Potrebbero piacerti

The fightback over the climate scam by crackpots like Al Gore & John Kerry has made it into the mainstream media in America. Jimmy Dore says climate models were wrong. 'How can you believe predictions based on models'? youtu.be/0BrjTqhI0t0?si… via @YouTube

youtube.com

YouTube

Ice Levels Dramatically INCREASE In Antarctica!

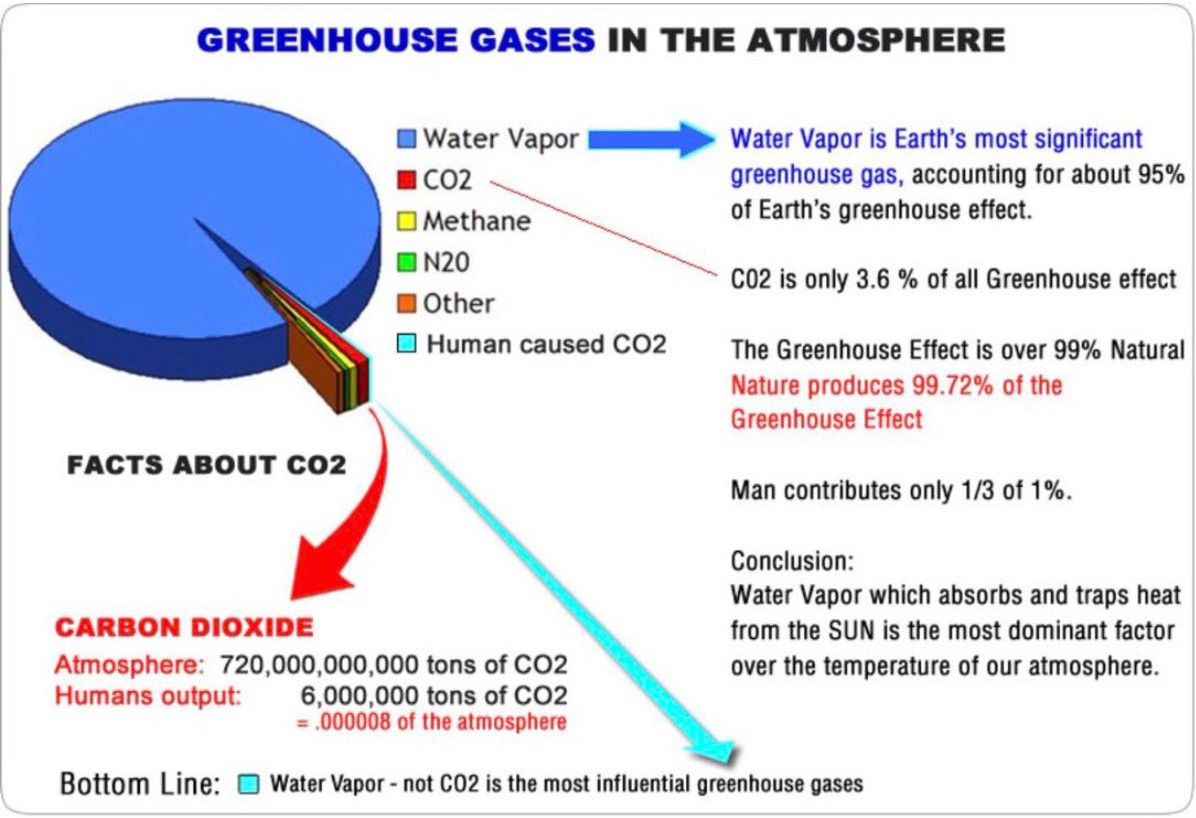

This is exactly how 'greenhouse gas' has been distorted. The biosphere is a massive dynamic structure no longer driven by only by the mechanics of geology, continental shift & the sun. Life is now a driving force in our evolving world fully based on microorganisms, cells & algae.

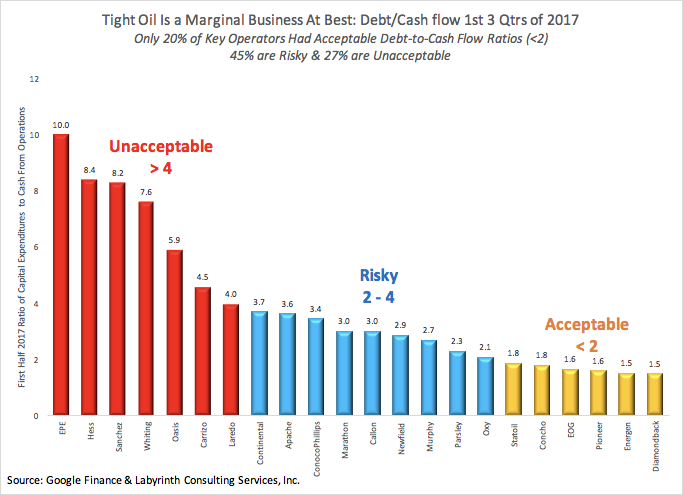

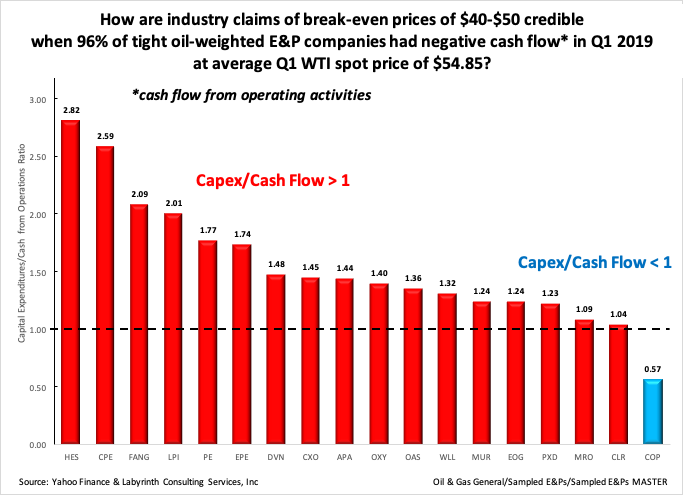

Permian shocker! True break-even prices for pure players are $60/b. Used 10-K filings for std measure (SMOG) of future discounted cash flows for PUDs. I subtracted that from SEC price & added in variable OPEX from same 10-K #OOTT #oilandgas #oil #WTI #CrudeOil #fintwit #OPEC

U.S. SHALE FIRMS are struggling with disappointing output from wells spaced too closely together: wsj.com/articles/a-fra…

wsj.com

A Fracking Experiment Fails to Pump as Predicted

Encana’s supersize fracking operation was widely expected to represent a new era in the U.S. drilling boom for oil and natural gas. But the wells’ results have fallen significantly, raising questions...

How are industry claims of break-even prices of $40-$50 credible when 96% of tight oil-weighted E&P companies had negative cash flow* in Q1 2019 at average Q1 WTI spot price of $54.85? #OOTT #oilandgas #oil #WTI #CrudeOil #fintwit #OPEC

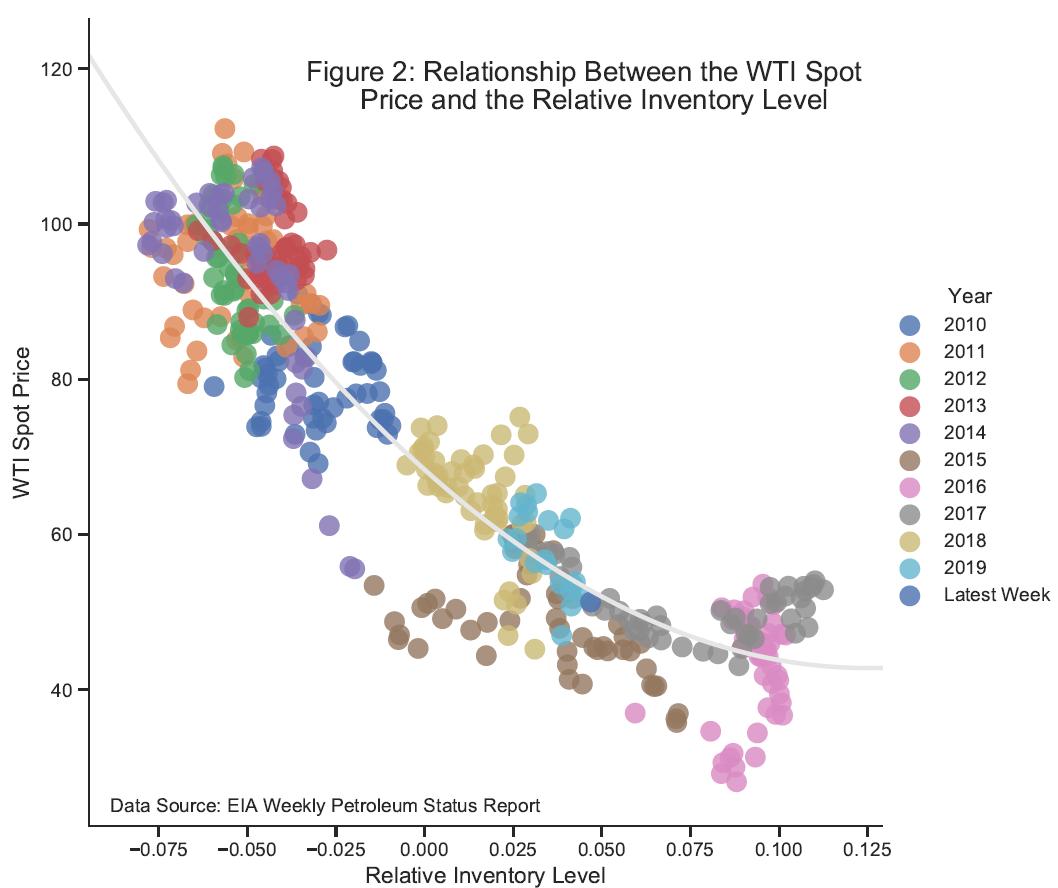

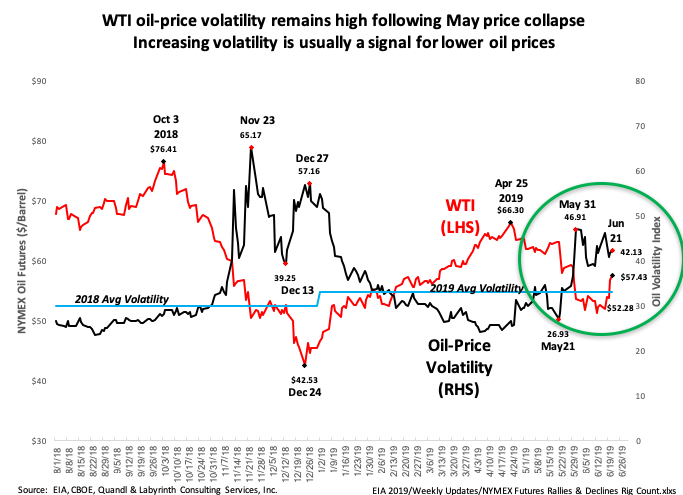

WTI oil-price volatility remains high following May price collapse. Increasing volatility is usually a signal for lower oil prices. #OOTT #oilandgas #oil #WTI #CrudeOil #fintwit #OPEC

The call options VCs buy have potential payoffs that follow what Nassim Taleb calls: "a power law type of statistical distribution, with big, near unlimited upside but because of optionality, limited downside.” All a VC can lose financially is what they invest - capped downside.

O&G stocks are HATED right now. Smart investors understand that the value of an investment is the PV of ALL its cash flows at (blank) discount rate. MOST O&G Cos. are trading at PV of their cash flows discounted at 25%+! W/ zero value attributed to non cash flowing assets. BUY

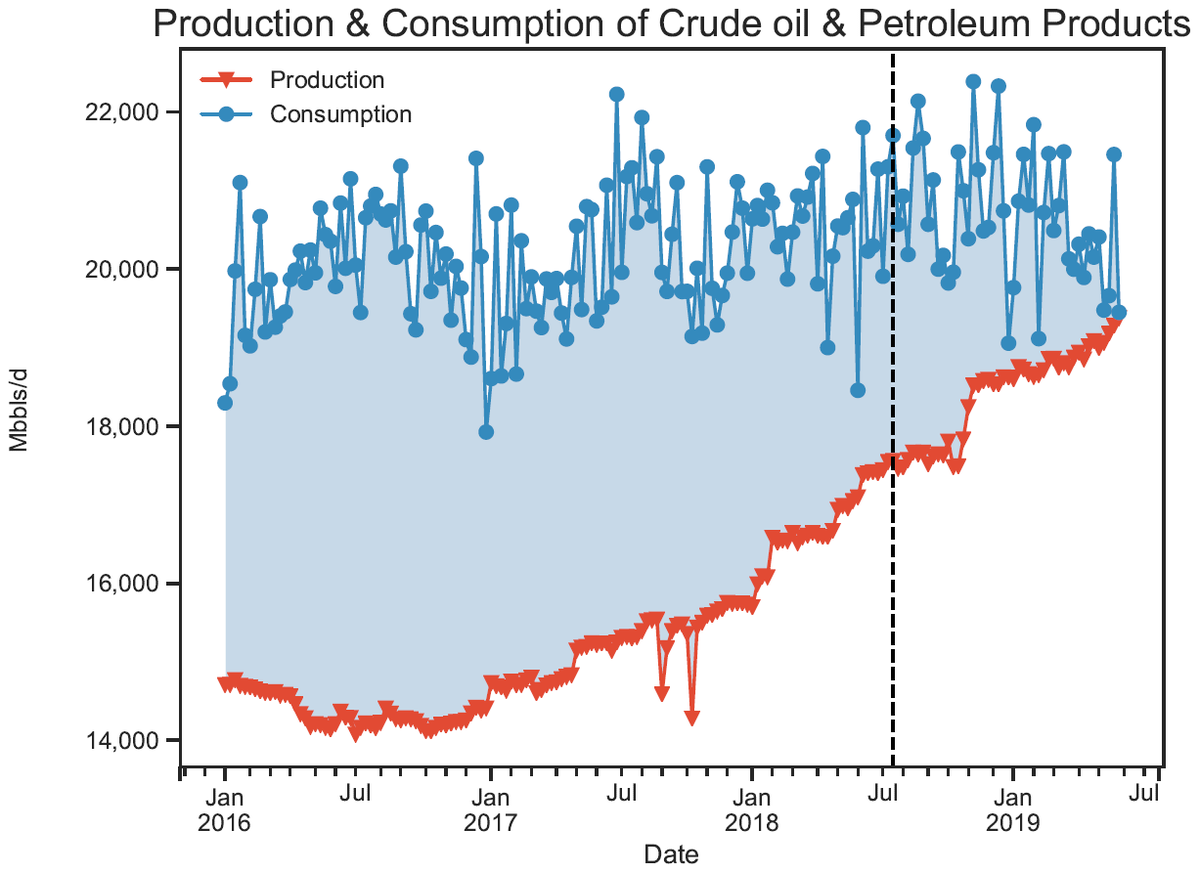

This is a supply problem. Not a good future for WTI when production > consumption.

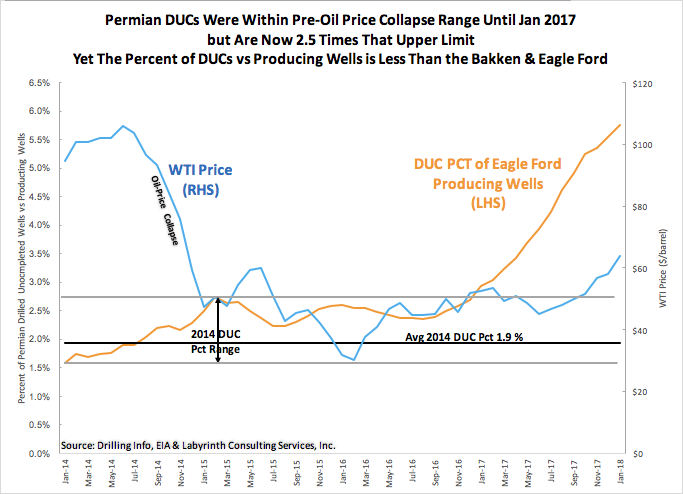

Permian DUCs were within pre-oil price collapse range until Jan 2017 but are now 2.5 times that upper limit. Yet the percent of DUCs vs producing wells is less than the Bakken & Eagle Ford. #OOTT #oilandgas #oil #WTI #CrudeOil #fintwit #OPEC

U.S. Crude + Refined Products net long positions inc +22 mmb wk ending Mar 29 from 592 to 614mmb (Mar 29 vs Mar 23 ) & WTI increased +$0.87 to $65.03. Long positions outnumber short positions by 12:1. #OOTT #oilandgas #oil #WTI #CrudeOil #fintwit #OPEC

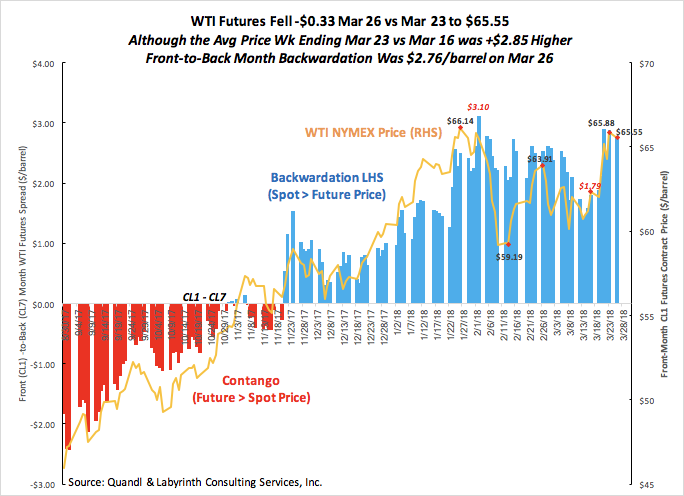

WTI futures fell -$0.33 Mar 26 vs Mar 23 to $65.55 although the avg price wk ending Mar 23 vs Mar 16 was +$2.85 higher. Front-to-back month backwardation was $2.76/barrel on Mar 26. #OOTT #oilandgas #oil #WTI #CrudeOil #fintwit #OPEC

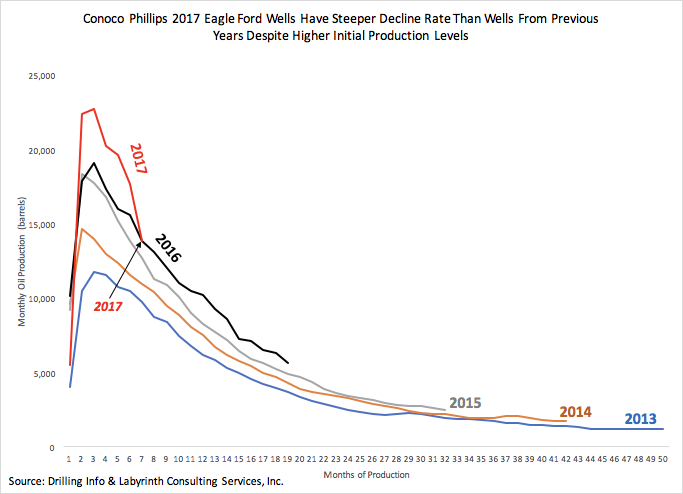

ConocoPhillips’ 2017 Eagle Ford wells have steeper decline rate than wells from previous years despite higher initial production levels. #OOTT #oilandgas #oil #WTI #CrudeOil #fintwit #OPEC

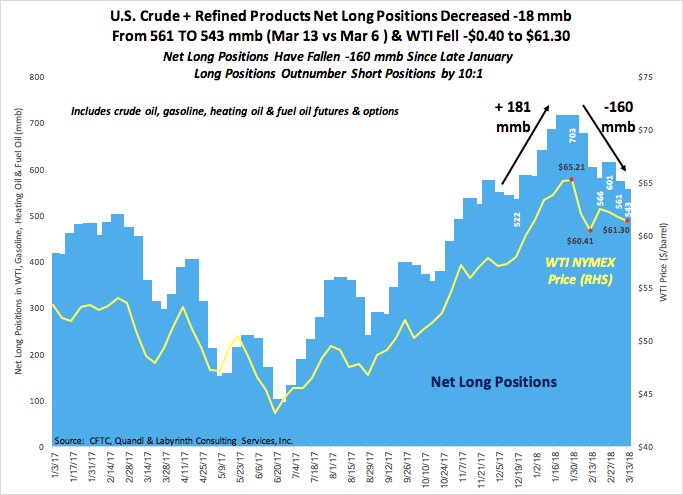

U.S. crude + refined products net long positions dec-18 mmb from 561 TO 543 mmb (Mar 13 vs Mar 6 ) & WTI Fell -$0.40 to $61.30. Net long positions have fallen -160 mmb since late Jan. Long outnumber short positions by 10:1. #OOTT #oilandgas #oil #WTI #CrudeOil #fintwit #OPEC

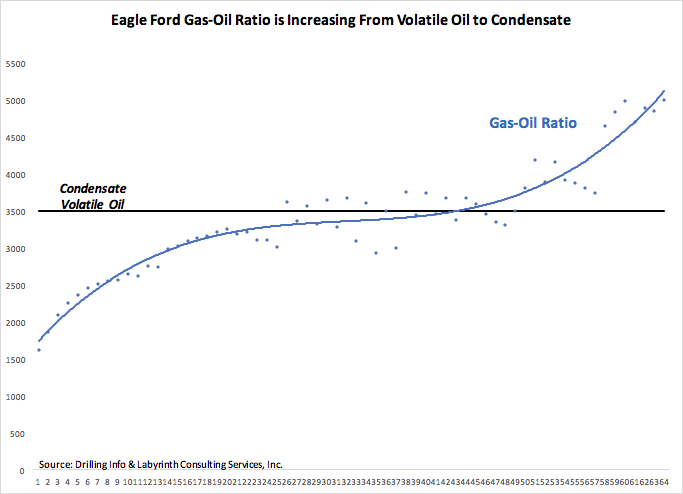

Eagle Ford gas-oil ratio is increasing from volatile oil to condensate. #OOTT #oilandgas #oil #WTI #CrudeOil #fintwit #OPEC #natgas #NaturalGas #shale

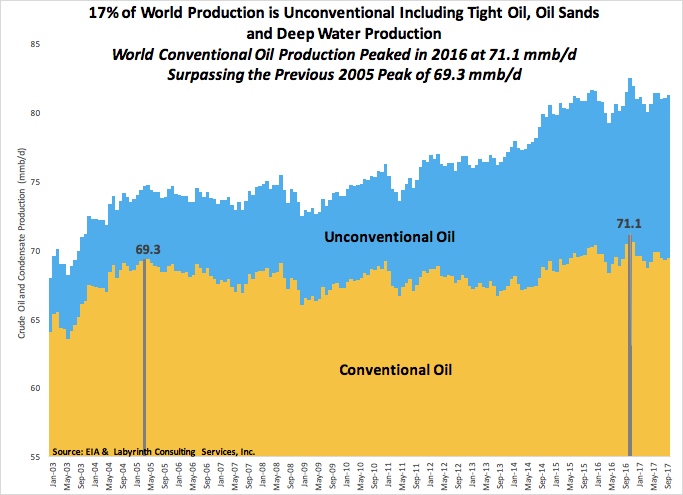

17% of world production is unconventional including tight oil, oil sands and deep water production. World conventional oil production peaked in 2016 at 71.1 mmb/d surpassing the previous 2005 peak of 69.3 mmb/d. #OOTT #oilandgas #oil #WTI #CrudeOil #fintwit #OPEC

United States Tendenze

- 1. Epstein N/A

- 2. #VERZUZ N/A

- 3. Marina N/A

- 4. Jay Z N/A

- 5. Izzo N/A

- 6. #OPLive N/A

- 7. Pusha N/A

- 8. Mike Will N/A

- 9. #GoBlue N/A

- 10. #Unrivaled N/A

- 11. #DragRace N/A

- 12. Don Lemon N/A

- 13. Fears N/A

- 14. Michigan State N/A

- 15. Hanoi Jane N/A

- 16. Jokic N/A

- 17. Michael Watts N/A

- 18. Hit Boy N/A

- 19. Trenton N/A

- 20. Bill Gates N/A

Potrebbero piacerti

-

Gabriel

Gabriel

@Gabriel25444001 -

Chris Atherton

Chris Atherton

@atherton_chris -

TheFarmer

TheFarmer

@Biggums68894031 -

Sir Loin

Sir Loin

@scotch_vessel -

Jimmy Hollowell Jr.

Jimmy Hollowell Jr.

@jghollowell -

Leath

Leath

@leath1990 -

Deus Ibi Est

Deus Ibi Est

@WrafterN -

Amber McCullagh

Amber McCullagh

@amber34owl -

The Wolf of Wall Street Bar & Grill

The Wolf of Wall Street Bar & Grill

@guillermogusto -

Tyler Langford

Tyler Langford

@TyLang06 -

J

J

@J_Sal_OTC -

Jack Burton

Jack Burton

@pragmatic4you -

Fugitsu

Fugitsu

@Fugitsu007 -

Anita Creech

Anita Creech

@anitalc76

Something went wrong.

Something went wrong.