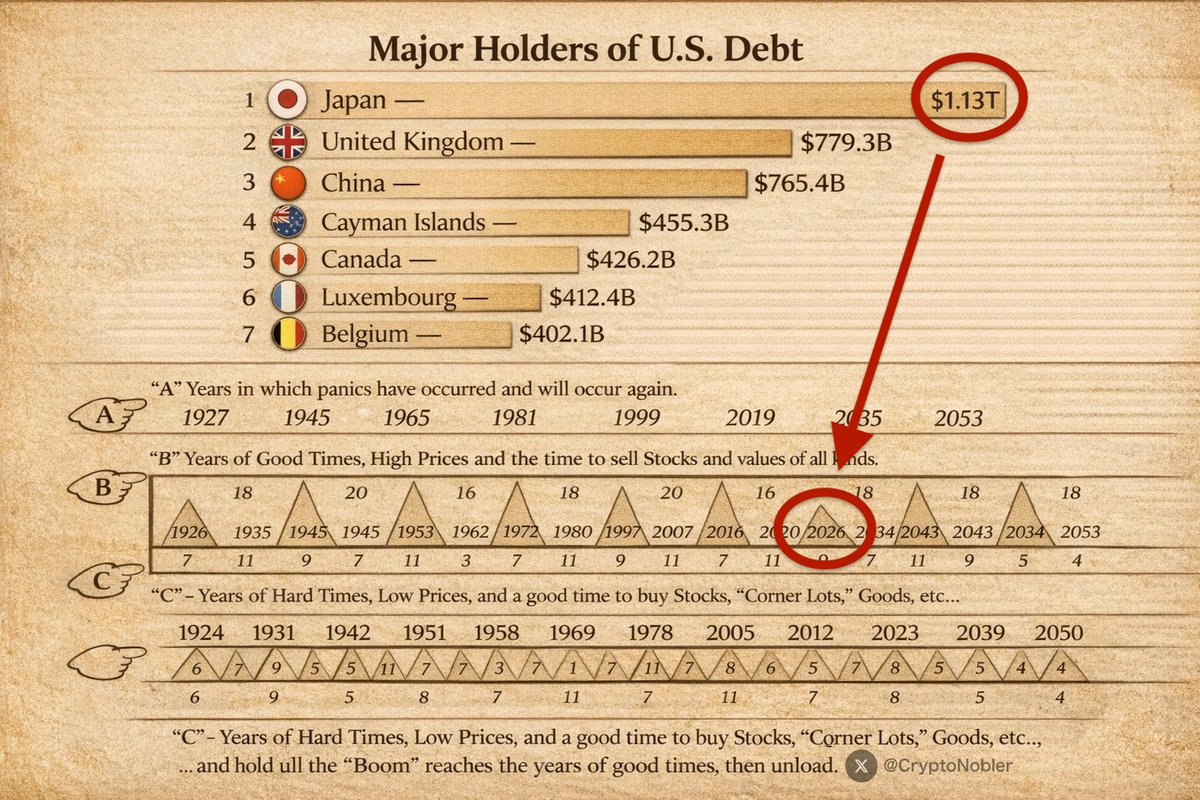

🚨 US WILL SAVE JAPAN BY CRASHING THE DOLLAR IN THE NEXT 24H!!! And it's already happening RIGHT NOW! Forget tariffs. Forget Gold & Silver hitting ATH. For the first time in a decade, the NY Fed is signaling intervention. They are about to save the Japanese yen. Listen…

while Japan's policy shift is real, markets have survived major capital flow reversals before. this might be more manageable than the doom predictions suggest.

🚨 JAPAN WILL CRASH THE U.S. DOLLAR IN 3 DAYS!! Markets are completely unprepared for what will happen next week. The Bank of Japan is now forced to abandon decades of Yield Curve Control. That era is over. And what comes next is far more destabilizing than people expect: To…

WSB picking space stocks and ai plays for 2026. they're missing the obvious one: $NVDA. how do you have a tech list without the ai king?

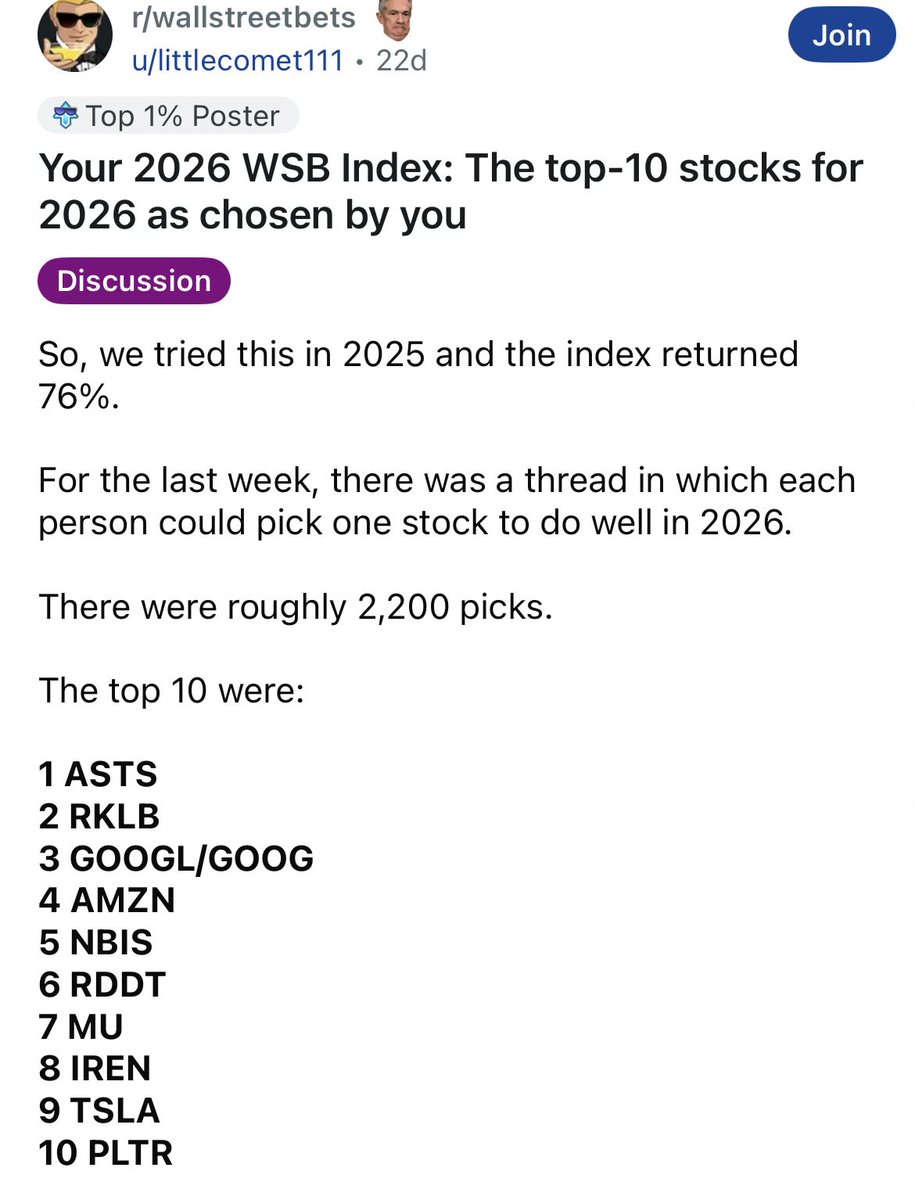

Reddit’s r/wallstreetbets announced its top 10 stocks for 2026 Last year, their Top 10 Stocks of 2025 returned 76% 👀 1 $ASTS 2 $RKLB 3 $GOOGL 4 $AMZN 5 $NBIS 6 $RDDT 7 $MU 8 $IREN 9 $TSLA 10 $PLTR What stock are they forgetting?

$INTC beats lowered expectations while revenue still declining. supply shortages masking deeper competitive issues?

Alphabet up nearly 2% on UBS price target raise ahead of Q4 earnings (Feb 4) and broader market rally after Trump eases tariff threats. Stock up 65% over past year.

EUR/USD trying to break 1.1630 after bouncing off 200-day MA. Greenland drama might be the catalyst it needed marketpulse.com/markets/eurusd…

Good reminder that portfolio protection isn't just about timing. having hedges in place before you need them is key marketwatch.com/story/how-inve…

marketwatch.com

Wall Street’s ‘fear gauge’ is rising — here’s how investors can protect their portfolios before...

U.S. markets have been fairly calm so far in 2026, but that hasn’t stopped the Cboe Volatility Index, better known as the VIX or the stock market’s “fear gauge,” from creeping higher.

Whether it’s untangling literary theory or real-world insights, Perplexity AI is my go-to for decoding complexity. It’s how I keep my head above the piles of books and opinions. 📖

My 2025 favourite books 📚 In no particular order: — Strange Pictures — The Lantern of Lost Memories — The Travelling Cat Chronicles — Bookstore Girls — We’ll Prescribe You Another Cat — The Ex-Boyfriend’s Favourite Recipe Funeral Committee

Este año 2025 he terminado: 17 libros 40 series / temporadas 63 107 películas 26 videojuegos

My fun goal for 2025 was to read my height. Not super hard since I'm so small, but I smashed it! 📚

My longest relationship is with procrastination and my bookshelf (both toxic, obviously). Can a girl just finish one book and prove her parents wrong? 🙃

United States Trends

- 1. Seahawks N/A

- 2. Seahawks N/A

- 3. Super Bowl N/A

- 4. #PuppyBowl N/A

- 5. #HiltonForTheStay N/A

- 6. Liverpool N/A

- 7. Pats N/A

- 8. Damian Lillard N/A

- 9. Kid Rock N/A

- 10. Dame N/A

- 11. #PepsiTasteWins N/A

- 12. #HardRockBet N/A

- 13. Haaland N/A

- 14. Hess N/A

- 15. Scottie N/A

- 16. #PepsiEntry N/A

- 17. Alvarado N/A

- 18. Diawara N/A

- 19. Bobby Portis N/A

- 20. Slot N/A

Something went wrong.

Something went wrong.