InnerEdge

@InnerEdgeApp

Trading journal that tracks WHY you trade, not just what you traded. For traders who know their strategy works but can't execute it. Beta open.

InnerEdge — full walkthrough. Raw, unscripted, exactly how I use it daily.

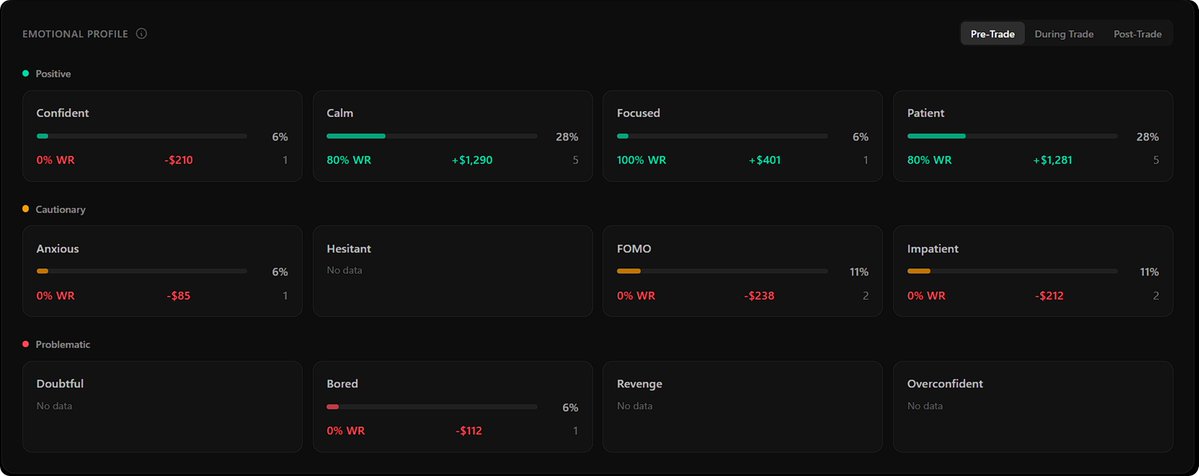

Tracked my pre-trade emotions for 18 trades. The results: Patient/Calm: 80% win rate, +$2,571 FOMO/Impatient: 0% win rate, -$450 Same setups. Same strategy. The difference was entirely mental state. Your edge isn't just your system. It's knowing when YOUR head is right to…

Here's what I realized about trading journals: They track WHAT you traded. P&L, entries, exits. They don't track WHY you traded. What emotion made you enter? What triggered the FOMO? You can't fix a psychology problem with P&L data. So I built something…

This week on indices: → Knew exactly where price was going → Watched it go there → Took zero trades No setup on LTF. So I sat on my hands. Hardest part of trading isn't finding direction. It's waiting for YOUR setup to show up.

Your pre-trade emotions predict your outcome more than your strategy. Anxiety → early exits FOMO → chasing entries Confidence → proper execution Most traders only journal after the trade. That's like diagnosing the disease after you're already dead.

Trader psychology speedrun: 7am: "I'm only taking A+ setups today" 9am: Hesitates on perfect setup 10am: FOMOs into random PA 11am: "I just need to make back what I lost" 2pm: Blown daily loss limit We've all been there.

United States Trends

- 1. Good Monday N/A

- 2. #MondayMotivation N/A

- 3. #MondayVibes N/A

- 4. #สนามอ่านเล่น2026xJossGawin N/A

- 5. IONQ N/A

- 6. JOSSGAWIN GUINZLY FAM GREETING N/A

- 7. $CRWV N/A

- 8. #26Ene N/A

- 9. #RepublicDay N/A

- 10. Ben Shelton N/A

- 11. Darnold N/A

- 12. Signal N/A

- 13. Ruud N/A

- 14. Kurt N/A

- 15. The Vikings N/A

- 16. Mr Ed N/A

- 17. Stacey N/A

- 18. Super Bowl LX N/A

- 19. gerard N/A

- 20. Hochul N/A

Something went wrong.

Something went wrong.