IntroLend

@IntroLend

IntroLend is a RESPA-compliant, agent-owned, digital mortgage marketplace that lets homebuyers conveniently shop for a home and mortgage under one trusted roof.

Was dir gefallen könnte

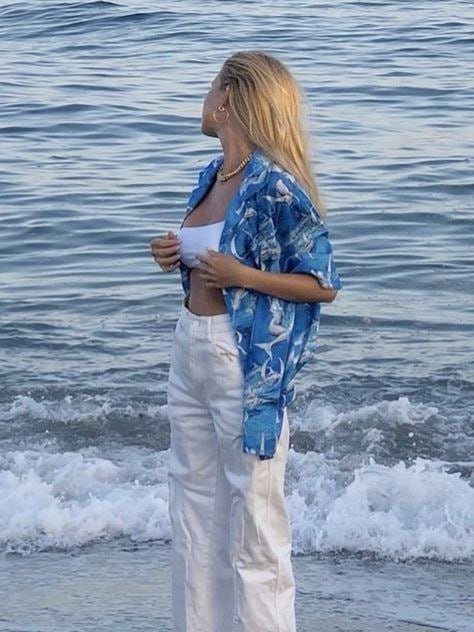

The @IntroLend gang at the @kwri Family Reunion this week in Las Vegas. Come visit our booth!

#SalesTips: You can transform your #mistakes into valuable learning experiences. Remember, the best #salespeople are those who are constantly learning and evolving. So embrace your missteps, use them to fuel your growth, and watch your sales success soar!

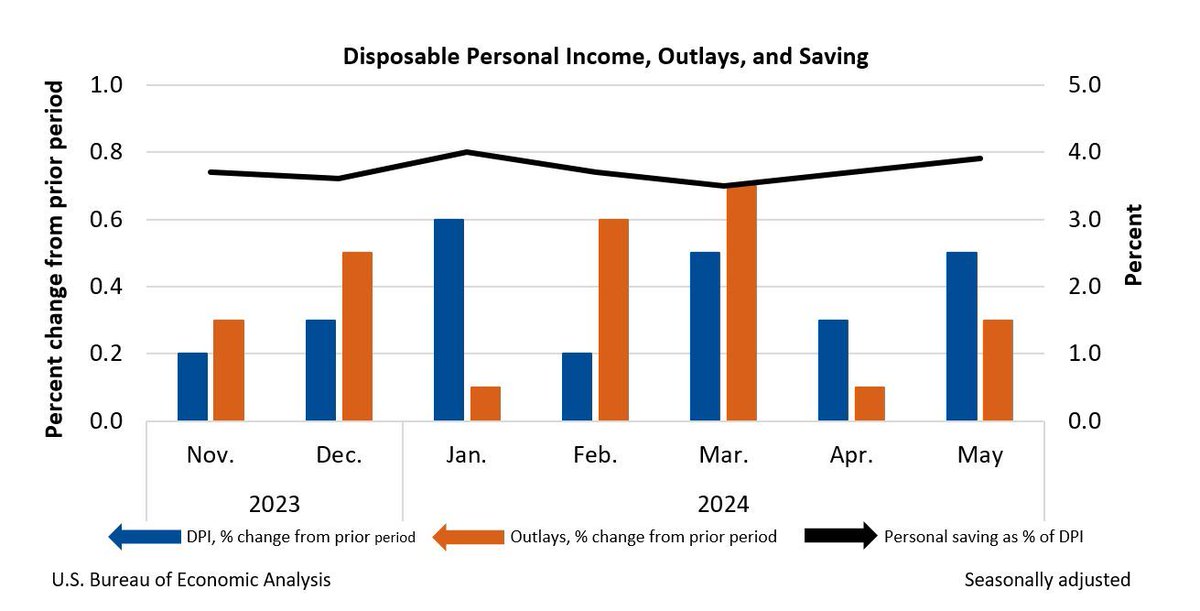

#ClientResources: The Personal Income & Spending report dives into how much money people are earning and spending. Rising income with even higher spending could indicate inflation concerns, potentially affecting #MortgageRates. #EconomicReports

#SalesTips: The world of #RealEstate is a marathon, not a sprint. Patience and persistence are muscles that get stronger with exercise. There will be ups and downs along the way, but if you're patient and persistent, you'll eventually reach your goals. #FeelGoodFriday

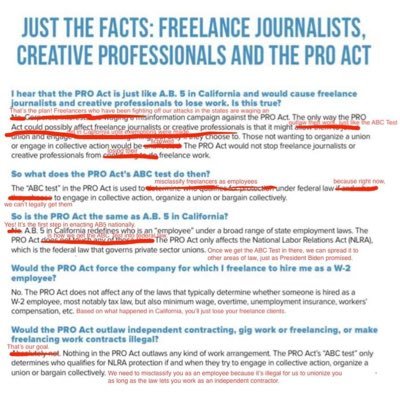

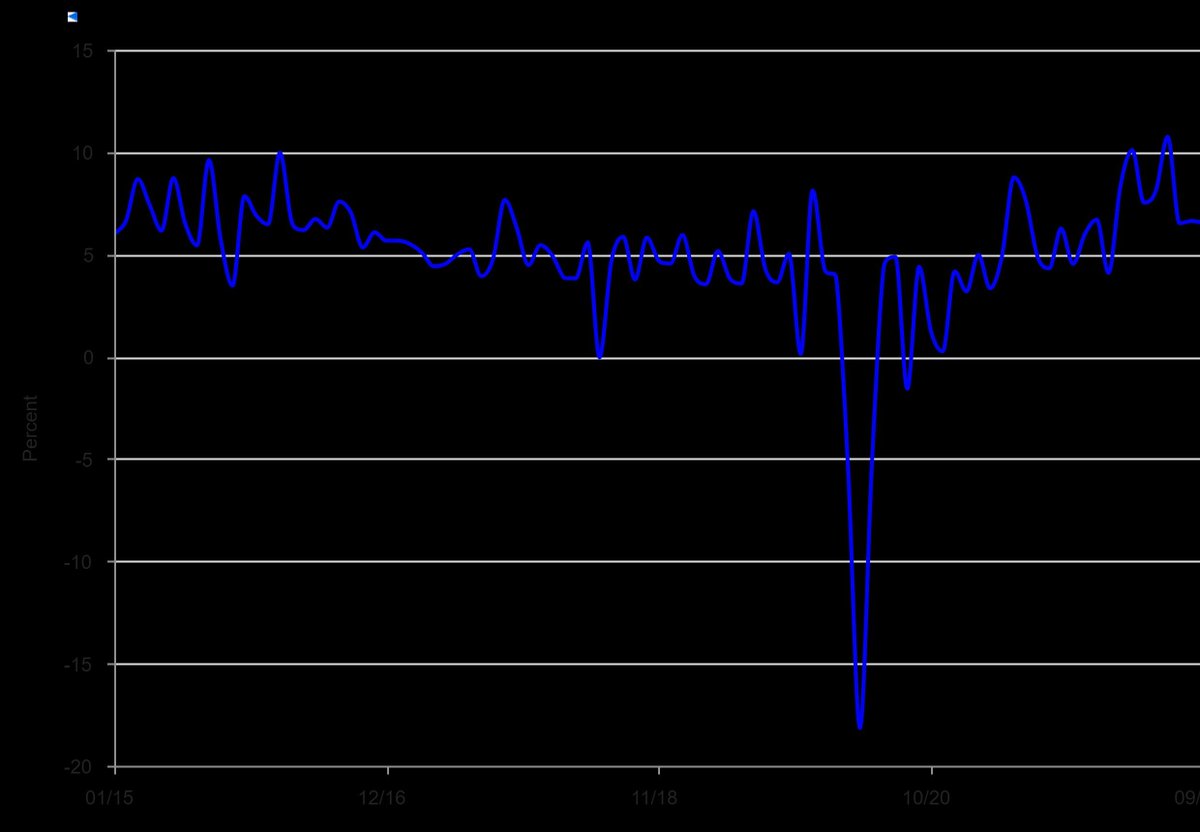

#ClientResources: The #ConsumerCredit report is like a peek at people's wallets. If it shows an increase in credit card debt & loans, it could suggest people feel less confident about the future & want to spend now. This could impact inflation and lead to higher #MortgageRates.

Relationships are essential for success in #RealEstate. You need to build strong relationships with your clients, other realtors, lenders & other industry professionals. These relationships will help you generate leads, close deals & get referrals. #FeelGoodFriday #SalesTips

#ClientResources: A strong #FactoryOrders report suggests factories are busy, which could be a sign of future economic growth. This, in turn, could make investors a little nervous about inflation (prices going up) down the line, potentially pushing #MortgageRates up a tick.

Success in real estate doesn't happen overnight. It takes time, #patience, and #persistence to build a successful career. There will be ups and downs along the way, but if you're patient and persistent, you'll eventually reach your goals. #FeelGoodFriday #SalesTips

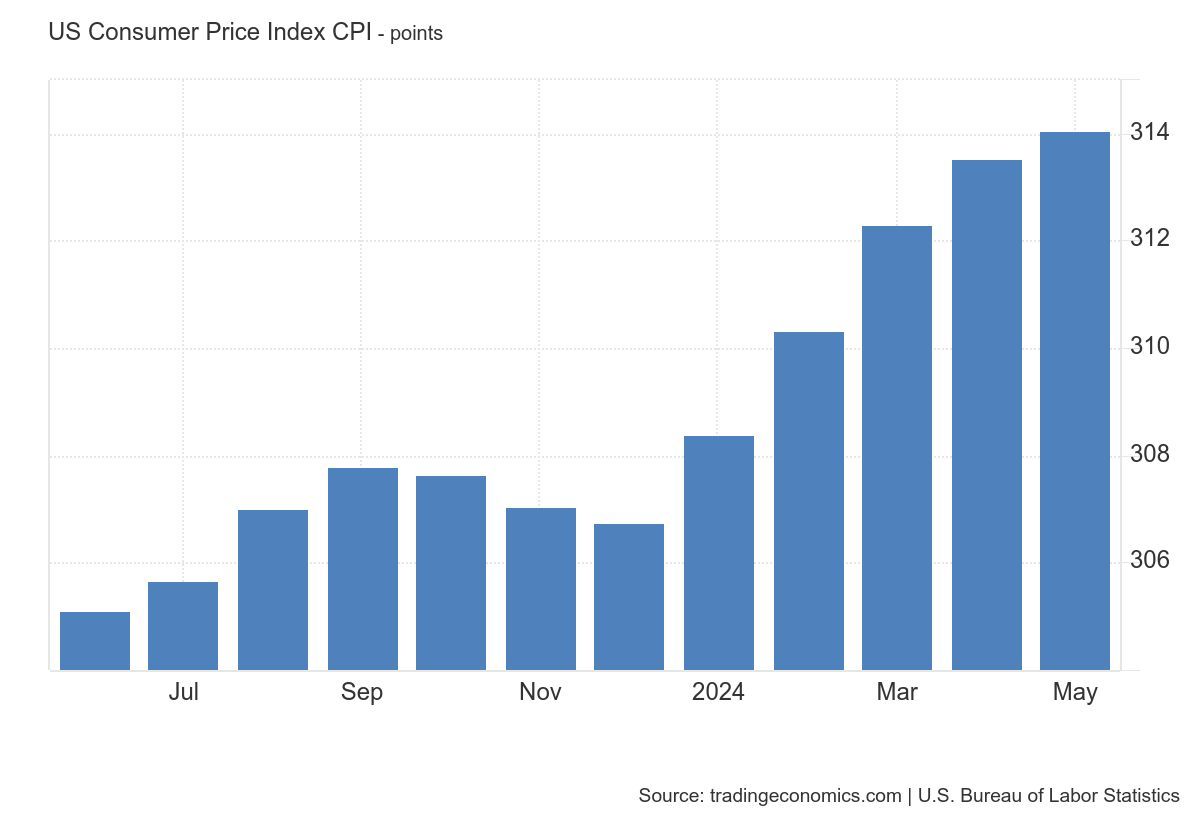

#ClientResources: The #ConsumerPriceIndex is basically a fancy way of saying "cost of living." It tracks the prices of everyday goods and services that consumers buy. A higher-than-expected #CPI could spook investors about inflation and potentially push #MortgageRates up.

Real estate is a people-centric business, so focus on helping others achieve their goals. This means understanding your clients' needs and wants, and then providing them with the solutions they need. You'll build strong #relationships and generate repeat business.

#ClientResources: The #RetailSales report shows how much people are spending at stores (in-person & online). Strong retail sales could reflect a healthy economy, which can be good news overall. But if it's too strong it could raise inflation concerns & affect #MortgageRates.

Celebrating #success isn't bragging; it's acknowledging your hard work and dedication. By treating yourself, paying it forward, and setting new goals, you can turn your sales victories into fuel for even greater achievements! #FeelGoodFriday #SalesTips

#ClientResources: Imagine #ProducerPriceIndex (PPI) as a peek at a business's grocery list. It tracks what firms pay for raw materials. If the #PPI shows a jump in prices, it could signal that businesses might raise their own prices, increasing inflation and #MortgageRates.

Remember, #rejection is a chance to learn, adapt, and improve. By embracing these tips, you can turn rejection into a valuable tool for becoming a top-notch salesperson! #FeelGoodFriday #SalesTips

#ClientResources for your networks: The Job Openings & Labor Turnover Survey (#JOLTS) shows how many people are quitting jobs. Many vacancies could mean businesses are struggling to find workers, thus offering higher wages (raises!), which could raise inflation & #MortgageRates.

#IntroLendAcademy: The #ConsumerCredit report is like a peek at people's wallets. If it shows a sharp increase in credit card debt & loans, it could mean people feel less confident about the future & want to spend now. This could impact inflation & lead to higher #MortgageRates.

Over the next few weeks we'll be sharing some brief explainers to help you decode #EconomicReports and understand their impact on #MortgageRates. Look out for #IntroLendAcademy posts.

We're excited to sponsor The Gathering by @HousingWire, April 21-24. Join mortgage executives, investors and issuers, real estate brokers, technology innovators, and policymakers to connect, learn, and discuss the housing industry: events.housingwire.com/the-gathering-… #housing

Twice each month, look for this video to get your new #HousingMarketUpdate: ow.ly/j5N050Lhgrc * Continuing Inflation Drumbeat * Mortgage Rates Exceed 7% * Home Builder Confidence Dips * Existing Home Bargains in Sunbelt #HousingMarket #MortgageNews #HMU

United States Trends

- 1. Branch 36.7K posts

- 2. Chiefs 111K posts

- 3. Red Cross 49.5K posts

- 4. Mahomes 34.6K posts

- 5. Exceeded 5,964 posts

- 6. Binance DEX 5,163 posts

- 7. #LaGranjaVIP 81.7K posts

- 8. #njkopw 4,772 posts

- 9. Air Force One 55.3K posts

- 10. Rod Wave 1,600 posts

- 11. #TNABoundForGlory 58.9K posts

- 12. #LoveCabin 1,357 posts

- 13. Tel Aviv 58.3K posts

- 14. Bryce Miller 4,592 posts

- 15. Alon Ohel 15.2K posts

- 16. Omri Miran 15.1K posts

- 17. Eitan Mor 14.8K posts

- 18. LaPorta 12K posts

- 19. Matan Angrest 14.3K posts

- 20. Goff 13.9K posts

Was dir gefallen könnte

Something went wrong.

Something went wrong.