Captain Rob 🇬🇧

@GoldBugRob

Husband, Father, Business owner, Brexiter, Goldbug

You might like

Since 1964, new U.S. currency has had zero intrinsic value. It's only because of 90% silver in pre-1964 coinage that U.S. currency had any value at all. Now a pre-1964 quarter is worth over $10 and the masses are only now waking up to this 60 years later. #SilverSqueeze

Breaking 🚨 #SILVER JUST TOLD A SLAM TO FUCK RIGHT OFF DUE TO UNPRECEDENTED GLOBAL SILVER SHORTAGE

#Silver purchases by central banks is ENORMOUSLY important. x.com/KingKong9888/s…

The Cat is out of the bag boyz… #Gold #Silver All I can say is that more major central banks are buying physical #Silver… Which country is doing tokenized #Silver hint*. Via Goldbroker.com

I don’t think it’s a coincidence that Silver was added to the critical minerals list and price started moving up even more aggressively than before. The ”big buying” may only accelerate from here as Game Theory continues to play out in the precious metals market. Exciting!

The Cat is out of the bag boyz… #Gold #Silver All I can say is that more major central banks are buying physical #Silver… Which country is doing tokenized #Silver hint*. Via Goldbroker.com

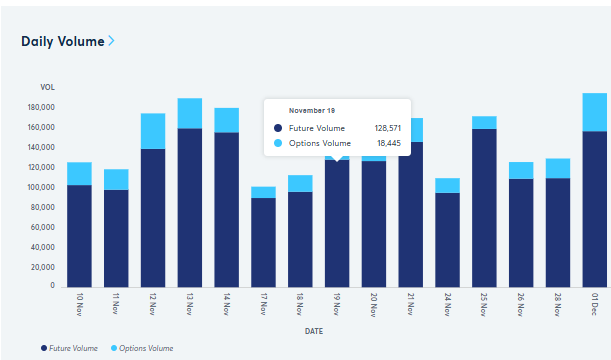

The biggest amount of fictional silver ever traded? Over 1.5 billion ounces in 24 hours. Paper leverage over 500× the physical stock. And they still dare to call this market ‘fair’. 👉 And yet… look at the chart. Even with record-level paper suppression, the price keeps…

Sir Isaac Newton invested in the South Sea Company and lost almost everything and he was smart.

I'm neutral on Bitcoin. Can Bitcoin do another 10x? Yes. Can Gold do a 10x from here? Yes (Gold revaluation). Can Silver do a 10x from here? Yes (end of paper price suppression). Can Bitcoin drop 50%+ anytime? Yes. Can Gold & Silver drop 50% anytime? Unlikely (central bank…

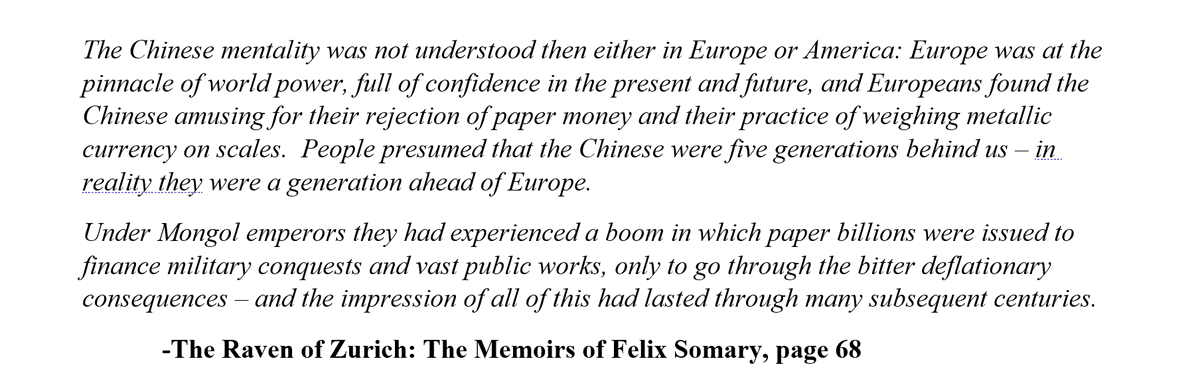

Below is a quote on gold & silver from circa 1910 as quoted in "The Raven of Zurich: The Memoirs of Felix Somary." While many investors (correctly) say, "It's never different this time", most investors do not look back far enough in time. History did not start in 1980 or 1945.

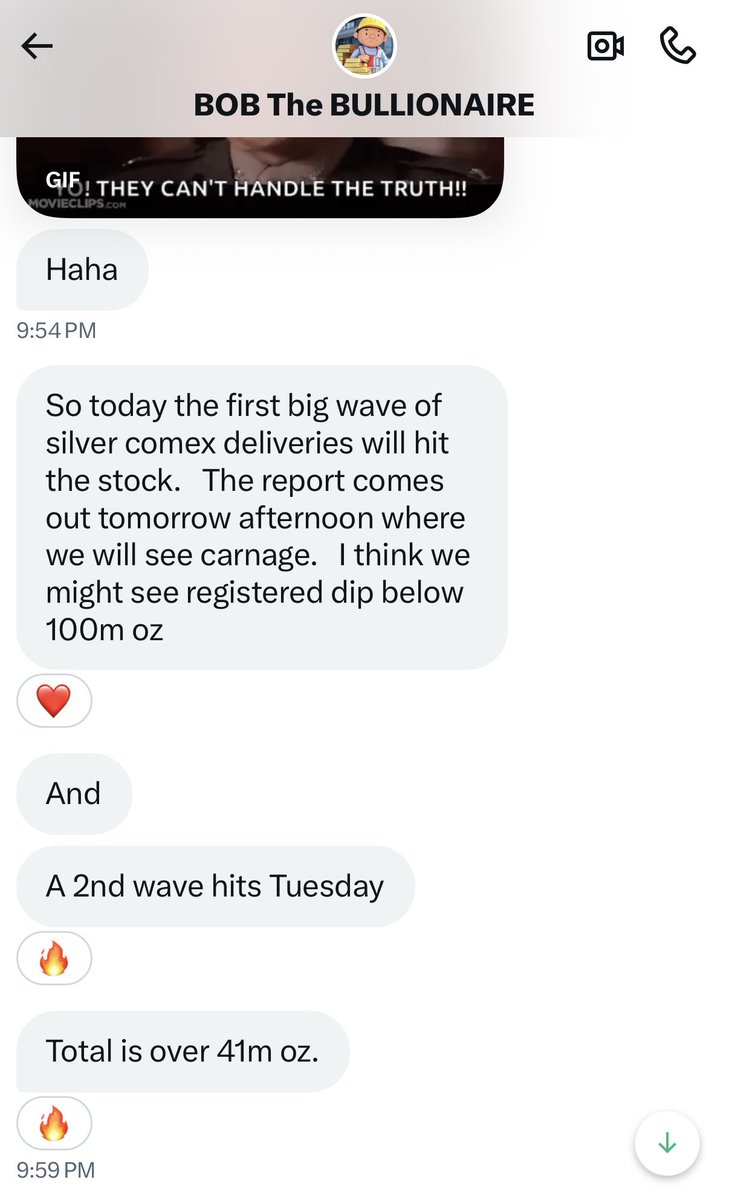

Eric is CORRECT👍 The COMEX could always rely on LBMA in a crunch as they had 100s of millions of free float oz available Those days are long gone👋 Note that depletion have outpaced additions by 8.15x This is a classic DRAIN w/ no material REPLENISHMENT 🚨 #silversqueeze

The psychological resistance to the idea of $100 silver is fascinating. Going to $100 within the next, say, 8 months would represent a completely normal move for silver. Measured from the 2022 pivotal lows that’s about 500%. Comparable to the 2008-2011 run, the 2001-2008 run,…

A single U.S. Dollar in 1980 is now $3.93 in purchasing power. So that $50 high in 1980 would be equivalent to $196 today. It wasn't just the Hunt Brothers that drove that spike. It was inflation fears, lost confidence in the Dollar and a distrust of the system. #SilverSqueeze

#SILVER GOING TO $80

Silver back in a runaway, lockout move. The recent 6 week pause the midpoint of the total move, targeting $80. Similar to prior runaway moves, like 2004 + 2011.

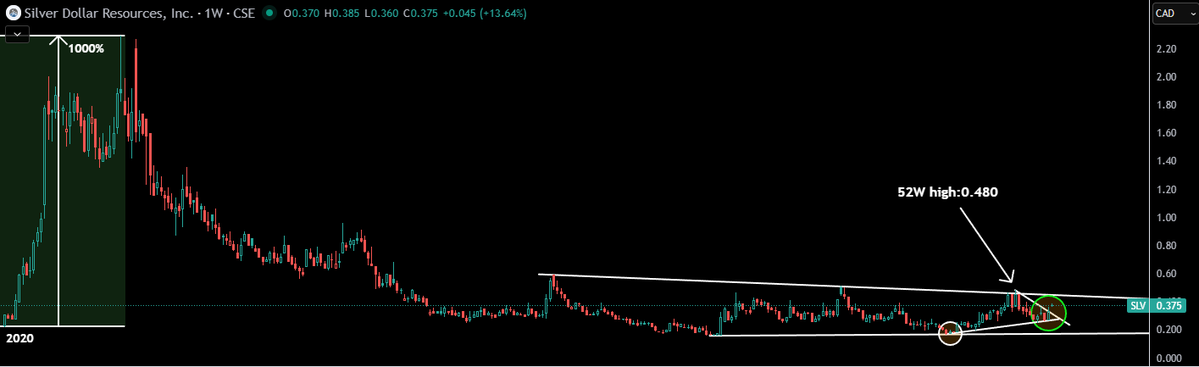

Wanna buy #SILVER #miners but don’t want to chase something already up +13% today and +40% this week? You basically can’t avoid that right now, because they all are. But you haven’t missed anything. When #Silver truly breaks out and the #silver #mining #stocks start their real…

COMEX thought it could run a silver exchange like a fractional reserve bank and that no one would ever do a "run on the bank" let alone nation states and central banks. #SilverSqueeze

What happened to the narrative that #Bitcoin was #digital #gold and a great store of #wealth? I pointed out months ago that #BTC had price movements that correlated with the #nasdaq and behaved nothing like gold Since mid Aug the GOLD/BTC is up 80% They clearly are opposites.

⏰You wanna make money on the #SILVER rush? Here is the (Mostly Juniors) #Silver #Mining #Stocks you need to own, and the #silver stocks you can own or should pay attention to: My core positions right now: $AGMR.v - Silver Mountain Resources (going into production 2026)…

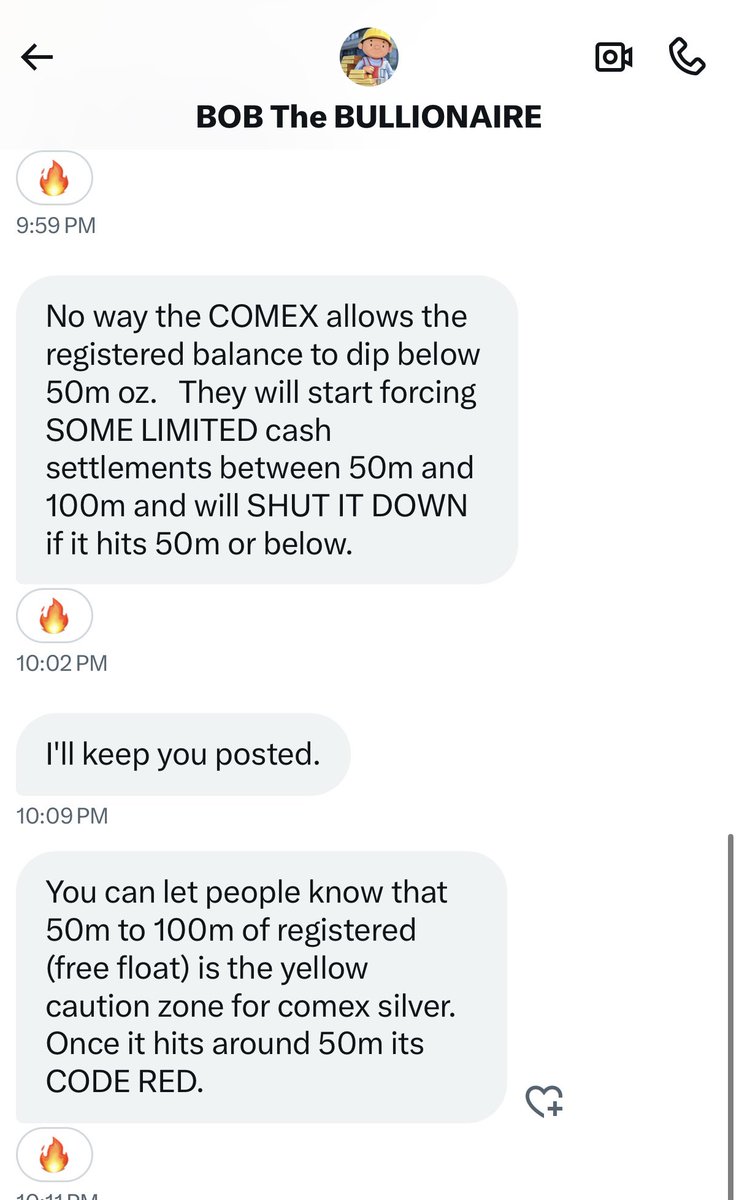

Thanks @BullionaireBob “No way the COMEX allows the registered balance to dip below 50m oz. They will start forcing SOME LIMITED cash settlements between 50m and 100m and will SHUT IT DOWN if it hits 50m or below. You can let people know that 50m to 100m of registered (free…

#SILVER AT $0.52 AN OUNCE

SSV has a market cap of $128 million. They have silver reserves of 243 million ounces. So you are paying $.52 per ounce which when extracted will sell for $50+ going to $100 plus. Hell you can’t discover silver for that cost. It is insane!

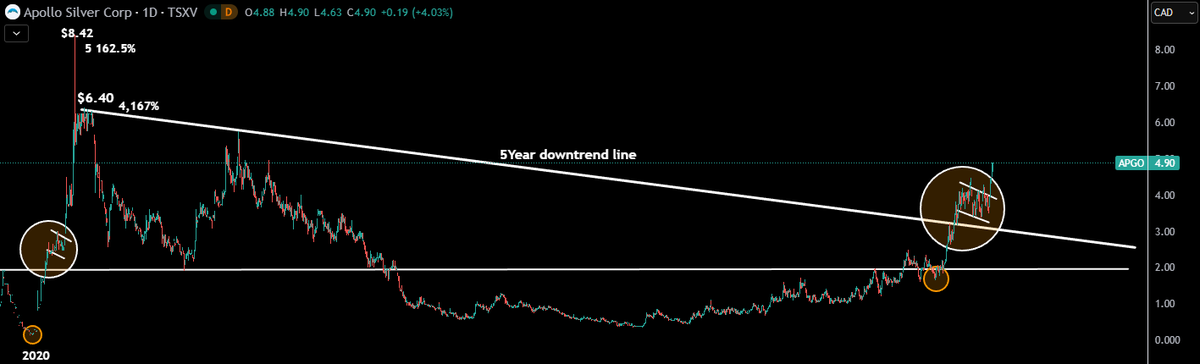

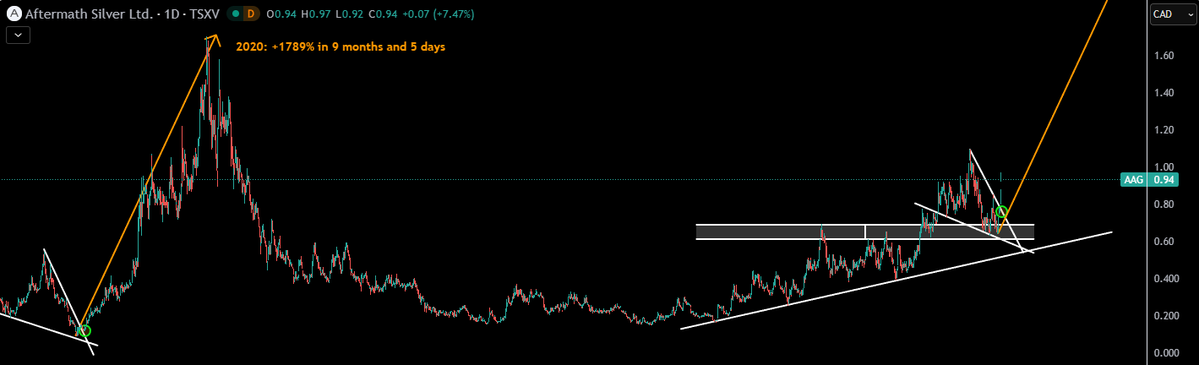

⏰Why Southern Silver ($SSV.v) currently beats every #Silver stock out there at #silver $57: I’ve compared every major silver name side by side at $57 silver: $BCM.v, $AGX.v, $ELO.to, $GSVR.v, $EXN.v, $GRSL.v, $AAG.v, $APGO.v, $AGA.v, $KTN.v, $MGG.v, $SCZ.v, $ASM.to, $APM.to,…

United States Trends

- 1. Chris Paul 4,761 posts

- 2. Pat Spencer 2,598 posts

- 3. Kerr 5,512 posts

- 4. Podz 3,243 posts

- 5. Shai 15.3K posts

- 6. Jimmy Butler 2,619 posts

- 7. Seth Curry 4,697 posts

- 8. Hield 1,577 posts

- 9. Carter Hart 4,013 posts

- 10. Mark Pope 1,941 posts

- 11. #DubNation 1,414 posts

- 12. Derek Dixon 1,283 posts

- 13. Kuminga 1,453 posts

- 14. Brandy 8,251 posts

- 15. #SeanCombsTheReckoning 4,705 posts

- 16. Connor Bedard 2,391 posts

- 17. Caleb Wilson 1,178 posts

- 18. #ThunderUp N/A

- 19. The Clippers 8,389 posts

- 20. Braylon Mullins N/A

You might like

-

Biggus Macus

Biggus Macus

@biggus_macus -

Luciano Pestarino

Luciano Pestarino

@lucpestarino -

Alvaro Barrios

Alvaro Barrios

@AlvaroB63256150 -

Jay Prince

Jay Prince

@jayprince2001 -

yeoldjinman

yeoldjinman

@yeoldjinman -

sodacan bong shaman

sodacan bong shaman

@danny99656 -

TBones

TBones

@tbones2013 -

ike

ike

@nozbiom -

Viktor Rigo

Viktor Rigo

@rigo_viktor -

Brian Armston

Brian Armston

@ArmstonBrian -

Craig Pallister 🍌🦍🚀

Craig Pallister 🍌🦍🚀

@PallisterCraig -

Dan Dee

Dan Dee

@DanDee17611834 -

SzQD

SzQD

@Szkudlar89 -

@sexy_economist

@sexy_economist

@DevinRoundtree -

CarpetCleaningSydney

CarpetCleaningSydney

@CarpetRugSydney

Something went wrong.

Something went wrong.