GoMining Institutional

@GoMiningInst

Structured Bitcoin Mining & Yield Strategies for Eligible Investors | Scalable, Compliant, Professionally Managed.

Bitcoin mining. Built for institutions. See everything GoMining Institutional brings together — with structure, security, and scale.

GoMiners, we had to reschedule today’s session, and we apologize for the confusion across channels. Thank you to everyone who planned to join — we appreciate your patience and understanding! 🔔 Set a reminder for tomorrow’s webinar: linkedin.com/events/7399524…

The GoMining Institutional webinar has been rescheduled to Thursday, November 27 at 12 PM ET. Set your reminder - see you there.

Hydropower remains one of Bitcoin mining’s most strategic energy sources. From Paraguay to Bhutan, miners continue to follow the flow of efficient, underused energy. But why does hydro still dominate the mix? Watch the highlight from our webinar on why miners keep turning to…

The GoMining Institutional webinar has been rescheduled to Thursday, November 27 at 12 PM ET. Set your reminder - see you there.

No single chart explains Bitcoin. But when market, on-chain, and mining signals line up, that’s where the real shifts happen. Join @Smidnico & Fakhul Miah from @GoMiningInst as they break down: 🔹 Cycle signals that matter 🔹 Mining profitability trends behind current margins…

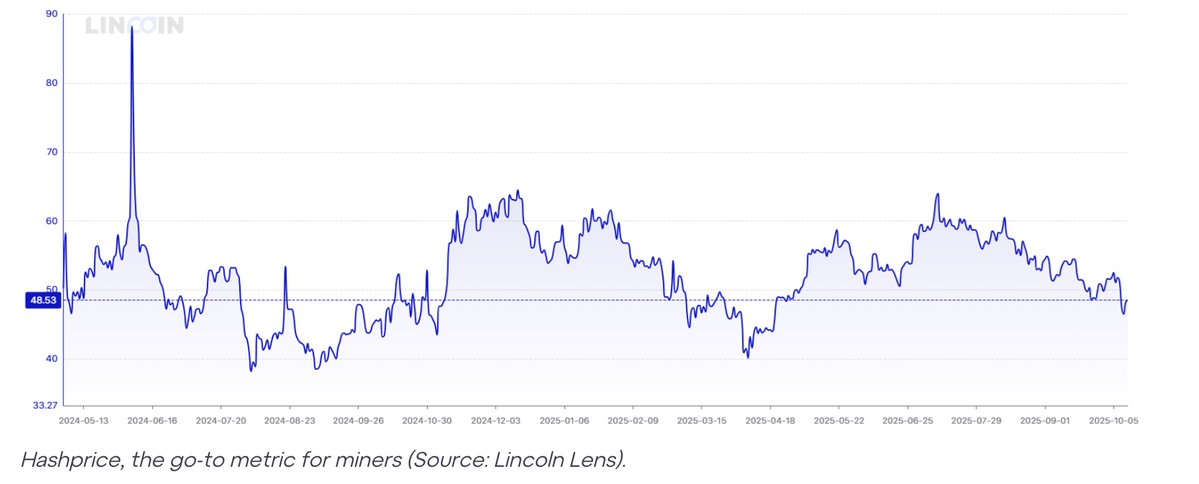

Bitcoin miners earn in BTC but pay in fiat. That mismatch defines the industry’s financial reality. To stay liquid without selling too much Bitcoin, miners are: • Diversifying into hosting, heat reuse, and grid services • Using hedging, forward sales, and BTC-backed loans…

No single chart explains Bitcoin. But when market, on-chain, and mining signals line up, that’s where the real shifts happen. Join @Smidnico & Fakhul Miah from @GoMiningInst as they break down: 🔹 Cycle signals that matter 🔹 Mining profitability trends behind current margins…

Most Bitcoin top signals are just noise. Our new research shows why no single model works, and why multi-signal convergence is the only thing that matters. If you want to understand how cycle tops actually form, start here 👇 gomining.com/blog/navigatin…

What powers more than half of Bitcoin’s network? — Renewables now supply ≈ 42 % of total energy use — Adding nuclear brings sustainable sources above 50 % — Hydro leads (23 %), with wind and solar growing fast The data challenges old assumptions about Bitcoin’s footprint.…

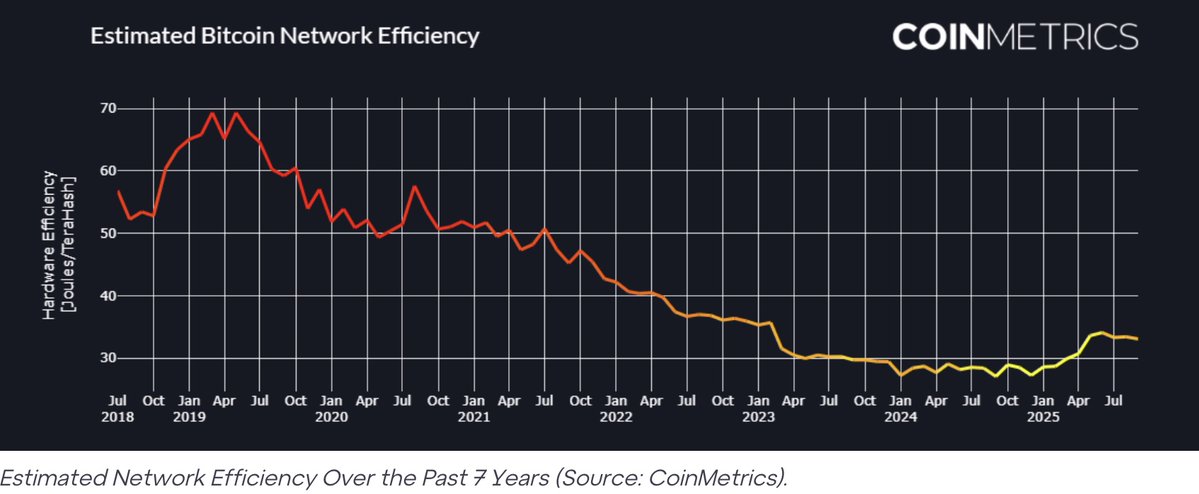

Bitcoin miners can’t raise prices — revenue is set by protocol and market. Where do they compete instead? • Power costs ($/kWh) • Hardware efficiency (J/TH) • Timing ASIC cycles and capex Margins flow to operators who treat cost control as their main lever. Read the full…

Institutional capital is shifting from passive Bitcoin exposure to active ownership of the systems that produce it. As GoMining CEO @MarkZalan_ highlighted in a recent conversation with @Investingcom — mining infrastructure provides operational leverage and steady yield…

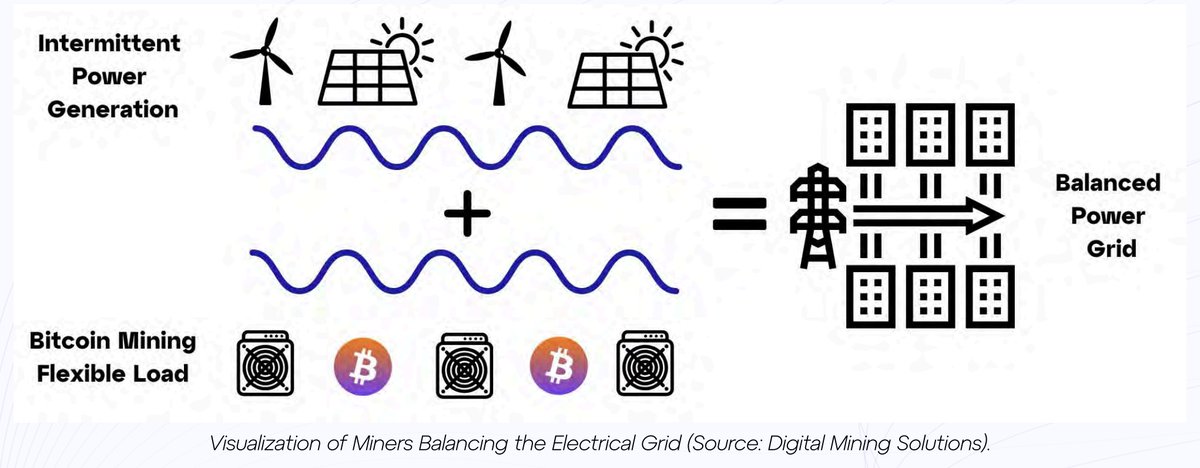

What happens when Bitcoin’s biggest criticism becomes one of its strengths? — Mining now helps balance grids and reuse wasted energy — 25 GW equals less than 1 % of global power demand — Flare gas, hydro, and curtailed wind turn into productive supply Watch the highlight from…

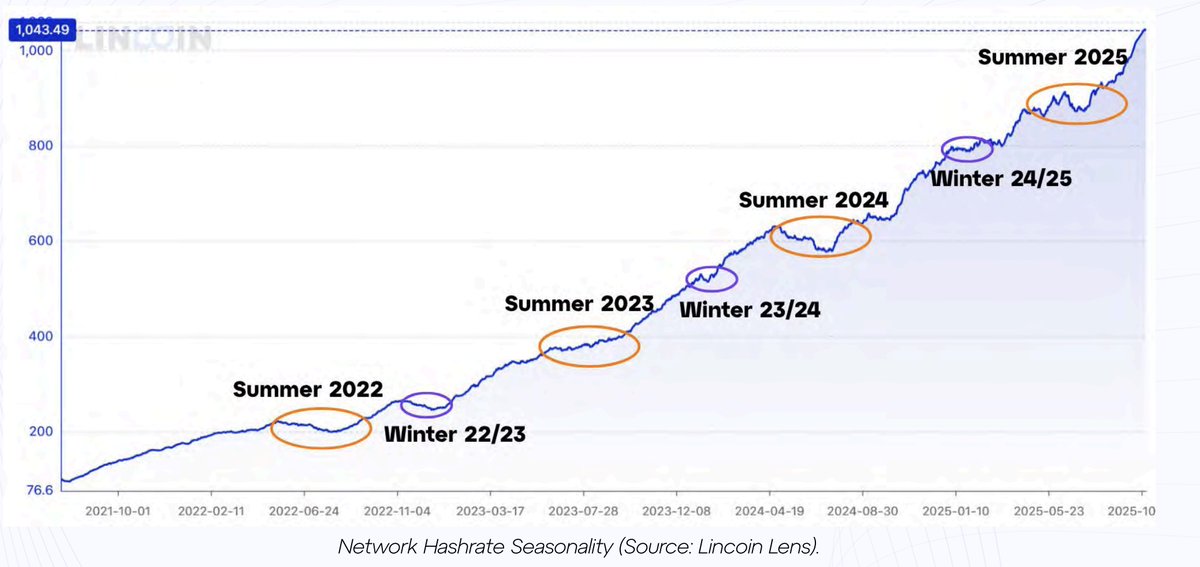

Hashrate tells a story beyond price. Each summer, U.S. miners scale back during grid peaks and global hashrate dips in sync. This flexibility turns mining into a grid-balancing load, not just an energy consumer. Now, as AI enters the same power markets, how will these two…

Mining isn’t just consuming energy — it’s balancing it. Miners now act as flexible grid loads, curtailing during peaks and absorbing surplus from renewables. A model once criticized as wasteful is becoming a stabilizer. See how this dynamic unfolds in our Q3 Report:…

Bitcoin miners can’t control BTC’s price or network difficulty, yet some consistently stay ahead. What do they know that others miss? We broke it down in full. Read the article here: gomining.com/blog/miner-pro…

Bitcoin’s October told a story of resilience. As gold peaked and corrected, Bitcoin held key support, institutions doubled down, and miners pushed new records. Is this the start of a rotation back to BTC? 📊 Read our full October Market Update ↓ gomining.com/blog/market-up…

Electricity accounts for up to 80% of mining OPEX. Margins rise and fall with every cent per kWh. In Q3, power strategy — not hardware — defined resilience. How miners source, price, and manage power now shapes who survives the next halving. Insight from our Institutional…

Institutional presence doesn’t just add scale, it reshapes the market. 🔹 Regulation adapts around participation 🔹 Infrastructure expands to meet demand 🔹Bitcoin’s only organic yield still comes from mining How is institutional demand reshaping the Bitcoin yield landscape?…

United States Trends

- 1. Happy Thanksgiving 195K posts

- 2. #StrangerThings5 305K posts

- 3. BYERS 71.2K posts

- 4. Afghan 341K posts

- 5. robin 108K posts

- 6. #DareYouToDeath 157K posts

- 7. DYTD TRAILER 102K posts

- 8. Dustin 62.7K posts

- 9. Vecna 70.8K posts

- 10. Holly 72.1K posts

- 11. Reed Sheppard 7,234 posts

- 12. Jonathan 76.4K posts

- 13. noah schnapp 9,595 posts

- 14. Turkey Day 14.3K posts

- 15. Taliban 44.2K posts

- 16. mike wheeler 10.9K posts

- 17. Rahmanullah Lakanwal 134K posts

- 18. hopper 17.7K posts

- 19. Nancy 71.5K posts

- 20. Erica 20.2K posts

Something went wrong.

Something went wrong.