Hicks & Associates

@Hicks_Associate

Hicks & Associates Wealth Management

You might like

In our last video we said we are not in a bull market. We are not in a bear market, but it's not a bull market either. We are transitioning from bear to bull. This got one viewer to ask "If this is not a bull market, how would we define one?" The answer: youtu.be/ZQW9qvrZ990

youtube.com

YouTube

Monthly Market Monologue - October 2023

What Do We See In the Current Market Correction Plus A Possible Government Shutdown youtu.be/3YiouFRTZPI?si…

youtube.com

YouTube

What Do We See Plus A Possible Government Shutdown

The Fed kept rates steady in September but their projections suggest that rates could remain higher for longer ... our view: hicks-associates.com/blog/what-the-…

In this week's video, we provide one final video update on the TD Ameritrade and Charles Schwab Merger. Specifically, what you should expect over Labor Day weekend. #charlesschwab #tdameritrade #stockmarket #portfoliomanagement youtu.be/ysv2NWbiSRQ

youtube.com

YouTube

Final Conversion Update: What To Expect

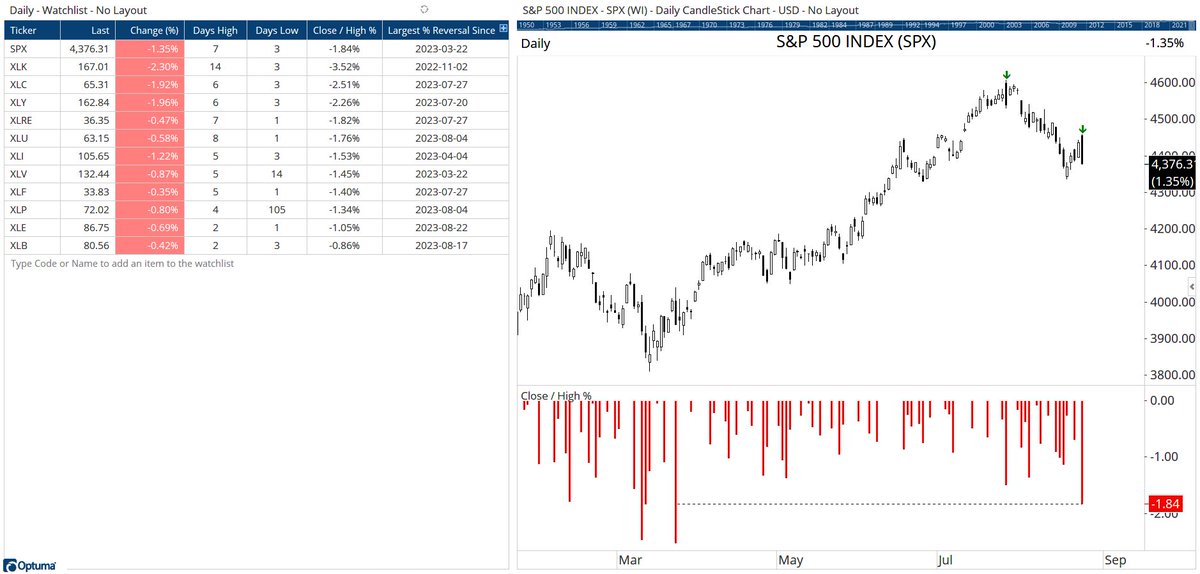

Today was both a 7 day high & 3 day low in $SPX, closing 1.84% below the high. Biggest intraday reversal since March 22nd. $XLK with 3.5% reversal after making 14 day high:

Financial markets have pulled back in recent weeks due to factors such as rising interest rates and uncertainty in China. hicks-associates.com/blog/why-inves…

In Part 2 of this week's video, we define the terms - Cyclical and Secular Bear. We then talk about one reason why we are concerned that we are in a Secular Bear that is merely experiencing a Cyclical Bull phase. youtu.be/DYZQxqEIX6o

youtube.com

YouTube

Weekly Video Part 2 - Cyclical Bull in a Secular Bear?

In this video, we discuss the Atlanta Fed GDP Now tool. It is currently forecasting GDP of 5.8%. Typically, this is good news. However, since inflation has ticked back up, a growing economy will put additional inflationary pressure on the economy. youtu.be/bqSWkxE7ngg

youtube.com

YouTube

Weekly Video Part One - GDP at 5.8%?

Despite the economic uncertainty of the past year, everyday individuals and households have been resilient. But how do personal balance sheets & spending look today? hicks-associates.com/blog/how-perso…

We just learned @braxtonfurstein passed CMT 3. This is the last major hurdle to earning the CMT. He still has to show relevant work experience & agree to ethics standards before he is granted his Charter, but those steps are minor. Please join us in congratulating him.

No matter where you are on your journey, we're here to support you by creating environments for continuing transformation, connection with like-minded peers, & equipping to make a kingdom impact. #kingdomadvisors

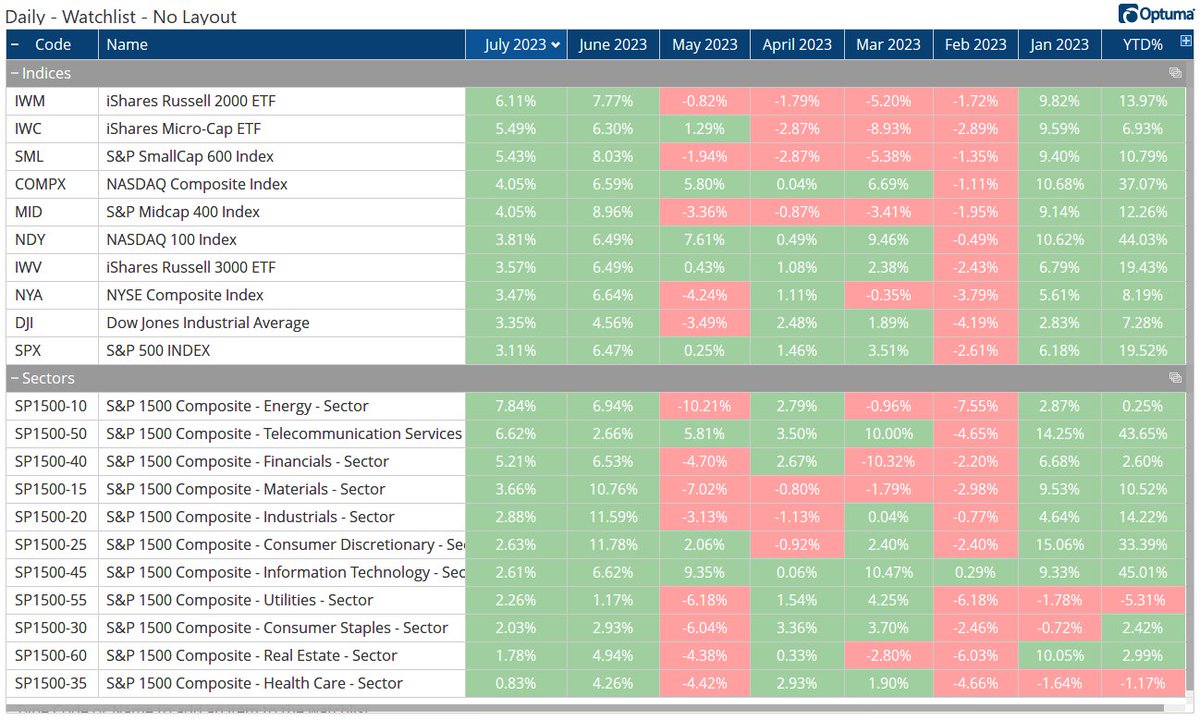

Smallcaps $IWM $RUT +6.11% performed almost twice as well as $SPX in July. On a sector level, all were positive in July, with Energy +7.8% now positive YTD:

Update on TD and Schwab Merger + Is The Yield Curve Still Predicting A Recession? youtu.be/0k33Y_tWaq4

youtube.com

YouTube

Update on TD and Schwab Merger Plus Is The Yield Curve Still Predic...

One of our local cycling team members is participating (again) in this year’s ride across Iowa. In that sea of bikers, he found another one of this year’s team members. Nice jersey Steve! @RAGBRAI_IOWA

Our weekly video, to be published Friday (hopefully by mid-day), will address two main topics: 1) The latest GDP figure - hint: it's not recessionary 2) The TD Ameritrade to Charles Schwab conversion We hope you find these videos helpful.

Soft Landing Ahead ? Will the Federal Reserve accomplish the ever allusive "soft landing"? We take a look ... plus we explain how most indices are calculated by talking about Michael Jordan. youtu.be/3mO9glqqhjM

youtube.com

YouTube

Soft Landing Ahead ?

United States Trends

- 1. FINALLY DID IT 902 B posts

- 2. The PENGU 239 B posts

- 3. The Jupiter 306 B posts

- 4. The BONK 171 B posts

- 5. Iran 1,23 Mn posts

- 6. #LetterboxdWrapped 1.042 posts

- 7. Mamdani 638 B posts

- 8. #ThankYouTrump 24,5 B posts

- 9. Texas State 18,4 B posts

- 10. Celina Powell N/A

- 11. #FursuitFriday 11,5 B posts

- 12. Robertson 9.208 posts

- 13. Communism 64,8 B posts

- 14. #FanCashDropPromotion 3.376 posts

- 15. #tremendous 4.900 posts

- 16. Max Payne N/A

- 17. Avery Johnson N/A

- 18. Trocheck 2.047 posts

- 19. Nelson 16,2 B posts

- 20. Dilbert 4.648 posts

You might like

Something went wrong.

Something went wrong.