James Seyffart

@JSeryff

CFA. CAIA. ETFs. Cryptos. Asset Management. @Bloomberg . @bbgintelligence . Runner. Opinions my own. Likes, RT's & Follows≠endorsements

The ETF Master @JSeyff and I are doing an interview today. We will discuss this big news

JUST IN: CME Group, the world's largest futures exchange to launch Solana $SOL futures.

Just think of how insane this argument would be if we change the subjects of the action: "Because some journalists have bank accounts, the Trump admin did not target journalistic outfits for debanking." Or more deranged: "Because some black people have bank accounts, redlining…

unfortunately the yale academics are at it again and are trying to gaslight everyone into thinking that debanking crypto didn't happen. it did, everyone dealt with it, everyone knows it, and the evidence is excruciatingly clear. full treatment soon withoutwarningresearch.com/p/where-debank…

BlackRock just filed for a Securitized Income Active ETF which will hold a bunch of dif acronyms including ABS, MBS, CMO, CLO and TBA. Fidelity has similar ETF and it has $2.1b in aum, amazing how fast these things grow

I *literally* just tweeted this. But I really can't believe how fast things are moving at the SEC

i feel like i'm living in some alternate reality

Also. This was pretty much the stance of the prior admin. So this isn't a 180. They didn't really touch or do anything for or against memecoins. but they also refused to issue this type of explicit guidance which i think is the correct way to handle this stuff

SEC is working overtime with all of their moves over the last few weeks. Genuinely impressive. Really did not expect things to be moving this fast or unwinding this fast.

It’s official: case dismissed. Time for fair legislation for the entire industry.

Reading @HesterPeirce's older writings then re-reading her request for comments to the Crypto Task Force. Not sure there's another person on the planet a better fit for the job. If she has her way, US cap markets will have a Renaissance.

To be clear, i just needed to restart/refresh everything and its working like a charm again. But the timing is/was rather comical lol

The @SECGov commission has a closed meeting today at 2PM EST where agenda items include “resolution of litigation claims and other matters relating to examinations and enforcement proceedings.” Could be that commissioners are gearing up to vote to finalize the dismissals of…

🚨SCOOP: The @SECGov and @Consensys have reached an agreement in principle to end the agency’s lawsuit against the blockchain software company, according to people with direct knowledge of the matter. The dismissal is subject to approval by the commission and an announcement by…

How likely do you think it is that Trump will follow through on 25% tariffs for Mexico and Canada due 3/4?

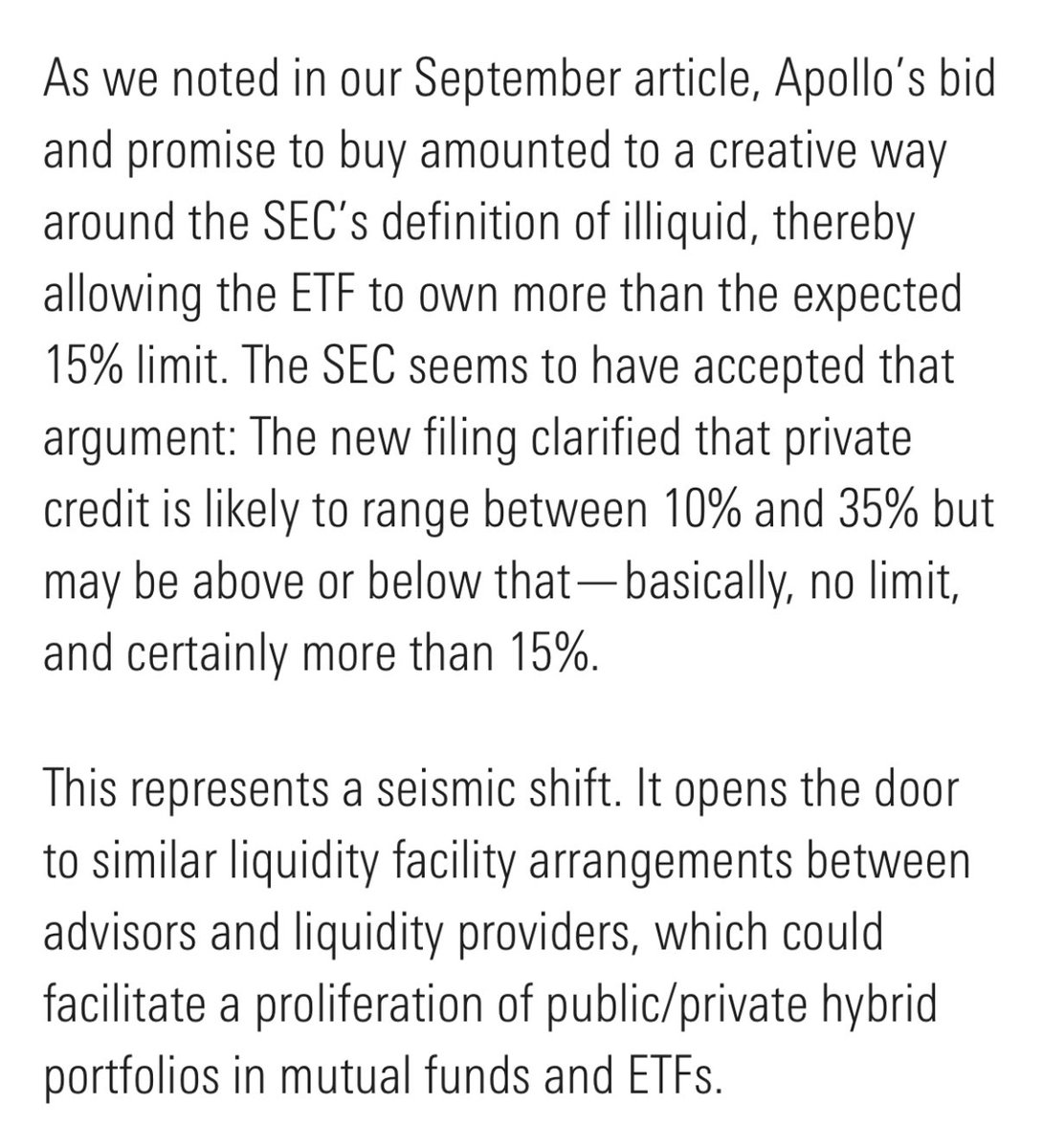

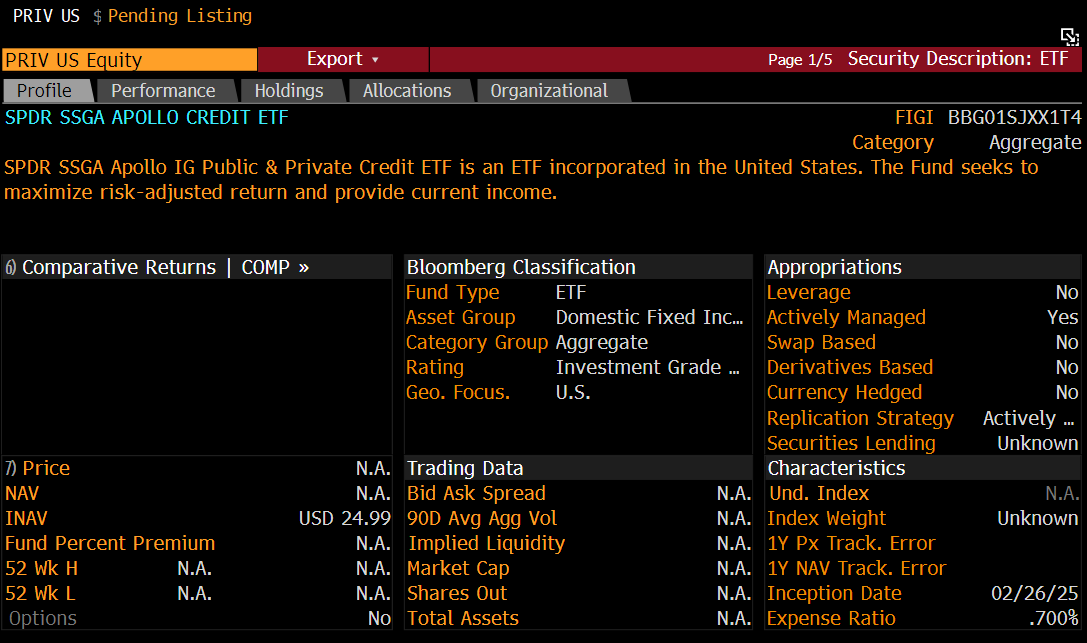

I agree, $PRIV represents a “seismic shift” in ETFs in that it found a solution (using Apollo) to allow a fund to go beyond the 15% illiquid holdings limit. Whether this ETF is a hit or not it opens up a whole new world. Nice write up from @bpmoriarty morningstar.com/bonds/groundbr…

BOOM: looks like SPDR Apollo IG Public & Private Credit ETF has been made effective and preparing to launch. Private credit can be up to 10-35% of the ETF. 70bp fee. This is potential game changing launch esp w Apollo involved, h/t @bpmoriarty for catching the filing update.

Whenever bitcoin has a 10% pullback after going up 50%

ETF investors doing what they do: buying the dip everyone is so afraid of as +$13B(!) went into ETFs yesterday with Trading Crowd faves $SPY and $QQQ leading. So far they nailed it as stocks up pre-market. Nvidia will be huge tho. Aside, $188b YTD is wild, on pace for $1.3T

today is the most important day of our lives

Welcome back to The Bitcoin Treasuries Podcast. Presented by @OnrampBitcoin. Today's guest host is Tad Smith. Tad is an American business executive known for his leadership in the media, arts, and entertainment industries. He served as CEO of Sotheby's from 2015 - 2019,…

Yea but $MSTZ & $SMST ( the 2x MSTR inverse ETPs) are up 67% since Feb 14. Glass half full!

Leveraged ETFs tied to bitcoin stockpiler Strategy drop nearly 50% in just five days theblock.co/post/343378/le…

theblock.co

Leveraged ETFs tied to bitcoin stockpiler Strategy drop nearly 50% in just five days

Funds which track the share price of Michael Saylor's Strategy have been sliding since last week as risk-off sentiment drags down crypto.

United States Trends

- 1. Steelers 51.7K posts

- 2. Rodgers 21.1K posts

- 3. Chargers 36.1K posts

- 4. Tomlin 8,178 posts

- 5. Schumer 218K posts

- 6. Resign 103K posts

- 7. #BoltUp 2,915 posts

- 8. #TalusLabs N/A

- 9. Tim Kaine 18K posts

- 10. Keenan Allen 4,773 posts

- 11. #HereWeGo 5,626 posts

- 12. #RHOP 6,830 posts

- 13. Durbin 25.4K posts

- 14. Herbert 11.6K posts

- 15. Gavin Brindley N/A

- 16. #ITWelcomeToDerry 4,384 posts

- 17. Angus King 15.3K posts

- 18. Ladd 4,373 posts

- 19. 8 Dems 6,696 posts

- 20. 8 Democrats 8,654 posts

Something went wrong.

Something went wrong.