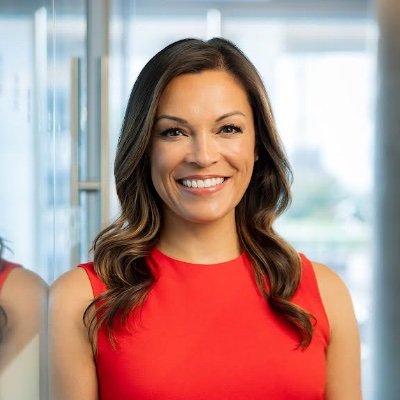

Gunjan Banerji

@GunjanJS

Covering markets & money @WSJ, Contributor @CNBC. Dancer. New Yorker. Reach me at [email protected] On instagram @ gunjansb. Views are my own.

You might like

Thrilled that WSJ's first Netflix documentary, EAT THE RICH, has been nominated for an Emmy award in the business and documentary category Such a fun project to work on with the @WSJ team @charlesforelle @JAVerlaine @EmmaMoodyWSJ @BennyBip , Dan Rosen🚀🚀🚀

"Tthe current equity allocation of retail investors is sitting near the highest levels we’ve seen over the past 20 years or so, while cash allocations are near their lowest levels" -- Piper Sandler

The Trump administration is preparing tariff rollbacks on goods from countries beyond those that have reached trade agreements with the US in effort to lower prices @AnaSwanson @tylerpager me nytimes.com/2025/11/13/us/…

The share of cash/ bonds in Vanguard retirement funds didn't see a meaningful jump after 2022, even while interest rates were at the highest level since 2008 Bond funds made up just 6% of Vanguard retirement funds, cash at 5%. A lot of investors still all-in on stocks

The 20% of small cap stocks with the greatest options volumes make up 70-75% of stock trading --Soc Gen

Who’s the smart money now?

Institutional investors are now buying the dip, too. Retail has been steadily buying for years Via Bofa: "Institutional clients led the buying & have started buying dips YTD. Retail has been the most frequent dip buyer since 2020."

Options trading in Russell 2000 cos that are money-losing, versus those with profits "The majority of this activity looks to be driven by retail investors trading options in the most volatile and loss-making companies." via SocGen

Pearls of wisdom from Warren Buffett's farewell shareholder letter: berkshirehathaway.com/news/nov1025.p…

"Corporate bond spreads have widened somewhat but remain below their average 2024 levels. Their recent upticks are consistent with the softness in equity valuations but do not signal any real concern about a looming economic slowdown" --@DataTrekMB

fascinating how early advances in our understanding of probability were driven by gamblers

Who remembers those Fed balance sheet / S&P 500 charts? You don't see those so much any more

GOLDMAN: “.. the expected change in the unemployment rate over the next year has never been this bad outside recessionary periods since the University of Michigan started asking the question in 1978.” Via @carlquintanilla

Goldman: "We don’t think the AI investment boom is too big. At just under 1% of GDP, the level of spending remains well below the 2-5% peaks of past general purpose technology buildouts so far."

"No-fare bus service would save the average New Yorker $2,000 a year—and cost the city under $800 million annually, Mamdani says" wsj.com/politics/elect…

United States Trends

- 1. #UFC322 116K posts

- 2. Valentina 13.6K posts

- 3. Morales 33.6K posts

- 4. Sark 5,750 posts

- 5. Kirby 18.3K posts

- 6. Georgia 83.4K posts

- 7. Zhang 25.4K posts

- 8. #GoDawgs 9,287 posts

- 9. Leon 72.6K posts

- 10. Ole Miss 11.5K posts

- 11. Bo Nickal 6,819 posts

- 12. Sean Brady 6,327 posts

- 13. Arch 21.8K posts

- 14. Dillon Danis 8,135 posts

- 15. Ahmad Hardy 1,111 posts

- 16. Texas 196K posts

- 17. Bama 22.2K posts

- 18. Gunner Stockton 2,027 posts

- 19. Lebby 1,439 posts

- 20. #OPLive 2,336 posts

You might like

-

Gina Martin Adams

Gina Martin Adams

@GinaMartinAdams -

Lisa Abramowicz

Lisa Abramowicz

@lisaabramowicz1 -

Mark Newton CMT

Mark Newton CMT

@MarkNewtonCMT -

Otavio (Tavi) Costa

Otavio (Tavi) Costa

@TaviCosta -

BrynTalkington

BrynTalkington

@BrynTalkington -

Macro Charts

Macro Charts

@MacroCharts -

Liz Thomas

Liz Thomas

@LizThomasStrat -

Christophe Barraud🛢🐳

Christophe Barraud🛢🐳

@C_Barraud -

David Rosenberg

David Rosenberg

@EconguyRosie -

Steve Donzé

Steve Donzé

@steve_donze -

Tom McClellan

Tom McClellan

@McClellanOsc -

Jeff Weniger

Jeff Weniger

@JeffWeniger -

Ayesha Tariq, CFA

Ayesha Tariq, CFA

@AyeshaTariq -

Katie Stockton, CMT

Katie Stockton, CMT

@StocktonKatie

Something went wrong.

Something went wrong.