InsightSquawk

@InsightSquawk

AI-powered squawk service to help retail traders out —bringing live breaking news, sentiment vibes, and handy insights. Sign up for our FREE weekly newsletter!

Something new is coming to the tape… 🚨 We’ve built a tool for traders who know: - Every second counts - Every headline matters - Every edge compounds The market speaks — but most can’t hear it clearly. We’ll help you change that. Follow us & DM if you want early access.

Fed Cuts Overnight Rate by 25 bps 🚨 $SPX / $QQQ Context: Markets priced this in, but confirmation removes uncertainty. If Powell leans dovish in the presser (signals more cuts ahead) → strong upside in risk assets, especially $QQQ (tech/growth). If Powell sounds…

🚨 The U.S. didn't add 147,000 jobs/month. It added 71,000. A 911,000-job overstatement just got revealed — and markets are still digesting what it means. The slowdown started before we thought. Get these insights in plain English → @InsightSquawk

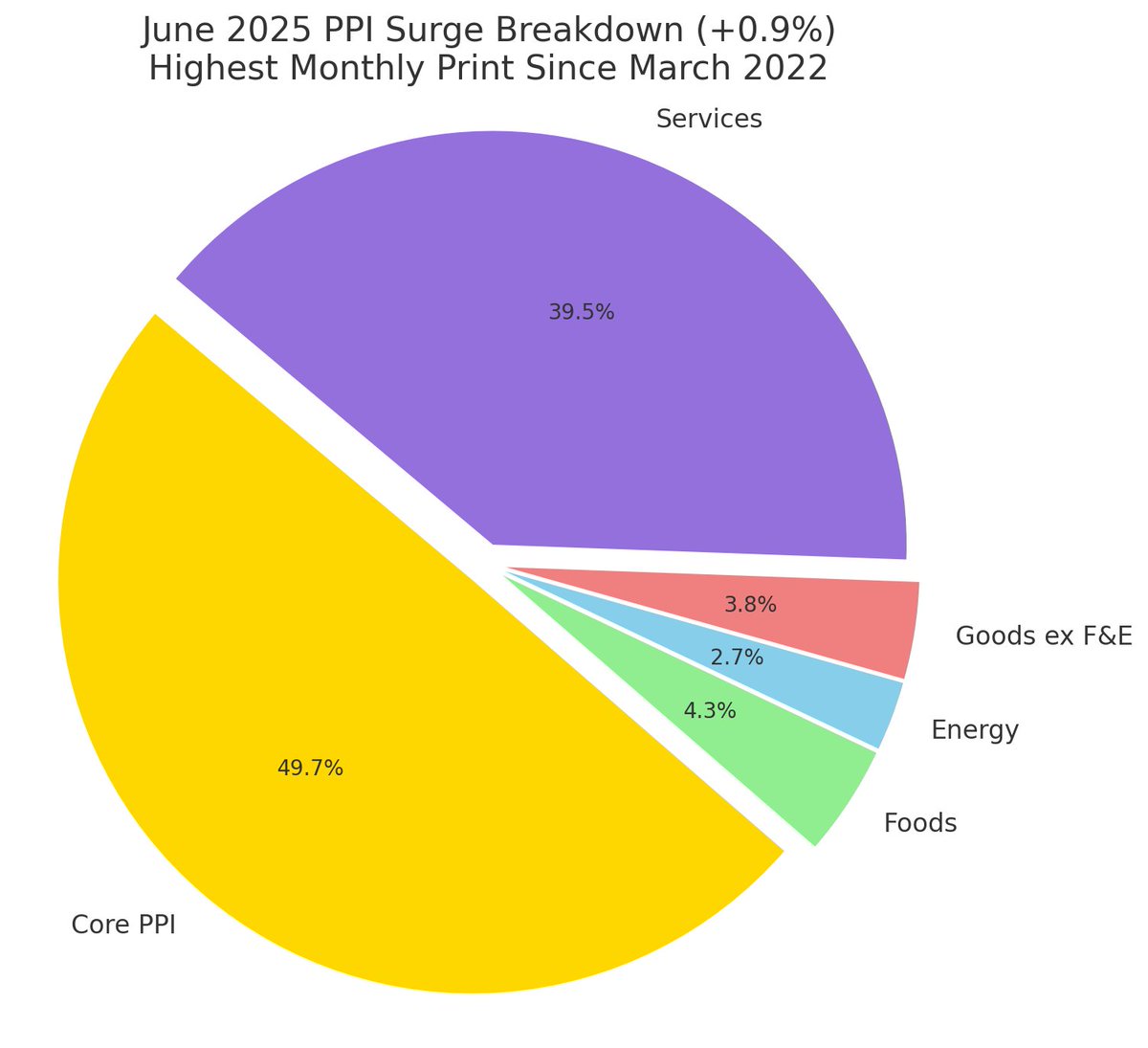

🚨 Inflation watch: PPI surged +0.9% MoM in June — the hottest since March 2022. Core goods & services led the spike. Traders betting on Fed cuts just got a reality check. Rates may stay higher, longer 🧯📈 This isn’t over. #Inflation #FOMC #SPY #SPX

🏠 First-time buyers now need $126,700/year to afford a median home — that’s up over 50% since 2021, per The Street. Soaring rates + home prices have priced out much of Gen Z and millennials. The American Dream just got a lot more expensive.

🚨 Social Security’s clock is ticking: the trust fund is projected to run dry by 2033, per NPR. Unless Congress acts, future retirees could face benefit cuts of up to 20%. Major implications for spending, savings, and retirement planning. 🧓📉 #SocialSecurity #Economy

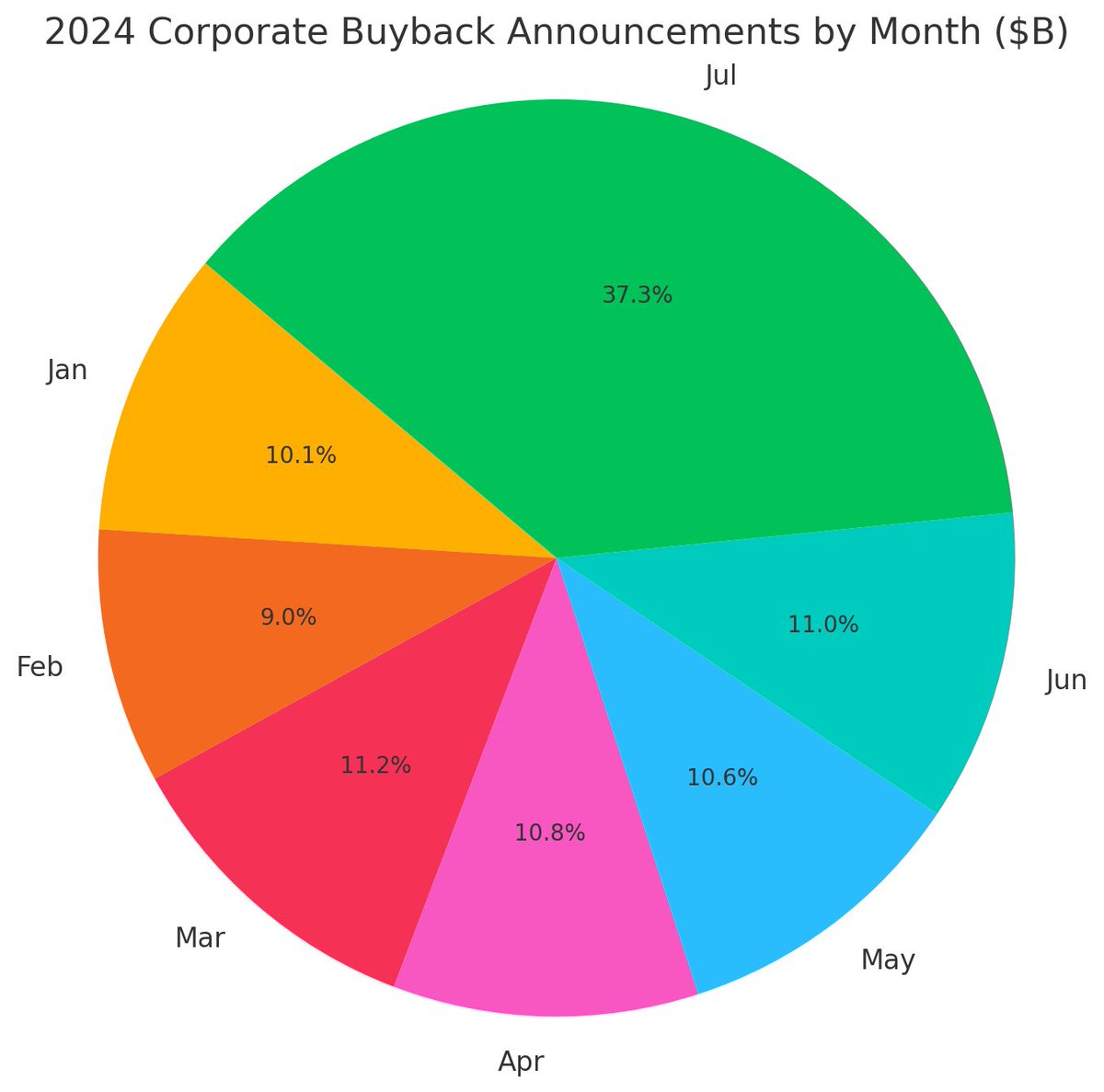

Corporate America spent a record $166B on July buybacks, the highest ever. Why it matters: Fewer shares boost EPS, strengthening earnings. In a low-volume August, this fuels stock gains. Dip buyers have support. 💸📈 #Buybacks #SPX

🚨 New front in the trade war? Trump plans a 25% tariff on Indian imports, citing India’s continued oil trade with Russia. This could spike costs, hit US-India relations, and shake emerging markets. Watch for ripple effects in global trade. #Tariffs #Geopolitics #Oil #Markets…

US Q2 GDP surged to +3.0% QoQ, beating the 2.6% estimate and rebounding from last quarter’s -0.5% decline. Economy’s strong — rate cut expectations may fade. Yields & USD could rise. #GDP #Rates $SPY $TLT $DXY

Foldable iPhone in 2026? 👀 JPMorgan sees Apple dropping a $1,999 model with iPhone 18. Big upgrade cycle incoming 📱 Could open a $65B market and lift earnings. Eyes on $AAPL as hype shifts past the sleepy iPhone 17. #AI #Tech $QQQ $SMH

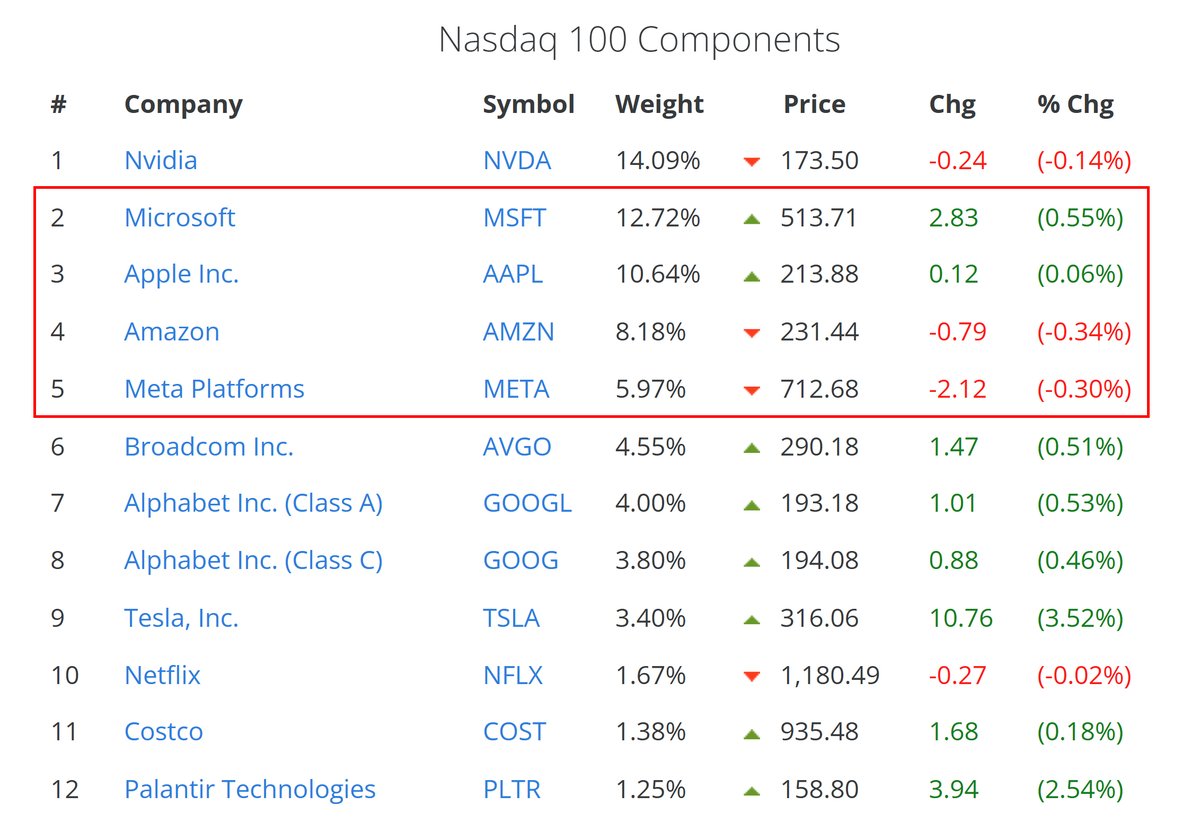

The most important week of earnings season is here. Over 37% of $QQQ reports earnings this week. Enjoy the show. 🍿 $MSFT | $AAPL | $AMZN | $META

EU Officials and Diplomats: European framework trade deal with the US could happen this weekend. 📌 What it means short-term: lowers trade tensions, boosts global risk appetite. Retail impact: risk-on tone may lift $SPY & $QQQ early week.

- Today was a wild "mixed bag" ride! After hours, the mood’s mostly sunny. Alphabet ($GOOGL) smashed earnings, pumping up the bulls, while Tesla ($TSLA) missed, leaving EV fans a bit worried. - S&P 500 futures edged up (+0.16%), so optimism’s still in the air for…

BREAKING: xAI (Elon Musk’s AI company) is teaming up with Kalshi, a real-money prediction market platform. This means Grok, their AI model, will now help forecast market outcomes — in real-time. 🤖 + 📊 = AI-powered prediction markets. How do you feel about this?

United States Trends

- 1. Nobel Peace Prize N/A

- 2. Anthony Black N/A

- 3. Kathleen Kennedy N/A

- 4. Machado N/A

- 5. Lucasfilm N/A

- 6. Dave Filoni N/A

- 7. Drew Lock N/A

- 8. Leon N/A

- 9. Insurrection Act N/A

- 10. Karoline N/A

- 11. Grizzlies N/A

- 12. Board of Peace N/A

- 13. New World Order N/A

- 14. #ResidentEvilRequiem N/A

- 15. Lynwen Brennan N/A

- 16. #LoveIslandAllStars N/A

- 17. The GitHub N/A

- 18. Lara Croft N/A

- 19. Joan Garcia N/A

- 20. The Discord N/A

Something went wrong.

Something went wrong.