Intelligent Investor Insights

@IntInvInsights

We think of ourselves as the Benjamin Graham disciples, with nearly 100 years of collective experience helping clients with their financial future.

You might like

The dollar remains the world’s safe haven—but its dominance is no longer absolute. Structural cracks are forming: sanctions risk, fiscal drift, digital alternatives. The next monetary era? Not replacement. Dilution. New piece: savvywealth.com/blog-posts/a-g…

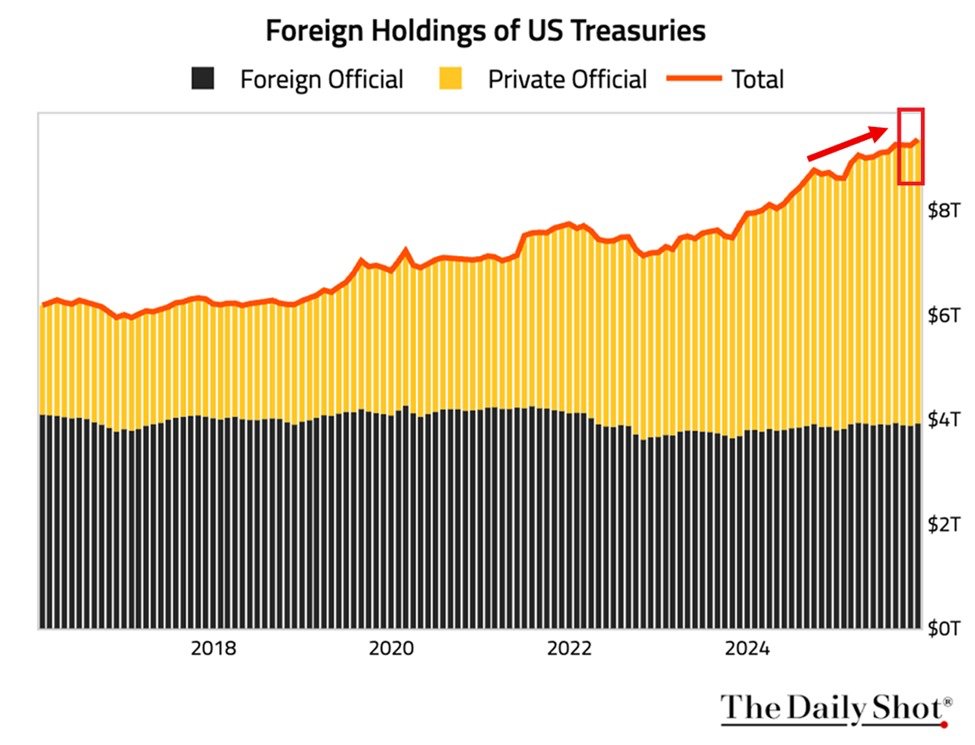

BREAKING: Foreign holdings of US Treasuries jumped +$112.8 billion in November, to a record $9.4 trillion. However, China's stockpile, the 3rd-largest holder, dropped -$6.1 billion, to $682.6 billion, the lowest since 2008. Belgium's holdings, which include Chinese custodial…

Imagine shopping for stocks in a retail store where everyone’s maxing out credit, chasing trends, and ignoring the risks. That’s today’s market—and the shelves are looking fragile. Read: savvywealth.com/blog-posts/ret…

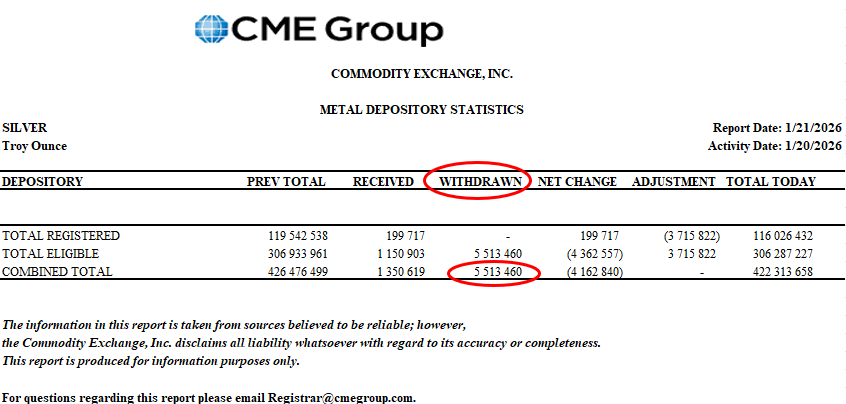

🚨5.5 mill oz silver withdrawn from Comex Tuesday. I can't remember seeing over 4 mill oz in a single day before. 🍿 (Number reported by CME Group yesterday evening).

🚨 TRUMP: BIG RETALIATION IF EUROPE SELLS US ASSETS LIKE BONDS

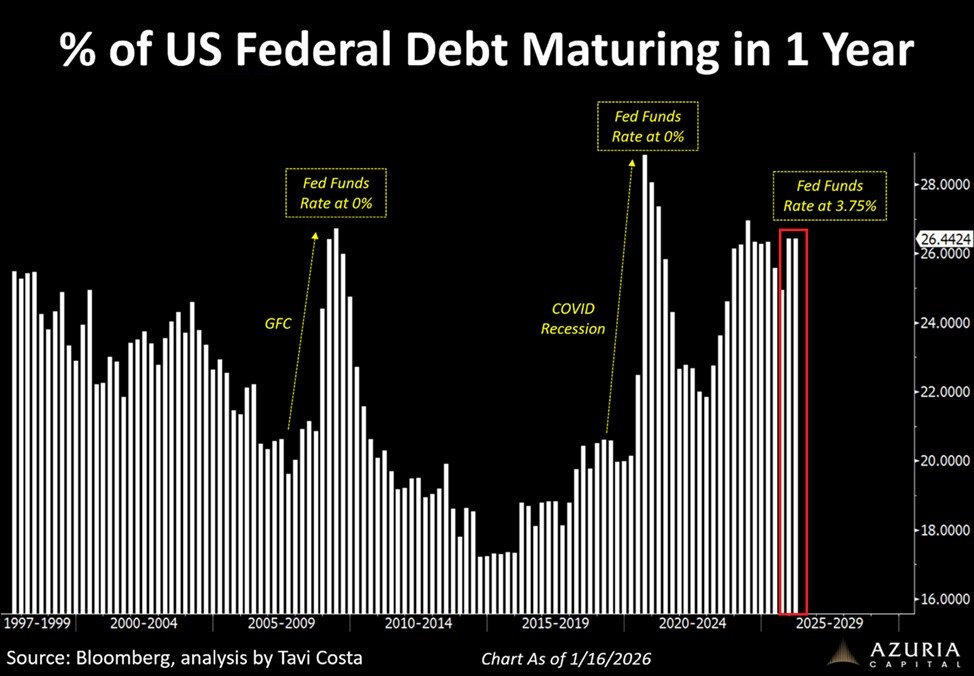

The US debt crisis intensifies: ~26% of US federal debt is set to mature within the next 12 months, one of the largest portions this century. By comparison, the peak was ~29% in 2020, when interest rates set by the Fed were at 0%. Between 2010 and 2020, this percentage…

It’s just three weeks into 2026 and Goldman Sachs analysts already increased their yearend price target for gold. They raised it to $5,400 from $4,900 “because the key upside risk we have flagged - private sector diversification into gold - has started to realize.”

We’re not entering a new scarcity cycle. We’re exiting one. The return of Venezuela, Iran & Russia to “white market” crude flows means: – Heavy oil glut – Shadow fleet collapse – Petro-yuan erosion – USD reassertion Read here: savvywealth.com/blog-posts/the…

I’ve seen markets soar on AI-driven optimism, but are we overlooking critical economic signals? I explore the reality behind the AI boom, from Nvidia’s rise to accounting challenges that could shift the narrative. Read more: savvywealth.com/blog-posts/ai-…

Update: the Trump administration was angry about this research note. Treasury Secretary Bessent: “The CEO of Deutsche Bank called to say that Deutsche Bank does not stand by that analyst report.” bloomberg.com/news/articles/…

DB’s Saravelos sees more dollar weakness ahead. EU countries “own $8 trillion of US bonds and equities, almost twice as much as the rest of the world combined…Developments over the last few days have potential to further encourage dollar rebalancing.”

*US PENDING HOME SALES FALL 9.3% M/M, MOST SINCE '20; EST. -0.3%

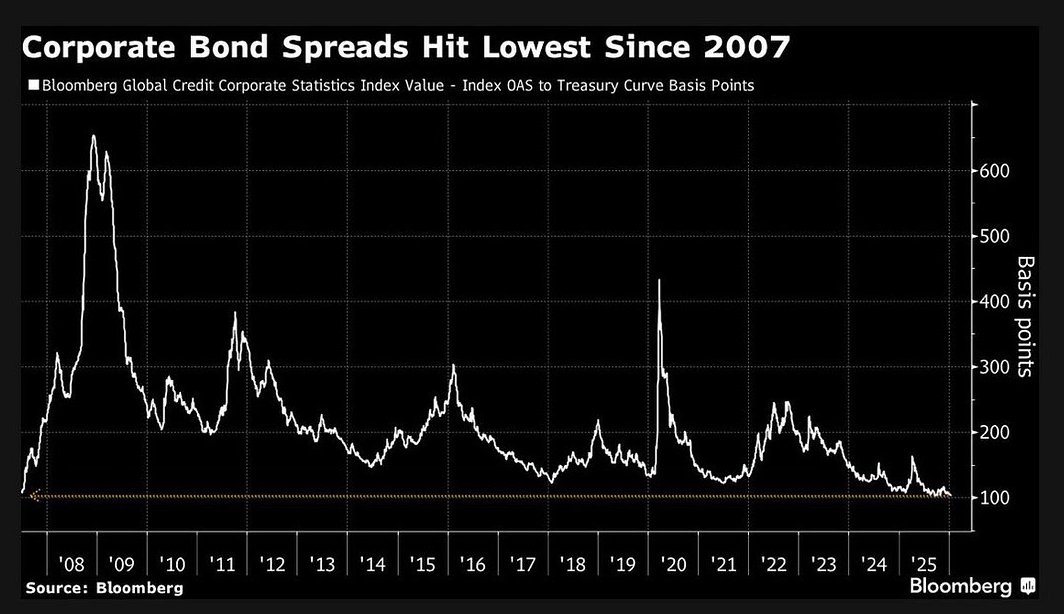

Corporate Bond Spreads fall to lowest level since 2007 🚨

Uncle Sam’s way of demanding taxes from businesses already struggling. In today’s fragile economy, tariffs squeeze margins, disrupt supply chains, and create the illusion of growth. Are the trade-offs worth it? Read more: savvywealth.com/blog-posts/how…

8 hours later, 6-sigma collapse

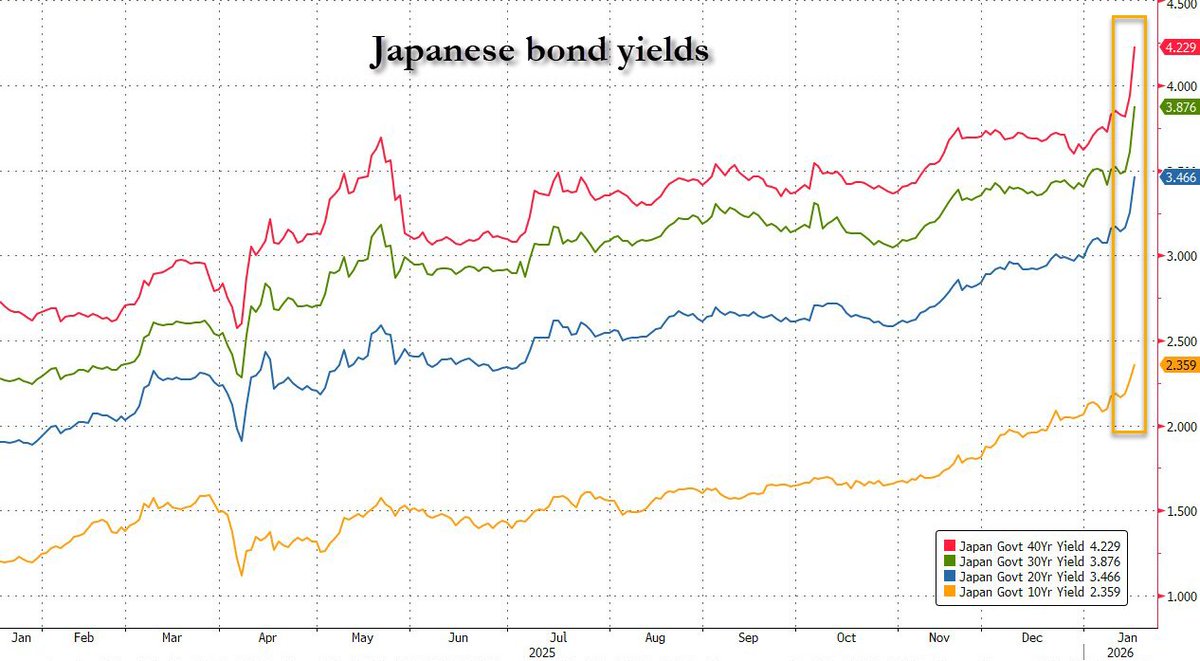

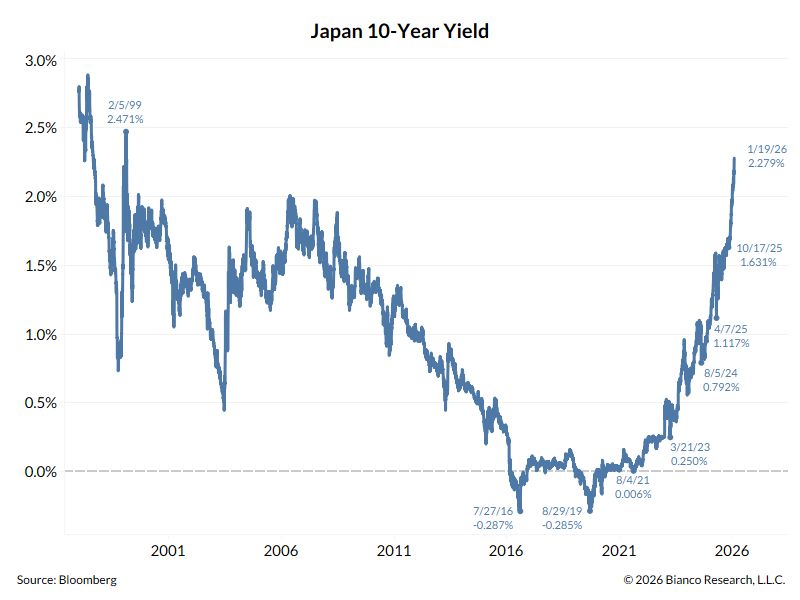

Japan 40Y yield up another 13 bps. This is a full-blown bond meltdown

As JGB Yields Blow Out, Goldman's Delta-One Desk-Head Lays Out Japan's 2 Options zerohedge.com/markets/jgb-yi…

Bessent in Contact With Japan Counterparts to Calm Markets Scotty pull an Argentina and buy JGBs next?

BREAKING: Danish pension fund AkademikerPension announces they will sell all US Treasuries by month-end, citing "rising credit risk" under President Trump. The fund's CIO says US finances are no longer "sustainable," due to weak fiscal discipline, a softer Dollar, and Trump’s…

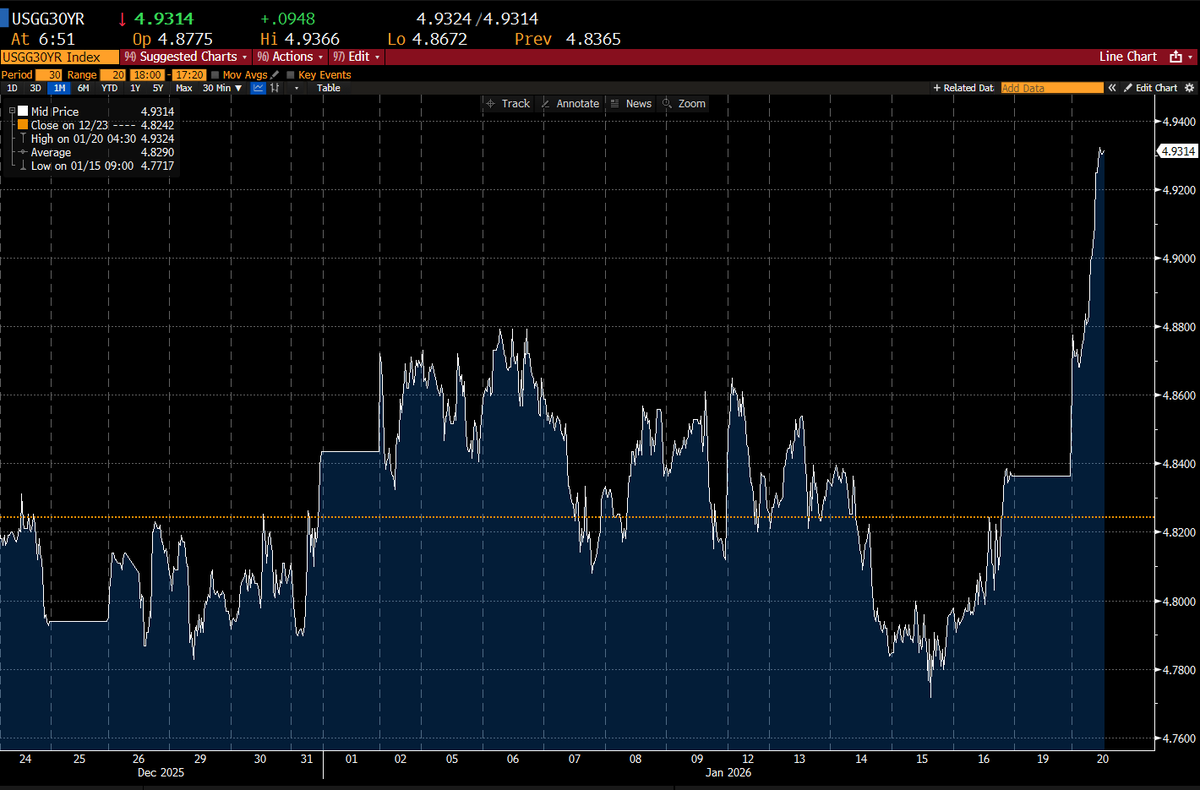

Whew US 30-year yield. You're not getting a cheaper mortgage

The old bond market adage is that yields will keep rising until something breaks. In 2022/23, rising U.S. yields "broke" several banks by March 2023 (Silicon Valley Bank). Japanese yields are now at a 27-year high and going vertical. When does something "break" in Japan?

You can defy economics—until you can’t. My latest: The 2026 tax regime hands out front-loaded stimulus while hollowing out the safety net. It looks like growth. It feels like populism. But gravity always wins. Read the full breakdown: savvywealth.com/blog-posts/the…

United States Trends

- 1. Paddy N/A

- 2. #UFC324 N/A

- 3. Alex Pretti N/A

- 4. Ilia N/A

- 5. O'Malley N/A

- 6. Arman N/A

- 7. Derrick Lewis N/A

- 8. Derrick Lewis N/A

- 9. Suga N/A

- 10. Muratalla N/A

- 11. Moro N/A

- 12. WHAT A FIGHT N/A

- 13. #SNME N/A

- 14. #UFCParamount N/A

- 15. Silva N/A

- 16. Kyle Rittenhouse N/A

- 17. #Skyscrapperlive N/A

- 18. Dragon Ball N/A

- 19. Yadong N/A

- 20. Battle of Gods N/A

Something went wrong.

Something went wrong.