$BTU Asset Acquisitions: On May 5, 2025, Peabody Energy notified Anglo American Plc and Pt Bukit Makmur of a Material Adverse Change concerning their acquisition of Anglo's steelmaking coal assets. This event indicates challenges in moving forward with the deal.…

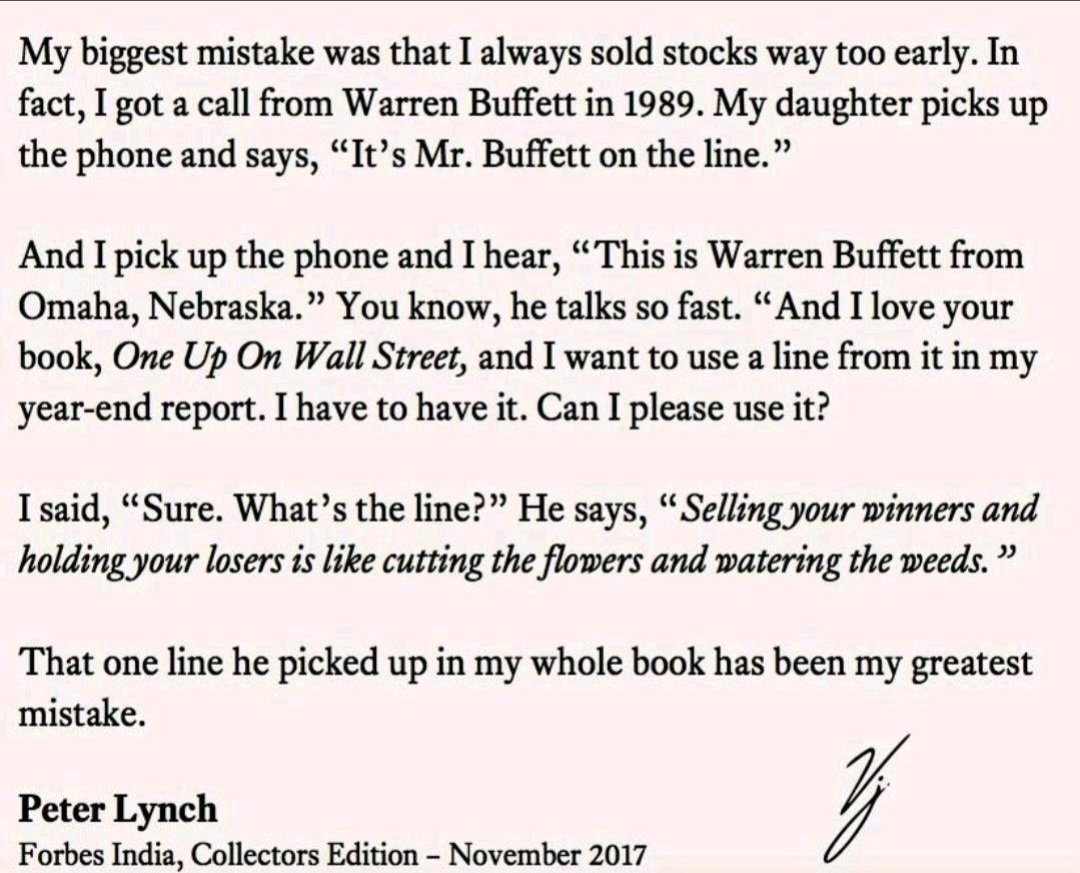

Warren Buffett talking to Peter Lynch:

Podcast: Ferroglobe Exec Talks U.S. Silicon Strategy This week, Bill Hightower of Ferroglobe USA (Nasdaq: $GSM) joins @Pocobelli to discuss the critical role silicon plays in strengthening U.S. manufacturing. #mining #miningnews #podcast northernminer.com/news/podcast-f…

With shipping blood bathed, who will be the first with a significant insider buy or repurchase tranche? Or will they all hunker down given the chaos?

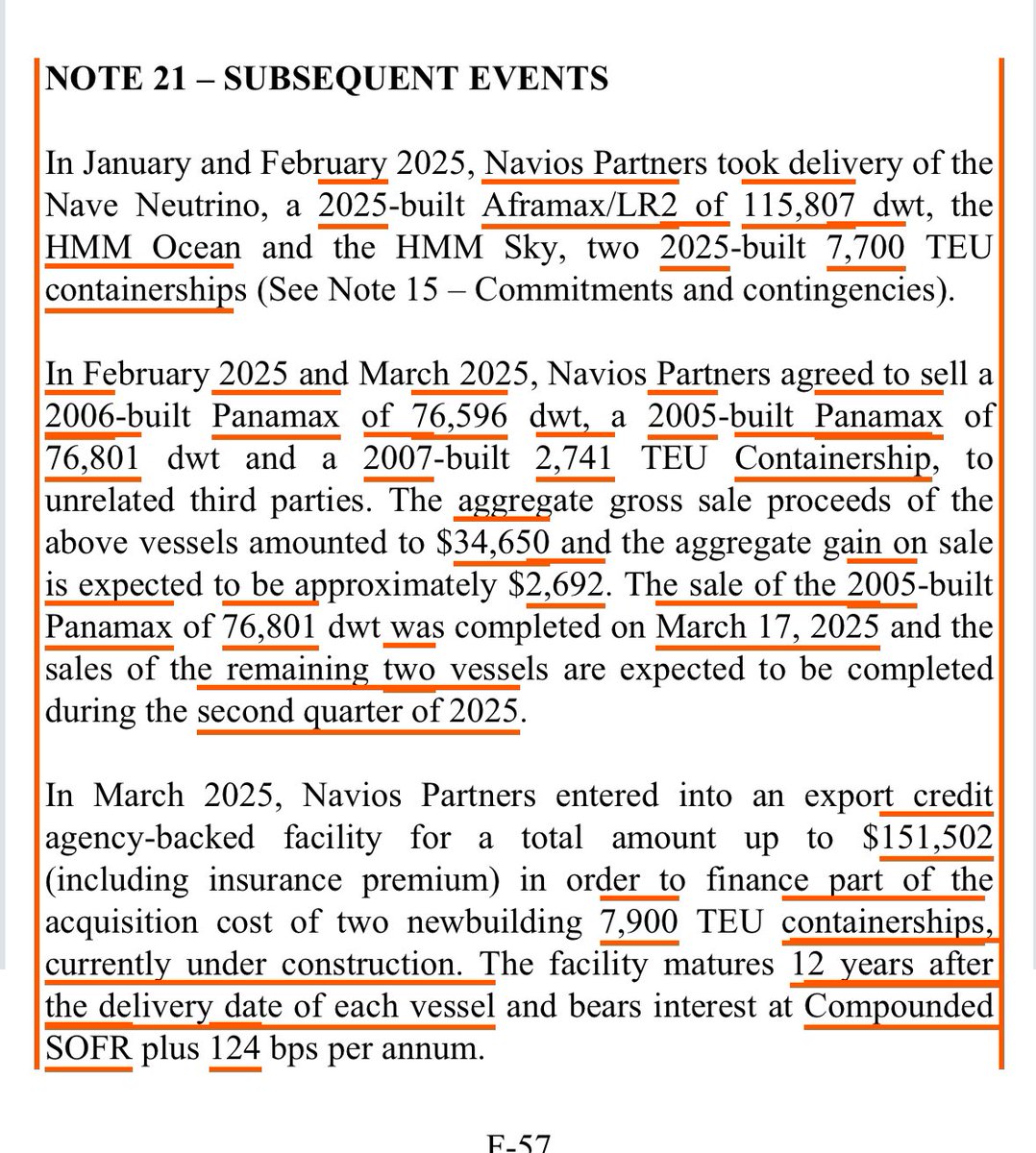

In $NMM 20F, they disclosed continued repurchases (110K since their Q4 date) and addl vessel sales (including a container vessel)

Stanley Druckenmiller hasn't had a losing year in his entire 4.5 decades as a trader. He recently sat down for a talk that every retail investor/trader needs to listen to. We've broken it down for you into 10 clips (covering TA, risk management, selling losers, & much more):

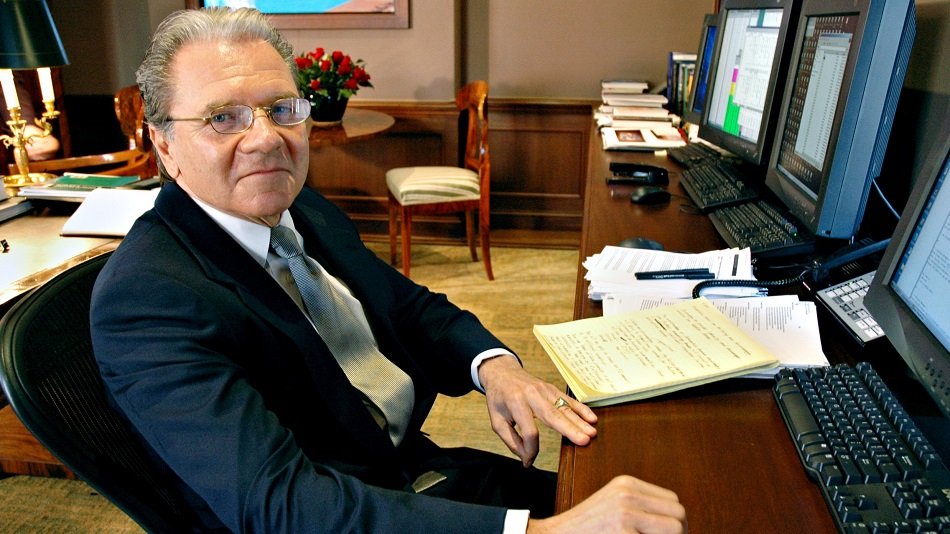

This is Thomas Peterffy. He's worth an estimated $38.3 billion. He is the founder of one of the biggest brokerages in the world and was one of the first electronic traders. Here's his story from 100 dollars to billions:

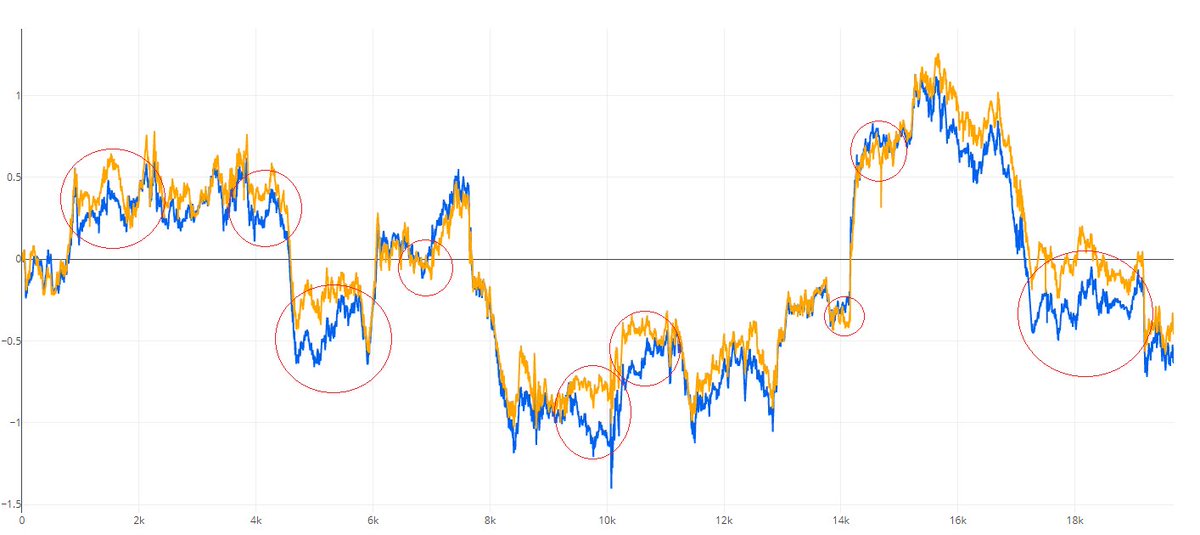

A crash course in Mathematical Trading Strategies by a 3.48 trillion dollar company. It's over an hour long. So, here are some of the best parts (in less than 6 minutes):

Wall Street lost a legend today. Rest in peace, Jim Simons. He was a true one-of-one character who built one of the most successful investment firms ever. Here's my favorite Jim Simons lecture. I still learn so much each time I listen. Source: Free Engineering Course on YT

1/ Selling “penny puts” in the $SPX complex has become commonplace in today’s markets, it’s essentially now a socially acceptable practice amongst portfolio managers. This is the story of James Cordier from Optionsellers, a fund that blew up and the infamous $150M margin call.

This is Kristjan Qullamaggie. He's a swing trader, who turned $9,100 into over $80,000,000 from 2013 to 2021. In 2021, he was featured as the 15th highest income earner in Sweden. Here’s Kristjan's story:

7 visuals every investor should memorize: 1: In the long run, stocks win:

Mark Leonard is the most peculiar businessman I have ever read. Some extracts from his letters showing why:

¡Acabo de enterme de la fatídica noticia! Hoy, uno de mis grandes referentes, Charlie Munger, acaba de fallecer a los 99 años. En su honor, comparto un hilo con 50 frases/enseñanzas que aprendí de él y que me han convertido en una mejor persona y más sabia. Descanse en paz.

Anthony Bolton has one of the most legendary track records of all time: His fund compounded at 19.5% annually over 28 years! Here are 27 simple keys to his success:

Investing can be looked at as an emotional competition – your emotions and ability to control them versus the emotions of those you buy or sell securities from and to. microcapclub.com/i-passed-on-be…

David Tepper is one the greatest HF managers of his generation; earning a 25% CAGR over 26 years. He became extraordinarily wealthy but claims he's "a regular guy who happens to be a billionaire”. Some career advice from the man himself.

He Averaged a 40% Return Per Year From 1985 to 1995 Once investing 40% of his fund into a stock that looked like garbage, getting an incredible result within 3 months. The story of Joel Greenblatt's unique rise to $1 billion net worth: 🧵

Market Wizard Linda Raschke’s 12 Technical Trading Rules: 1. Buy the first pullback after a new high. Sell the first rally after a new low. 2. Afternoon strength or weakness should have follow through the next day. 3. The best trading reversals occur in the morning, not the…

Marc Andreessen has grown a16z from their first fund of $300M in 2009 to over $25B+ in AUM as of 2022. His framework for understanding any business is simple. It comes down to unpacking what he calls "the onion theory of risk." Here's what he means...

United States Trends

- 1. Skubal N/A

- 2. #AEWDynamite N/A

- 3. Jokic N/A

- 4. Knicks N/A

- 5. Brunson N/A

- 6. Andrade N/A

- 7. Tigers N/A

- 8. Mikal Bridges N/A

- 9. Framber N/A

- 10. Ryan Preece N/A

- 11. #NASCAR N/A

- 12. Trey Murphy N/A

- 13. Double OT N/A

- 14. Mitchell Robinson N/A

- 15. Brody King N/A

- 16. Jamal Murray N/A

- 17. #SistasOnBET N/A

- 18. Daytona N/A

- 19. #NewYorkForever N/A

- 20. #TheMuppetShow N/A

Something went wrong.

Something went wrong.