Hallmark Financial

@HallmarkFi

Utah & CA based mortgage broker since 1996. Here to provide the most superior experience possible for our clients. Owned by WrigleyvilleUte @jhallito

قد يعجبك

When one of your childhood best friends finally moves back to the U.S. & buys his first home, helped out by another amazing HS friend, it’s a good day! #HallmarkFinancial #mortgagebroker #realtor

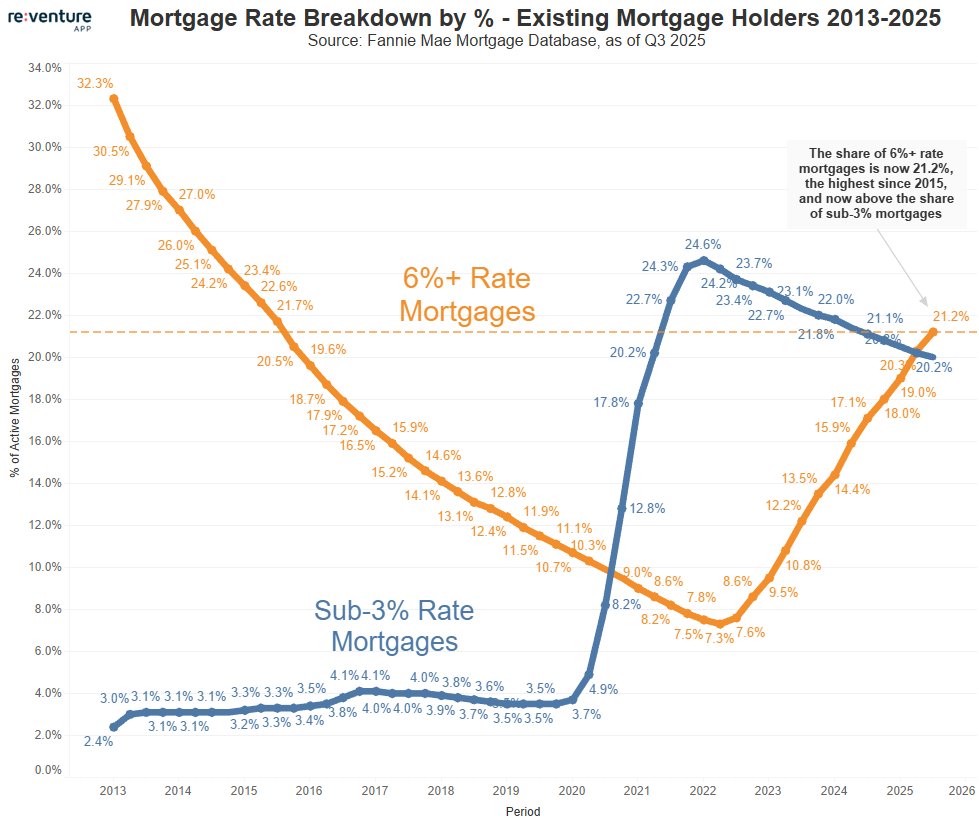

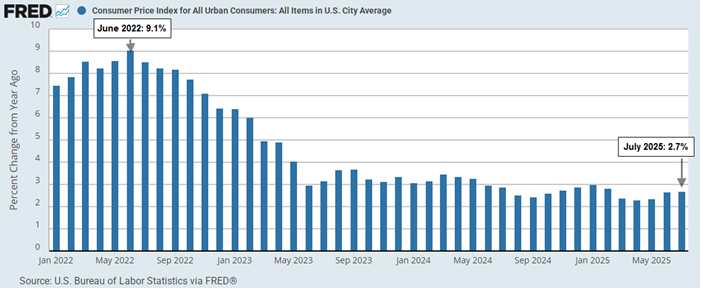

Very interesting stuff. #mortgagebroker #HallmarkFinancial

Something big just happened in the U.S. Housing Market. As of the end of 2025, there are now more 6%+ rate mortgage holders than sub-3%. Meaning that the dreaded Mortgage Rate "Lock-In" Effect is fading. Since more existing owners have a higher rate, that means more have a…

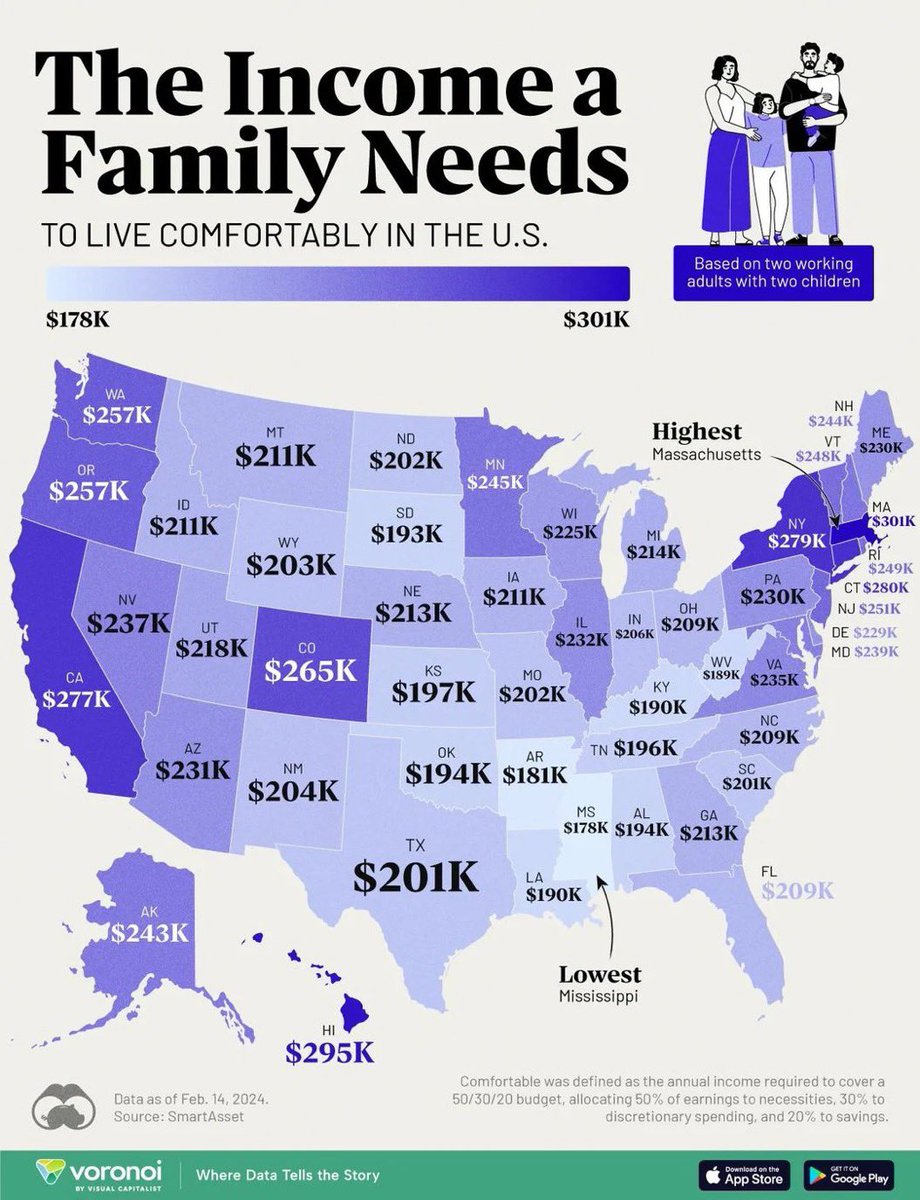

Over 57% of U.S. households make less than $100K per year. There is nowhere in the U.S. where the average family can live comfortably for under $178,000 per year. Affordability is disappearing.

Risk for inflation increasing - “uncomfortably highs.” Be prepared. Plan accordingly. #HallmarkFinancial #mortgagebroker #realtor ksl.com/article/513911…

As predicted mortgage rates have now worsened three times since the Fed decided to reduce their benchmark interest rate today. We will see how this shakes out over the next week and what kind of long-term impact is felt #mortgagebroker #HallmarkFinancial

Good for mortgage rates at the expense of the entire economy unfortunately #hallmarkfinancial #mortgagebroker

All this bad economic news is pushing people out of stocks, into bonds & lowering mortgage rates. Good for housing. #hallmarkfinancial #mortgagebroker #realtor x.com/NewsLambert/st…

BIG DROP TODAY The average 30-year fixed mortgage rate today: 6.29% Same day last year: 6.35% ----------------- 10-year treasury yield: 4.07% Spread today: 222 bps

Here it comes. This is really, really bad.

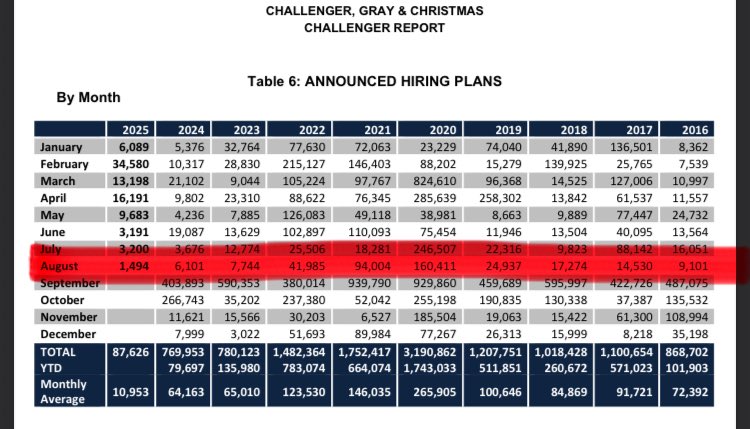

We just posted the worst August jobs number since 2009. 1,494 jobs. 85,979 layoffs. 👇👇👇 Without the excuse of a financial crisis.

This is bad bad bad

History unfolding, in one chart: The US Dollar to Gold ratio is falling off of a cliff.

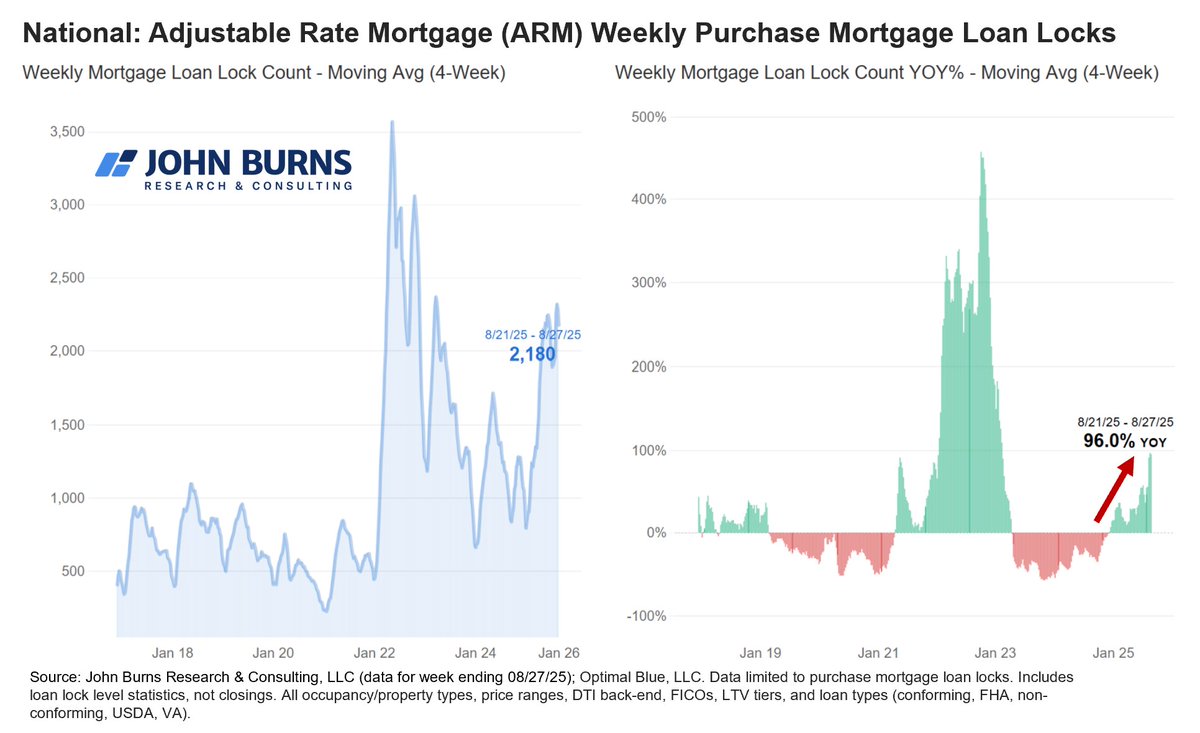

I’ve seen this a lot lately. The ARMs are making a comeback. I’ve closed a handful. Great way to save for 3-5 years over current rates. #HallmarkFinancial #mortgagebroker #realtor

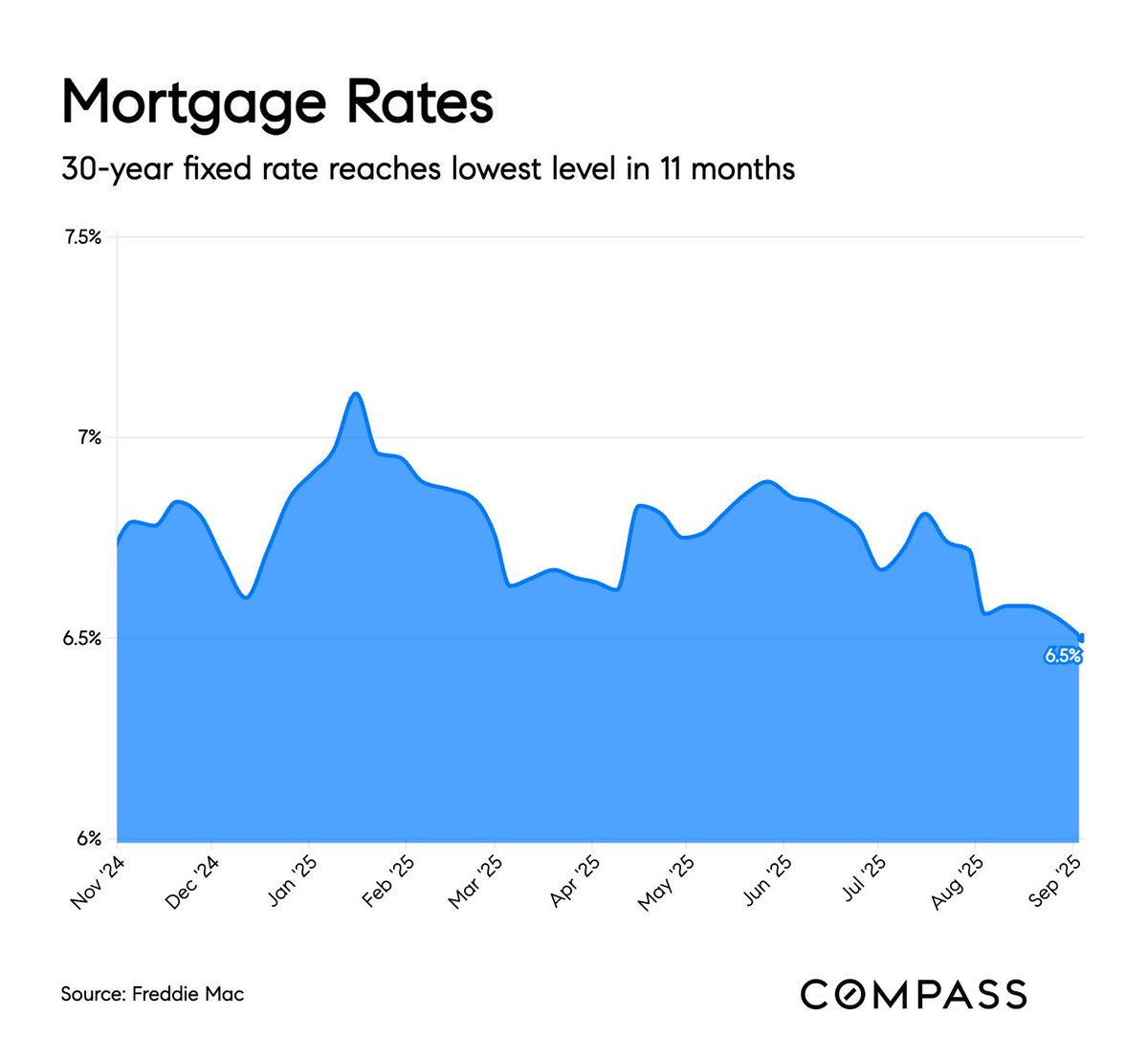

Adjustable rate mortgage (ARM) demand is accelerating as the spread between 30-year fixed rate mortgages (~6.5%) and ARMs (~5.75%) widens. As the chart shows, ARM home purchase mortgage loan locks grew +96% YOY for the week ending August 27.

Light job numbers, overall economic uncertainty, inflation - pushing rates down ever so slowly #HallmarkFinancial #mortgagebroker #realtor

Why aren’t buyers buying right now? Prices, rates, overall economic uncertainty? So many reasons, but what can be done?

Housing data shows sellers now exceed buyers by over 500,000, marking the largest imbalance ever recorded in the market, per Redfin.

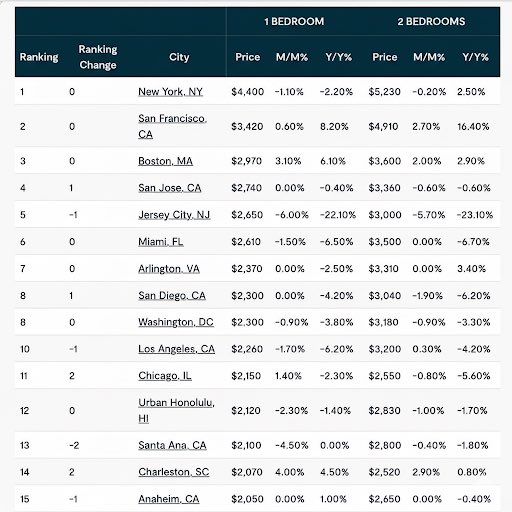

Rent is getting out of control in so many places. Housing costs in general with high prices & elevated rates are crazy. We need this to come down. It’s just not sustainable nor affordable #Hallmarkfinancial #mortgagebroker #realtor

Really good info & analysis about what this could mean to Americans. It’s an unprecedented & complex situation. #HallmarkFinancial #mortgagebroker

The Fed drama worsens: President Trump just signed an Executive Order which "fired" Fed Governor Cook due to a "Criminal Referral." Never in the 111-year history of the Fed has a President fired a Fed Governor. This would COMPLETELY shift the Fed. Here's why: (a thread)

Powell doesn't have any good options with monetary policy. Cutting rates in STAGFLATION is nuts. The weakening consumer & employment picture means you cut rates. Tariff inflation makes you want to hold or raise rates. Someone loses no matter what he decides #hallmarkfinancial

SUMMARY OF FED CHAIR POWELL'S SPEECH (8/22/25): 1. Shifting balance of risks "may warrant adjusting policy" 2. Suggests downside risks to employment are rising 3. Labor supply has softened in-line with demand 4. Fed abandoning flexible average inflation targeting framework…

July 2025 (CPI) showed inflation steady at 2.7% YoY, energy prices dropped 1.1% MoM, easing costs for homeowners, but shelter costs, up 0.2%, keep affordability key. The CPI report shows steady inflation & falling energy costs; stable inflation may support lower mortgage rates

I have a massive incentive for borrowers looking to reduce the rate on their current loan! A 90 basis point incentive - equates to about .375% lower in RATE! If you’re over about 6.75%, this is probably a make sense deal for you. Hit me up! #HallmarkFinancial #mortgagebroker

Just closed a VA purchase for a buyer. Final rate was 5.9%. Costs & rates are definitely coming down. If you have any questions about your situation, just hit me up & let's chat. #HallmarkFinancial #mortgagebroker #realtor

United States الاتجاهات

- 1. Steelers 153 B posts

- 2. Tomlin 37,7 B posts

- 3. Aaron Rodgers 43,4 B posts

- 4. DeepNodeAI 65,3 B posts

- 5. CJ Stroud 21,5 B posts

- 6. Arthur Smith 6.225 posts

- 7. Christian Kirk 4.343 posts

- 8. #HereWeGo 21,5 B posts

- 9. #HOUvsPIT 3.956 posts

- 10. #HTownMade 5.367 posts

- 11. Will Anderson 4.662 posts

- 12. Jonnu Smith 3.171 posts

- 13. TJ Watt 3.293 posts

- 14. Nico Collins 3.265 posts

- 15. Woody Marks 2.917 posts

- 16. #tellmelies 1.121 posts

- 17. Marvin Lewis 1.209 posts

- 18. Muth 1.647 posts

- 19. #ConnorStorrieOnSethMeyers 2.099 posts

- 20. Rooney 6.116 posts

قد يعجبك

-

WrigleyvilleUte

WrigleyvilleUte

@jhallito -

anne godfrey

anne godfrey

@annemgodfrey -

christian judd

christian judd

@christianmjudd -

Tanner Martin

Tanner Martin

@TanMart03 -

Sarge

Sarge

@msargent88 -

Eva-Marie Not Eva

Eva-Marie Not Eva

@EvaMarie73 -

Back Nine Tag

Back Nine Tag

@801_Ute -

Connor

Connor

@cronair -

Jim Bob Cooter, Esquire 🇺🇦 #tusksup

Jim Bob Cooter, Esquire 🇺🇦 #tusksup

@cooterbobjim -

kirk livingstone 🦮

kirk livingstone 🦮

@klivingstone -

Mark Aurelius

Mark Aurelius

@MarkAurelius9 -

Chravis with a “T”

Chravis with a “T”

@tko140pt6 -

drpatp

drpatp

@DrPatP -

&rü Z a u g g needs Zero Sugar Mtn Dew Spark

&rü Z a u g g needs Zero Sugar Mtn Dew Spark

@ZogUte -

Dominic

Dominic

@PNWUTE

Something went wrong.

Something went wrong.