HML_Compounder

@HML_Compounder

Engineer with an interest in systematic investing.

Vous pourriez aimer

Tip: if you use gmail and need to give you email to a company you expect to abuse it, then you can add +anything to the end. e.g. for the Washington Post, if your email is [email protected] you can give them [email protected] and you'll still receive the emails they send. But…

Hey @choffstein this may be the 1st time I’ve seen someone use (or suggest using) this fund in the way you intended it 🤣.

2 years ago, I briefly discussed using $RSSB in a well-diversified, naive mix of 50% global stocks, 50% bonds, 50% gold. Short timeframe aside, the idea has proved fruitful recently with gold doing well, and illustrates layering modest leverage onto a mix of uncorrelated assets.

Amazing story and an amazing guy who you all used to know as a blue cube, but today he reveals his face. Best of luck bud, so excited to see where this journey takes ya!

1/ For years I’ve written here anonymously as TrendingValue. That anonymity let me learn in public and speak freely about money and investing. But today I’m stepping out from behind the handle. And sharing a personal reason why.

This is actually a great test for whether you should be managing your own money. If you don’t realize that a completely risk free, “6% real return” investment - if it existed, would be the most awesome deal ever, then it is probably worth the money to hire an expert to help you.

If you could lock into a guaranteed 6% real return on your investments for the next 10 years, would you do it?

So yeah I’m going to announce my identity tomorrow. And some cool news. Wish me luck!

I don’t think $140K makes sense as a poverty line

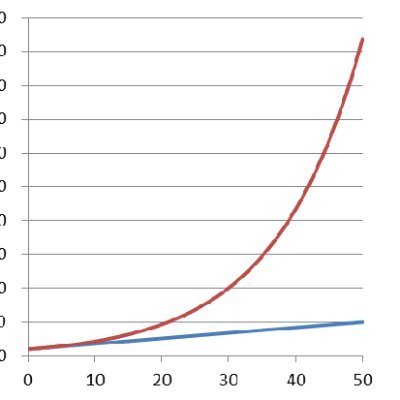

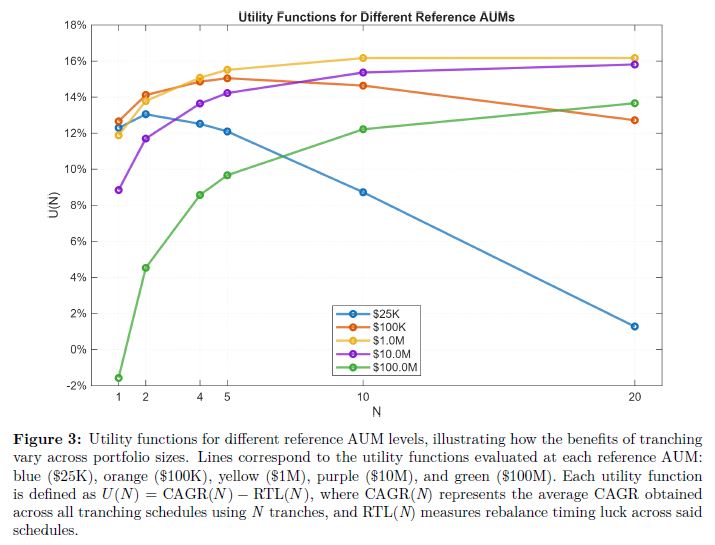

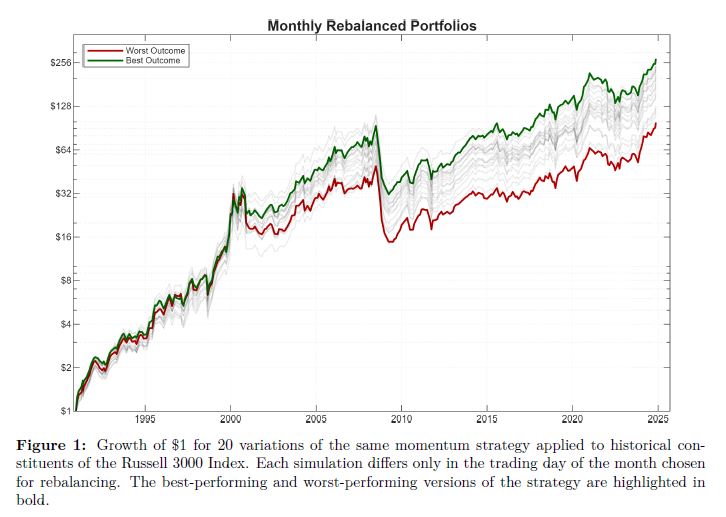

📆 Visualizing Rebalance Timing Luck 📆 Last week, we released our latest paper, “The Tranching Dilemma: A Cost-Aware Approach to Mitigate Rebalance Timing Luck in Factor Portfolios.” The study shows empirically how simply shifting the rebalancing schedule of a concentrated…

Me: yea wtf happened in markets today HFT chat:

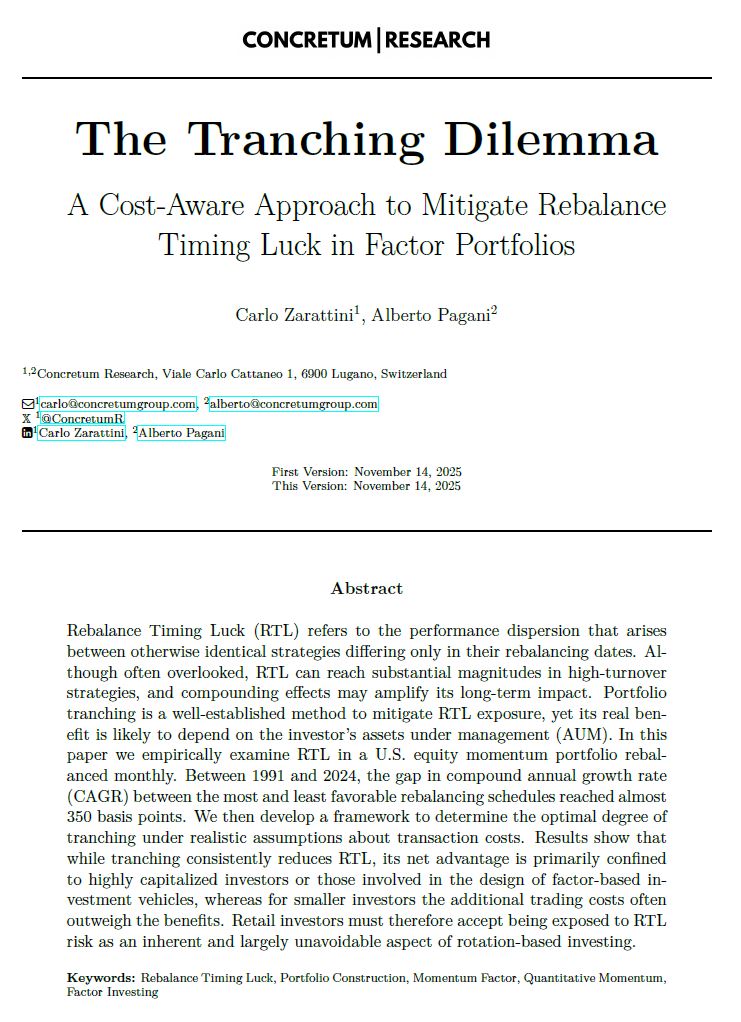

We’re pleased to announce that our new research paper is now available for download on SSRN: 𝗧𝗵𝗲 𝗧𝗿𝗮𝗻𝗰𝗵𝗶𝗻𝗴 𝗗𝗶𝗹𝗲𝗺𝗺𝗮: 𝘈 𝘊𝘰𝘴𝘵–𝘈𝘸𝘢𝘳𝘦 𝘈𝘱𝘱𝘳𝘰𝘢𝘤𝘩 𝘵𝘰 𝘔𝘪𝘵𝘪𝘨𝘢𝘵𝘦 𝘙𝘦𝘣𝘢𝘭𝘢𝘯𝘤𝘦 𝘛𝘪𝘮𝘪𝘯𝘨 𝘓𝘶𝘤𝘬 𝘪𝘯 𝘍𝘢𝘤𝘵𝘰𝘳 𝘗𝘰𝘳𝘵𝘧𝘰𝘭𝘪𝘰𝘴…

LOL. Not sure which of these savage descriptions I love more: “sad me-too statistical futures-based replication product last Tuesday” or “a twelve-minute old statistical futures-based replication product” Never change Cliff.

TL;DR version: Learn how to do performance evaluation 101 or at least read up on those you're going to attack to see how to do it: aqr.com/-/media/AQR/Im… Now the much longer and angrier version. Gee some bad and nastily personal “analysis” (multiple tweets implying…

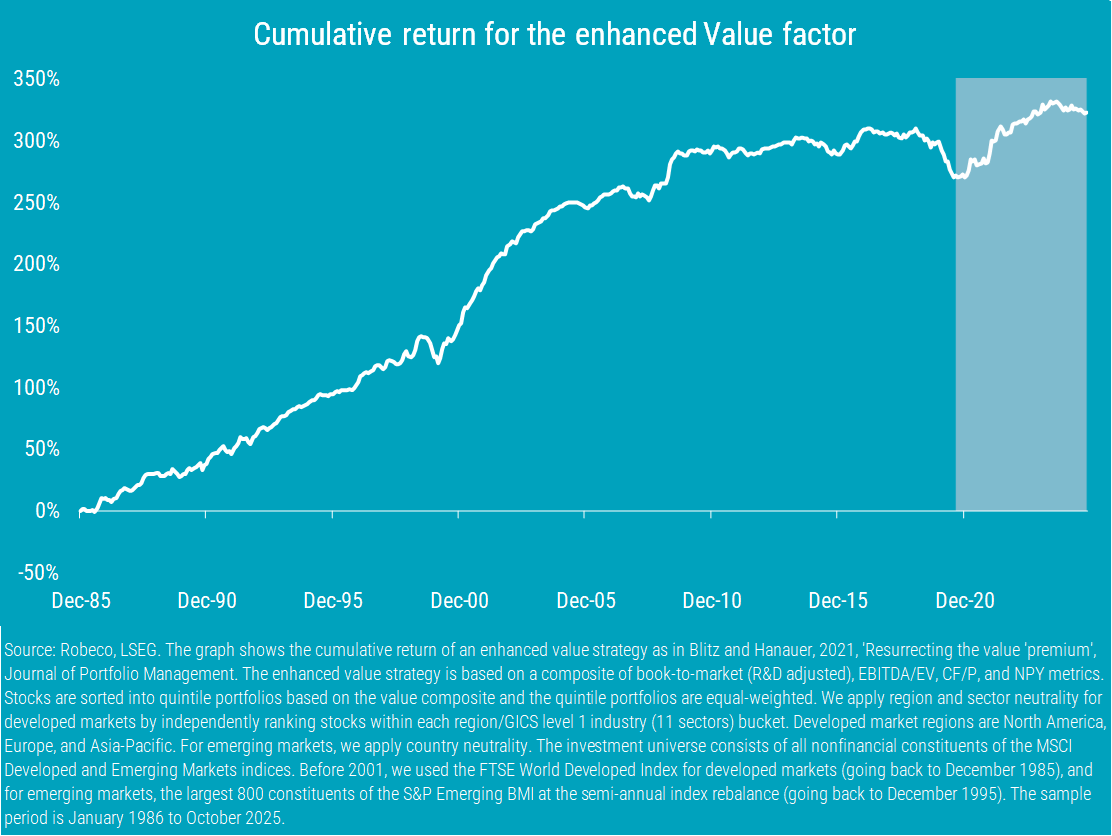

Value is not dead, but quant is more than value! To the day five years ago, the announcement of the successful Pfizer-BioNTech COVID-19 vaccine candidate results triggered a major market rotation. Since then, the average #value stock has outperformed the average growth stock.…

The chart plots forward P/E ratios (price / next-12-month expected earnings) for two US small-cap indexes from 2002–2025: Russell 2000 (red): Broader, includes many unprofitable companies S&P 600 Small Cap (blue): Profitability-screened, higher quality Current readings (Oct…

More people have been to space than have flown the B-2 stealth bomber. We were privileged to speak with Lt Col (ret) Todd Moenster who is one of these elite few. What a fascinating conversation! preferredsharespodcast.com/p/endurance-fr…

Trend following FTW

A thing often in common among great startup investors, founders, and researchers: Trading making a lot of small mistakes in exchange for getting a few giant wins. (Surprisingly many people seem to prefer a few big mistakes in exchange for a lot of small wins.)

Really fun conversation, even if @EricBalchunas spent a good chunk of it ripping my investment style apart 🤣. "Never go full CFA!"

This week on @ETFPrime, @NateGeraci sits down with @Bloomberg's @EricBalchunas to explore the trends shaping the next wave of ETF innovation. From crypto and leveraged funds to multi-share class structure, Balchunas breaks down what they mean for the future of the ETF market.…

Going to take an October break from Twitter... Will still poke around Rational Reminder community, and chat with some of you on email/LinkedIn. For everyone else, happy compounding!

United States Tendances

- 1. Chris Paul 6,483 posts

- 2. Pat Spencer 2,638 posts

- 3. Kerr 5,497 posts

- 4. Podz 3,262 posts

- 5. Shai 15.4K posts

- 6. Jimmy Butler 2,632 posts

- 7. Seth Curry 4,815 posts

- 8. Hield 1,566 posts

- 9. Carter Hart 4,064 posts

- 10. The Clippers 9,556 posts

- 11. #DubNation 1,423 posts

- 12. Pope 46.4K posts

- 13. Derek Dixon 1,293 posts

- 14. #SeanCombsTheReckoning 4,921 posts

- 15. Kuminga 1,469 posts

- 16. Lawrence Frank N/A

- 17. Connor Bedard 2,424 posts

- 18. Caleb Wilson 1,188 posts

- 19. Brandy 8,182 posts

- 20. Elden Campbell N/A

Vous pourriez aimer

-

Systematic Microcaps ⚙️

Systematic Microcaps ⚙️

@systvest -

Jack Forehand

Jack Forehand

@practicalquant -

Matthias Hanauer

Matthias Hanauer

@HanauerMatthias -

Larry Swedroe

Larry Swedroe

@larryswedroe -

Tobias Carlisle

Tobias Carlisle

@Greenbackd -

Drew Dickson

Drew Dickson

@AlbertBridgeCap -

Jason C. Buck 🪳🏴☠️

Jason C. Buck 🪳🏴☠️

@jasoncbuck -

Standpoint

Standpoint

@StandpointFunds -

Wes Gray 🇺🇸

Wes Gray 🇺🇸

@alphaarchitect -

Adam Butler

Adam Butler

@GestaltU -

Drew Feldman, APMA® | TrendingValue

Drew Feldman, APMA® | TrendingValue

@TrendingValue -

ReSolve Asset Mgmt

ReSolve Asset Mgmt

@InvestReSolve -

Lawrence Hamtil

Lawrence Hamtil

@lhamtil -

Andy 🍕🏔️

Andy 🍕🏔️

@bizalmanac -

Ryan Patrick Kirlin 👽

Ryan Patrick Kirlin 👽

@RyanPKirlin

Something went wrong.

Something went wrong.