Investment Twits

@InTwits

Investment community for UK, Canada, HK, India and US stock investors. Here we post the best twits from our users.

You might like

#HSW #Hostelworld record revenues and raised EBITDA guidance to €17.5-18.0m for FY23 (up from €16.5-17.0m at AGM in May 2023). Social strategy is working: - Direct marketing 51% of revenue, -10% YoY - Growth in the share of bookings made by social members in Q3 (59% in Sept)

#RFX #Ramsdens Positive trading update, one line says it all: "Profit Before Tax for the Period to be a record result of more than £10m (FY22 £8.4m)." Concerns: challenging economic environment and inflation Why the stock dropped yesterday on 7.3%?

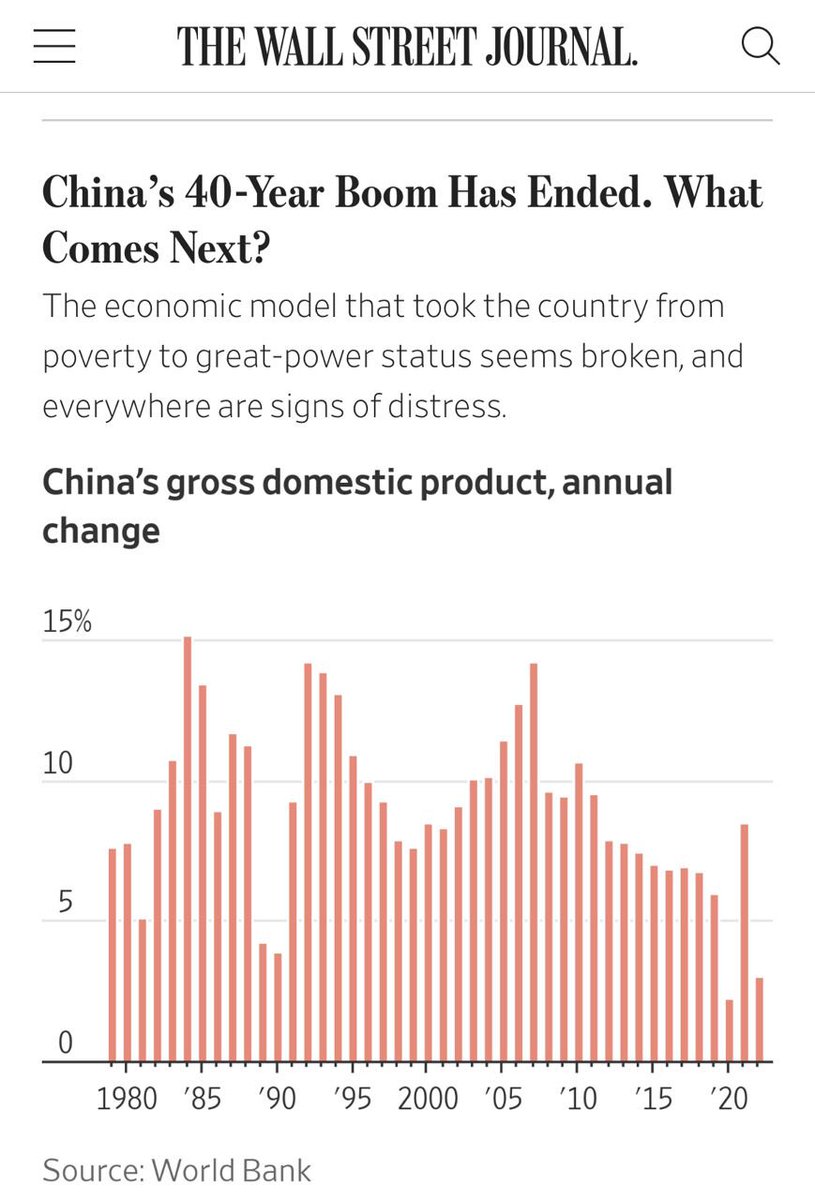

Now it's official - China's growth has ended. How is will influence 1) Chinese policy 2) Global economy? #China #GDP

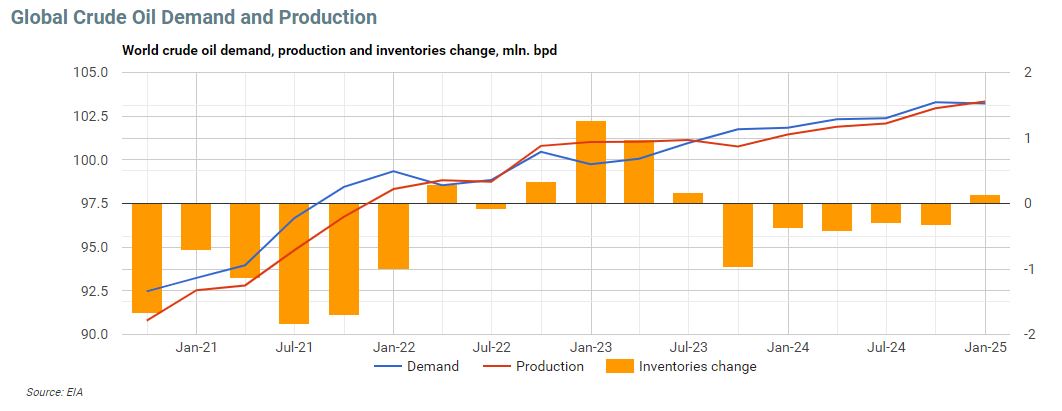

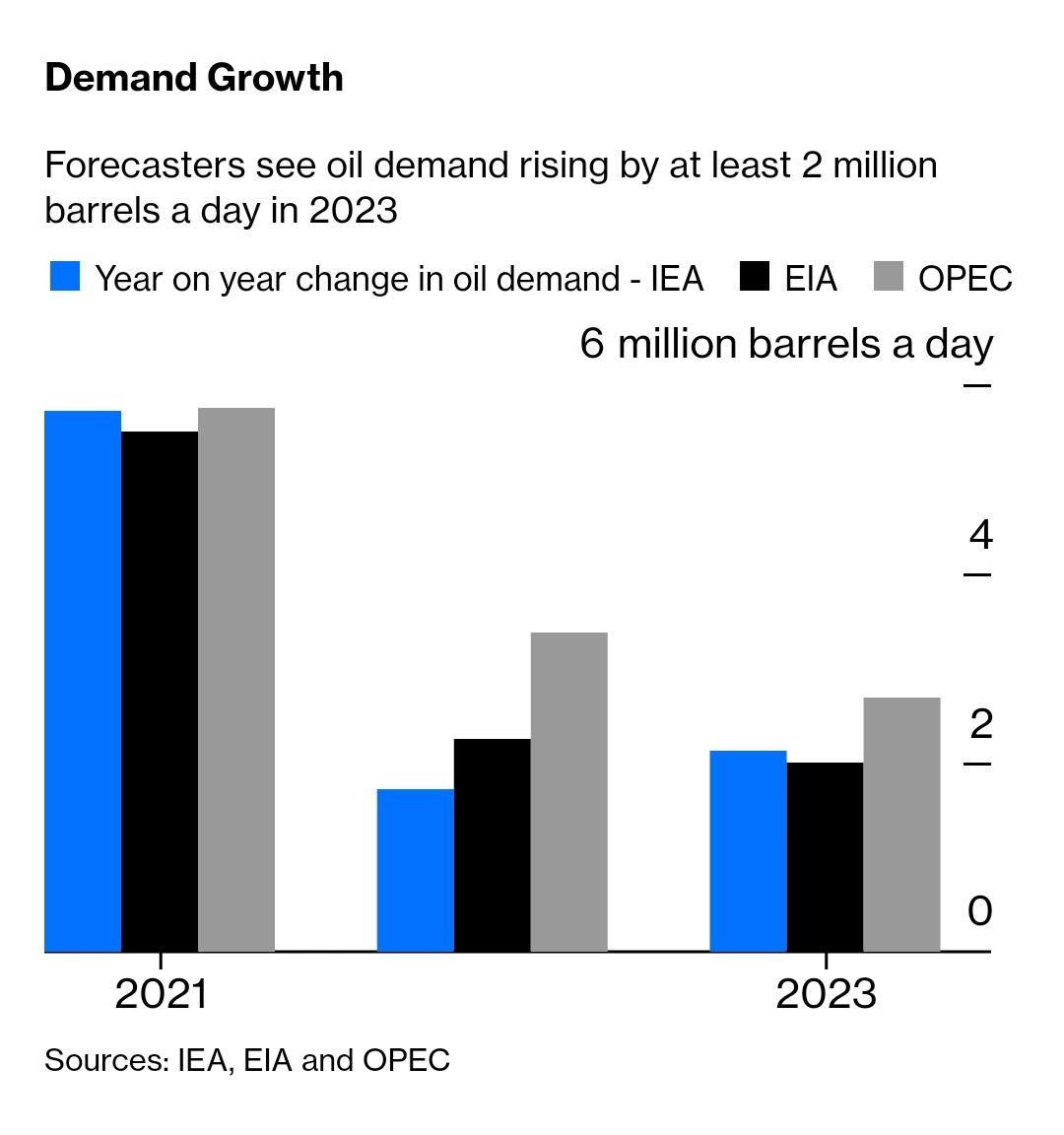

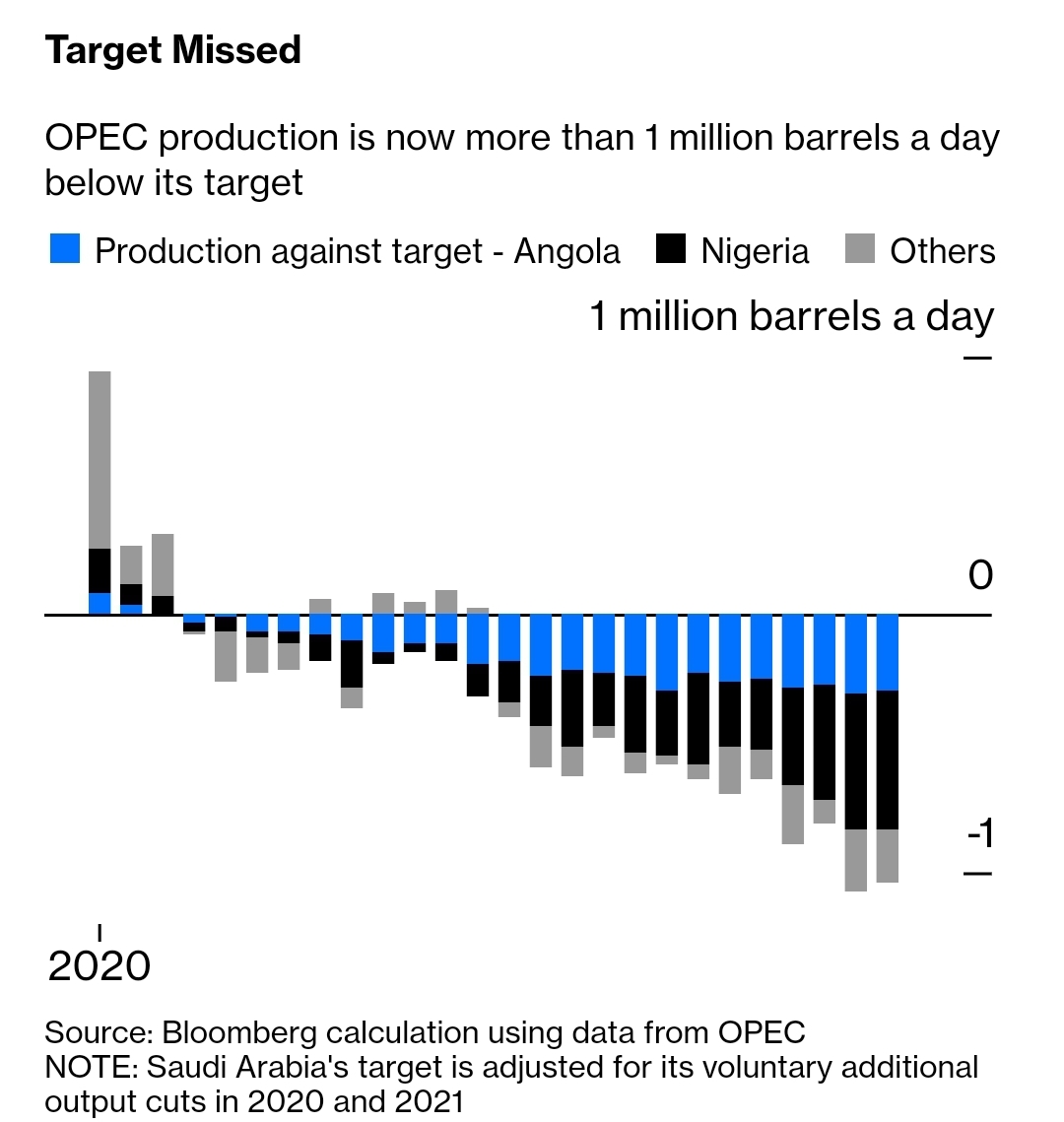

Period of oil oversupply which lasted for 4 Quarters is ending. 1 mbpd of deficit is expected in Q3 2023 and the deficit will continue for the next 5 Qs. That's probably why we saw oil prices rebound in the last two weeks. #OOTT #WTIC #Crudeoil #oilprice intwits.com/monitors/oil/

Since US indexes pivoted in ~14 Oct 2023 UK indexes under-performed US indexes. Inside each country: 1) S&P #SPX under-performed #NASDAQ 2) #AIM all Share #FTSE100 After a positive inflation report this week is it time to load up UK and S&P ex. Nasdaq #stocks?

UK will allocate up to 5% of pension assets to unlisted equities, which is #VC and #PE. £50b by 2030. Will it support small cap IPOs or will they continue go to the US? cnbc.com/2023/07/10/bri…

UK investors are more prudent vs. US ones and UK valuations are more attractive vs. US ones. #IPO cnbc.com/2023/05/08/as-…

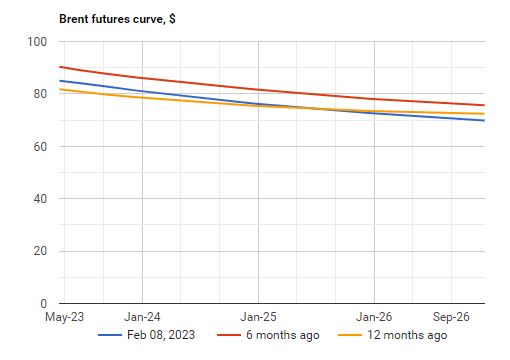

#oil market is quite calm: #Brent futures curve is smooth and it was the same way 6m and 12m ago. Futures curve doesn't assume any big movements in the oil price. #OOTT

WSJ: #BP CEO Looney has said he is disappointed in the returns from some of the oil giant’s renewable investments and plans to pursue a narrower green-energy strategy, according to people familiar with the discussions... he plans to place less emphasis on so-called ESG goals...

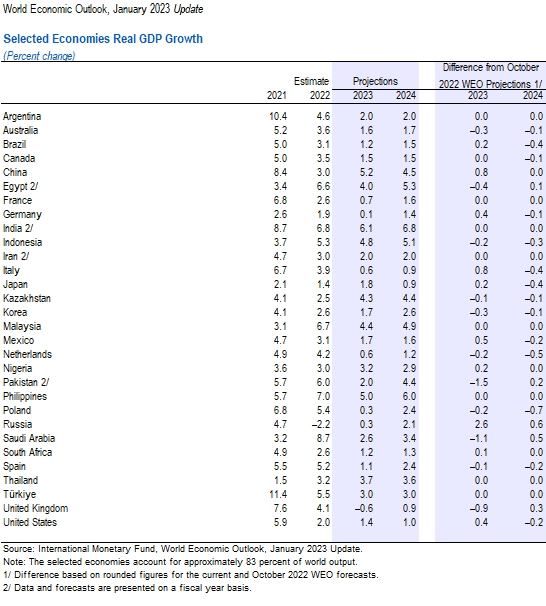

#IMF updated 2023 #GDP forecast. Of top-30 countries only the #UK will have a negative GDP growth. Even Russia and Germany will have positive. This is telling about UK's economic policies - how an economy based on trade and finance can decline when everybody else will be growing?

#GHT FY2022 Trading update: Organic revenue growth +16%, Clareti ARR +17%, ARR Net Retention >100%, Cash EBITDA +76%

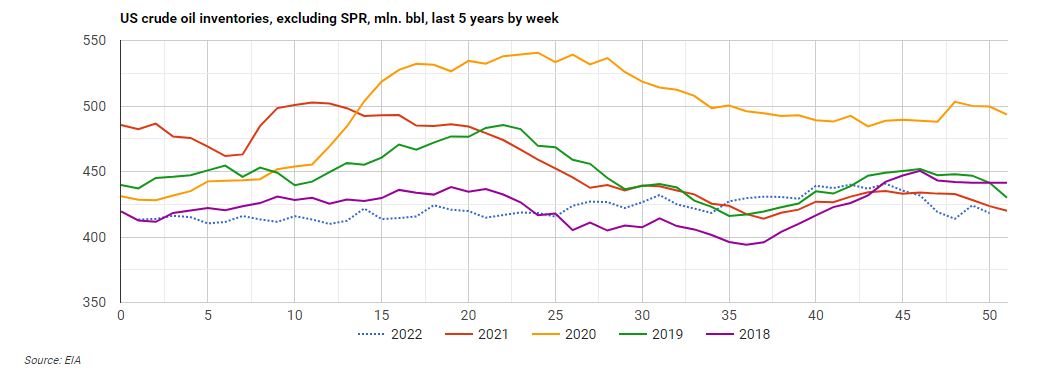

We are finishing 2022 with US Crude oil inventories at record lows for the last 5 years. But the #oilprice continue to slide. Tight oil market coming in 2023 with price rebound? #OOTT #WTIC #Crudeoil #commodities

#BGO #Bango 2022 H1 trading update: - Revenue up 9% in $ - EUS up 16% (too fast vs. revenue - take rate decrease, or country mix shift?) - EBITDA -7%, but positive Market reaction for a price in £ -6%, but take into account that $ appreciated against £ in the last 1.5 years.

UK retail sales volume is still above pre - COVID-19 level, more room to decline

Demand destruction happening across the globe Central banks are yet to understand this H/t @MichaelAArouet and @FT

2023 #oil market forecast: strong demand (+2.7mbpd in the latest OPEC forecast) and lack of supply. For example, in OPEC countries only SA, UAE and Iraq pump more than they did in 2018 #OOTT intwits.com/monitors/oil/

United States Trends

- 1. The PENGU N/A

- 2. HARRY STYLES N/A

- 3. #PMSSEATGEEKPUNCHAHT N/A

- 4. #BLACKWHALE N/A

- 5. Insurrection Act N/A

- 6. FINALLY DID IT N/A

- 7. The Jupiter N/A

- 8. Kiss All The Time N/A

- 9. Kuminga N/A

- 10. #BTS_ARIRANG N/A

- 11. Lara Croft N/A

- 12. Karoline Leavitt N/A

- 13. Arrest Tim Walz N/A

- 14. InfoFi N/A

- 15. Guess 1 N/A

- 16. The Great Healthcare Plan N/A

- 17. benson boone N/A

- 18. Sophie Turner N/A

- 19. Franz N/A

- 20. Giants N/A

You might like

Something went wrong.

Something went wrong.