你可能會喜歡

I'm a RE guy & have followed Trump since I was a teenager. I've also provided flawless Political commentary this season. Assuming he wins, here is how I see it playing out & why the market has alot of things 'wrong': 1/2 the Country has TDS & the mArKeT assumes he will be the

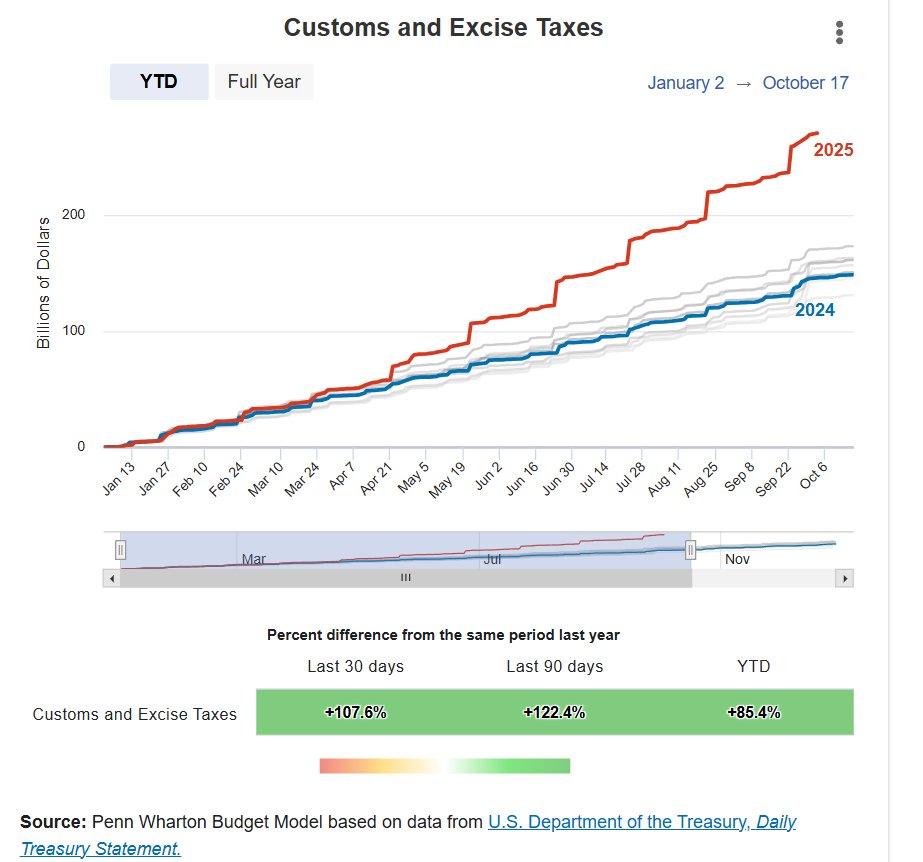

Hey let me just set the record clear to all the talking heads and residual risk biased cheerleaders. Tariffs are a tax. This is the largest tax increase on a global scale that almost anyone alive has ever seen. If you fell prey to anyone trying to sell you that this was…

the worst thing about gold going to infinity is that your crazy uncle rob was obviously right about the whole thing and in fact was right about pretty much everything so you should really update to listening to him more but unfortunately he's crazy and priors are important right

People call this a credit event. I call it a legal event. Credit risk is when the borrower cannot pay. Legal risk is when three lenders show up at court waving the same invoice. The borrower is fine. The system is not.

We are losing a Credit/Private Equity/CLO expert when we need him most!! 🥹 Geoffrey sums up well: "Every equity investor who has not survived a previous credit cycle believes that credit cycles do not exist or do not matter. As the credit cycle hits, those are washed away and…

One of the all-time great X posts

A Post-Crash Pilot Debrief from The White Whale $62M - gone in a flash. But as was repeatedly pounded into my head in pilot training: any landing you can walk away from is a good landing. As I’ve been processing yesterday’s events, I want to share a few thoughts from a place…

hot take: you should not make fun of people who have killed themselves even if you think their positioning was dumb

Monday will be super interesting for margin calls. Why? Systematics (var controlled funds, cta) will be big sellers ( hearing on x up to 100$b) over time Well how do u satisfy margin calls. 3 ways 1 liquidate some crypto - well with $20b liquidated on Friday less likely 2 move…

Depends precisely how we close, but my estimate of 1 day systatic selling is roughly equivalent of 1 month worth of retail buying. Big part of past months' rally was riding systematic tailwinds.

Millions of young Gen z guys just got their entire net worth wiped out in seconds. 10x leverage and a 10% flash crash will do that to you. These people will be scarred from risk assets for life.

The $10B liquidation figure floating around is fake, the real number is likely much higher, somewhere in the $30B–$40B+ range. On Hyperliquid alone, nearly $7B was liquidated. Here’s the full breakdown for anyone interested: Total liquidations since 20:45 UTC: - Total Value:…

I'd wager that the coordinated Crypto smash this afternoon will be looked back at as the biggest financial news of October, 2025. Particularly in the YEARS ahead. And Brother, I'm following the 🍊👑 & 🇨🇳 SITUATION closely.

I'm fairly certain we'll look back at this as the biggest financial news of September. Canaries. Coal mines. All that.

In case you didn’t know - the BTC whale closed 90% of his BTC short and fully closed his ETH short, making around $190–$200M profit in just one day on Hyperliquid. The crazy part is that he shorted another 9 figs worth of BTC and ETH minutes before the cascade happened. And this…

Trump TACOs only get served when the bond market sells off. Today, it is rallying

FUCK YES!!! 1. This is exactly how he should be handling 🇨🇳 2. This might FINALLY blow out the lingering bond shorts 3. Pumping markets for months & months bought him some 'license' for another April PARTY.

*TRUMP: US WILL IMPOSE 100% TARIFF ON CHINA STARTING NOV 1 *TRUMP: US TARIFF ACTION BASED ON CHINA'S EXPORT CONTROLS

Reminder: First Brands was a widely held BSL and $2.3B allegedly just vanished Now think about private credit deals with 2-3 lenders, quarterly (maybe) reporting, and marks set by the people who made the loan If this happened in the visible market, what’s happening in the…

Sticking my ding dong out there a bit... I'm selling LOTS of puts on the 10-year at ~ 4.15%. Some ITM puts as well. I'll be taking no further questions at this time. (Jobs market is not improving)

United States 趨勢

- 1. Jets 101K posts

- 2. Justin Fields 20K posts

- 3. Broncos 43.3K posts

- 4. James Franklin 31.5K posts

- 5. Drake Maye 8,303 posts

- 6. Aaron Glenn 8,332 posts

- 7. Puka 6,629 posts

- 8. George Pickens 3,561 posts

- 9. Penn State 45.7K posts

- 10. Cooper Rush 1,650 posts

- 11. Steelers 36.3K posts

- 12. Sean Payton 3,601 posts

- 13. Tyler Warren 1,966 posts

- 14. London 202K posts

- 15. TMac 1,587 posts

- 16. Jerry Jeudy N/A

- 17. #DallasCowboys 1,957 posts

- 18. #Pandu N/A

- 19. Garrett Wilson 4,975 posts

- 20. #HereWeGo 2,545 posts

你可能會喜歡

-

Goehring & Rozencwajg

Goehring & Rozencwajg

@Go_Rozen -

Marhelm

Marhelm

@MarhelmData -

Coal Newswire

Coal Newswire

@CoalNewswire -

Ferg

Ferg

@trader_ferg -

LazCap

LazCap

@Laz_Cap -

Kuppy's Korner

Kuppy's Korner

@kuppyskorner -

🏴☠️

🏴☠️

@calvinfroedge -

Tommy Lee

Tommy Lee

@TommyDeepwater -

contrarian 8888

contrarian 8888

@contrarian8888 -

Bison Insights

Bison Insights

@BisonInsights -

Billy No Mates

Billy No Mates

@Billypasdemates -

Ed Finley–Richardson

Ed Finley–Richardson

@ed_fin -

Yellow Lab Life Capital

Yellow Lab Life Capital

@YellowLabLife -

MARKETS FULL OF R3TARD5

MARKETS FULL OF R3TARD5

@ShitValueFund -

The Coal Trader

The Coal Trader

@dyer440

Something went wrong.

Something went wrong.