Monolith Investments

@variance_swap

"I am afraid I can't do that Dave"

Bạn có thể thích

“If I really like a fundamental thesis, but the chart stinks, I won’t do it” I could have avoided a lot of heartburn over the years following this advice. The first thing I do now when starting to research a stock is look at the chart.

How Stanley Druckenmiller (he managed over $12 billion in assets) looks at technical analysis:

$ASPI: BIG business update from ASPI. For those that don't know, the highly enriched Silicon-28 and Medical Isotope business will be separated from the uranium enrichment business in the coming months. 1) The Company has entered into a supply contract with a U.S.-based customer…

Done and Done

Odds of Trump Sunday evening post: "Had a great call with China's wonderful president Xi Jinping, and our relations have never been better. Look forward to our meeting in two weeks. Thank you for your attention to this matter!"

Another 3.6 million ounces of #SILVER left the Comex yesterday while the London spot price was blowing out.

Probably won't be seeing a lot of PNL screenshots for a while.

$AFM23.V THIS IS THE MOST BULLISH THING I’VE SEEN!!! Kibati is the farthest western town on R529 under M23 occupation. This was heavily reinforced and was where M23 pulled back to after the withdraw from Walikale center. They have repelled every attack Wazalendo has ever…

Walikale : les rebelles de l'AFC/M23 perdent quatre positions sur les cinq installées à Kibati après d’intenses combats contre les wazalendo actualite.cd/2025/10/10/wal…

The spot/future basis on Silver is going crazy because the London market has little metal available for delivery. The lease rate in the chart below, for 1 month, 3M and 1Y is adjusted by USD interest rates so in normal circumstances it is near 0.2%, reflecting only the normal…

The #silver market is showing clear signs of stress amid severe physical tightness in the London cash market. One-month lease rates have spiked as strong demand from major global trading hubs strains available supply. As a result, the normally stable relationship between COMEX…

$AFM.V printing $96mm per Q in EBITDA on mkt cap $1bn

The chart for small caps looks like this, and you're worried about market froth? 🤣 $IWM

Mostly just sit around, change diapers, feed, get scolded by wife, read tweets from anonymous macro and small cap accounts and wait for the next meme shitco to break out.

Rich traders: “We mostly just sit around reading, thinking and waiting.” – Stanley Druckenmiller

The truth will set you free $AFM.V

Is the Turamlina ramp up finally going to happen just as copper prices are perking up again? $ERO.TO

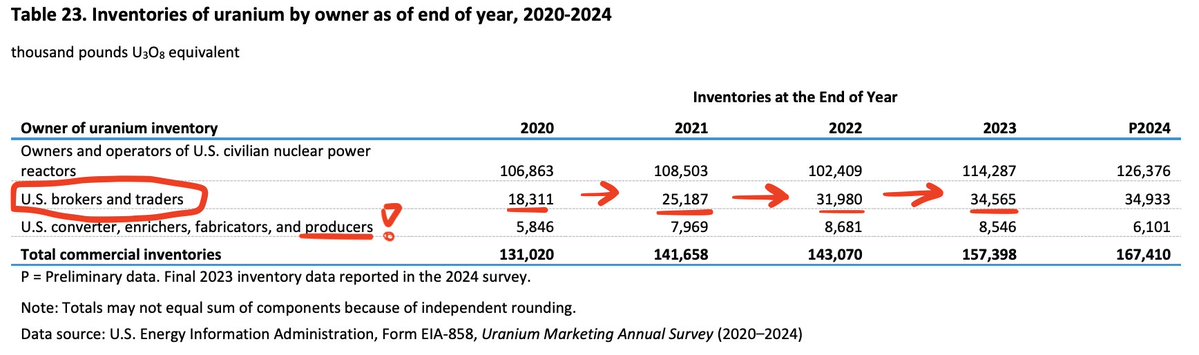

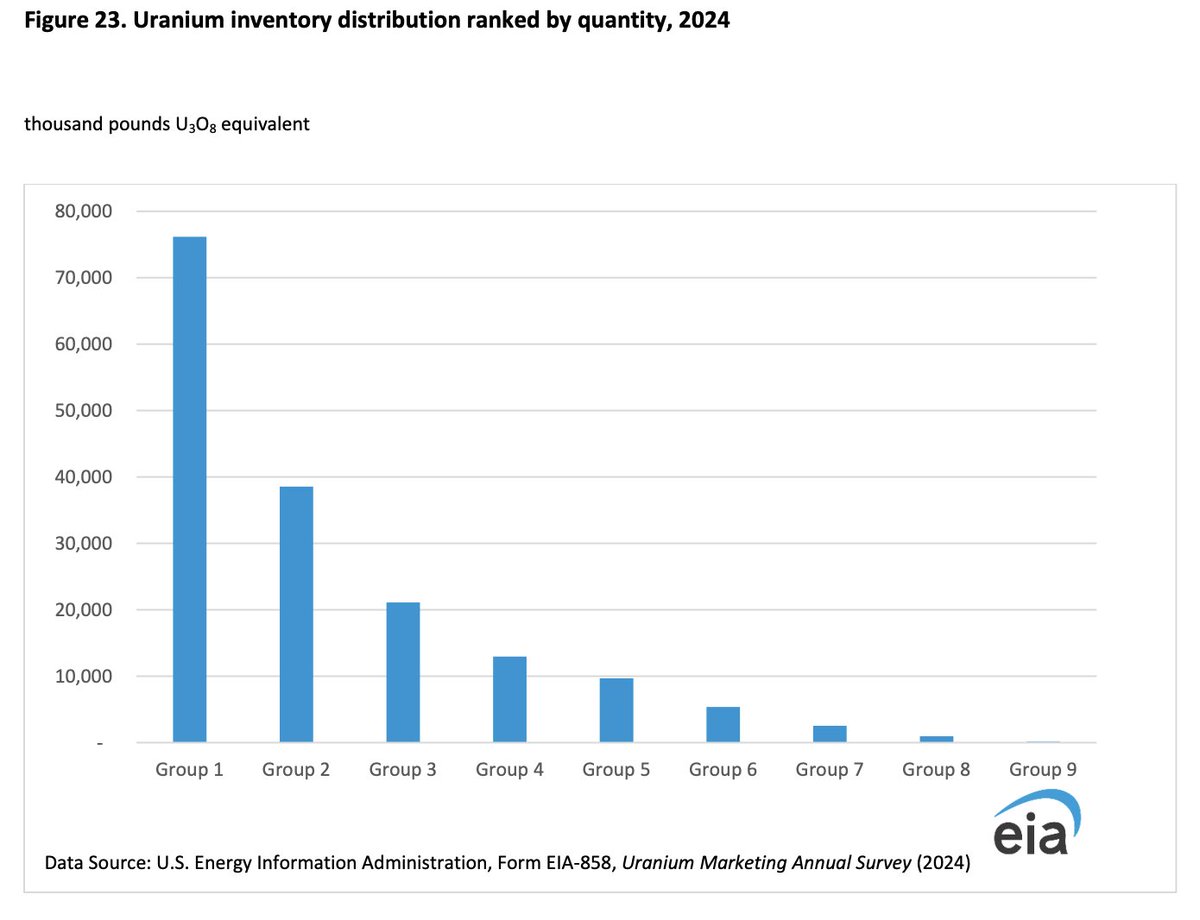

Let's be clear, EIA is doing sketchy things when counting US commercial inventories: 1) They include inventory of US based brokers and traders(!) 2) They include inventory owned by US producers(!) 3) Speculation: Are they by any chance counting inventory owned by SPUT, stored at…

You may have seen 167Mlbs U3O8eq quoted as the US utility inventories as per the latest EIA report. This number is wrong. In reality, US utilities have 126.4Mlbs U3O8eq in inventory, equivalent to ~2.5* years of demand. This is an average number too and some utilities have less…

US utilities are in deep trouble... only 3 yrs inventory, most of which is held by the big boys, in enriched format. A lot of those lbs are not in the utilities hands. >50mm lbs of uncovered needs by 2030 which is tomorrow in fuel cycle / mining terms. #uranium spike secured.

"Due to strong investor demand, the Company agreed with the Bookrunner to increase the size of the Placing to approximately US$175 million from the approximately US$125 million originally proposed (the "Upsize"). $YCA #uranium

Another 1.33mlbs #uranium taken out off the market by $YCA after executing their $100m purchase option with Kazatomprom $YCA had 5.46% short interest prior to this announcement, so shorters will be racing to participate in this placement to avoid being forced to buy on market

Interesting to think that the 5.56% short position represents ~12m shares in $YCA and with #uranium at $77.5/lb the NAV of Yellow Cake is at ~£5.8/share. These 12m shares are valued at £69.6m / $93.8m, which is just shy of the cash needed to execute the $100m Kazatomprom option.

United States Xu hướng

- 1. phil 87.9K posts

- 2. phan 80.7K posts

- 3. Jorge Polanco 6,156 posts

- 4. Columbus 228K posts

- 5. Falcons 14.3K posts

- 6. Mitch Garver N/A

- 7. Kincaid 1,704 posts

- 8. Doug Eddings 1,005 posts

- 9. Middle East 329K posts

- 10. Jake Moody N/A

- 11. Martin Sheen 1,701 posts

- 12. Springer 11.2K posts

- 13. Yesavage 3,617 posts

- 14. #BillsMafia 5,276 posts

- 15. Go Bills 7,455 posts

- 16. Gilbert 9,845 posts

- 17. Monday Night Football 7,117 posts

- 18. Ray Ray 96.8K posts

- 19. Bijan 3,295 posts

- 20. John Schneider 1,395 posts

Bạn có thể thích

-

Patrick Hill

Patrick Hill

@PatrickHill1677 -

Atilla Yurtseven

Atilla Yurtseven

@atillayurtseven -

Sheila Bair

Sheila Bair

@SheilaBair2013 -

Forward Party

Forward Party

@Fwd_Party -

Homeward Harrison

Homeward Harrison

@IGOSODAMNHAM -

RySci 🛢

RySci 🛢

@The_RySci -

Kalpen Parekh

Kalpen Parekh

@KalpenParekh -

Momentum Structural Analysis

Momentum Structural Analysis

@Oliver_MSA -

Dave Nadig

Dave Nadig

@DaveNadig -

Diego Parrilla

Diego Parrilla

@ParrillaDiego -

justincastelli

justincastelli

@jus10castelli -

MI2 Partners

MI2 Partners

@MI2Partners -

IceCap

IceCap

@IceCapGlobal -

MacroKurd

MacroKurd

@macrokurd -

M Lebon

M Lebon

@LongTplexTrader

Something went wrong.

Something went wrong.